Baidu Stock Soars 15% on Kunlunxin AI Chip Spinoff: Hong Kong IPO Filed

January 03, 2026 · by Fintool Agent

Baidu just fired the starting gun on one of 2026's most anticipated IPOs. The Chinese search and AI giant filed to spin off its AI chip subsidiary Kunlunxin for a Hong Kong Main Board listing on January 1—and investors immediately bid the stock up 15% to $150.30, its largest single-day gain since February 2023 and a new 52-week high.

The move marks a strategic pivot for Baidu: rather than keeping Kunlunxin buried inside its corporate structure, the company is betting that a standalone listing will unlock billions in hidden value while positioning the chip unit to compete more aggressively in China's intensifying race for semiconductor self-sufficiency.

The Deal: $3 Billion Valuation, Path to Profitability

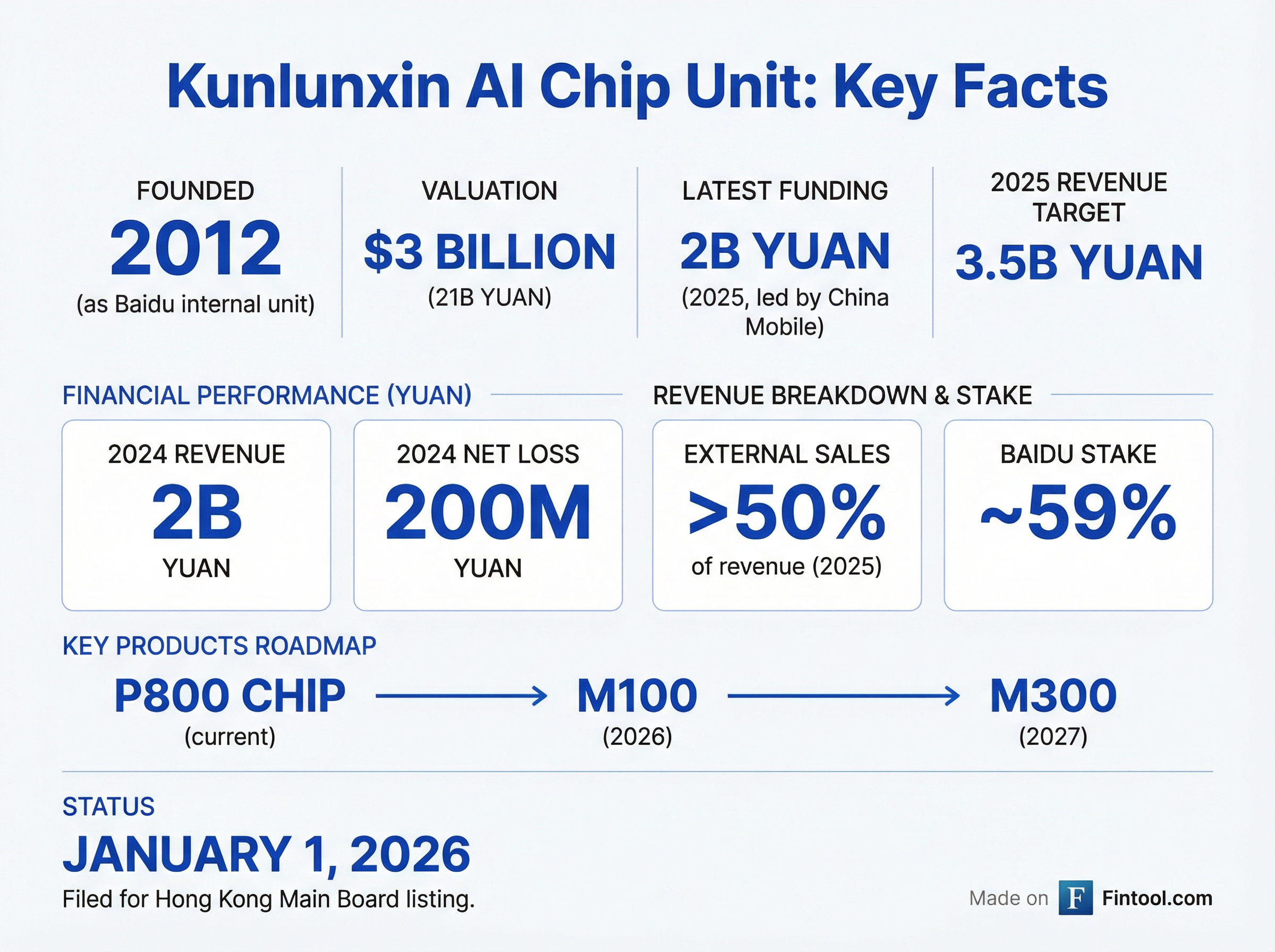

Kunlunxin—officially Kunlunxin (Beijing) Technology Co., Ltd.—filed confidentially with the Hong Kong Stock Exchange, with plans to complete the IPO by early 2027. The unit was valued at approximately 21 billion yuan ($3 billion) after a funding round in late 2025 that raised over 2 billion yuan from China Mobile and other strategic investors.

Baidu holds approximately 59% of Kunlunxin and will retain majority ownership after the spinoff. The company framed the transaction as a value-unlocking event designed to "independently showcase Kunlunxin's value, attract investors focused on the AI chip sector, and leverage its standalone listing to enhance its market profile, broaden financing channels, and better align management accountability with performance."

| Metric | Value |

|---|---|

| Valuation | $3 billion (21B yuan) |

| 2024 Revenue | 2 billion yuan |

| 2025 Revenue Target | >3.5 billion yuan |

| 2024 Net Loss | 200 million yuan |

| 2025 Target | Break-even |

| External Sales | >50% of revenue (2025) |

| Baidu Stake | 59% |

Jefferies responded by hiking its Baidu price target from $159 to $181, maintaining a "buy" rating. Analyst estimates suggest Kunlunxin could be valued between $16 billion and $23 billion post-IPO, implying Baidu's stake alone could be worth $9-13 billion.

From Internal Project to External Powerhouse

Kunlunxin began life in 2012 as an internal Baidu division building AI chips for the company's own data centers. Over the past two years, it has aggressively expanded beyond its captive customer base. In 2025, over half of Kunlunxin's revenue is expected to come from external sales—a critical milestone that demonstrates commercial viability independent of Baidu.

The unit's most advanced product, the P800 chip, has gained traction supplying data center projects for state-owned enterprises and government buyers. Looking ahead, Kunlunxin unveiled two new products in November 2025:

- M100: Inference-focused chip launching early 2026

- M300: Training and inference chip for multimodal models, targeting early 2027

"[Kunlunxin's chips] work best for inference and other workloads that are easier to move, especially for government, telecom, and state-owned cloud users, where stable supply and lower cost matter more than top performance," said Counterpoint Research analyst Brady Wang.

China's AI Chip Ecosystem: Racing for Self-Sufficiency

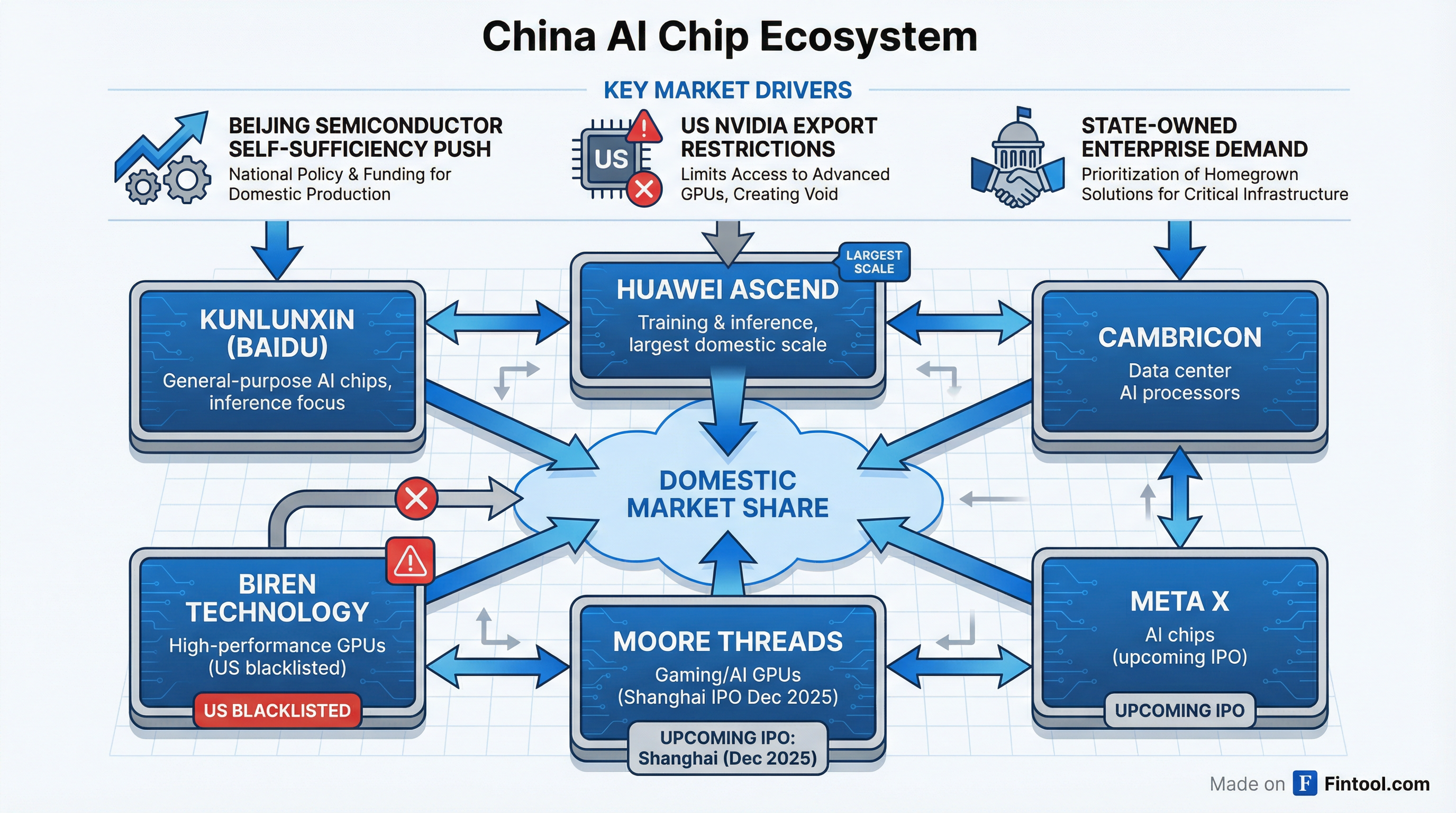

The Kunlunxin IPO arrives amid a gold rush in Chinese AI semiconductor listings. Beijing's semiconductor self-sufficiency campaign—turbocharged by escalating US export restrictions on advanced chips including Nvidia's latest GPUs—has created massive demand for domestic alternatives.

In December 2025, Moore Threads debuted on the Shanghai Stock Exchange at more than 5x its IPO price, signaling enormous appetite for AI chip stocks. Biren Technology, which has been blacklisted by the US, is also planning a Hong Kong listing.

Kunlunxin competes in this crowded but fast-growing market alongside:

| Company | Focus | Status |

|---|---|---|

| Huawei Ascend | Training & inference | Largest domestic scale |

| Cambricon | Data center AI processors | Publicly traded |

| Biren Technology | High-performance GPUs | US blacklisted, HK IPO planned |

| Moore Threads | Gaming/AI GPUs | Shanghai IPO Dec 2025 (+500%) |

| MetaX | AI chips | IPO imminent |

"Beijing is not relying on a single company," Wang noted. "Instead, Kunlunxin works together with Huawei Ascend, Cambricon, Alibaba, and others to build a domestic AI computing ecosystem."

Baidu's AI Strategy: Chips as a Competitive Moat

For Baidu, Kunlunxin isn't just a financial asset—it's a strategic hedge against geopolitical risk. CEO Robin Li has emphasized the company's "four-layer AI architecture" spanning infrastructure, frameworks, models, and applications, with Kunlunxin providing the foundational chip layer.

"Even without access to the most advanced chips, our unique full-stack AI capabilities enable us to build strong applications and deliver meaningful value," EVP Dou Shen said on the Q1 2025 earnings call. "We have the flexibility to select from a range of chip solutions based on different business scenarios, especially for inference."

Baidu's AI cloud business—which relies heavily on Kunlunxin chips for inference workloads—has been the company's growth engine, surging 42% year-over-year in Q1 2025 to 6.7 billion yuan and now representing 26% of Baidu Core revenue.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $2,650* | $2,385* | $2,441* | $2,327* |

| EBITDA Margin | 17.5%* | 19.9%* | 16.5%* | 10.9%* |

| AI Cloud % of Revenue | 20% | 26% | — | — |

*Values retrieved from S&P Global

Market Reaction: Best Day in Three Years

Baidu's US-listed ADRs jumped 15% on January 2—the first trading day after the announcement—to $150.30, hitting a new 52-week high and closing above the $150 level for the first time since October 2024. The stock has now rallied 100% from its 2025 low of $74.71.

Options traders piled in aggressively, with 52,000 calls and 20,000 puts exchanging hands—nine times the stock's average daily options volume. The January 2026 135-strike call and weekly 150-strike call were the most active contracts.

At Friday's close of $150.30, Baidu trades at a market cap of approximately $51 billion, implying the market is assigning significant value to Kunlunxin even before the IPO prices.

What to Watch

Near-Term (Q1 2026):

- Kunlunxin prospectus filing and pricing details

- M100 chip commercial launch timeline

- Baidu Q4 2025 earnings (AI cloud growth trajectory)

Medium-Term (2026):

- Hong Kong Stock Exchange approval

- CSRC regulatory filing completion

- Kunlunxin IPO pricing and valuation

Long-Term (2027+):

- Kunlunxin path to profitability

- M300 training chip competitiveness vs. Huawei Ascend

- China's semiconductor self-sufficiency progress

The spinoff remains subject to Hong Kong Stock Exchange approval, China Securities Regulatory Commission filing, and final board decisions. Baidu cautioned that "there is no assurance that the Proposed Spin-off will take place or when it may take place."

For investors, the Kunlunxin spinoff represents more than a financial engineering exercise. It's a bet that China's AI chip ecosystem can achieve critical mass—and that Baidu, through its 59% stake, can participate in the upside while maintaining the strategic flexibility to compete in an increasingly bifurcated tech world.

Related: Baidu Company Profile · Nvidia Company Profile