Biohaven's Depression Drug Fails Phase 2 Trial, Capping Brutal Year of Clinical Setbacks

December 24, 2025 · by Fintool Agent

Biohaven shares plunged 17% in after-hours trading on Christmas Eve after the company announced its experimental depression drug BHV-7000 failed to meet the primary endpoint in a Phase 2 proof-of-concept study—the third major clinical or regulatory failure for the biotech in 2025 and the final nail in its once-promising psychiatric franchise.

The stock, which traded as high as $44.28 earlier this year, dropped to approximately $9 in extended trading, extending a year-to-date decline that now exceeds 75%.

The Numbers

BHV-7000, a Kv7 ion channel activator, failed to demonstrate a statistically significant reduction in depressive symptoms over six weeks compared to placebo, as measured by the Montgomery Åsberg Depression Rating Scale (MADRS).

While the company noted "trends favoring BHV-7000" in subgroups of patients with more severe depression at baseline, management characterized these findings as "hypothesis generating" only.

The drug was safe and well-tolerated, with headache (10.7% vs 9.9% placebo) and nausea (4.2% vs 5.6% placebo) as the only adverse events occurring above 5%.

Market Reaction:

| Metric | Value |

|---|---|

| Regular session close (Dec 24) | $10.81 |

| After-hours price | $9.08 |

| After-hours decline | -17% |

| 52-week high | $44.28 |

| 52-week low | $7.48 |

| YTD decline | -71% |

| Market cap | $1.1B |

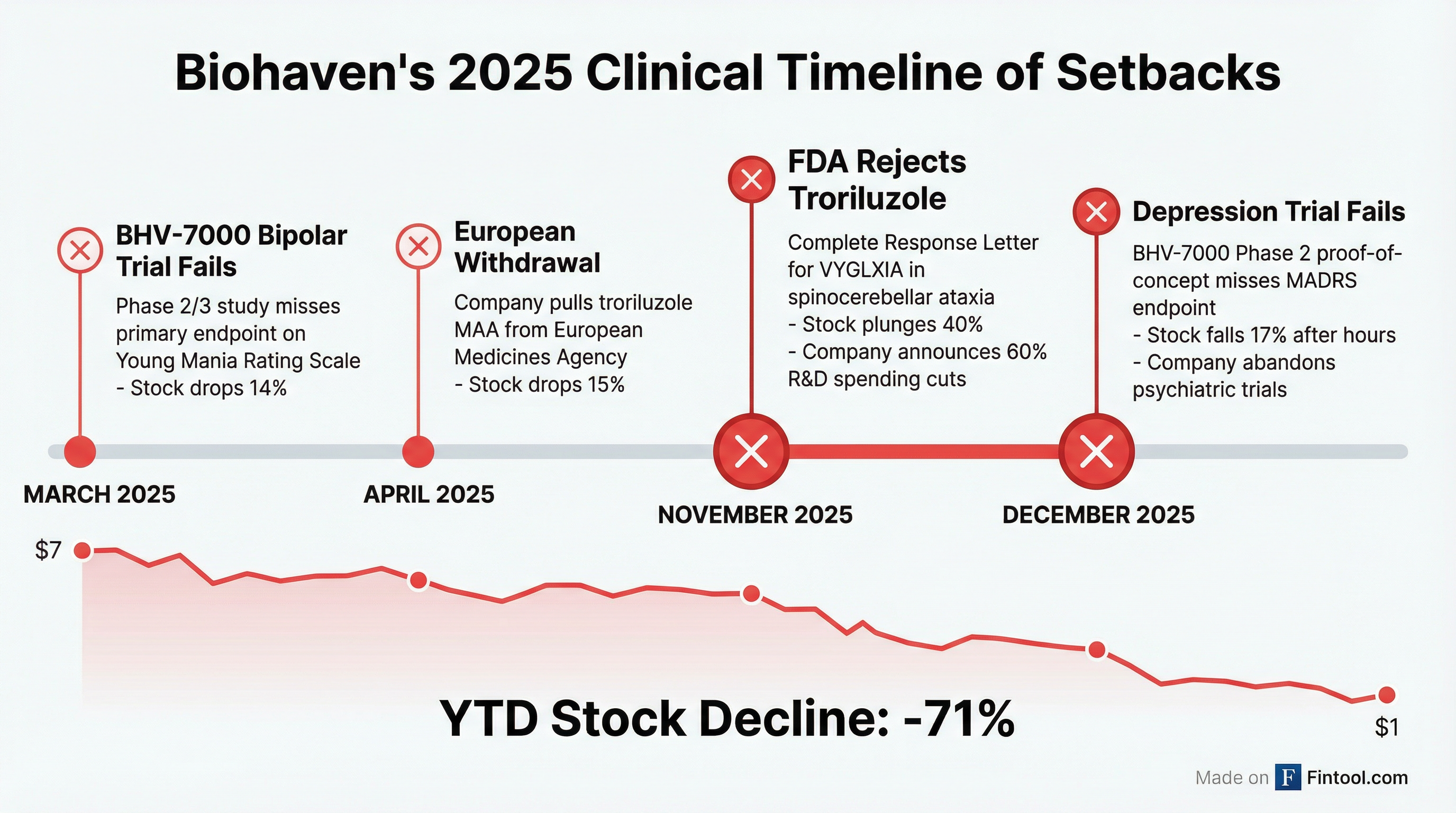

A Year of Failures

This latest setback caps the worst year in Biohaven's history—a cascade of clinical and regulatory failures that has eviscerated shareholder value and forced a wholesale restructuring of the company's pipeline.

March 2025: BHV-7000 failed to meet its primary endpoint in a Phase 2/3 trial for bipolar mania, showing no statistically significant separation from placebo on the Young Mania Rating Scale (YMRS). Shares fell 14%.

April 2025: Biohaven withdrew its Marketing Authorization Application for troriluzole in Europe, signaling growing regulatory challenges for its lead asset. Shares dropped 15%.

November 2025: The FDA issued a Complete Response Letter rejecting troriluzole (VYGLXIA) for spinocerebellar ataxia, despite the company's claims of "robust" real-world evidence. Shares crashed 40%, prompting management to announce 60% cuts to annual R&D spending.

December 2025: BHV-7000 fails in major depressive disorder. Company abandons all psychiatric development.

The company is also facing securities class action lawsuits alleging that management made "materially false and misleading statements" about the clinical prospects of both troriluzole and BHV-7000.

Exiting Psychiatry

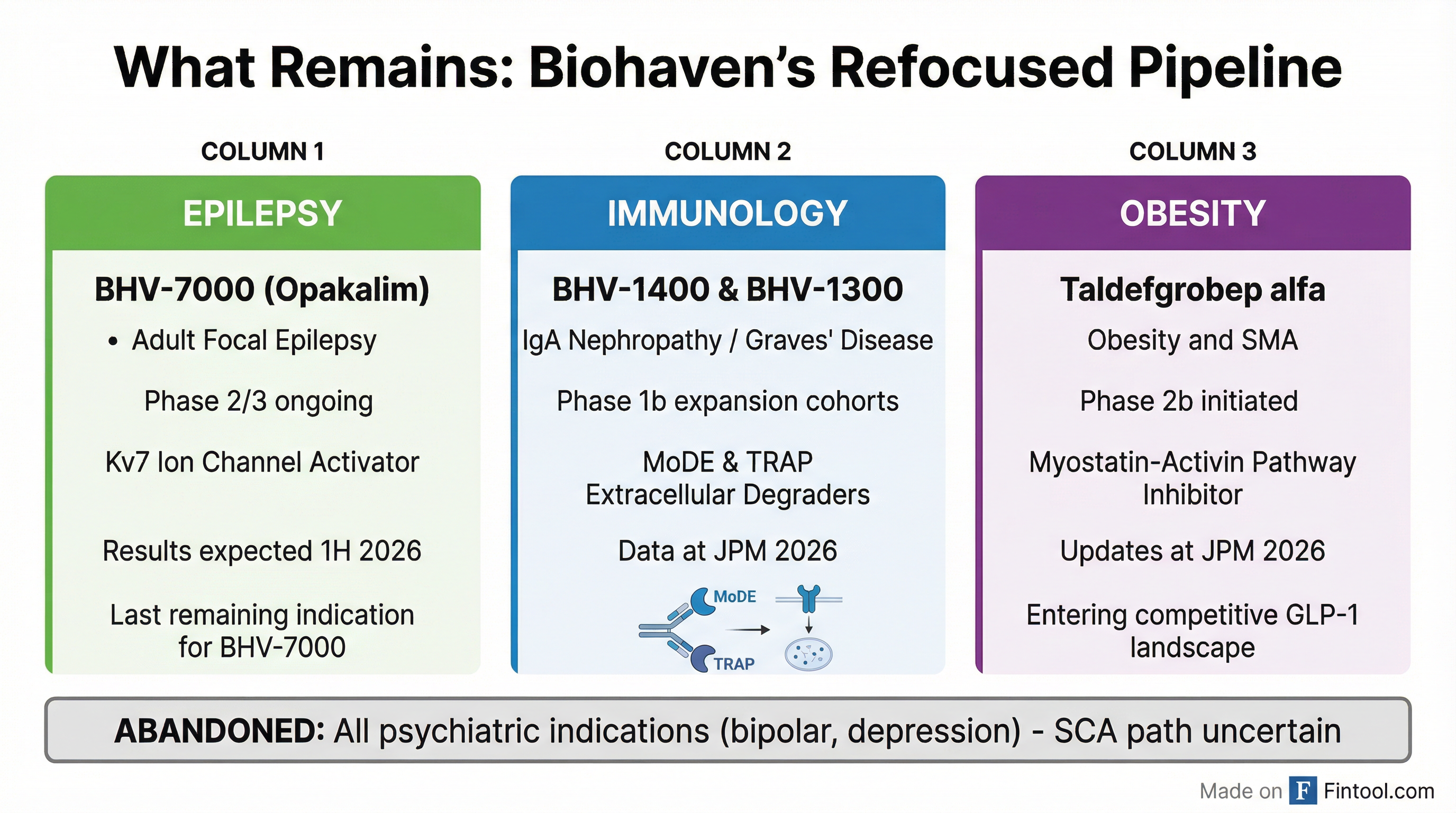

Biohaven confirmed it will abandon all psychiatric clinical development to "keep resources focused on key priority areas of immunology, obesity and epilepsy in 2026."

This represents a major strategic pivot. The company had positioned BHV-7000—a novel Kv7.2/7.3 channel activator—as a differentiated approach to mood disorders, touting its favorable side effect profile compared to existing treatments and its lack of GABA activity (which causes the sedation common in many psychiatric drugs).

RBC Capital Markets analyst Leonid Timashev said the failure was "not surprising" given the limited clinical efficacy data and major depressive disorder being a "challenging indication with significant variability and placebo-effects."

What's Left

After three trial failures and an FDA rejection in a single year, Biohaven's pipeline has narrowed dramatically.

Epilepsy (BHV-7000): The only remaining indication for the Kv7 activator. Two Phase 2/3 studies in adult focal epilepsy are ongoing, with initial results expected in the first half of 2026.

Immunology (BHV-1400 / BHV-1300): Lead extracellular degrader programs targeting IgA nephropathy and Graves' disease, respectively. Phase 1b expansion cohort data expected at the J.P. Morgan Healthcare Conference in January 2026.

Obesity (Taldefgrobep alfa): A myostatin-activin pathway inhibitor. Phase 2b study in obesity was initiated in Q4 2025.

| Financial Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Net Loss | -$173M | -$198M | -$222M | -$187M |

| Cash | $185M | $166M | $98M | $99M |

The company raised $175 million in a public offering in November 2025 to extend its runway following the FDA rejection.

What to Watch

J.P. Morgan Healthcare Conference (January 2026): Management will present updates across all priority programs, including first patient data from the BHV-1400 and BHV-1300 Phase 1b expansion cohorts and expectations for the obesity trial.

Epilepsy readout (1H 2026): BHV-7000's last chance. If the drug fails in focal epilepsy—Biohaven's third attempt to find an indication where the Kv7 mechanism works—the asset will likely be abandoned entirely.

SCA path forward: Management has said it plans to meet with the FDA to discuss potential next steps for troriluzole, though the agency's rejection was unequivocal and the company has already cut resources in this area.

For investors, the January conference will be critical. With psychiatric development abandoned, the SCA program on life support, and the stock down 75% year-to-date, Biohaven's remaining pipeline assets need to deliver—starting with the immunology data in January.

As RBC's Timashev noted: "With the highest risk events now behind us, we think downside may be somewhat capped by the story refocusing on near-term updates across higher investor interest and greater probability of success programs such as epilepsy."

Related Companies: