Azenta Shareholders Approve 2.75M Share Equity Expansion at 2026 Annual Meeting

January 28, 2026 · by Fintool Agent

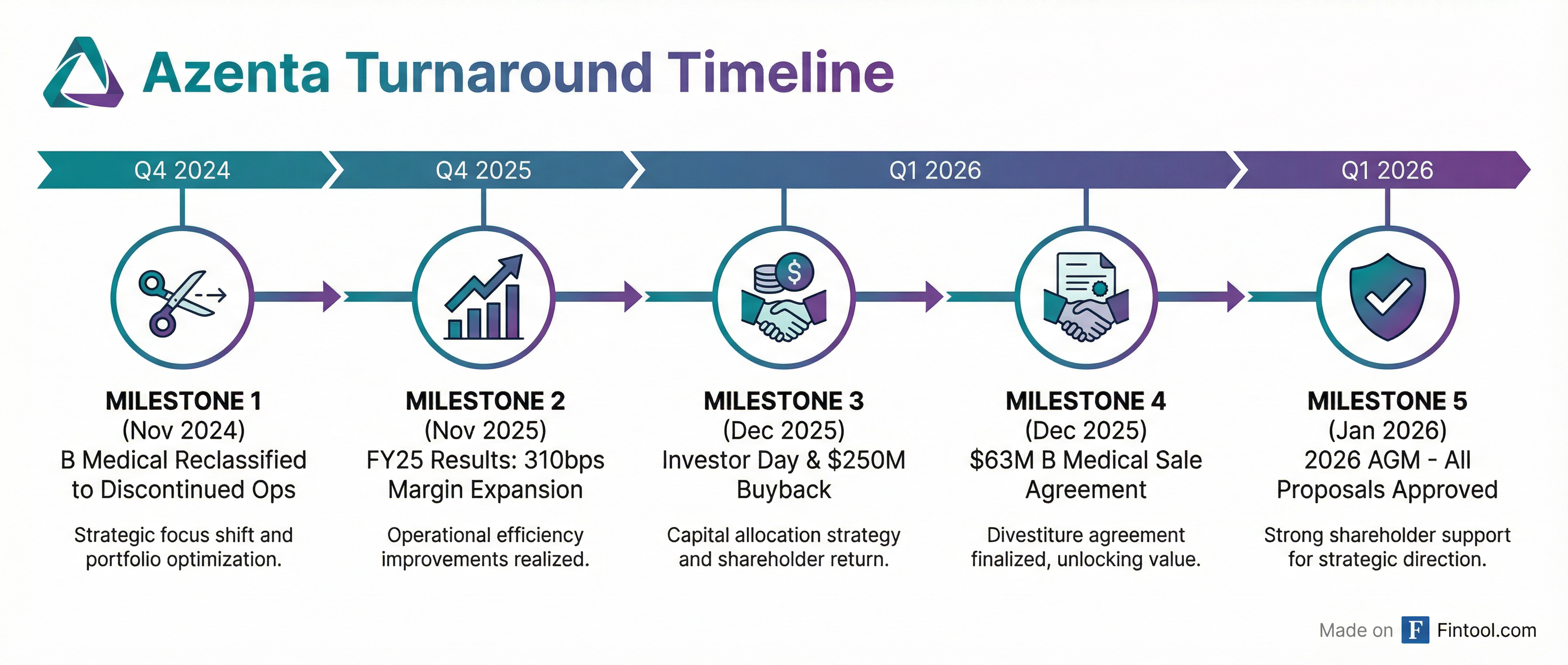

Azenta shareholders delivered a strong endorsement of management's turnaround strategy at the company's 2026 Annual Meeting today, approving all four proposals including a significant expansion of the equity incentive plan by 2,750,000 shares.

The life sciences tools provider held its virtual annual meeting this morning, with 42.3 million of 46.0 million outstanding shares participating—a 92% turnout that reflects heightened investor engagement as the company executes on its portfolio simplification strategy.

Shares of AZTA traded at $39.60, down 1.4% on the day, amid broader market weakness. The stock has rallied 66% from its 52-week low of $23.91 but remains below its January 2025 level of $50.04.

What Shareholders Approved

The meeting, chaired by Frank Casal with CEO John Marotta leading the executive presence, ratified four proposals:

| Proposal | Description | Status |

|---|---|---|

| 1 | Election of 10 directors | Approved |

| 2 | Advisory vote on executive compensation (Say-on-Pay) | Approved |

| 3 | Amendment to 2020 Equity Incentive Plan (+2,750,000 shares) | Approved |

| 4 | Ratification of PwC as independent auditors for FY 2026 | Approved |

The equity plan expansion is the most notable approval, giving Azenta additional runway to attract and retain talent as it executes a multi-year turnaround. The 2,750,000 additional shares represent approximately 6% of shares outstanding.

"A Transformative Year"

Board Chair Casal used the meeting to reinforce the turnaround narrative, calling fiscal 2025 "a turnaround year for Azenta" marked by "disciplined strategy" and "meaningful margin expansion despite a challenging macro environment."

The numbers support the characterization. Fiscal 2025 delivered:

| Metric | FY 2025 | FY 2024 | Change |

|---|---|---|---|

| Revenue | $594M | $573M | +4% |

| Organic Growth | 3% | — | — |

| Adjusted EBITDA | $66M | $46M | +44% |

| Adjusted EBITDA Margin | 11.2% | 8.0% | +310 bps |

| Cash Position | $546M | — | — |

| Free Cash Flow | $38M | $12M | +$26M |

"The organization became simpler, more accountable, and better positioned to serve our customers while driving long-term shareholder value," Casal told shareholders.

Strategic Actions Accelerating

The AGM comes amid a flurry of capital allocation moves that underscore management's commitment to the turnaround:

$250 Million Share Buyback (December 10, 2025): The Board authorized a multi-year repurchase program through December 2028, explicitly citing "undervaluation" as a motivation. CEO Marotta framed the buyback as one of "four key levers" alongside productivity improvements, organic growth, and disciplined M&A.

B Medical Divestiture (December 29, 2025): Azenta signed a definitive agreement to sell its B Medical Systems business—a Luxembourg-based medical refrigeration unit—to THELEMA S.À R.L. for $63 million. The deal is expected to close by March 31, 2026.

"The agreement to sell B Medical Systems marks a major step forward in simplifying the portfolio to prioritize our core capabilities with the highest strategic impact," Marotta said when announcing the deal.

The B Medical divestiture represents the culmination of a strategic review announced in November 2024, when Azenta first reclassified the business to discontinued operations.

Stock Performance and Valuation

Azenta shares have been volatile over the past year, swinging from a 52-week low of $23.91 to a high of $55.64. The stock currently trades at $39.60, implying a market capitalization of approximately $1.8 billion.

| Price Metric | Value |

|---|---|

| Current Price | $39.60 |

| 52-Week High | $55.64 |

| 52-Week Low | $23.91 |

| 50-Day Average | $35.69 |

| 200-Day Average | $31.30 |

| Market Cap | $1.8B |

The analyst consensus target price of $43.50 implies roughly 10% upside from current levels.*

What's Ahead

Azenta is guiding for continued momentum in fiscal 2026:

| FY 2026 Guidance | Target |

|---|---|

| Organic Revenue Growth | 3-5% |

| Adjusted EBITDA Margin Expansion | 300 bps |

| Free Cash Flow | Higher YoY |

Near-term catalysts include:

- Q1 FY26 Earnings: February 4, 2026 (before market open)

- B Medical Closing: Expected by March 31, 2026

- Buyback Activity: Program active through December 2028

The company will host its earnings call on February 4 at 8:30 AM Eastern, where investors will look for updates on B Medical transaction progress and early FY26 trends.

The Bottom Line

Today's AGM was a procedural milestone that nonetheless reinforced key themes: strong shareholder support for management's turnaround strategy, commitment to capital returns via the $250 million buyback, and continued portfolio simplification through the B Medical exit. With 310 basis points of margin expansion already delivered in FY25 and another 300 targeted for FY26, Azenta is positioning itself as a leaner, more focused life sciences tools player—a transformation that will face its next test when Q1 earnings arrive February 4.

*Values retrieved from S&P Global.

Photo: Azenta Life Sciences