BlackRock Private Credit Fund Crashes 13% After $150M of Loans Go Bad

January 26, 2026 · by Fintool Agent

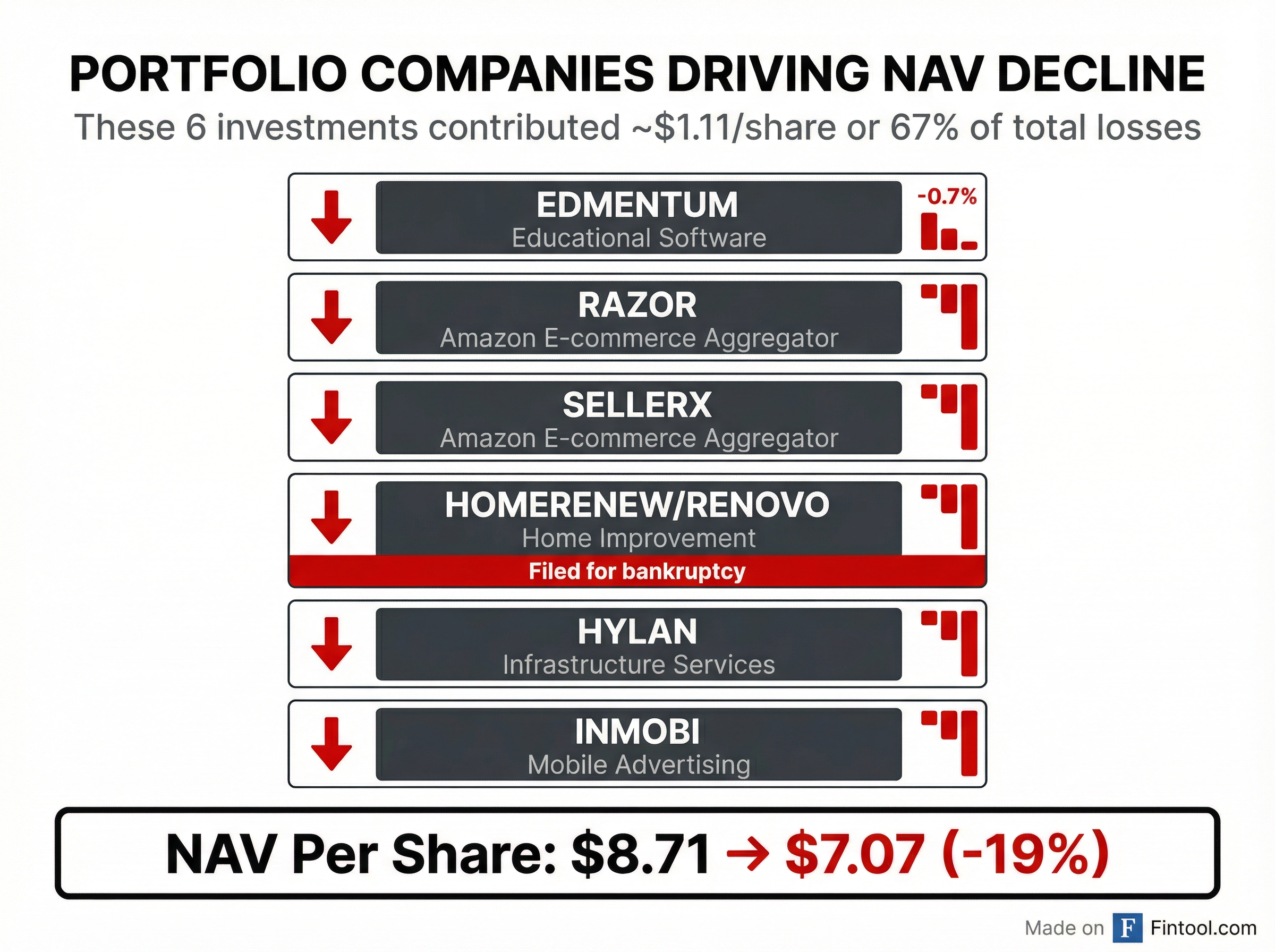

Blackrock TCP Capital Corp. (TCPC) plunged 13% to a record low Monday after disclosing that a string of troubled loans—including exposure to failed Amazon e-commerce aggregators and a bankrupt home improvement company—will slash its net asset value by 19%. The fund dropped to $5.12, marking the steepest single-day decline in nearly six years.

