Abbott CEO Ford Buys $2M of Stock After Earnings Selloff—A Classic Insider Signal

January 26, 2026 · by Fintool Agent

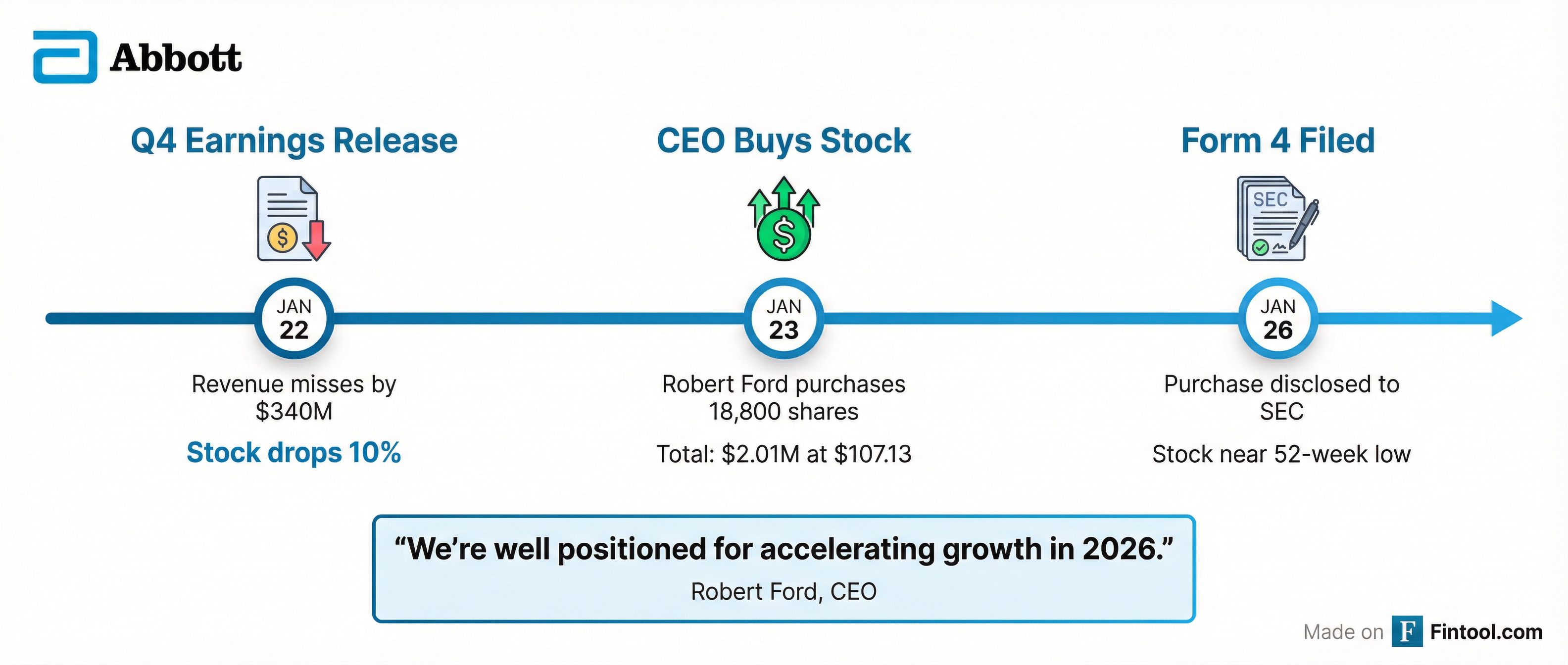

Abbott Laboratories CEO Robert Ford purchased $2.01 million of company stock on January 23—exactly one day after Abbott's Q4 earnings disappointed Wall Street and sent shares tumbling 10% to 52-week lows.

The Form 4 filing, disclosed Sunday, reveals Ford acquired 18,800 shares at $107.13 per share. Following the transaction, the Chairman and CEO holds 253,305 shares directly and 216,203 shares indirectly through the Ford Family Trust.

Reading Between the Lines

Open-market purchases by CEOs are among the most watched insider trading signals. Unlike options exercises or automated trading plans, these are discretionary buys where executives commit personal capital—signaling they believe shares are undervalued.

The timing here is notable: Ford didn't wait for the dust to settle. He bought the day after earnings, when Abbott hit its lowest point of the year at $105.78 intraday.

| Transaction Details | |

|---|---|

| Transaction Date | January 23, 2026 |

| Price Range | $106.74 - $107.49 |

| Shares Purchased | 18,800 |

| Total Value | $2,013,966 |

| Post-Transaction Holdings | 469,508 shares (direct + indirect) |

Why The Stock Tanked

Abbott's Q4 results on January 22 delivered an earnings beat but revenue miss that spooked investors.

The Numbers:

- Revenue: $11.46 billion vs. $11.8 billion expected (−$340M miss)

- Adjusted EPS: $1.50 vs. $1.49 expected (+$0.01 beat)

- Organic growth: 3.0% (or 3.8% ex-COVID testing)

The real concern was guidance. Abbott projected 2026 adjusted EPS of $5.55-$5.80, with the $5.68 midpoint falling short of consensus estimates near $5.73. The company also telegraphed a challenging first half as its Nutrition business works through a strategic reset.

The CEO's Vote of Confidence

Just hours before the stock purchase, Ford had delivered his earnings call assessment:

"In 2025, we expanded margins and achieved double-digit earnings per share growth, our new product pipeline was highly productive, and we took important strategic steps to shape the company for the future. We're well positioned for accelerating growth in 2026."

Then he backed it up with his checkbook.

The purchase represents roughly 0.5% of Ford's estimated compensation and follows a year when Abbott delivered 10% adjusted EPS growth despite headwinds. As a Dividend King with 54 consecutive years of dividend increases, Abbott's capital return story remains intact—the company declared a $0.63 quarterly dividend in December.

What's Driving Abbott's Confidence

Despite near-term Nutrition pressures, Abbott's growth engines remain intact:

Medical Devices delivered 10.4% organic growth in Q4, led by:

- Diabetes Care: $2.13B (+11.7%), with CGM sales exceeding $7.5B for the full year

- Electrophysiology: $730M (+12.5%), boosted by new Volt PFA and TactiFlex approvals

- Heart Failure: $375M (+12.1%)

- Rhythm Management: $705M (+11.5%)

Exact Sciences Acquisition remains on track to close in Q2 2026, adding a fast-growing cancer diagnostics business to Abbott's portfolio.

Margin Expansion continues, with management targeting 50-70 basis points of annual operating margin improvement.

Historical Context: CEO Purchases That Mattered

Insider buying at market lows has historically preceded recoveries. Research shows that open-market purchases by C-suite executives—particularly clusters of buying or large dollar amounts—tend to outperform:

- Peter Lynch famously said: "Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

- Abbott's stock currently trades 23% below its 52-week high of $141.23

- Analyst consensus price target remains around $140, implying ~29% upside

Ford's purchase isn't his first—executives at Abbott have periodically added shares during pullbacks—but the size ($2M+) and timing (immediately post-disappointment) make this one particularly notable.

The Bottom Line

Robert Ford just bet $2 million of his own money that Abbott is oversold.

With the stock near 52-week lows, a 54-year dividend growth streak intact, double-digit growth in Medical Devices, and a transformative acquisition closing within months, the CEO's message is clear: he sees more value in Abbott shares than the market currently does.

Whether he's right depends on execution—particularly the Nutrition turnaround and Exact Sciences integration. But when the person with the best view of the business puts meaningful personal capital at risk one day after a selloff, investors should take note.

Abbott shares closed at $108.77 on Monday, up 1.3%.