BlackRock Files for Bitcoin Income ETF, Bringing Covered-Call Strategy to the $70B IBIT Franchise

January 26, 2026 · by Fintool Agent

Blackrock-4.43% (BLK) filed an S-1 registration statement with the SEC on January 23 to launch the iShares Bitcoin Premium Income ETF, a new product that would generate monthly income by selling call options on Bitcoin exposure through its flagship $70 billion iShares Bitcoin Trust (IBIT).

The move marks a significant expansion of BlackRock's crypto ETF ambitions—and a direct play for income-seeking investors who have largely sat out the volatile Bitcoin trade.

The Strategy: Yield From Volatility

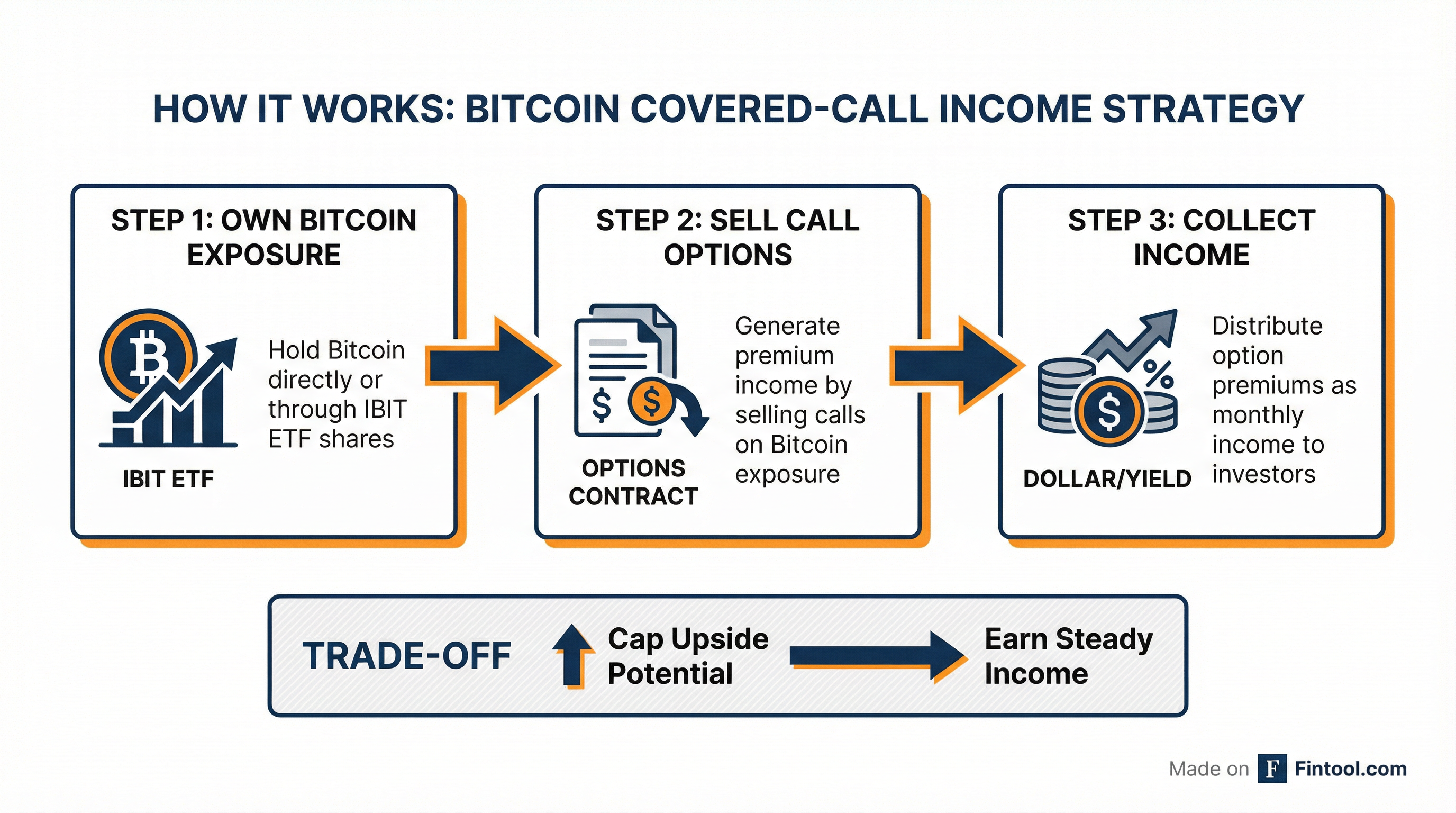

The iShares Bitcoin Premium Income ETF will employ a covered-call strategy, a time-tested approach in equity markets now being applied to crypto. The fund will:

- Hold Bitcoin directly or through IBIT shares

- Actively sell call options on that exposure

- Distribute option premiums as monthly income to shareholders

The trade-off is straightforward: investors cap their upside in exchange for steady income. When Bitcoin rallies past the strike price, gains above that level go to the option buyer. But the premium income arrives regardless of which way the price moves.