The meltdown signals growing cracks in the $1.7 trillion private credit market that has boomed since 2020, raising questions about underwriting standards at funds that have aggressively deployed capital into middle-market loans.

The Numbers

In an 8-K filing late Friday, BlackRock TCP Capital revealed preliminary Q4 2025 results that shocked investors.

| Metric | Q3 2025 | Q4 2025 (Prelim) | Change |

|---|---|---|---|

| NAV per Share | $8.71 | $7.05-$7.09 | -19% |

| Non-Accrual (Fair Value) | 3.5% | 4.0% | +0.5 ppts |

| Non-Accrual (Cost) | 7.0% | 9.6% | +2.6 ppts |

| Net Regulatory Leverage | 1.20x | 1.45x | +0.25x |

| Debt-to-Equity | 1.47x | 1.74x | +0.27x |

Source: BlackRock TCP Capital Corp. 8-K filed January 23, 2026

The fund's advisor volunteered to waive one-third of its management fee for Q4, providing about $0.02 per share in relief—cold comfort given the $1.66 per share NAV destruction.

The Six Problem Children

Six portfolio companies accounted for 67% of the NAV decline—approximately $1.11 per share. The portfolio reveals concentrated exposure to troubled sectors:

E-Commerce Aggregators (Razor, SellerX)

The fund bet big on companies that rolled up Amazon third-party sellers—a strategy that flourished during the pandemic e-commerce boom but has since imploded as consumer spending normalized and Amazon changed its marketplace dynamics.

Home Improvement (HomeRenew/Renovo)

Renovo Home Partners, a roll-up of regional kitchen and bathroom remodeling businesses created by Audax Private Equity in 2022, abruptly filed for Chapter 7 bankruptcy in late 2025 with plans to liquidate. BlackRock held the majority of Renovo's roughly $150 million in private debt. Just one month before the filing, the fund was valuing the loans at 100 cents on the dollar.

"Early in the fourth quarter, company-specific performance and liquidity issues led the Renovo board to determine that the best available path forward was a liquidation process," CEO Philip Tseng said on an earlier earnings call. "We expect to fully write down this position."

Other Troubled Names

The remaining losses came from Edmentum (educational software), Hylan (infrastructure services), and InMobi (mobile advertising).

Canary in the Private Credit Coal Mine?

UBS analysts didn't mince words: "Even if the NAV decline is idiosyncratic, the disclosure will remind investors that credit normalization is underway, and non-accrual rates will rise from today's below-trend levels. Given heightened near-term concerns, we expect alts to underperform broadly, with more acute pressure on those with greater exposure to direct lending."

The fund is now trading at a steep discount to its already-reduced NAV—about 27% below the midpoint estimate of $7.07. This signals the market expects more writedowns ahead.

| Metric | Current |

|---|---|

| Stock Price | $5.12 |

| NAV per Share (est.) | $7.07 |

| Price/NAV | 72% |

| 52-Week High | $9.48 |

| Decline from High | -46% |

Source: Market data as of January 26, 2026

The Broader Picture

BlackRock TCP Capital is a business development company (BDC)—a publicly-traded vehicle that invests in private debt, primarily first-lien loans to middle-market companies. The fund manages about $1.8 billion in total assets and is part of BlackRock's broader private credit platform, which expanded significantly through the 2018 acquisition of Tennenbaum Capital Partners.

The fund's Q3 2025 results showed total equity of $740 million and a volatile earnings history:

| Period | Net Income |

|---|---|

| Q3 2025 | $24.4M |

| Q2 2025 | -$15.9M |

| Q1 2025 | $20.9M |

| Q4 2024 | -$38.6M |

For parent Blackrock, the $175 billion asset manager, TCP Capital represents a small but reputationally significant piece of its expanding alternatives business. BlackRock shares dipped 0.3% Monday, barely registering the subsidiary's troubles.

What to Watch

The fund expects to reduce leverage over time as it exits positions, but the path forward looks rocky:

- February 27, 2026: Full Q4 results and earnings call

- Non-accrual trajectory: Already at 9.6% of cost basis, up from 7.0% last quarter

- Dividend sustainability: With net investment income of just $0.24-$0.26 per share (including 10.9% PIK income), the current $0.34 quarterly dividend may come under pressure

The private credit industry came under heightened scrutiny in 2025 following high-profile bankruptcies including auto supplier First Brands and subprime auto lender Tricolor. BlackRock TCP Capital's disclosure adds another data point suggesting the cycle has turned.

Related Companies: Blackrock | Blackrock TCP Capital