BitGo Prices IPO at $18, Becomes First Crypto Custody Firm to Go Public in 2026

January 22, 2026 · by Fintool Agent

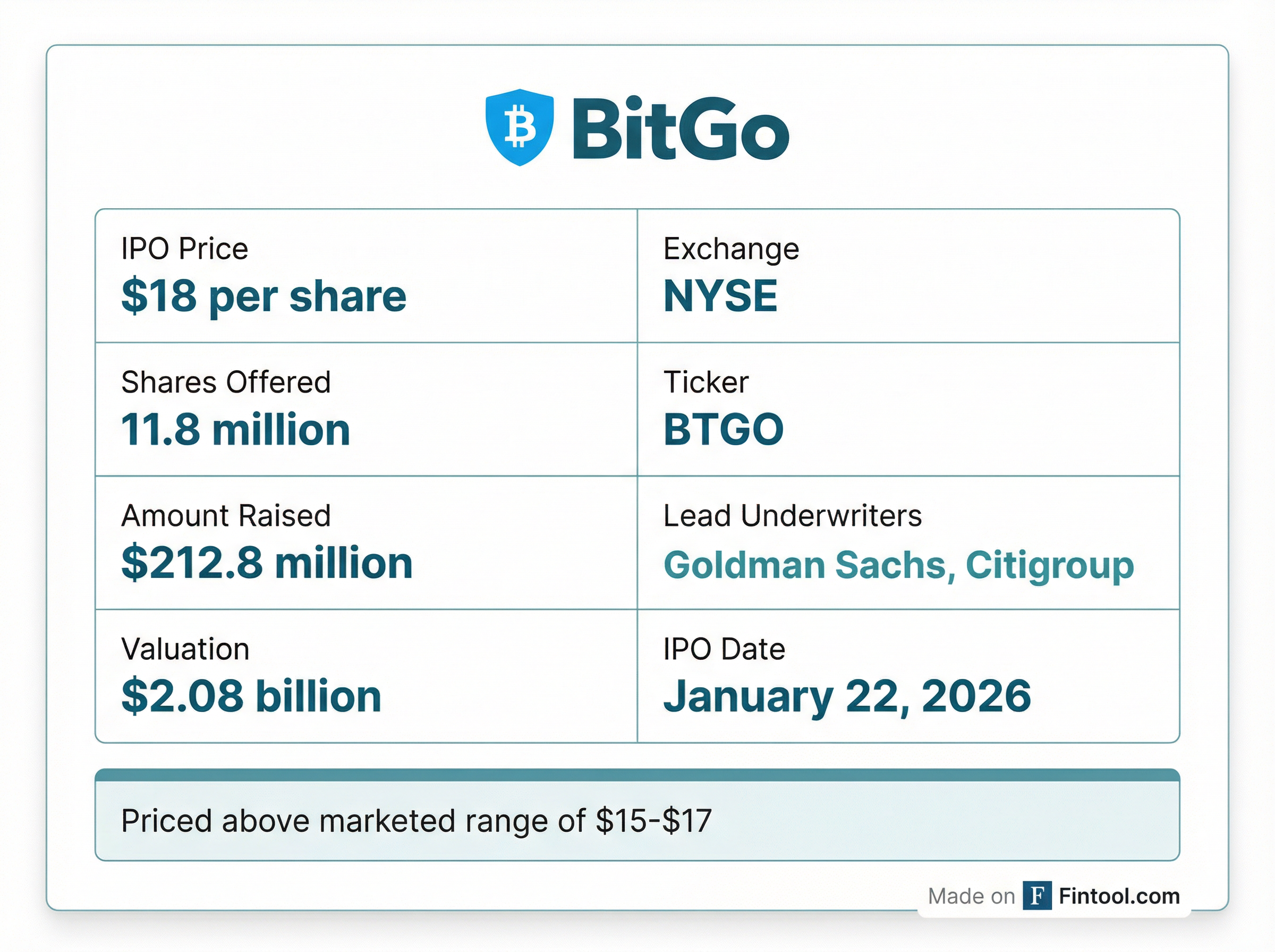

BitGo Holdings priced its initial public offering at $18 per share on Wednesday—above its $15-$17 marketed range—raising $212.8 million and valuing the company at approximately $2.08 billion. The Palo Alto-based crypto custody firm becomes the first digital asset company to go public in 2026 and the first publicly traded company to offer investors pure-play exposure to the institutional crypto custody business.

The above-range pricing signals robust institutional appetite for crypto infrastructure despite the volatile trading environment that characterized late 2025. Goldman Sachs and Citigroup led the offering, with shares set to begin trading on the New York Stock Exchange under the ticker "BTGO."

The Custody Case

Founded in 2013 by Mike Belshe—a former Google engineer who created the SPDY protocol that became HTTP/2—BitGo pioneered multi-signature wallet technology and has built what it claims is an unblemished security record: zero hacking losses in over a decade of operation.

The company now custodies $104 billion in digital assets for more than 1,500 institutional clients across 50 countries. It processes roughly 20% of all on-chain Bitcoin transaction volume by value and has facilitated over $3 trillion in lifetime transactions.