According to the filing, Coinbase will serve as custodian of the fund's Bitcoin holdings, while Bank of New York Mellon handles cash custody. The fund will support in-kind creations and redemptions—a structure that can improve tax efficiency for ETF investors.

BlackRock has not disclosed the ticker symbol or management fee.

Why This Matters: Scale Changes Everything

BlackRock isn't the first to offer Bitcoin income through covered calls. Roundhill's YBTC and NEOS's BTCI have been operating since 2024. But scale is the differentiator.

Bitcoin Income ETF Landscape:

| Fund | Issuer | Strategy | AUM | Expense Ratio |

|---|---|---|---|---|

| iShares Bitcoin Premium Income ETF | BlackRock | Covered call on IBIT/BTC | TBD | TBD |

| YBTC | Roundhill | Covered call | $233M | 0.95% |

| BTCI | NEOS | Covered call | $77M | 0.98% |

| IBIT | BlackRock | Spot Bitcoin | $70B | 0.25% |

IBIT's $70 billion in assets under management gives BlackRock unmatched liquidity for options trading. Higher liquidity typically means tighter bid-ask spreads on options, which translates to better execution and potentially higher net yields for investors.

YBTC has delivered an annualized dividend yield above 40% in some periods, but its AUM remains below $250 million. BlackRock's entry could dramatically expand the addressable market.

BlackRock's Crypto Playbook

This filing is the latest chapter in BlackRock's aggressive digital asset expansion. CEO Larry Fink has transformed from crypto skeptic to vocal advocate, calling Bitcoin a "legitimate financial instrument" that belongs in diversified portfolios.

The numbers tell the story. In Q2 2025, IBIT crossed $75 billion in AUM with $12 billion in quarterly net inflows. By the following quarter, it surpassed $80 billion. Digital asset ETPs contributed $14 billion of BlackRock's ETF net inflows in Q2 2025 alone—second only to bond ETFs.

Perhaps more importantly, IBIT has become a gateway drug to the broader iShares franchise. According to BlackRock's Q2 2025 earnings call, nearly one-third of investors who first came to BlackRock for IBIT have since purchased other iShares products.

BlackRock Recent Performance:

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $5.28* | $5.25 | $6.31* | $6.83* |

| Net Income ($B) | $1.51 | $1.59 | $1.32 | $1.13 |

*Values retrieved from S&P Global

The Income Investor Opportunity

The Bitcoin Premium Income ETF targets a specific investor segment that has been underserved: those who want crypto exposure but are uncomfortable with the asset's legendary volatility.

Bitcoin dropped over 20% in the three months leading up to this filing. Traditional Bitcoin ETFs offer no cushion during drawdowns. A covered-call approach doesn't eliminate downside risk, but the premium income provides a buffer—and may appeal to retirees, endowments, and other yield-focused allocators who previously viewed crypto as too speculative.

The strategy works best in range-bound or moderately bullish markets. In explosive rallies, covered-call funds underperform their underlying assets. But for investors prioritizing income over capital appreciation, that trade-off may be acceptable.

What's Next

The S-1 filing represents the first step in the regulatory process. BlackRock must still secure SEC approval for 19b-4 rule changes and complete the Nasdaq listing application. Given the SEC's track record of approving BlackRock's spot Bitcoin ETF in January 2024—which became the third-largest ETF launch in history—the pathway appears favorable.

The timing coincides with broader crypto ETP outflows. U.S. crypto ETPs logged their largest weekly outflows since November last week, with $1.73 billion exiting the space. IBIT itself saw a rare $22 million outflow on January 23—small relative to its $70 billion base, but a signal that some investors are trimming exposure amid price weakness.

An income-generating alternative could re-engage those investors—or attract new ones who've been waiting for a more conservative entry point into digital assets.

Related

- Blackrock-4.43% — Company Profile