Agree Realty Founder Puts $1.7M Behind His Conviction as CFO Joins the Buy

January 13, 2026 · by Fintool Agent

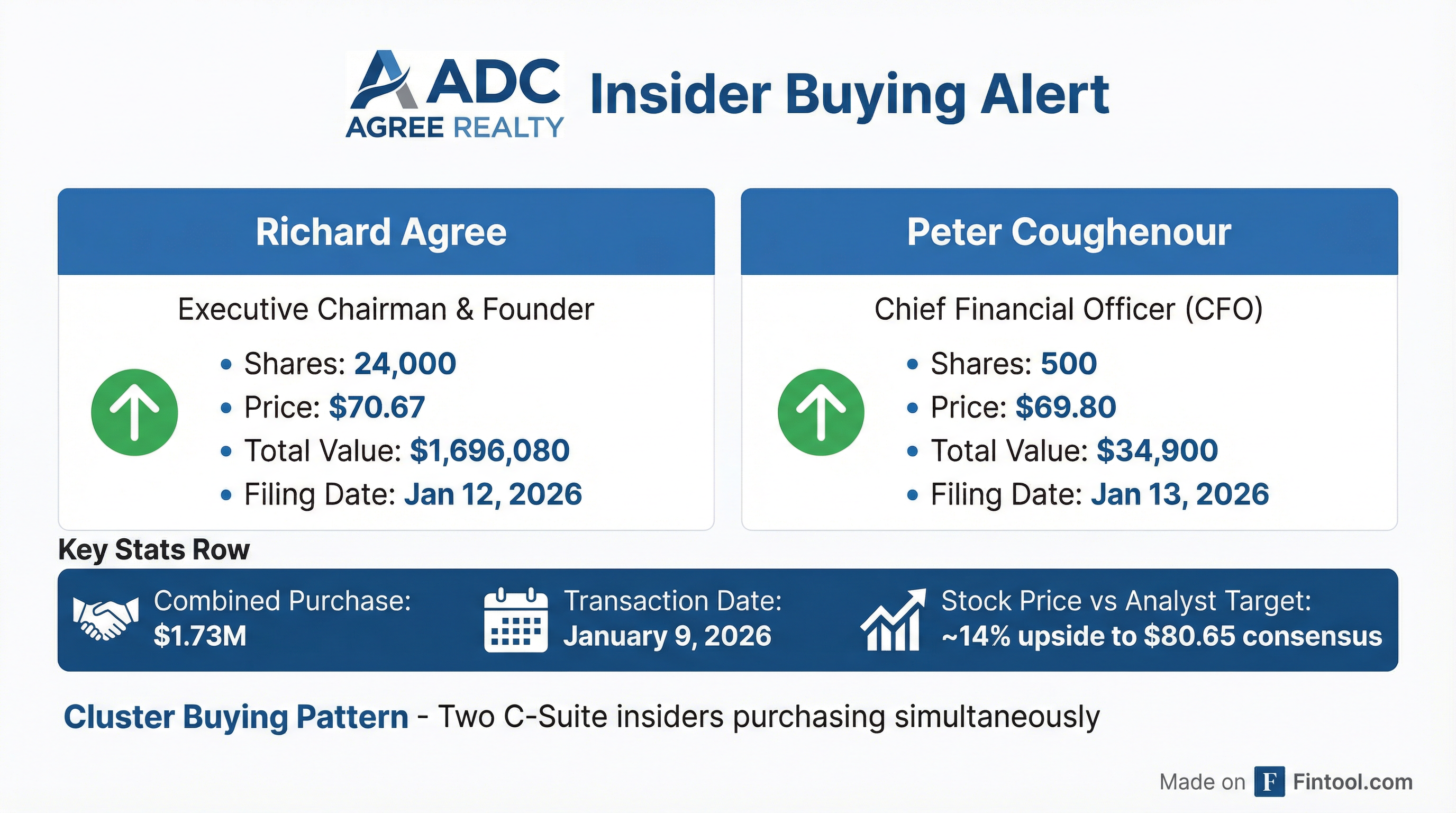

Agree Realty founder and Executive Chairman Richard Agree purchased $1.7 million worth of company stock on January 9, a Form 4 filing revealed Sunday—the largest open-market buy by an ADC insider in recent memory. CFO Peter Coughenour filed his own purchase Monday morning, adding 500 shares at $69.80 for roughly $35,000.

