Anglo American Posts $3.7B Loss as De Beers Suffers Third Straight Writedown

February 20, 2026 · by Fintool Agent

Anglo American has taken another $2.3 billion impairment on De Beers, its third consecutive annual writedown on the 137-year-old diamond business, as lab-grown gems and weak demand continue to devastate the natural diamond market. The mining giant reported a $3.7 billion net loss for 2025, though underlying earnings rose 2% to $6.4 billion on the strength of copper and iron ore.

The impairment slashed De Beers' carrying value to $2.3 billion from over $4 billion, bringing total writedowns over three years to $6.8 billion—a collapse that underscores how rapidly lab-grown diamonds have upended an industry De Beers once controlled.

"There is at the moment a plentiful supply of rough diamonds in the market," CEO Duncan Wanblad told reporters Friday, noting that demand for smaller and lower-quality stones has weakened sharply while only larger, higher-quality diamonds retain strong pricing.

The Lab-Grown Takeover

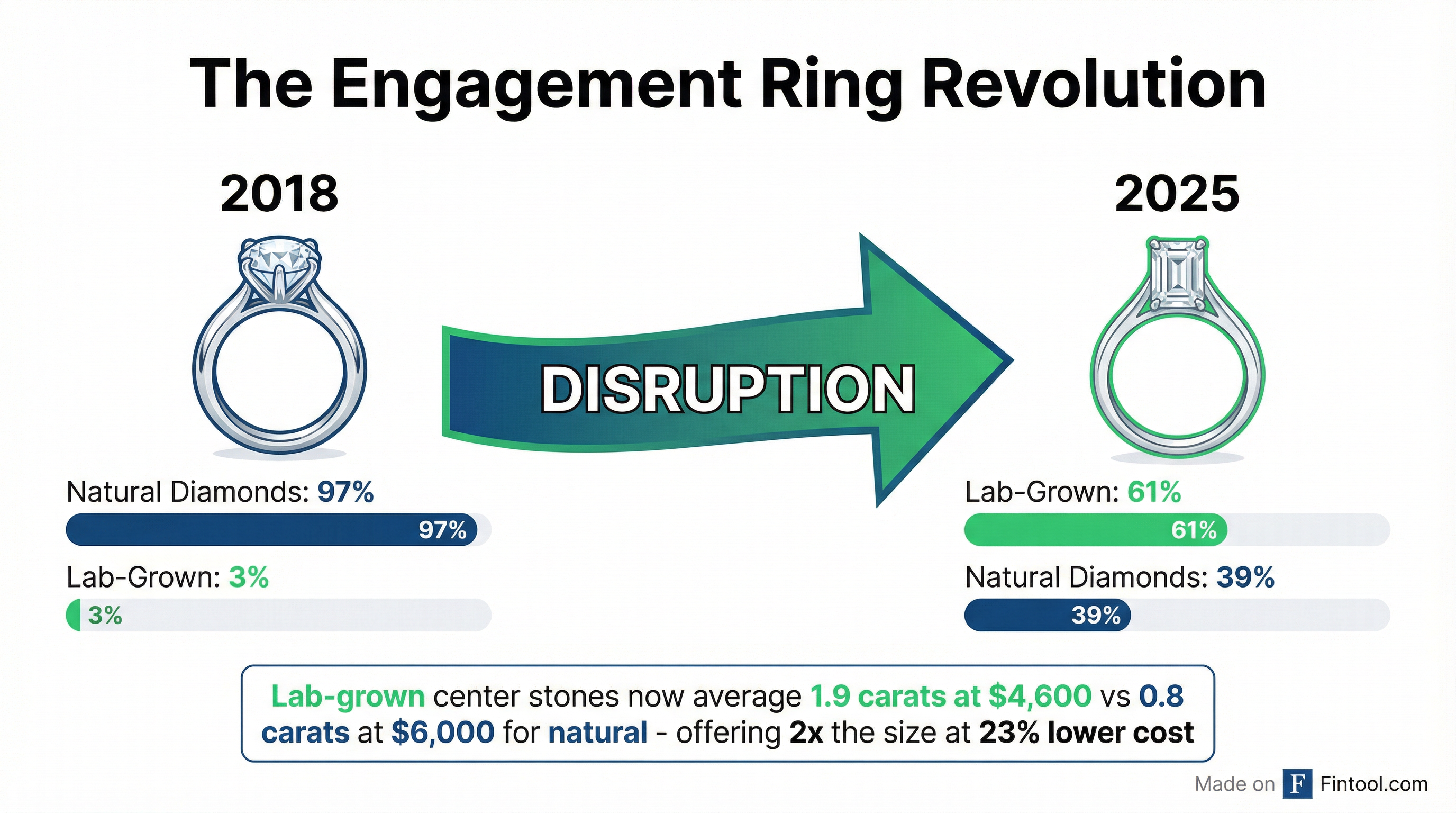

The natural diamond industry is facing an existential threat that has accelerated far faster than producers anticipated. Lab-grown diamonds now account for 61% of US engagement ring center stones—a staggering 239% increase from just 3% in 2018.

The economics are impossible for natural diamonds to match: consumers can now purchase a 1.9-carat lab-grown center stone for an average of $4,600, while natural diamonds at the same price point yield significantly smaller stones. For price-conscious buyers—particularly those shopping below $2,000—lab-grown has become the default choice.

"Below $2,000, one of the greater ways to maximize that emotional value, particularly if you're shopping for a center stone, is a lab-grown diamond," Signet Jewelers CEO J.K. Symancyk explained at a recent investor conference. "As you move up the price point scale, disproportionately, the interest moves towards natural diamond because there is a uniqueness and a rarity."

De Beers' Bleeding Balance Sheet

The operational numbers are stark. De Beers posted an underlying EBITDA loss of $511 million in 2025, compared to a $25 million loss the prior year—a twentyfold deterioration. Production fell 12% to 21.7 million carats as the company produced only into prevailing demand rather than building inventory.

The average realized price for rough diamonds declined 7% to $142 per carat from $152, but that figure masks the true price destruction: when accounting for stock rebalancing initiatives, the effective price index fell 25% year-over-year.

| Metric | 2025 | 2024 | Change |

|---|---|---|---|

| Production (million carats) | 21.7 | 24.7 | -12% |

| Underlying EBITDA | -$511M | -$25M | -1,944% |

| Average Price ($/carat) | $142 | $152 | -7% |

| EBITDA Margin | -15% | -1% | -14pp |

Values retrieved from De Beers preliminary results.

De Beers cut its 2026 production guidance to 21-26 million carats and is targeting unit costs of approximately $80 per carat—down from $86 in 2025—through cost controls and slightly higher volumes.

The company has launched desperate marketing initiatives to revitalize natural diamond demand, including signing the "Luanda Accord"—a government-industry commitment to promote natural diamonds—and launching "ORIGIN De Beers Group," a blockchain-backed branded polished diamond program using the Tracr traceability platform.

The Battle for De Beers

Anglo American is now deep into a structured sale process for its 85% stake in De Beers, with multiple African nations and business consortia circling what was once the crown jewel of the diamond industry.

Botswana—which already owns 15% of De Beers and supplies 70% of its annual rough diamond production—is aggressively pursuing majority control. Diamonds generate approximately one-third of Botswana's government revenue, making De Beers a strategic national asset despite the price collapse.

Angola is pursuing a 20-30% stake through its state diamond company Endiama, proposing a collaborative ownership structure with other African diamond-producing nations. De Beers and Endiama are already joint venture partners in Angolan exploration, having announced the country's first kimberlite field discovery in three decades last year.

Namibia has also expressed interest in an equity stake, aligning with the broader African push for producer-country partnerships.

"We need to get to final binding bids and then pick the partner that we want to go forward with and negotiate that with all the parties involved, including the government of Botswana," Wanblad said, adding he is "optimistic" a deal will be signed this year.

Anglo Teck: The Copper Pivot

While De Beers bleeds value, Anglo American is executing a radical portfolio transformation centered on copper—the metal powering the AI and EV revolutions.

The $53 billion merger with Teck Resources, announced in September 2025, will create Anglo Teck: a Canadian-headquartered copper giant projected to be among the world's top five copper producers with over 1.2 million metric tons of annual output and more than 70% exposure to copper.

Shareholders of both companies have approved the transaction, and regulatory clearances are pending in China and South Korea. Wanblad expects the deal to close between September 2025 and March 2026.

The deal will combine Anglo's Los Bronces (Chile), Collahuasi (Chile), Quellaveco (Peru), and Sakatti (Finland) copper assets with Teck's Quebrada Blanca (Chile) and Highland Valley (Canada) operations, creating a portfolio of world-class copper mines positioned to benefit from soaring demand for electrification and data center construction.

Anglo also announced a potential partnership with Mitsubishi Corp for its Woodsmith fertilizer project in northern England—home to the world's largest known deposit of polyhalite—which had been placed on care and maintenance as the company prioritized its copper pivot.

What to Watch

Near-term: De Beers sale negotiations with shortlisted bidders and Botswana government. Wanblad has not ruled out spinning off De Beers if negotiations fail, though a sale remains the primary objective.

Mid-term: Anglo Teck merger closing, expected by March 2026 pending Chinese and South Korean regulatory approvals.

Long-term: Whether natural diamonds can establish clear differentiation from lab-grown. De Beers maintains that bifurcation will occur in the medium term as consumers recognize lab-grown diamonds as "low-cost fashion jewelry"—but that thesis has been delayed as retailers maintain high margins on synthetics.

The diamond industry built its mystique on scarcity and romance. Neither applies to stones grown in a reactor for pennies on the dollar. De Beers invented the modern engagement ring; it may not survive what's replacing it.

Related Companies:

- Anglo American (ngloy) — Mining conglomerate divesting De Beers

- Teck Resources (teck) — Merging with Anglo American to form Anglo Teck

- Signet Jewelers (sig) — Largest specialty jewelry retailer managing lab-grown transition