Alt5 Sigma Goes Through Three Auditors in Six Weeks as Trump-Linked Crypto Firm Faces Nasdaq Delisting

December 29, 2025 · by Fintool Agent

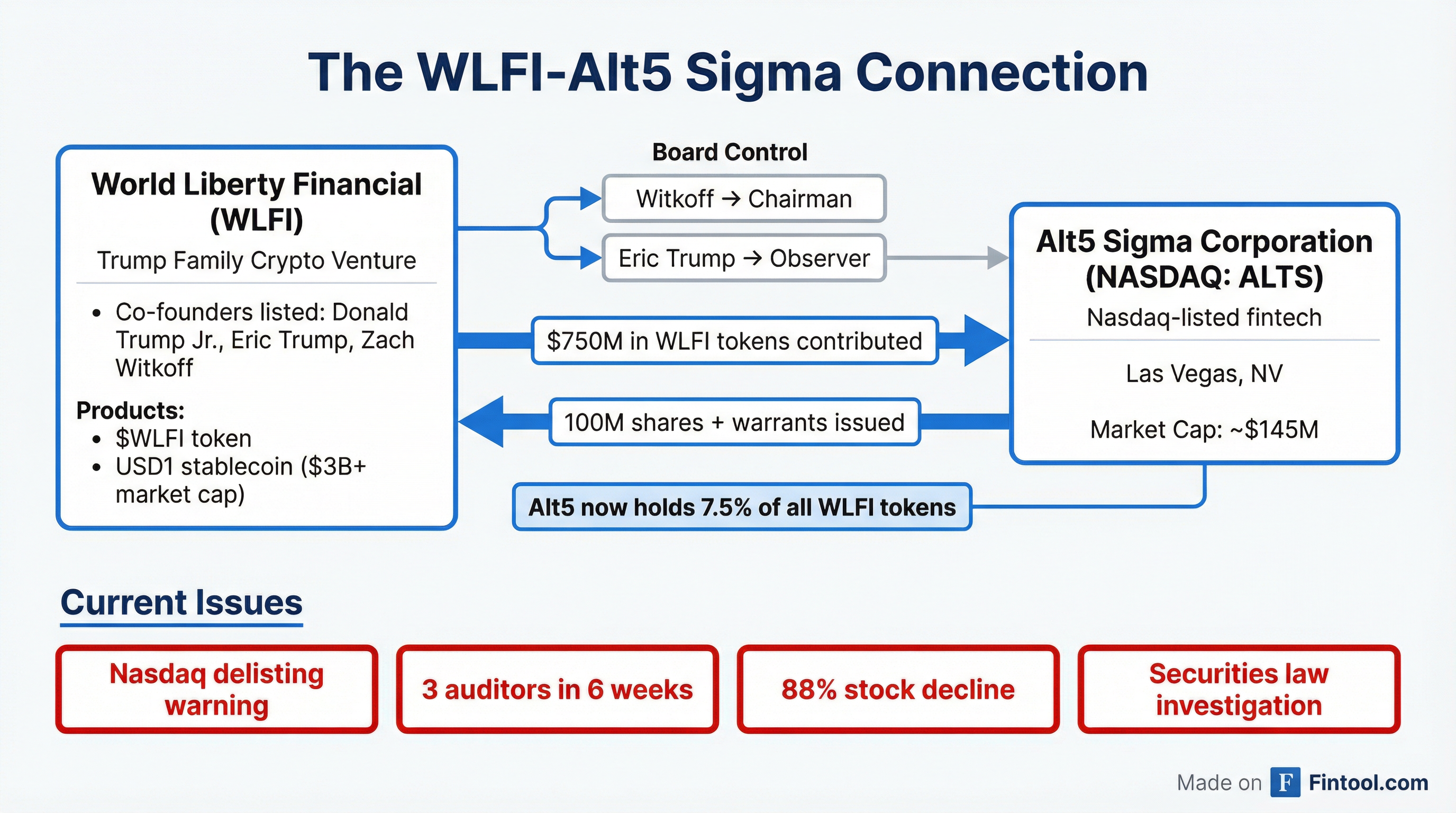

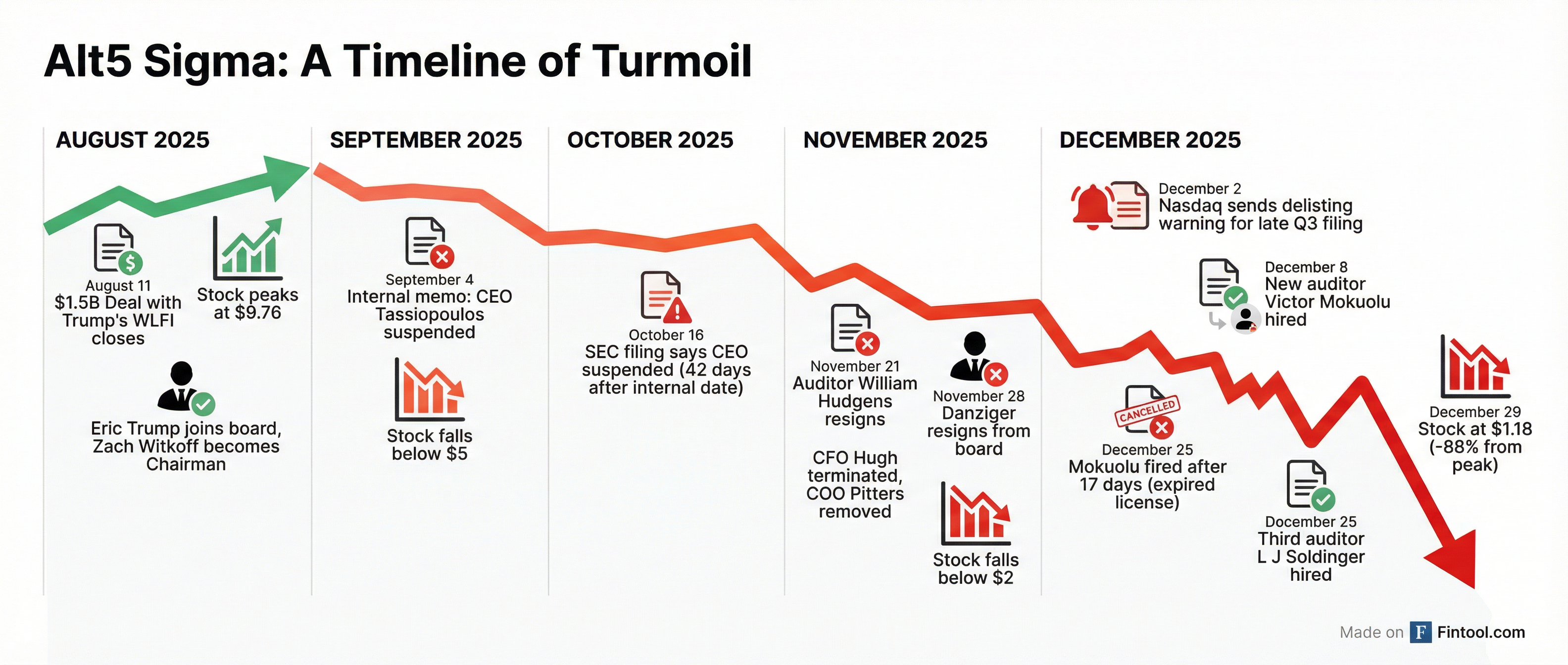

A Nasdaq-listed fintech company tied to the Trump family's World Liberty Financial venture has cycled through three independent auditors in just six weeks, with its latest appointment lasting only 17 days before being dismissed on Christmas Day. Alt5 Sigma Corporation (NASDAQ: ALTS) now trades at $1.18—down 88% from its August peak—as it faces Nasdaq delisting warnings, a law firm investigation, and mounting questions about internal controls.

The turmoil comes just four months after Alt5 completed a $1.5 billion capital raise led by World Liberty Financial, bringing Zach Witkoff (WLFI's CEO and son of President Trump's Middle East adviser) to the chairman role and Eric Trump onto the board.

The Auditor Carousel

The latest SEC filing tells a remarkable story of audit dysfunction.

| Date | Event | Duration |

|---|---|---|

| November 21, 2025 | William Hudgens resigns as auditor | — |

| December 8, 2025 | Victor Mokuolu CPA PLLC appointed | — |

| December 25, 2025 | Victor Mokuolu dismissed | 17 days |

| December 25, 2025 | L J Soldinger Associates LLC appointed | Current |

The Christmas Day dismissal of Victor Mokuolu came after reports surfaced that the Texas-based firm's license had expired in August 2025 and remained inactive, legally barring it from conducting audit work under state regulations.

Alt5 acknowledged the issue, stating that its auditor was "undergoing a peer review per Texas State Board of Accountancy regulations and will be completed by the end of January 2026, at which point the auditor expects the license to be active." The company added: "No reviews or audits of Alt5's financial statements will be issued by our auditor until the firm's licence is active."

