Azenta Shareholders Approve All Proposals as Turnaround Strategy Gains Traction

January 28, 2026 · by Fintool Agent

Azenta shareholders delivered a resounding endorsement of management's turnaround strategy Tuesday, approving all four proposals at the company's 2026 Annual Meeting—including a contested equity plan expansion—as the life sciences company advances its portfolio simplification efforts and $250 million capital return program.

The virtual meeting, held January 28, 2026, capped a transformative 12-month period that saw Azenta divest its B Medical Systems business for $63 million , authorize its largest-ever share repurchase program , and deliver 310 basis points of margin expansion in fiscal 2025 .

What Happened

With 42.3 million shares present out of 46.0 million outstanding—representing a 92% quorum—shareholders voted in favor of all four proposals :

- Election of 10 directors to the board

- Advisory vote on executive compensation (say-on-pay)

- Amendment to the 2020 Equity Incentive Plan adding 2.75 million shares for issuance

- Ratification of PwC as independent auditor for fiscal 2026

The equity plan amendment, which expands the share pool available for employee compensation, was the most consequential item on the ballot. Such proposals can draw opposition from institutional investors concerned about dilution, but Azenta shareholders appear confident the expanded equity capacity will help retain talent through the ongoing transformation.

The Turnaround Story

Board Chair Frank Casal didn't mince words in his opening remarks, calling fiscal 2025 "a turnaround year for Azenta" .

The numbers support that characterization. After years of struggling with profitability, Azenta delivered meaningful improvement across key metrics:

| Metric | FY 2024 | FY 2025 | Change |

|---|---|---|---|

| Revenue | $573M | $594M | +4% |

| Adjusted EBITDA Margin | 8.0% | 11.2% | +310 bps |

| Organic Growth | — | 3% | — |

| Free Cash Flow | $18M | $50M | +$32M |

CEO John Marotta attributed the improvement to "business simplification through the Azenta Business System, and enhanced execution, which led to measurable improvements in quality, delivery, and productivity" .

B Medical Divestiture: Final Piece of Portfolio Simplification

The most significant strategic move referenced at the meeting was the December 2025 agreement to sell B Medical Systems to THELEMA S.À R.L. for $63 million .

B Medical, a Luxembourg-based manufacturer of medical refrigeration devices, was reclassified as a discontinued operation in November 2024. The sale represents the final step in Azenta's portfolio simplification, allowing management to focus exclusively on its two core segments:

- Sample Management Solutions ($325M revenue in FY2025, +2% YoY)

- Multiomics ($269M revenue in FY2025, +6% YoY)

There's an unusual wrinkle to the deal: Luc Provost, the current CEO of B Medical and an Azenta Vice President, is the majority owner of buyer THELEMA . Azenta disclosed that despite this related-party dynamic, "the terms of the Share Purchase Agreement were negotiated on an arm's-length basis following a competitive auction process" .

The transaction structure includes protective provisions for Azenta: THELEMA has deposited $9 million, with the remaining $54 million due at closing. If financing conditions aren't met by March 31, 2026, Azenta retains $5 million as a break-up fee .

Capital Allocation: Putting $546 Million to Work

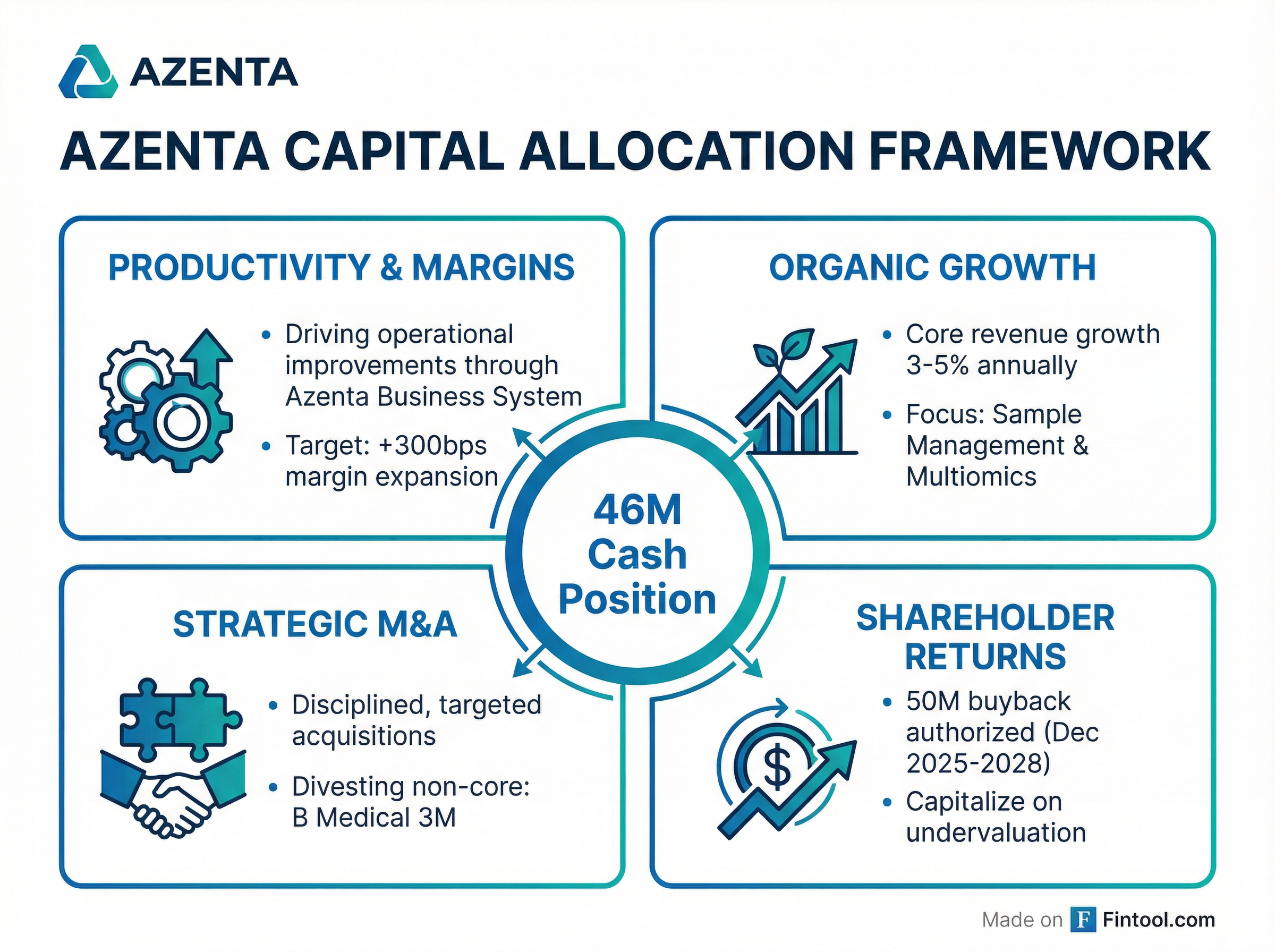

Azenta ended fiscal 2025 with a formidable $546 million in cash, cash equivalents, restricted cash, and marketable securities —a war chest that management outlined plans to deploy across four priorities at its December 2025 Investor Day:

The centerpiece of the shareholder return strategy is a $250 million share repurchase program authorized in December 2025 . Management was explicit about the rationale: the buyback is "intended to enhance shareholder value and capitalize on undervaluation" .

At current prices around $40 per share, the authorization represents roughly 14% of Azenta's $1.8 billion market cap—a substantial commitment to capital returns for a company that historically prioritized M&A.

Stock Performance: A Tale of Two Halves

Azenta shares have rallied 67% from their 52-week low of $23.91 reached in May 2025, though they remain 26% below where they started 2025.

The stock gained 2.5% on December 10, 2025, when the company hosted its Investor Day in Indianapolis and announced the buyback program . It traded relatively flat on the B Medical sale announcement December 29.

Analysts maintain a consensus price target of $43.50, representing roughly 9% upside from current levels.*

What's Next

Azenta's next catalyst is its Q1 FY2026 earnings report scheduled for February 4, 2026 . Management has guided for 3-5% organic revenue growth and approximately 300 basis points of additional adjusted EBITDA margin expansion for fiscal 2026 .

| Metric | FY 2026 Estimate | FY 2027 Estimate |

|---|---|---|

| Revenue | $618M* | $654M* |

| EPS | $0.79* | $1.02* |

| EBITDA | $86M* | $107M* |

*Values retrieved from S&P Global.

Key dates to watch:

- February 4, 2026: Q1 FY2026 earnings

- March 31, 2026: Expected close of B Medical divestiture

With the annual meeting behind them and shareholders aligned, Azenta's management team enters 2026 with a clear mandate to execute on the next phase of its turnaround: proving the margin improvement is sustainable and deploying capital in ways that drive long-term value.

Related Companies: Azenta