Anthropic CEO Calls Nvidia China Sales 'Crazy,' Likens Chip Exports to 'Selling Nukes to North Korea'

January 20, 2026 · by Fintool Agent

Anthropic CEO Dario Amodei delivered a stunning public rebuke of the Trump administration's AI chip export policy at the World Economic Forum in Davos on Tuesday, calling the decision to allow Nvidia+7.87% to sell H200 processors to China "crazy" and likening it to "selling nuclear weapons to North Korea."

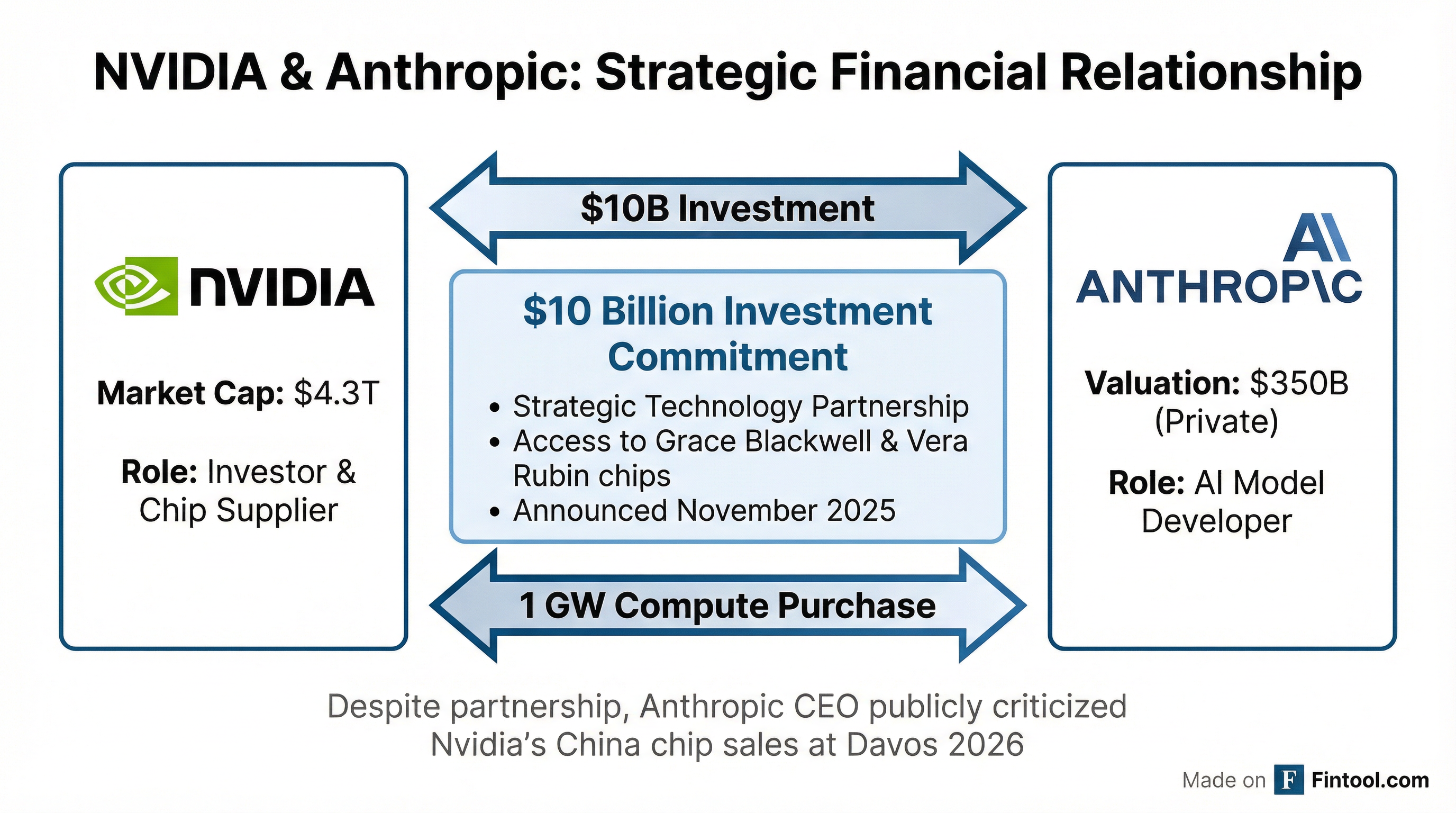

The criticism is remarkable for its source: Nvidia announced just two months ago that it would invest up to $10 billion in Anthropic as part of a sweeping strategic partnership. Amodei is now publicly attacking the core China strategy of a company that has committed billions to his firm.

'A Country of Geniuses in a Data Center'

Speaking with Bloomberg's editor-in-chief at Davos, Amodei painted an alarming picture of AI's national security stakes.

"The CEOs of these companies say, 'It's the embargo on chips that's holding us back,'" Amodei said, clearly frustrated. "We are many years ahead of China in terms of our ability to make chips. So I think it would be a big mistake to ship these chips."

He then described why the stakes are so high: "I've called where we're going with this, a country of geniuses in a data center. So imagine 100 million people smarter than any Nobel Prize winner, and it's going to be under the control of one country or another."

The Anthropic CEO stopped short of naming Nvidia specifically but made his target clear: "I wouldn't refer to any particular people but I would just say that this particular policy is not well advised."

The $10 Billion Partnership That Makes This Awkward

Amodei's criticism creates an extraordinarily uncomfortable situation. In November 2025, Nvidia, Microsoft, and Anthropic announced a landmark partnership that included:

- $10 billion investment commitment from Nvidia into Anthropic

- $5 billion investment from Microsoft

- $30 billion Azure compute capacity purchase by Anthropic

- 1 gigawatt of Nvidia Grace Blackwell and Vera Rubin chips

At the time of the partnership announcement, Nvidia CEO Jensen Huang called Anthropic a "rocket ship" and praised the company's "seminal work in AI safety." The two companies committed to deep engineering collaboration, with Nvidia optimizing its future chip architectures specifically for Anthropic's workloads.

Now Amodei is publicly savaging the China policy that Nvidia has lobbied aggressively for.

The Policy at the Center of the Fight

The Trump administration formally approved H200 chip exports to China on January 13, 2026, codifying a policy Trump announced in December 2025. The new rules allow sales under specific conditions:

| Condition | Requirement |

|---|---|

| Volume Cap | China-bound sales cannot exceed 50% of U.S. domestic sales |

| Third-Party Review | Independent lab must verify chip specifications before export |

| Security Certification | Chinese buyers must demonstrate security procedures |

| Military Use Ban | Chips cannot be used for military purposes |

| Government Cut | U.S. government receives 25% of sales proceeds |

Nvidia praised the move, saying it "strikes a thoughtful balance that is great for America" and will help the company compete for "real jobs for real Americans."

Chinese tech companies have already placed orders for more than 2 million H200 chips, far exceeding Nvidia's current inventory of approximately 700,000 units. At roughly $27,000 per chip, this represents a potential multi-billion dollar revenue stream—and a significant commission for the U.S. government.

Two CEOs, Two Visions

The clash exposes a fundamental split in the AI industry over how to compete with China.

Jensen Huang's position: The Nvidia CEO has consistently argued that selling chips to China actually strengthens American technology leadership. In recent earnings calls, he estimated China represents a $50 billion annual opportunity for Nvidia.

"About 50% of the world's AI researchers are based in China," Huang told analysts. "The platform that wins China is positioned to lead globally... Shielding Chinese chipmakers from US competition only strengthens them abroad and weakens America's position."

Dario Amodei's position: The Anthropic CEO believes the opposite—that the U.S. lead in AI chips is precisely the advantage America must protect, not monetize.

"We are many years ahead of China in terms of our ability to make chips," Amodei said at Davos. He noted that Chinese AI companies like DeepSeek have "publicly admitted they have fallen behind due to a lack of NVIDIA chips."

Nvidia's China Problem

Nvidia has already paid a heavy price for export control volatility. The company disclosed in its most recent 10-Q that it took a $4.5 billion charge in Q1 FY2026 related to H20 chips—a China-specific product—after export rules changed unexpectedly.

The filing reveals the strategic bind Nvidia faces: "We are unable to create and deliver a competitive product for China's data center market that receives approval from both the USG and the Chinese government. We have effectively been foreclosed from competing in China's data center computing market."

Meanwhile, Nvidia's stock fell 4.4% on Tuesday to $178.07 amid broader market turmoil triggered by Trump's Greenland tariff threats. The shares are now trading 16% below their 52-week high of $212.19.

| Metric | Value |

|---|---|

| Tuesday Close | $178.07 |

| Daily Change | -4.4% |

| YTD Performance | -4.2% |

| 52-Week High | $212.19 |

| Market Cap | $4.3 trillion |

The Political Crossfire

Amodei's criticism aligns him with Republican China hawks who have challenged the administration's policy. House Foreign Affairs Committee Chair Brian Mast (R-Fla.) is pushing legislation to prevent China from accessing sensitive U.S. technology.

But Amodei has also drawn fire from the Trump administration. White House AI czar David Sacks has previously accused Amodei of being among the foremost AI "doomers" who prioritize regulations over progress.

Notably, Amodei declined to directly blame Sacks for the policy: "I wouldn't refer to any particular people but I would just say that this particular policy is not well advised."

What It Means for Investors

The public rift raises questions about the Nvidia-Anthropic partnership's durability. While the $10 billion investment commitment and deep technology collaboration are legally binding, the relationship clearly has tensions beneath the surface.

For Nvidia investors, the episode underscores the geopolitical risk embedded in the company's China ambitions. The chipmaker's own filings warn that export controls have "encouraged customers outside China and other impacted regions to 'design-out' certain U.S. semiconductors from their products" and that controls "may disadvantage us against certain of our competitors."

For the broader AI industry, Amodei's comments signal that the sector is far from unified on how to navigate the U.S.-China technology competition. As AI capabilities race toward what Amodei calls "a country of geniuses in a data center," the policy debate will only intensify.

Related: