Berkshire Files to Exit Kraft Heinz: End of Buffett's $16 Billion Mistake

January 20, 2026 · by Fintool Agent

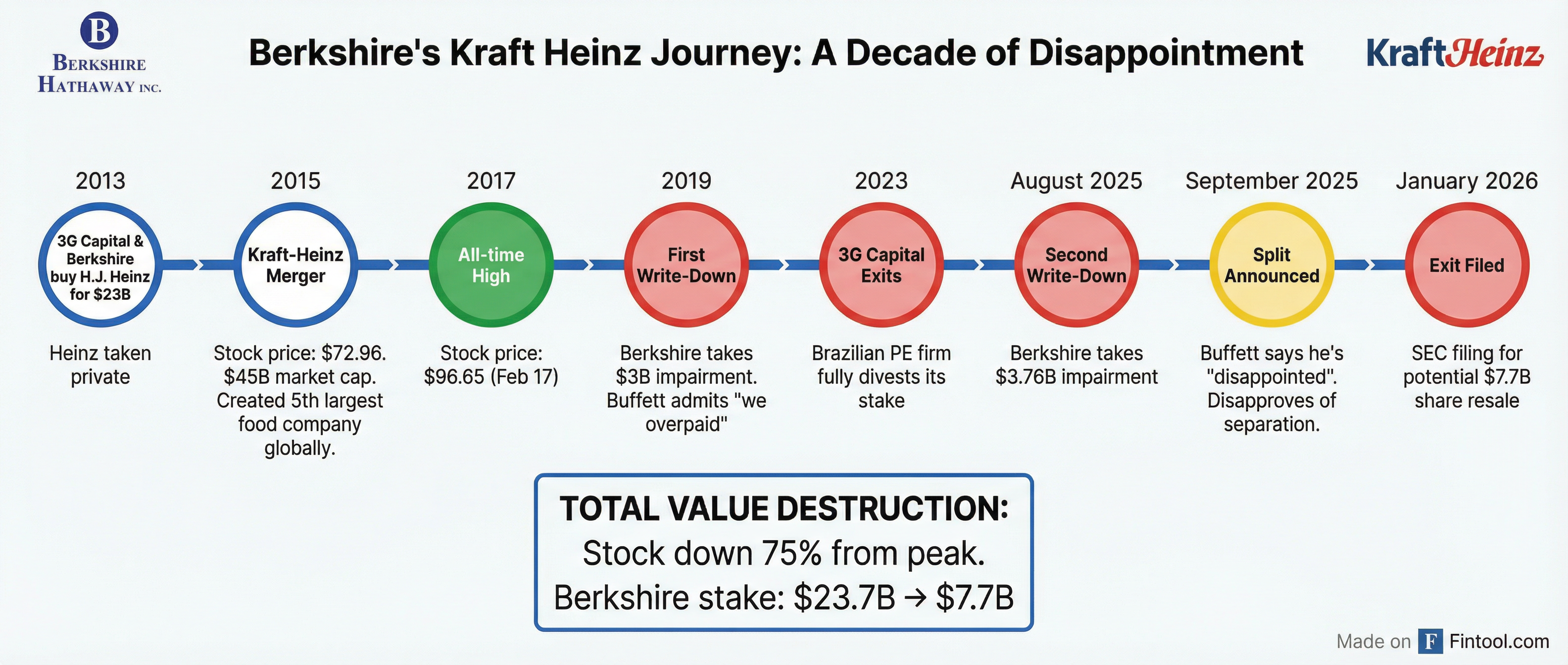

Berkshire Hathaway filed today to potentially sell its entire 325.4 million share stake in Kraft Heinz, worth approximately $7.7 billion—signaling the end of one of Warren Buffett's most painful investment mistakes.

The prospectus supplement, filed with the SEC on Tuesday, registers "the potential resale" of Berkshire's entire 27.5% stake in the packaged food giant. While the filing doesn't guarantee a sale will occur, it comes just weeks after Buffett publicly expressed his disappointment with Kraft Heinz's decision to split into two separate companies—a breakup he disapproved of.

KHC shares fell 4.9% in after-hours trading to $22.59 following the filing.

A Decade of Disappointment

The numbers tell a brutal story. When the Kraft-Heinz merger closed in July 2015, shares traded at $72.96. At today's closing price of $23.76, the stock has lost 67% of its value from merger day and 75% from its February 2017 peak of $96.65.

For Berkshire specifically, the stake that was worth approximately $23.7 billion in 2015 is now worth just $7.7 billion—a destruction of roughly $16 billion in value. Add in $6.76 billion in cumulative write-downs ($3 billion in 2019 , $3.76 billion in August 2025 ), and the investment represents one of the Oracle of Omaha's most significant missteps.

"It certainly didn't turn out to be a brilliant idea to put them together, but I don't think taking them apart will fix it," Buffett told CNBC in September 2025 when the split was announced.

What Went Wrong

The 2015 merger of Kraft Foods and H.J. Heinz was supposed to create a consumer staples powerhouse. Backed by Buffett's Berkshire Hathaway and Brazilian private equity firm 3G Capital—known for aggressive cost-cutting through "zero-based budgeting"—the combined company was initially valued at $45 billion and ranked as the fifth-largest food company globally.

But the thesis failed on multiple fronts:

Consumer Preferences Shifted: American shoppers moved toward fresher, healthier options, shopping the perimeter of grocery stores rather than center aisles filled with packaged foods.

Cost Cuts Backfired: 3G Capital's ruthless expense reductions "significantly impaired" the company's ability to innovate, according to the Harvard Business Review. Underinvestment in brands left them vulnerable to store-brand alternatives.

Revenue Stagnated: Net sales have declined every year since 2020's pandemic bump. The most recent quarters show continued weakness:

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($B) | $6.86 | $6.41 | $6.48 | $6.38 | $6.58 | $6.00 | $6.35 | $6.24 |

| EBITDA Margin | 21.2% | 24.4% | 25.5% | 25.3% | 25.0% | 24.4% | 24.5% | 21.6% |

| Gross Margin | 34.0% | 35.0% | 35.4% | 34.2% | 34.2% | 34.4% | 34.4% | 31.9% |

The Q2 2025 net loss of $7.8 billion reflected massive impairments and write-downs that highlighted the ongoing value destruction.

The Split Buffett Didn't Want

In September 2025, Kraft Heinz announced it would separate into two independent, publicly traded companies:

Global Taste Elevation Co. – A sauces, spreads, and shelf-stable meals business with ~$15.4 billion in 2024 revenue and ~$4.0 billion in EBITDA. Brands include Heinz, Philadelphia, and Kraft Mac & Cheese. Approximately 75% of sales come from sauces, spreads, and seasonings.

North American Grocery Co. – A portfolio of North American staples with ~$10.4 billion in 2024 revenue and ~$2.3 billion in EBITDA. Brands include Oscar Mayer, Kraft Singles, and Lunchables.

The separation is expected to close in the second half of 2026 and will cost up to $300 million in "dis-synergies."

Buffett and Greg Abel, who became Berkshire's CEO on January 1, 2026, both disapproved of the split. Their skepticism—and now this SEC filing—suggests Berkshire would rather exit entirely than navigate the complexity of holding positions in two smaller, still-challenged companies.

New Leadership, Uncertain Future

Kraft Heinz named Steve Cahillane as CEO effective January 1, 2026—the same day Abel took over at Berkshire. Cahillane, who previously led Kellanova (formerly Kellogg) through its own corporate split before its acquisition by Mars, will lead the Global Taste Elevation unit after the separation.

Cahillane inherits a company that has become one of the worst-performing stocks in the U.S. food sector. At ~$28 billion market cap, Kraft Heinz is worth less than it was when the merger was announced in 2015.

A search is underway for a CEO to lead North American Grocery Co.

What to Watch

Timing of Sales: The filing enables—but doesn't require—sales at any time. Watch 13-F filings for evidence Berkshire is trimming. Given the position size, any material selling would likely pressure the stock.

Split Execution: The separation is expected in H2 2026. Investors will watch for capital structure details, brand allocation decisions, and whether the promised operational focus materializes.

New Leadership Impact: Cahillane's track record at Kellanova offers some hope, but analysts warn that Kraft Heinz's issues "could take many years of investment and improvement to overcome."

For Buffett, now watching from the sidelines as Abel runs Berkshire, the filing represents a symbolic closing chapter. As he approaches 96, Kraft Heinz will stand as a cautionary tale: Even the most iconic brands—and the most legendary investors—can't outrun shifting consumer tastes.