Aluminum Breaks $3,000 for First Time in Three Years as Supply Crisis Deepens

January 2, 2026 · by Fintool Agent

Aluminum has crossed the $3,000-per-ton threshold for the first time since March 2022, capping an 18% rally in 2025 as a perfect storm of supply disruptions collides with China's self-imposed production ceiling. The breakout signals a structural shift in global aluminum markets that could persist through 2026 and beyond.

LME aluminum traded near $2,996/ton on December 31, 2025—up from $2,500 at the start of the year—as investors priced in a growing deficit driven by smelter closures across three continents and China's 45 million-ton capacity cap.

The rally has been a boon for U.S. aluminum producers. Century Aluminum shares surged 112% in 2025, Kaiser Aluminum gained 62%, and Alcoa rose 39%—all dramatically outperforming the broader market.

The Supply Squeeze Tightens

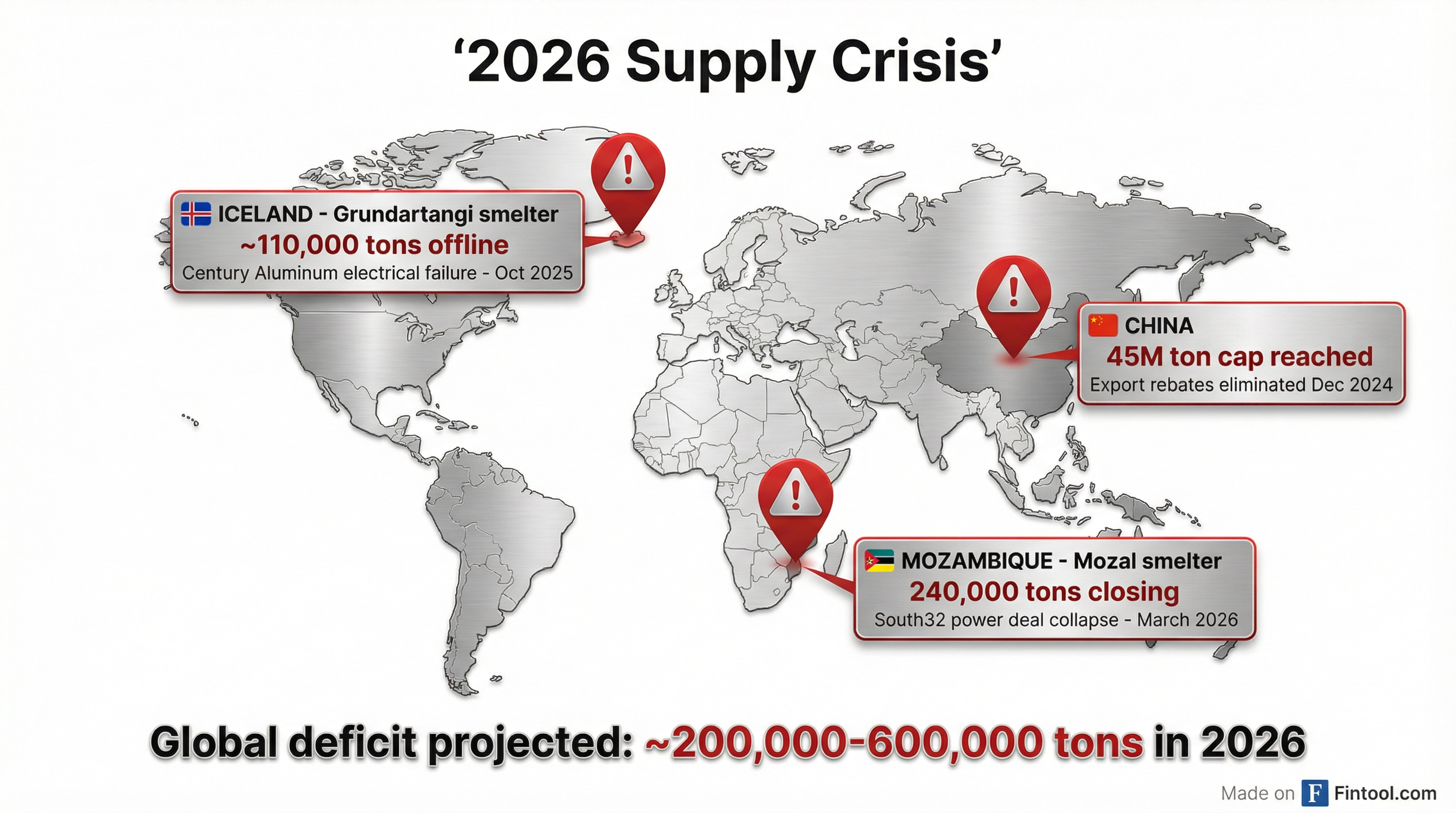

Three major disruptions are converging to create the tightest aluminum market in decades:

1. Mozal Closure: 240,000 Tons Going Dark

South32 will place its Mozal smelter in Mozambique under care and maintenance on March 15, 2026, after failing to secure affordable electricity. The smelter—which produces 240,000 tons annually (South32's share)—couldn't reach agreement with Mozambique's government and state power provider HCB on pricing.

"The parties remained deadlocked on an appropriate electricity price, which was exacerbated by ongoing drought conditions affecting electricity supply from HCB," South32 CEO Graham Kerr said in December.

The closure is particularly painful for European buyers. Mozal's aluminum qualifies as "low-carbon" (hydroelectric-powered) and enters the EU duty-free—making it highly sought after as the bloc implements its Carbon Border Adjustment Mechanism (CBAM) in 2026.

2. Century Aluminum's Iceland Outage

Century Aluminum's Grundartangi smelter in Iceland has been operating at roughly one-third capacity since October 2025, when an electrical equipment failure forced the company to halt one of two potlines. The outage—expected to last 11-12 months—removes approximately 110,000 tons of annual production from an already tight European market.

Like Mozal, Grundartangi produces "green" aluminum using renewable energy, commanding premium prices in carbon-conscious markets.

3. China Hits the Wall

China, which produces over 60% of the world's aluminum, is bumping against its self-imposed 45-million-ton annual capacity cap—a ceiling implemented in 2017 to curb overcapacity and emissions. With smelters unable to expand, Chinese producers are prioritizing domestic sales over exports.

The squeeze intensified in December 2024 when Beijing eliminated the 13% VAT export rebate on aluminum products, effectively raising costs for foreign buyers. Chinese aluminum exports fell 9.2% year-over-year in November 2025 as a result.

U.S. Aluminum Stocks Soar

The supply crisis has translated directly to shareholder returns. U.S. aluminum producers posted exceptional gains in 2025:

| Company | Ticker | YTD Return | 52-Week Range |

|---|---|---|---|

| Century Aluminum | CENX | +112% | $13.05 - $40.83 |

| Kaiser Aluminum | KALU | +62% | $46.81 - $119.13 |

| Alcoa | AA | +39% | $21.53 - $54.82 |

Values retrieved from S&P Global

Alcoa CEO Bill Oplinger noted on the company's Q3 2025 earnings call that the U.S. market is running dangerously lean. "In the U.S., I think our days of consumption have gone down to something like 35 days, which is below a level where it typically triggers higher pricing," Oplinger said.

The Midwest premium—the price U.S. buyers pay above LME—has risen to cover the full 50% Section 232 tariff plus logistics costs, reaching "import parity" for the first time since tariffs were doubled.

The Bull Case Strengthens

Analysts are increasingly bullish on aluminum's outlook. ING forecasts a global deficit of approximately 200,000 tons in 2026, widening to 600,000 tons if Mozal's closure proves permanent. Bank of America has called for prices to reach $3,000—a target now achieved ahead of schedule.

The structural underpinnings are compelling:

Supply constraints:

- China's capacity cap prevents meaningful production growth

- Western smelters struggle to restart due to energy costs and competition from data centers for power contracts

- Indonesia's expansion plans face execution delays and infrastructure bottlenecks

Demand support:

- Electrification and renewable energy require aluminum-intensive components

- Packaging demand remains resilient globally

- Electrical conductor applications are growing

"This is a historically oversupplied industry, but we're entering a deficit," Morgan Stanley's Rachel Zhang told the Financial Times. David Wilson of BNP Paribas added: "It's the first time in 20 years the market has had to think 'where is the next supply coming from?'"

What Could Go Wrong

The bear case centers on demand destruction and alternative supply:

Indonesian expansion: Chinese producers are building smelters in Indonesia to circumvent domestic capacity caps. An estimated 1.4 million tons of new capacity is expected by 2026, though ramp-ups have historically disappointed.

Automotive weakness: Both European and North American auto demand remains soft. Alcoa noted that automotive is "the real weakness that we're seeing both in Europe and in North America."

China stimulus: Any large-scale Chinese economic stimulus could boost domestic production and flood export markets—though the capacity cap limits this risk.

What to Watch

Near-term catalysts:

- March 15, 2026: Mozal shutdown deadline

- Q1 2026: CBAM implementation raising European premiums by an estimated $40-50/ton

- Century Aluminum's Iceland restart timeline

Key price levels:

- $3,000/ton: Psychological resistance (now breached)

- $3,500/ton: Some analysts' 2026 target

- $4,103/ton: All-time high (March 2022)

For investors, the aluminum bull market appears to have structural legs. With supply growth constrained across major producing regions and deficits expected to persist through at least 2027, the metal's decade-long bear market may finally be over.