Bill Hwang Seeks Trump Pardon for $10 Billion Wall Street Fraud

January 21, 2026 · by Fintool Agent

Bill Hwang, the convicted architect of Wall Street's costliest hedge fund collapse, is seeking a presidential pardon for the fraud that cost global banks more than $10 billion and helped topple Credit Suisse.

The Archegos Capital Management founder, currently free on bail while appealing his 18-year prison sentence, submitted a pardon application to the Justice Department in 2025, according to a notice on the DOJ's clemency case status website . If granted, it would be among the most controversial financial crime pardons in U.S. history—and one that fits a troubling pattern of clemency for wealthy fraudsters under the current administration.

The Crime: How Hwang Built a $36 Billion House of Cards

Hwang's scheme was elegant in its deception and catastrophic in its consequences.

Starting around 2013 with roughly $500 million, Hwang transformed Archegos from a modest family office into a $36 billion behemoth by using total return swaps—derivative contracts that allowed him to control massive stock positions without actually owning the shares or triggering disclosure requirements .

The catch: Hwang systematically lied to his prime brokers about the true size of his positions. Each bank thought it was one of perhaps two or three counterparties. In reality, Hwang was running the same concentrated bets across at least eight major institutions simultaneously—Goldman Sachs+4.31%, Morgan Stanley+2.34%, Credit Suisse, Nomura, Deutsche Bank, UBS+0.32%, Wells Fargo, and Mitsubishi UFJ .

His portfolio was dangerously concentrated in a handful of names: ViacomCBS, Discovery, Baidu, Vipshop, and Farfetch. When ViacomCBS announced a stock sale in late March 2021, sending its shares tumbling, the dominos began to fall.

The Collapse: $20 Billion Lost in Two Days

What happened over the final week of March 2021 was, as prosecutors later described it, "a national calamity."

When Archegos failed to meet margin calls on March 26, its prime brokers scrambled to liquidate the underlying positions. The result was a fire sale of historic proportions—Goldman Sachs alone dumped $6.6 billion of Baidu, Tencent Music, and Vipshop shares before the market opened, followed by another $3.9 billion later that day .

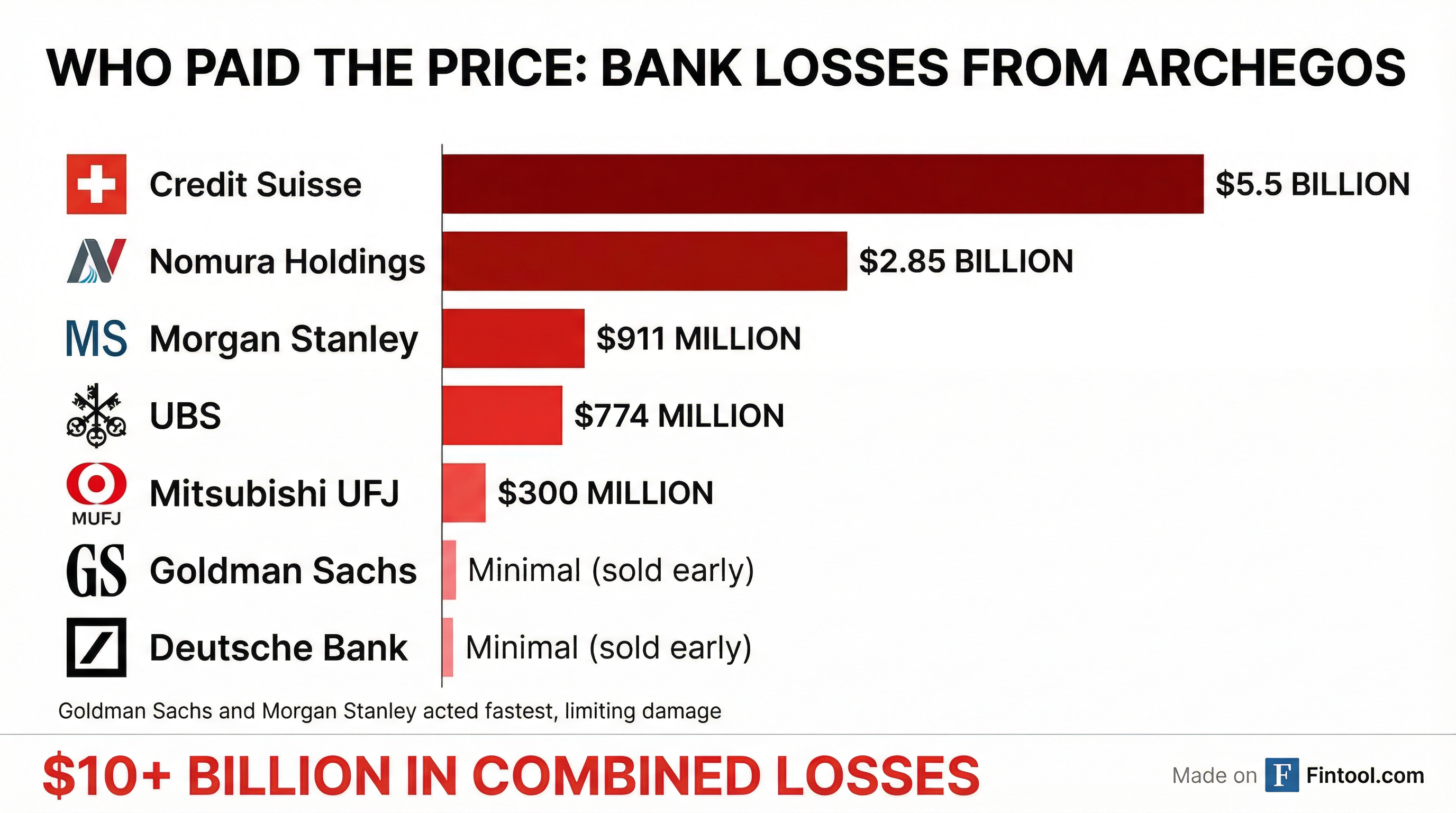

The banks that moved fastest—Goldman and Morgan Stanley—escaped with relatively minor damage. Those that hesitated paid dearly:

| Bank | Loss | Outcome |

|---|---|---|

| Credit Suisse | $5.5 billion | Contributed to 2023 forced sale to UBS |

| Nomura | $2.85 billion | Largest loss in firm history |

| Morgan Stanley | $911 million | CEO called it "money well spent" |

| UBS | $774 million | Ironically later acquired CS |

| Mitsubishi UFJ | $300 million |

Credit Suisse's loss represented more than half of its capital at the time. The scandal, combined with the simultaneous Greensill collapse, triggered executive departures, a $2 billion capital raise, and a credibility crisis that ultimately led to its forced marriage with UBS in 2023 .

The Conviction: 18 Years for "Weaponizing" a Hedge Fund

A Manhattan jury deliberated for just one day before finding Hwang guilty on 10 of 11 criminal counts in July 2024. The charges included racketeering conspiracy, securities fraud, market manipulation, and wire fraud .

At sentencing in November 2024, Judge Alvin Hellerstein didn't mince words: "The amount of losses that were caused by your conduct are larger than any other losses I have dealt with" .

Prosecutors had sought 21 years—an unusually harsh ask for a white-collar case that reflected the scale of the fraud. They ultimately got 18, plus an order to pay more than $9 billion in restitution.

"Bill Hwang weaponized his personal hedge fund, Archegos, to pursue financial fraud on a national scale," Acting U.S. Attorney Edward Kim said at sentencing .

The Pardon Play: Fitting a Pattern

Hwang's pardon application arrives during what critics have called an unprecedented era of clemency for financial criminals.

An NBC News analysis found that over half of Trump's 88 individual pardons in his second term have been for white-collar offenses, with money laundering, bank fraud, and wire fraud among the most frequent crimes forgiven . Notable recipients include:

- Changpeng Zhao (Binance founder) – pleaded guilty to enabling money laundering

- Joe Lewis (Tottenham Hotspur owner) – pleaded guilty to insider trading

- Julio M. Herrera Velutini – pardoned while awaiting sentencing for campaign finance violations

- Terren Scott Peizer – insider trading conviction wiped clean

The Wall Street Journal has reported that the going rate for a fast-track pardon from connected lobbyists is approximately $1 million, with some attorneys being offered success fees as high as $6 million .

Hwang's case would test the outer limits of this trend. Unlike some pardon recipients who faced ambiguous charges or arguably excessive sentences, Hwang orchestrated what prosecutors called "one of the largest market manipulation schemes in history"—a crime with clear victims and devastating systemic consequences.

What to Watch

Several factors could influence whether Hwang receives a pardon:

Arguments in his favor:

- Hwang's defense has emphasized his Christian faith and philanthropy through the Grace and Mercy Foundation, which has donated at least $600 million since 2006

- His lawyers argued he posed minimal risk of reoffending

- He's free on bail pending appeal, suggesting some legal uncertainty remains

Arguments against:

- The sheer scale of losses ($10+ billion) dwarfs other pardoned frauds

- This was his second fraud scandal (Tiger Asia pleaded guilty in 2012)

- The systemic risk his scheme posed to global banks

- Strong bipartisan concern about white-collar crime accountability

Hwang's co-defendant, former Archegos CFO Patrick Halligan, was scheduled to be sentenced separately. Both men chose not to testify at their trial.

The Bottom Line

The Archegos collapse was a watershed moment for Wall Street—a stark reminder of how opacity, leverage, and concentrated positions can combine catastrophically. It accelerated Credit Suisse's demise, prompted regulatory scrutiny of family offices, and led to the longest white-collar prison sentence in recent memory.

Now Bill Hwang is betting that the same administration pardoning crypto kingpins and insider traders will extend mercy to him. If successful, it would send a signal that even the most destructive financial frauds can be forgiven—as long as you have the right connections.

For investors, the saga raises uncomfortable questions: If the architect of a $10 billion fraud can walk free, what does that mean for market integrity? And for the banks that lost billions, is there any accountability left?

Related