Aquestive's Anaphylm FDA Rejection Validates Core Science—Stock Surges 40% After Hours

February 02, 2026 · by Fintool Agent

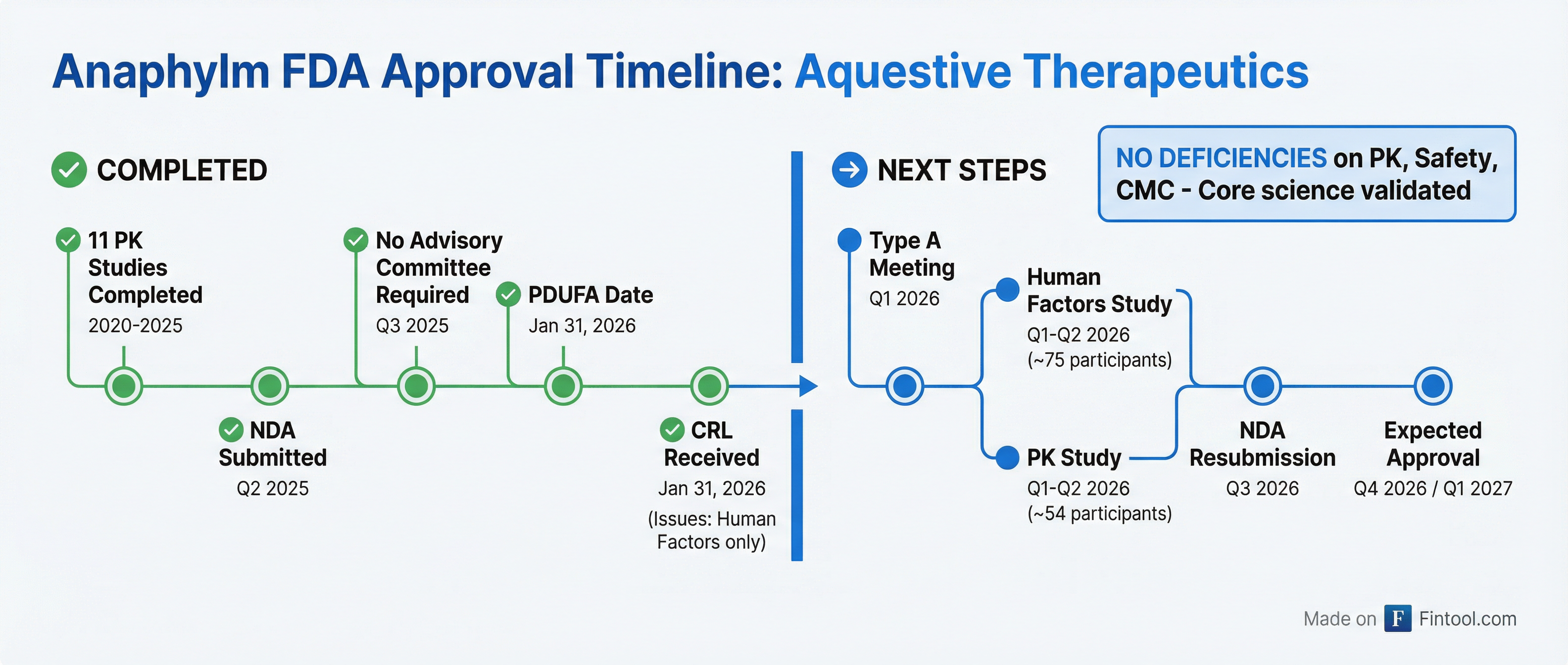

Aquestive Therapeutics (AQST) received a Complete Response Letter from the FDA on Friday rejecting its Anaphylm sublingual epinephrine film—but investors are treating it as a de-risking event. The stock fell 6.6% during regular trading to $2.95, then surged more than 40% in after-hours trading to $4.16 as details emerged showing the FDA's concerns were limited to packaging and administration, not the drug's safety or efficacy.

"This CRL represents a major de-risking event towards approval," CEO Dan Barber said on a conference call Monday morning. "We have a straightforward path to resubmission and expect to do so by the third quarter of this year."