Positioned for Institutional Adoption

BitGo's IPO arrives at a pivotal moment for digital asset infrastructure. In December 2025, the company received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to operate as a national trust bank, joining an elite group that includes Ripple, Fidelity Digital Assets, and Paxos.

The regulatory tailwinds are significant. The SEC's repeal of Staff Accounting Bulletin 121 removed the balance sheet burden that had discouraged traditional financial institutions from offering crypto custody. Combined with progress on stablecoin legislation under the GENIUS Act and the establishment of a Strategic Bitcoin Reserve, the landscape has shifted dramatically from the enforcement-heavy approach of prior years.

"BitGo stands alone as the only provider delivering an institutional-grade platform for every option described by the SEC," CEO Mike Belshe said in response to the agency's December 2025 investor bulletin on custody. "Our clients no longer have to choose between security and control—they can have both."

Revenue Profile

BitGo's financials tell a story of rapid growth tied to crypto market cycles. According to S-1 filings, the company generated $3.08 billion in revenue for 2024, up 233% from $926 million in 2023. Trailing nine-month net revenues reached $140 million through September 2025—up 65% year-over-year—with analysts projecting a $240 million annualized run rate by year-end.

| Metric | FY 2022 | FY 2023 | FY 2024 | TTM |

|---|---|---|---|---|

| Revenue | $2.51B | $926M | $3.08B | $6.14B |

| Gross Profit | $69M | $139M | $550M | $609M |

| Net Income | $4.61B | -$2M | $157M | $138M |

| Gross Margin | 2.8% | 15.0% | 17.9% | 9.9% |

Source: BitGo S-1/A SEC filings

Revenue streams include custody fees (percentage of assets under management), transaction processing, wallet licensing to exchanges and fintechs, prime brokerage services, and staking yield. The recurring nature of custody fees provides stability through market downturns—a key differentiator from exchange-dependent models.

How BitGo Stacks Up to Coinbase

The comparison to Coinbase is inevitable but imperfect. Coinbase—with a $61 billion market cap and dominant retail trading franchise—generates the majority of its revenue from transaction fees that swing violently with crypto market activity. BitGo's custody-centric model offers institutional investors a purer bet on the "picks and shovels" thesis: that digital asset infrastructure will grow regardless of which tokens win or lose.

| Metric | BitGo (BTGO) | Coinbase (COIN) |

|---|---|---|

| IPO/Market Cap | $2.08B | $61.2B |

| Assets Under Custody | $104B | $250B |

| Primary Revenue | Custody fees | Trading fees |

| Retail Exposure | Minimal | Significant |

| Bank Charter | OCC-approved | Pending |

Coinbase data as of January 21, 2026

The Bull Case

VanEck's Matthew Sigel, who manages the firm's digital assets fund, laid out the investment thesis in a pre-IPO analysis: "BitGo is one of the few publicly traded crypto-related businesses that likely grew revenues greater than 50% during 2025's disappointing crypto markets."

Sigel sees a clear runway from tokenization—real-world assets on blockchain grew 270% year-over-year—and the institutionalization of digital assets. His base case projects revenue of over $400 million and EBITDA exceeding $120 million by 2028, with a 12-month price target of $26.50 (approximately 47% upside from the IPO price).

The global expansion is equally ambitious. In 2025, BitGo secured MiCA-compliant custody and trading licenses from Germany's BaFin, VASP and broker-dealer approvals in Dubai to anchor MENA operations, and expanded its presence in Singapore and Korea.

What to Watch

The IPO comes "at a fraught moment for the U.S. crypto industry," Reuters noted, as lawmakers push ahead with market structure legislation that could redraw the lines between securities and commodities oversight. Major players like Coinbase have warned the CLARITY Act could "choke core parts of the business."

For BitGo, the path forward hinges on:

- Execution on the OCC charter: Converting conditional approval to full operational status as a national trust bank

- Custody market share: Defending the position against Coinbase Prime, Fidelity Digital Assets, and new entrants

- Margin expansion: Scaling prime brokerage and staking services to diversify beyond custody fees

- Crypto market correlation: While more insulated than exchanges, BitGo's AUC still tracks digital asset valuations

The company's hybrid custody model—combining institutional-grade third-party custody with self-custody options—may prove a competitive moat as traditional asset managers wade deeper into digital assets under clearer regulatory frameworks.

The Bottom Line

BitGo's IPO marks a maturation milestone for digital asset infrastructure. The above-range pricing, blue-chip underwriters, and OCC bank charter signal that institutional crypto custody has crossed from speculative to investable for a broader set of allocators.

At a $2 billion valuation, BitGo trades at a fraction of Coinbase's market cap while offering what bulls argue is a cleaner exposure to the secular growth in institutional digital asset adoption. The 13-year track record of zero security breaches provides a foundation that few competitors can match.

For investors seeking exposure to crypto infrastructure without the volatility of token holdings or exchange-centric revenue models, BTGO offers a new public market option—albeit one that still carries meaningful correlation to digital asset markets.