A History of Regulatory Fines

Victor Mokuolu CPA PLLC's troubles extend beyond expired licensing. The firm has faced repeated regulatory action:

- $30,000 fine from the Public Company Accounting Oversight Board (PCAOB) in 2023 for failing to notify regulators of six public company audits within the required 35-day period

- $15,000 penalty from the Texas State Board of Public Accountancy for similar violations

- Received a failing grade in the accounting profession's peer review process in 2023

Stock Collapse: From $9.76 to $1.18

The stock's trajectory tells the story of investor confidence evaporating in real-time.

| Period | High | Low | Key Events |

|---|---|---|---|

| August 2025 | $9.76 | $5.12 | $1.5B deal closes; stock peaks |

| September 2025 | $6.68 | $2.55 | Internal CEO suspension memo |

| October 2025 | $3.10 | $1.80 | SEC filing reveals suspension |

| November 2025 | $2.44 | $1.59 | Auditor resigns; CFO terminated |

| December 2025 | $1.80 | $1.10 | Nasdaq warning; auditor chaos |

At Monday's close of $1.18, the stock is trading at a 52-week low, with a market cap of roughly $145 million—a fraction of the $1.5 billion deal value announced just four months ago.

The Trump Family Connection

The August deal created deep ties between Alt5 Sigma and World Liberty Financial:

What World Liberty Financial Got:

- 1 million shares of Alt5 Sigma common stock

- Warrants for an additional 99 million shares

- Board control through chairman appointment

- Eric Trump as board director (later converted to observer role after Nasdaq review)

What Alt5 Sigma Got:

- $750 million worth of $WLFI tokens at $0.20 each

- Access to World Liberty Financial's crypto ecosystem

- Strategic partnership with the fastest-growing stablecoin (USD1 recently hit $3 billion market cap)

The deal made Alt5 a holder of approximately 7.5% of the total WLFI token supply, with Kraken serving as asset manager.

Timeline of Turmoil

The governance collapse accelerated in the fall:

September 4, 2025: Internal communications show CEO Spiro Tassiopoulos was suspended, with CFO Jonathan Hugh assuming CEO duties.

October 16, 2025: SEC filing discloses the CEO suspension—42 days after the internal date, raising questions about whether disclosure requirements were met. Under SEC rules, companies must report when an executive officer effectively stops serving within four business days.

November 21, 2025: Auditor William Hudgens resigns.

November 26, 2025 (day before Thanksgiving): In a filing after markets closed, Alt5 disclosed:

- CFO Jonathan Hugh terminated without cause

- COO Ron Pitters removed from role but retained on board

- Director David Danziger resigned for "personal reasons"

December 2, 2025: Nasdaq sends notice regarding late filing of Form 10-Q for the quarter ending September 2025.

December 25, 2025: Victor Mokuolu dismissed; L J Soldinger Associates appointed as third auditor in six weeks.

Legal Scrutiny Intensifies

Law firm Hagens Berman has launched an investigation into potential disclosure violations, focusing on:

- Potential auditor disclosure discrepancy: Under Form 8-K Item 4.01, companies must disclose auditor changes within four business days

- Timeline inconsistencies in executive suspension disclosures

- Breakdown of internal controls following the capital raise

The investigation has "intensified to include possible violations of federal disclosure rules, potentially providing further red flags of a breakdown of the company's internal controls immediately following the massive capital raise."

What's at Stake

For Alt5 Sigma:

- Must file overdue Q3 2025 financials to maintain Nasdaq listing

- Third auditor in six weeks must complete peer review by end of January

- Potential securities law violations under investigation

For World Liberty Financial:

- Reputational exposure through board positions and equity stake

- Alt5's WLFI token holdings could face forced liquidation in distressed scenario

- Conflicts of interest questions with incoming Trump administration

For Investors:

- 88% stock decline from August peak

- No audited financials since deal closed

- Uncertainty on WLFI token valuation carried on balance sheet

What to Watch

- Late January 2026: New auditor L J Soldinger's peer review completion deadline

- Q3 2025 10-Q Filing: Must be filed to avoid Nasdaq delisting action

- Hagens Berman Investigation: Potential securities class action

- WLFI Token Liquidity: Tokens remain largely illiquid; any forced selling could crater values

- Board Response: Whether World Liberty Financial executives take action or distance themselves

The audit chaos at Alt5 Sigma represents one of the most visible governance failures at a company directly tied to the incoming president's family business interests—a situation that's likely to draw continued regulatory and media scrutiny as the Trump administration takes office.