The FDA Said No to Packaging, Not the Science

The FDA's Division of Medication Error Prevention and Analysis (DMEPA)—the human factors group—raised concerns about three specific issues:

- Pouch opening difficulty: One child in the validation study failed to open the pouch, and the current design uses child-resistant packaging

- Film tearing risk: Six participants tore the film while opening the pouch, though all successfully administered the torn dose

- Tolerability concerns: Four of 166 participants removed the film prematurely, citing taste (2) or burning sensation (2)—not tingling as initially suggested

Critically, the FDA cited no deficiencies regarding:

- Pharmacokinetic bracketing

- Repeat dose safety

- Sustainability of performance

- Chemistry, manufacturing, and controls (CMC)

"There were also no CMC comments," Barber noted. "We believe this indicates we have adequately convinced the FDA on major CMC safety and efficacy data for this program."

A Decade of Clinical Work—Validated

Aquestive has conducted 11 clinical pharmacokinetic studies over the past several years, building what management calls "the most robust epinephrine clinical database in the world." The company has also shipped over 2.5 billion doses of sublingual film products to five continents over the past 15 years, with only one complaint related to a potentially torn film and zero complaints about pouch opening difficulty.

"Reading the CRL, it just defines a clear path for us to follow to gain approval," said Interim Chief Medical Officer Gary Slatko. "The response gives us great confidence in the PK profile of the product and the safety profile, and it tells us that the FDA concurs with that."

The Path Forward: Q3 Resubmission, Late-2026 Approval

Aquestive outlined two required studies before resubmission:

| Study | Scope | Timeline |

|---|---|---|

| Human Factors Validation | 75 participants (15 per arm, 5 arms) | Q1-Q2 2026 |

| PK Study | 54 participants (18 per arm, 3 arms in parallel) | Q1-Q2 2026 |

The company already has an alternate pouch opening design ready and has previewed it to the FDA. The FDA is allowing flexibility in the PK study design—parallel or sequential, with or without injectable comparator—and is not requiring repeat dosing.

"The standard review time after submission with the clinical data we'd be putting in is six months," Barber said. "Having said that, a competing product had a six-month clock and got approved in four months. We're very aware of that. We will be pushing hard."

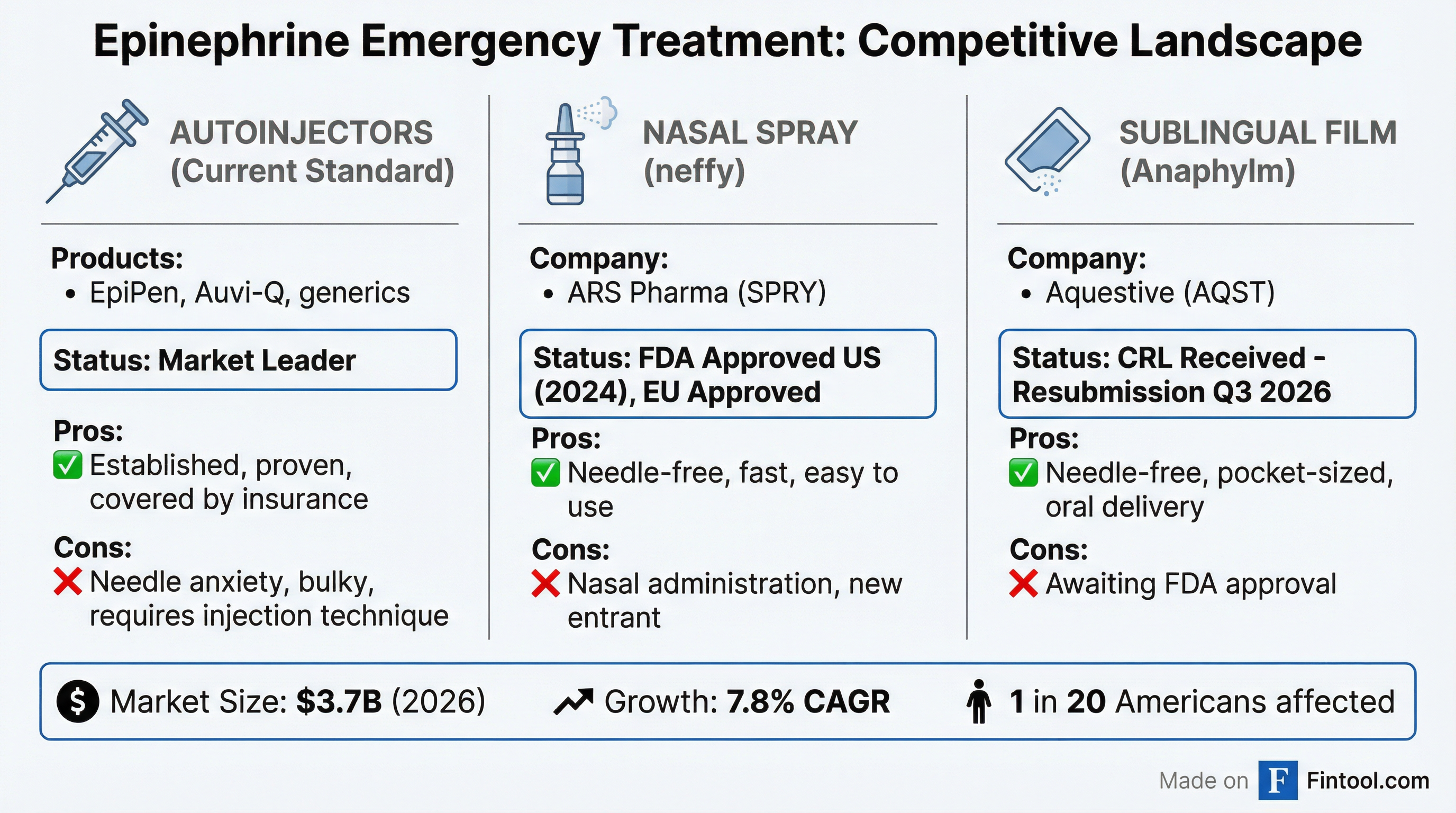

Competitive Context: neffy Expands as Anaphylm Awaits

The timing is notable. On the same day Aquestive disclosed its CRL, Ars Pharmaceuticals (SPRY) announced the European Medicines Agency's CHMP adopted a positive opinion for EURneffy 1 mg, expanding the needle-free nasal spray to younger children (15-30 kg).

ARS Pharma's neffy is already FDA-approved in the U.S. (2024), approved in Europe for the 2mg dose (August 2024), and has regulatory approvals in Japan, China, and Australia. SPRY shares trade at $9.99 with a market cap of $987 million—roughly 3x Aquestive's $293 million valuation.

The epinephrine autoinjector market was valued at $3.45 billion in 2025 and is projected to reach $5.43 billion by 2031, growing at a 7.84% CAGR. Despite neffy's entry, autoinjectors still dominate, and analysts believe needle-free alternatives are expanding the market rather than cannibalizing it.

Chief Commercial Officer Sherry Korczynski highlighted patient preference data: "When we send samples of our demos of Anaphylm as well as the other products on the market, when a patient sees, feels, touches Anaphylm as well as the other products, 96% of the time, patients are choosing Anaphylm."

Financial Position: $120 Million Cash, Runway Into 2027

Aquestive ended 2025 with approximately $120 million in cash and cash equivalents—sufficient to complete the approval process and launch in the U.S. The company raised $85 million in equity and $75 million in commercial launch financing during 2025.

| Metric | Value |

|---|---|

| Cash (Dec 31, 2025) | $120M |

| Projected Cash Runway | Into 2027 |

| Market Cap | $293M |

| 52-Week High / Low | $7.55 / $2.12 |

| Analyst Consensus | Strong Buy |

| Avg. Price Target | $8.40 (185% upside) |

The company has not yet hired its sales force—a deliberate decision to wait for approval. "We did not have to let anyone go," Korczynski said. District sales managers and representatives are "lined up" and ready to be activated post-approval.

International Expansion Continues

Despite the U.S. setback, Aquestive is pressing ahead internationally:

- Canada: Pre-submission meeting completed, "clear path forward," filing expected H2 2026

- Europe (EMA): Pre-submission meeting completed, package being finalized

- United Kingdom (MHRA): Upcoming meeting scheduled

"The FDA feedback we just received is actually way more important for us and where we're going than the competitor information," Barber said regarding the CHMP opinion for neffy. "It shows that the FDA on the big questions that were around our program is bought in. So we think from an EMA and Health Canada perspective, that gives us a green light to move forward rapidly."

What to Watch

Near-term catalysts:

- Type A meeting with FDA (targeting Q1 2026)

- Human factors study initiation and completion

- PK study results

- NDA resubmission (Q3 2026 target)

Key risks:

- FDA review could extend beyond 6 months

- Additional deficiencies could emerge in the resubmission

- neffy continues to build market share and prescriber relationships

- Cash runway depends on no significant delays

The market's after-hours reaction suggests investors see this as a buying opportunity—a regulatory delay, not a death knell. With the core science validated after a decade of clinical work, the question is no longer if Anaphylm will work, but when the FDA will be satisfied with the packaging.

Related: