Aptevo Therapeutics CEO Marvin White Retires After 9-Year Tenure, COO Lamothe to Take Helm

February 3, 2026 · by Fintool Agent

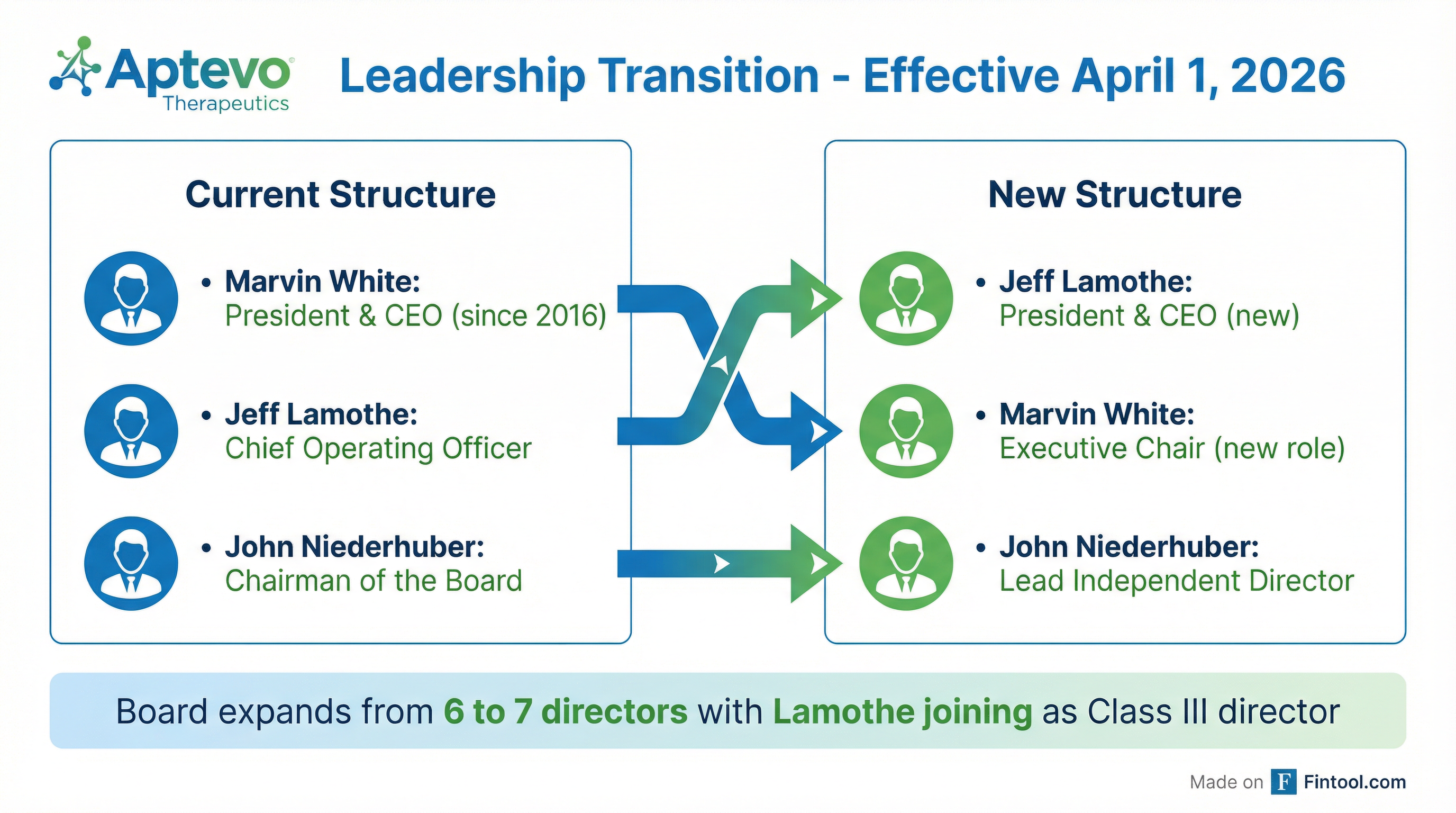

Aptevo Therapeutics+11.48% (APVO) announced today that CEO Marvin White will retire from the top job after nearly a decade, transitioning to Executive Chair effective April 1, 2026. COO Jeff Lamothe, a fellow founding executive, will step up to President and CEO and join the board of directors.

The stock ticked up 3.7% to $7.54 on the news, trading near all-time lows with a market cap of just $12 million—a shell of the company that once traded above $100,000 per share (split-adjusted).

A Planned Transition, Not a Departure

The 8-K filing explicitly states White's decision "was not because of any disagreement with management or the Board of Directors on any matter relating to the Company's operations, policies or practices." This is a planned succession, not a forced exit or sudden resignation.

White, 63, has led Aptevo since its August 2016 spinoff from Emergent BioSolutions. During his tenure, the company evolved from a single-platform antibody company to one with eight pipeline molecules across two proprietary platforms (ADAPTIR and ADAPTIR-FLEX).

"Aptevo has reached an important inflection point," White said in the announcement. "We have a clinically proven platform, a growing body of patient data, a strong balance sheet, access to liquidity sources, and a leadership team that has been executing together for many years."

The Incoming CEO: Jeff Lamothe

Lamothe, 60, has been with Aptevo since its inception, serving as CFO from 2016 to 2023 before becoming COO. His background includes C-suite roles at Cangene Corporation, Smith Carter Architects, Kitchen Craft Cabinetry, and Motor Coach Industries, plus stints at James Richardson & Sons and Ernst & Young.

"Many of the Company's key advances—including clinical progress, pipeline development, operational discipline, and financial execution—have occurred under his direct leadership," White noted.

| Role | Executive | New Compensation |

|---|---|---|

| President & CEO | Jeff Lamothe | $650,000 base + 60% bonus target + $150,000 one-time award |

| Executive Chair | Marvin White | $275,000 base (no bonus) |

| Lead Independent Director | John Niederhuber, M.D. | Board fees only |

The board will expand from six to seven members with Lamothe's addition as a Class III director.

Context: A Clinical Inflection Point

The timing aligns with several positive developments for Aptevo:

Strong Phase 1b Data: Mipletamig, the company's lead CD123 × CD3 bispecific for acute myeloid leukemia, showed a 93% overall response rate (87% CR/CRi) in the RAINIER trial with zero cytokine release syndrome events—a key differentiator versus competing T-cell engagers.

Secured Funding: Aptevo closed a $60 million equity line of credit with Yorkville Advisors in January 2026, extending its cash runway into 2029.

Orphan Drug Status: Mipletamig has received orphan drug designation for AML, providing regulatory advantages including potential market exclusivity.

Financial Reality Check

Despite the positive framing, Aptevo's financial position remains challenging:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Net Loss | -$6.3M | -$6.4M | -$6.2M | -$7.5M |

| Cash & Equivalents | $8.7M | $2.1M | $9.4M | $21.1M |

The company has zero revenue—typical for a clinical-stage biotech—and burns approximately $6-7 million per quarter. Cash position improved through 2025 via equity raises. The $60 million ELOC provides additional runway, though accessing it requires share issuances at a 4% discount to market.

The stock has cratered over the past two years, from split-adjusted highs above $100,000 to today's $7.54—reflecting multiple reverse splits (including a 1-for-18 split in December 2025) and persistent dilution.

Insider Activity: No Red Flags

Insider trading data shows no unusual selling patterns around the transition:

- Marvin White: Received a 30,000 share award in August 2025; no sales

- Jeff Lamothe: Received a 17,300 share award in August 2025; no sales

- Director Grady Grant III: Made a $20,000 open market purchase at $1.49/share in November 2025—the only insider purchase in the past year

The absence of insider selling and Grady's small purchase suggest this is a planned transition rather than executives heading for the exits.

What to Watch

Near-term Catalysts:

- Q4 2025 earnings expected February 20, 2026

- Additional RAINIER dose-optimization cohort data throughout 2026

- Potential Phase 2 initiation for mipletamig

Key Risks:

- Clinical-stage biotech with no approved products

- Continued dilution through ELOC

- Competitive pressure in CD3-engaging therapeutics

Bottom Line

This is an orderly CEO transition at a micro-cap biotech, not a crisis-driven departure. White remains engaged as Executive Chair, Lamothe brings operational continuity, and the timing coincides with positive clinical data and secured funding.

For a company this small ($12M market cap), executive changes typically matter less than pipeline readouts. The real test comes with mipletamig's Phase 2 data and whether Aptevo can translate strong early-stage results into a viable commercial asset—or find a partner willing to take it there.