Accel Entertainment Founder Andy Rubenstein Steps Down as CEO After 17 Years, Names Mark Phelan Successor

February 3, 2026 · by Fintool Agent

Accel Entertainment (NYSE: ACEL) founder Andy Rubenstein will step down as CEO after 17 years, handing the reins to longtime executive Mark Phelan in a planned succession that positions the distributed gaming operator for a major expansion into Chicago's nascent video gaming terminal market. Shares fell 2.7% on Monday to $11.09 following the announcement.

The transition, announced Sunday evening via 8-K filing, takes effect August 7, 2026. Rubenstein, who founded the company in 2009 and took it public in 2019, will become Chairman of the Board immediately while remaining CEO through the transition period. Phelan, 57, currently serves as President of US Gaming and has been appointed Chief Operating Officer effective immediately.

Timing Is Everything: Chicago VGT Market Opens Up

The succession comes at a pivotal moment for Accel. In January, the company announced it was "evaluating opportunities" to expand into Chicago following the city's consideration of legalizing video gaming terminals in licensed locations—a move that could unlock the single largest growth opportunity in the company's history.

The City Council Office of Financial Analysis estimates the proposed VGT framework could generate approximately $1 billion in annual gross gaming revenue when fully implemented—incremental to the $3 billion already generated in the rest of Illinois. For VGT operators, that translates to roughly $320 million in annual net terminal income based on the current 32.04% statutory revenue split.

Accel expects a Chicago VGT market could begin generating revenue as early as Q3 or Q4 2026, with a gradual ramp toward steady-state performance over the following decade.

Board member Karl Peterson framed the timing explicitly: the succession is designed "to help further position Accel to capitalize on promising growth opportunities, including expanding into the Chicago VGT market."

Rubenstein's Legacy: Building an Industry Leader

Rubenstein built Accel from a startup into the dominant video gaming terminal operator in Illinois and one of the largest in the country. Under his tenure, the company:

- Scaled revenue nearly 4x from $316 million in FY 2020 to $1.23 billion in FY 2024

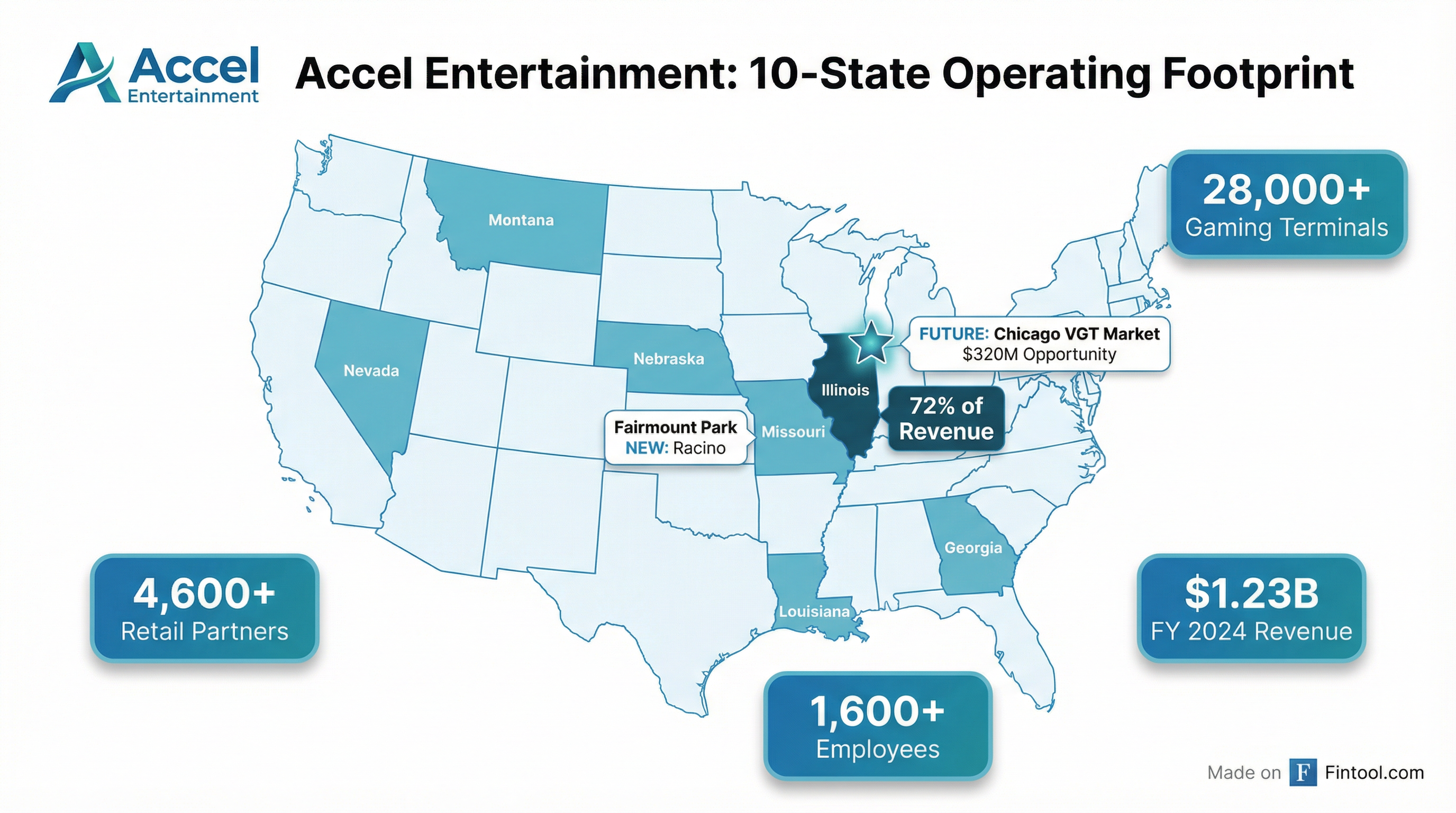

- Expanded from Illinois-only to 10 states including Nevada, Montana, Nebraska, Georgia, and Louisiana

- Grew to operate 28,000+ gaming terminals across 4,600+ retail partner locations

- Completed the December 2024 acquisition of Fairmount Park racino in Illinois, which opened its casino in April 2025

- Maintained consistent profitability with EBITDA margins of ~13-14%

"After 17 years, and having built a deep bench of talent, I am confident that transitioning day-to-day leadership to Mark will enable Accel to continue to capitalize on our many growth opportunities," Rubenstein said in the announcement.

The stock, however, has been less impressive. ACEL trades at $11.09 today versus approximately $10 at the start of 2019, representing only modest total returns despite the revenue growth. The stock hit an all-time high of $15.11 in September 2020 but has struggled to regain those levels, currently sitting 16% below its 52-week high of $13.27.

Who Is Mark Phelan?

Phelan, 57, brings a Wall Street background to the CEO role—unusual in the distributed gaming industry. Before joining Accel in 2017 as Chief Revenue Officer, he served as:

- Managing Director at Piper Jaffray (2004-2011), the investment banking platform

- CEO of M22 Capital LLC, a registered investment advisor (2011-2013)

- Director of Research and Portfolio Manager at SFG Asset Advisors

- Head of Asian Derivatives Trading at DRW Trading Group

He holds an MBA from the University of Chicago Booth School of Business and master's degrees in International Relations from the University of Chicago.

At Accel, Phelan has been instrumental in the company's multi-state expansion strategy and stepped into the role of Interim CFO in 2025 following Matt Ellis's departure. On earnings calls, he has demonstrated deep operational knowledge across markets and led the successful Phase 1 opening of Fairmount Park Casino.

The Compensation Package

Phelan's new employment agreement significantly enhances his compensation:

| Component | Current (Pre-Aug 7) | Post-Transition |

|---|---|---|

| Base Salary | $554,443 | $805,906 |

| Target Bonus | Pro-rated $562,199 | 100% of base salary |

| 2026 Equity Grant | $452,795 | + $671,588 one-time transition grant |

| Future Equity Target | — | 200% of base salary |

| Severance | — | 2x (base + target bonus) |

Rubenstein, meanwhile, will receive 78,930 RSUs in 2026 (vesting over two years) and 335,516 "Advisory RSUs" upon transitioning to his advisor role (vesting quarterly over three years). He must maintain at least 5% ownership of the company to remain on the Board—a condition he currently exceeds with approximately 3.9 million shares.

Financial Snapshot

Accel enters this transition period from a position of operational strength:

| Metric | Q4 2023 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|

| Revenue ($M) | $297.1 | $317.5 | $323.9 | $335.9 | $329.7 |

| EBITDA ($M) | $37.8* | $42.4* | $43.8* | $45.6* | $44.4* |

| EBITDA Margin (%) | 12.7%* | 13.3%* | 13.5%* | 13.6%* | 13.5%* |

| Net Income ($M) | $16.0* | $8.4* | $14.6 | $7.3 | $13.4 |

*Values retrieved from S&P Global

Illinois remains the bedrock of the business, generating 72% of Q3 2025 revenue ($239 million) from 15,641 gaming terminals across 2,728 locations.

The company carries approximately $311 million in net debt as of Q3 2025 but generates consistent free cash flow—$28.4 million in Q3 2025 and $55.6 million for full-year FY 2024.*

Analyst estimates point to continued growth:

| Metric | FY 2024 Actual | FY 2025E | FY 2026E |

|---|---|---|---|

| Revenue | $1.23B | $1.33B | $1.38B |

| EPS | $0.91 | $0.91 | $0.87 |

| Target Price | — | $15.17 | — |

*Values retrieved from S&P Global

The consensus price target of $15.17 implies 37% upside from current levels.

What to Watch

Chicago VGT regulatory timeline: The legislative, regulatory, and implementation process will determine how quickly Accel can begin capturing the Chicago opportunity. Management expects potential revenue contribution as early as Q3/Q4 2026.

Fairmount Park Phase 2: The company is still in design phases for Phase 2 of its racino development, which would expand to 600+ slot machines and 24 table games. Timing remains TBD pending Illinois Gaming Board alignment.

Transition execution: The 6-month overlap period between the announcement and Phelan's official assumption of the CEO role on August 7, 2026 should provide continuity, but investors will watch for any operational disruption.

Rubenstein's continued involvement: With Rubenstein staying on as Chairman and maintaining significant equity ownership, the company maintains founder influence—a positive for continuity, though it may limit Phelan's autonomy.