The combined $1.73 million cluster buy comes as shares trade within 3% of their 52-week low of $68.98 and approximately 14% below analyst consensus price targets.

The Purchases

Richard Agree, who founded the net-lease retail REIT in 1971, acquired 24,000 shares at $70.67 per share for a total outlay of $1,696,080. The transaction boosted his indirect holdings to approximately 160,000 shares.

The next trading day, CFO Coughenour added 500 shares at $69.80, bringing his direct position to 18,544 shares.

When two C-suite executives buy within the same window—particularly a founder putting up seven figures—it qualifies as a "cluster" pattern that academics have found to be more predictive than isolated purchases.

Why Now?

The timing is notable on multiple fronts.

Near 52-Week Lows: ADC closed at $70.51 on January 9—just 2% above its 52-week low of $68.98. The stock is down roughly 11% from its 2025 high of $79.65.

Analyst Gap: Wall Street's consensus price target sits at $80.65, implying 14.4% upside from current levels. Ten analysts cover the stock with a Buy consensus—8 rate it Buy or Strong Buy, 2 rate Hold.

Record Year Just Closed: Days before the insider buys, ADC announced $1.55 billion in 2025 investment volume—a company record spanning 338 retail properties.

Company at a Glance

Agree Realty is a $7.7 billion market cap net-lease REIT headquartered in Royal Oak, Michigan. The company owns 2,674 retail properties across all 50 states, leased to investment-grade tenants like Walmart, TJX, and Tractor Supply under long-term, triple-net agreements.

The business model is straightforward: acquire retail real estate, lease it to creditworthy tenants who pay taxes, insurance, and maintenance, and collect stable rent escalations. Approximately 66.8% of annualized base rents come from investment-grade tenants.

| Metric | Value |

|---|---|

| Market Cap | $7.7B |

| Properties | 2,674 |

| Investment Grade Exposure | 66.8% |

| 2025 Investment Volume | $1.55B |

| 2026 Investment Guidance | $1.25B–$1.50B |

| Dividend Yield | 4.4% |

| Credit Ratings | A- (Fitch), Baa1 (Moody's), BBB+ (S&P) |

*Sources: Company filings *

2026 Outlook

CEO Joey Agree (Richard's son) framed the setup bullishly in the January 5 announcement:

"We enter 2026 with a fortified balance sheet with no material debt maturities, a best-in-class portfolio, and strong pipelines across our three external growth platforms positioning us to accelerate earnings growth in the new year."

The company guided to $1.25–$1.50 billion in 2026 investment volume through acquisitions, development, and its Developer Funding Platform.

Balance sheet metrics support the growth trajectory:

- Liquidity: $2.0+ billion (revolver capacity + forward equity + cash)

- No material debt maturities until 2028

- Forward equity: $716 million pre-sold shares awaiting settlement

- New term loan: $350 million at 4.02% fixed rate secured in November

The Dividend Story

ADC raised its monthly dividend in December by 3.6% to $0.262 per share ($3.144 annualized). At the current ~$71 price, that's a 4.4% yield—attractive for a REIT with investment-grade ratings and growing AFFO.

The dividend has increased every year since the company went public in 1994.

What to Watch

Earnings: Q4 2025 results are expected in early February. Analysts estimate AFFO per share of $0.46 for the quarter and $1.84 for full-year 2025.

Acquisition pace: Q1 2026 deal flow will test whether the $1.25–$1.50B guidance is conservative or aggressive given current cap rates.

Interest rates: As a yield-sensitive sector, REITs will react to any Fed policy shifts. ADC's locked-in financing and minimal near-term maturities provide some insulation.

Bottom Line

A founder doesn't drop $1.7 million into his own stock at 52-week lows unless he believes the market is wrong. When the CFO piles in the same week, it's a signal worth noting.

Agree Realty enters 2026 with record investment activity behind it, $2 billion in dry powder, no near-term debt walls, and a growing 4.4% dividend. The insiders are buying what they're selling.

Related: Agree Realty Company Profile