Berkshire Completes $9.7B OxyChem Acquisition in Greg Abel's First Major Deal as CEO

January 02, 2026 · by Fintool Agent

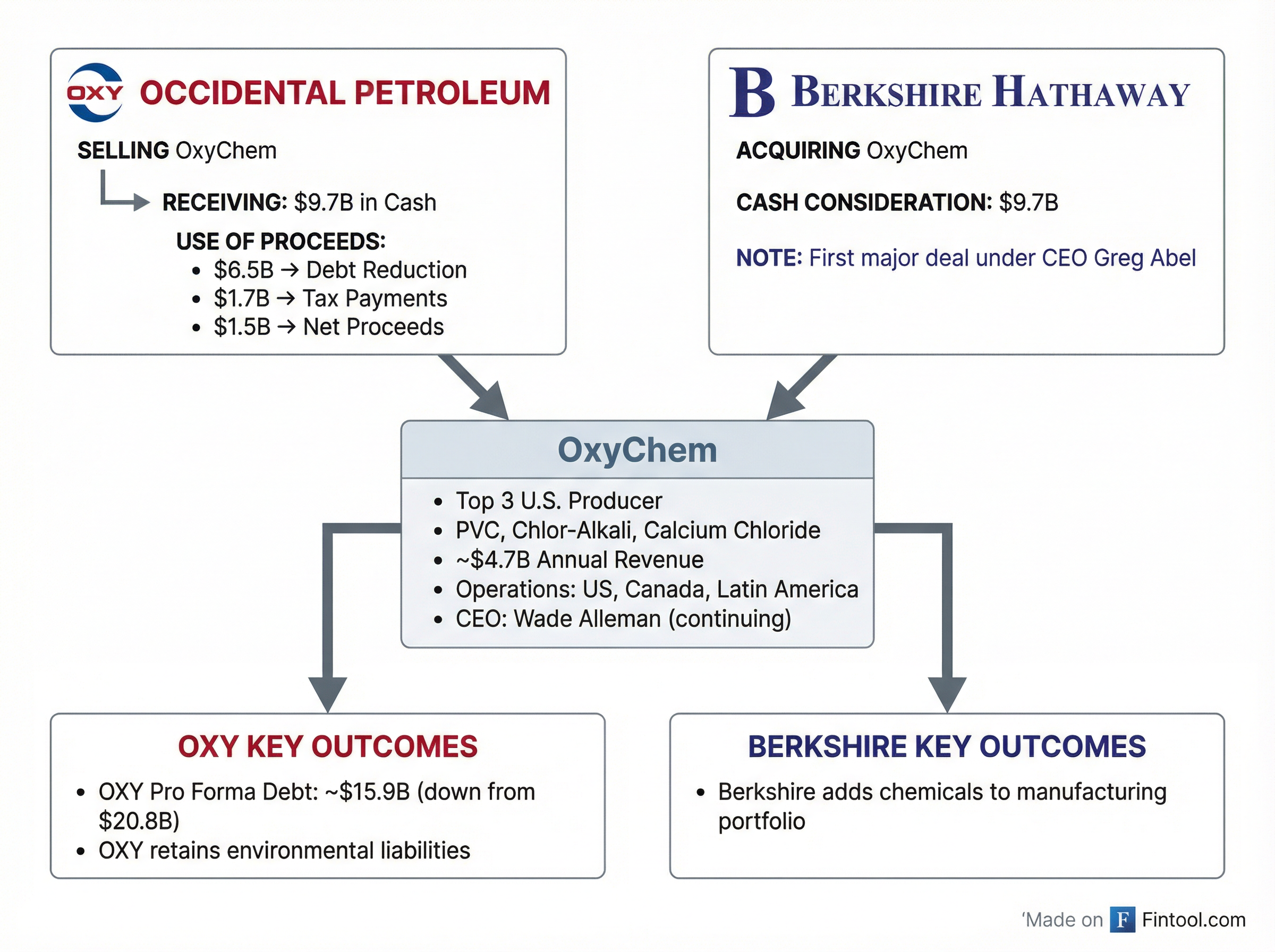

Just one day after Greg Abel officially took the helm at Berkshire Hathaway, the conglomerate completed its $9.7 billion acquisition of OxyChem from Occidental Petroleum—marking the first major transaction of the post-Buffett era .

Occidental shares surged 3.1% to $42.38 on the news, while Berkshire shares slipped 1.1% to $496.92—part of a broader market adjustment as investors digest the transition from Warren Buffett's 60-year reign to Abel's leadership.

The deal adds a top-three U.S. chemicals producer to Berkshire's sprawling manufacturing portfolio, while accelerating Occidental's balance sheet repair following years of debt-funded acquisitions .

The Deal Breakdown

OxyChem brings Berkshire a leading position in essential chemistry: polyvinyl chloride (PVC), chlor-alkali products, chlorinated organic chemicals, and calcium chloride . These products underpin water treatment, pharmaceuticals, healthcare, automotive, and residential construction—industries with stable, recurring demand.

Headquartered in Dallas, Texas, OxyChem operates across the U.S., Canada, and Latin America. Wade Alleman will continue as president and CEO, maintaining operational continuity under Berkshire's famously hands-off management style .

| Metric | Value |

|---|---|

| Transaction Value | $9.7 billion (all cash) |

| FY 2024 Revenue | $4.7 billion |

| Market Position | Top 3 U.S. producer (PVC, chlor-alkali) |

| Operations | U.S., Canada, Latin America |

| Leadership | Wade Alleman (continuing) |

Occidental retained OxyChem's legacy tort claims and environmental liabilities through a subsidiary, Environmental Resource Holdings, LLC . Glenn Springs Holdings will continue managing remediation activities "over many years based on the approved workplans" .

Occidental's Deleveraging Milestone

For Occidental CEO Vicki Hollub, this transaction represents the culmination of a multi-year deleveraging strategy that began with the 2019 Anadarko acquisition and intensified after the 2024 CrownRock deal.

"This transaction accelerates our strategy to strengthen Occidental's balance sheet and focus on our deep and diverse oil and gas portfolio which we have transformed over the last decade," Hollub said .

The numbers tell the story: Occidental's total debt peaked at $27.1 billion in FY 2024 following the CrownRock acquisition*. Of the $9.7 billion in proceeds, the company is directing $6.5 billion to debt redemption—bringing pro forma debt to approximately $15.9 billion and achieving its target of principal debt below $15 billion .

| Use of Proceeds | Amount |

|---|---|

| Debt Redemption | $6.5 billion |

| Cash Income Tax Payments | $1.7 billion |

| Transaction & Closing Adjustments | $0.2 billion |

| Net After-Tax Proceeds | $7.75 billion |

The pro forma financial statements paint a clearer picture: Occidental's balance sheet now shows total debt of $15.9 billion versus $20.8 billion historically, with stockholders' equity increasing from $36.3 billion to $39.5 billion .

Berkshire's Expanding Occidental Bet

This acquisition represents another chapter in Berkshire's increasingly intertwined relationship with Occidental. As of December 31, 2024, Berkshire's stake included:

| Investment | Details |

|---|---|

| Common Stock | 264 million shares (28% ownership) |

| Warrants | 83.9 million shares at $59.62 strike |

| Preferred Stock | $8.5 billion face value |

| Total Beneficial Ownership | 34.07% (including warrants) |

The preferred stock, issued during the 2019 Anadarko financing, carries an 8% dividend (rising to 9% if dividends accrue unpaid) and cannot be voluntarily redeemed before August 2029 . Berkshire has been steadily accumulating common shares, most recently adding 763,017 shares in February 2025 .

Now, with OxyChem, Berkshire effectively controls a portion of Occidental's former value chain while remaining the company's largest shareholder. The deal also brings potential synergies: certain Berkshire Hathaway subsidiaries already purchase chemicals from OxyChem .

Greg Abel's First Major Test

When the deal was announced in October 2025, Greg Abel—then Vice Chairman of Non-Insurance Operations—stated: "Berkshire is acquiring a robust portfolio of operating assets, supported by an accomplished team. We look forward to welcoming OxyChem as an operating subsidiary within Berkshire" .

Now, as CEO since January 1, 2026, Abel inherits this $9.7 billion commitment as his first major test . It's a fitting start: OxyChem slots neatly into Berkshire's manufacturing portfolio alongside Lubrizol (specialty chemicals), Precision Castparts (aerospace), and dozens of industrial businesses that Abel oversaw during his tenure managing non-insurance operations .

Abel takes the helm with Berkshire sitting on a record $381.7 billion in cash and equivalents as of September 30, 2025 . This deal barely dents that war chest—suggesting more acquisitions could follow if Abel finds opportunities meeting Berkshire's criteria.

What to Watch

For Occidental:

- Q4 2025 earnings (expected early February) will show the first full impact of discontinued operations treatment for OxyChem

- Progress toward stated goal of returning capital to shareholders once leverage targets are achieved

- Performance of the "20+ years of low-cost resource runway" Hollub referenced in announcing the deal

For Berkshire:

- Integration of OxyChem alongside Lubrizol in the chemicals/manufacturing portfolio

- Whether this signals a more active dealmaking approach under Abel

- Management of the substantial Occidental position (equity + preferred + warrants + now OxyChem)

For the Chemicals Sector:

- OxyChem's competitive positioning as a Berkshire subsidiary with patient capital

- Potential for Berkshire to pursue additional chemicals/materials acquisitions

The transaction closes a chapter for Occidental—and opens a new one for both Berkshire and its new CEO. Whether Abel can deploy Berkshire's massive cash pile as effectively as his predecessor remains the defining question of the next decade.

Related

*Values retrieved from S&P Global