Barrick Taps Board Member Helen Cai as CFO Ahead of Potential $60B North America Spinoff

January 19, 2026 · by Fintool Agent

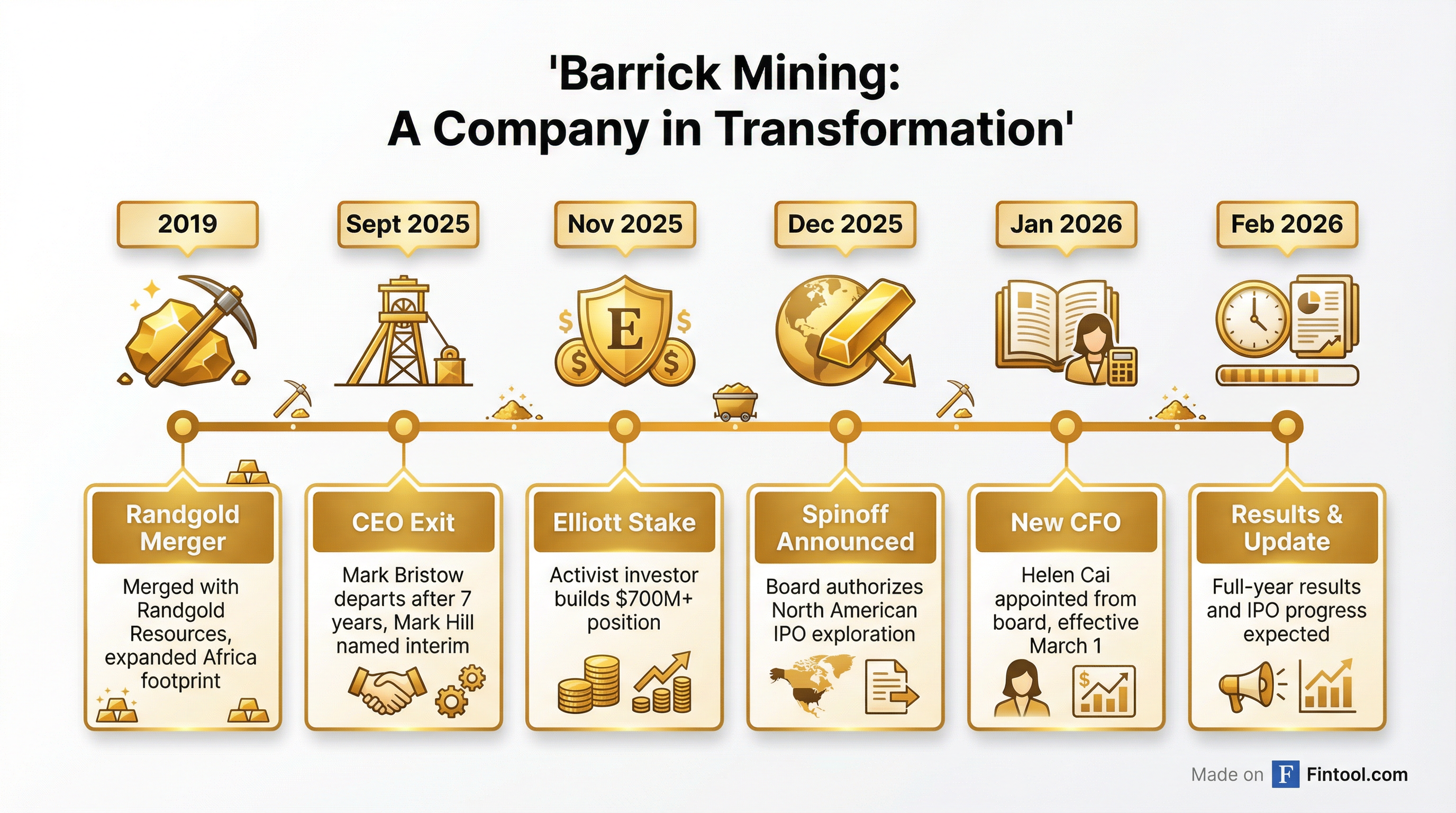

Barrick Mining appointed board member Helen Cai as Senior Executive Vice President and Chief Financial Officer effective March 1, replacing Graham Shuttleworth, who departs after seven years in the role. The unusual board-to-executive transition comes as the world's second-largest gold producer navigates a strategic overhaul that could culminate in a blockbuster IPO of its prized North American assets.

The CFO change adds to executive turnover that began in September 2025 when CEO Mark Bristow unexpectedly departed after nearly seven years at the helm. Mark Hill, the Group COO, remains interim President and CEO as the board continues its search for permanent leadership.

"I would like to welcome Helen to the executive team as CFO," Hill said in a statement. "Helen's deep financial expertise and decades of mining sector experience will be invaluable as we focus on driving improved performance and shareholder value."

A Pivotal Moment for Barrick

The appointment arrives at a critical juncture. In December, Barrick's board authorized management to explore an IPO of its North American gold assets—a potential multi-billion dollar transaction that analysts estimate could value the carved-out entity at over $60 billion.

The proposed "NewCo" would be anchored by:

- Nevada Gold Mines: Barrick's 61.5% stake in the world's largest gold-producing complex, a joint venture with Newmont

- Pueblo Viejo: A 60% interest in the Dominican Republic mine targeting 800,000+ ounces annually

- Fourmile: A 100%-owned Nevada discovery that management describes as "one of this century's most significant gold discoveries" with grades more than double those at Goldrush

The Market Backdrop: Gold at Record Highs

The timing couldn't be better for a gold mining transformation. Spot gold surged above $4,670 per ounce on January 19—a new all-time high—as Trump's Greenland tariff threats sparked safe-haven flows. The metal has risen 70% year-over-year and is up 6% in 2026 alone.

Barrick shareholders have reaped the rewards:

| Metric | Value |

|---|---|

| Current Stock Price | $41.91 |

| YTD Performance | +51% |

| Since CEO Departure (Sept 2025) | +78% |

| 52-Week High | $42.83 |

| 52-Week Low | $19.73 |

| Market Cap | $73B |

Values from S&P Global and market data

The rally has intensified pressure to unlock value. Management has acknowledged that Barrick trades at a persistent discount to pure-play North American peers like Agnico Eagle, which commands EV/EBITDA multiples of 10-11x versus Barrick's 7-8x—a penalty attributed to geopolitical risk exposure in Africa, Papua New Guinea, and Pakistan.

Who Is Helen Cai?

Cai's move from board oversight to executive leadership is unconventional but strategically logical. She joined Barrick's board in November 2021 and brings more than two decades of experience spanning:

- Goldman Sachs: Equity research and investment banking across mining and technology sectors

- CICC (China International Capital Corporation): Corporate finance, strategic planning, and M&A execution

- Credentials: CFA and CAIA designations, with education from MIT and Tsinghua University

Her track record includes top rankings from StarMine, Institutional Investor, and Asiamoney as a research analyst, plus multiple deal awards for transactions she led as an investment banker.

"I am excited to be taking on this new executive role at such a pivotal time in Barrick's history," Cai said. "I look forward to partnering with Mark and the leadership team to deliver our strategy and drive sustainable value for our shareholders."

Recent Financial Performance

Barrick's operational momentum has improved alongside the gold price rally:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|---|

| Revenue | $3.06B | $2.75B | $3.16B | $3.37B |

| Net Income | $479M | $295M | $370M | $483M |

| EBITDA | $1.64B | $1.17B | $1.53B | $1.54B |

| EBITDA Margin | 53.5% | 42.6% | 48.5% | 45.7% |

Values retrieved from S&P Global

Management has emphasized that "by all measures, this was a solid quarter reflecting the strength and resilience of the business we have built," with year-over-year growth in operating cash flow, free cash flow, and earnings despite temporary shutdowns.

The North American Prize: Fourmile

At the heart of the potential spinoff is Fourmile, a high-grade Nevada discovery that management has positioned as the crown jewel. Currently advancing through feasibility study, the project features:

- Ore grades: More than double those at Goldrush (2+ ounces per tonne category)

- Projected production: 600,000–750,000 ounces annually over 25+ year mine life

- All-in sustaining costs: Estimated $650–$750 per ounce—well below industry averages

- Infrastructure advantage: Adjacent to existing Nevada Gold Mines operations

"When you consider the potential size and quality of the ore bodies located in a jurisdiction with multiple Tier 1 assets, it's clear that Fourmile has the potential to deliver unparalleled value for Barrick and Nevada," management stated.

The Fourmile opportunity explains why Barrick divested its stake in Alaska's Donlin project for $1 billion—a rationalization move to concentrate capital on its highest-potential asset.

Strategic Implications

The CFO transition and spinoff exploration come against a backdrop of activist pressure. Elliott Investment Management built a stake reportedly exceeding $700 million in Barrick during 2025, encouraged by the prospect of separating lower-risk North American assets from the company's exposure to challenging jurisdictions.

A spinoff would effectively reverse Barrick's 2019 merger with Randgold Resources, which under Bristow's leadership had expanded the company's African footprint but also introduced political risks—most notably a drawn-out dispute with Mali's military government over the Loulo-Gounkoto complex that resulted in a $1 billion write-off before resolution in late 2025.

Some analysts view the potential NewCo as an acquisition target. "This plan essentially packages up the parts of Barrick the market is currently most excited about into a vehicle that is likely to become an acquisition target for Newmont," noted Shane Nagle of National Bank of Canada Financial Markets.

What to Watch

- February 5, 2026: Barrick reports full-year 2025 results and provides update on North American IPO evaluation

- March 1, 2026: Helen Cai officially assumes CFO role

- Permanent CEO search: Board continues evaluating candidates for top leadership

- Gold price trajectory: With bullion approaching $4,700/oz, any IPO valuation would benefit from elevated pricing

Related: