Box CEO Aaron Levie: Enterprises Must 'Adapt to How Agents Work' — Not the Other Way Around

February 03, 2026 · by Fintool Agent

Box CEO Aaron Levie delivered a stark message to enterprise technology leaders at Cisco's second annual AI Summit on Monday: the AI agent revolution demands that companies fundamentally reshape how they work—not wait for agents to adapt to existing processes.

"We have to probably imagine a world where instead of thinking agents will adapt to how we work, we will have to adapt to how agents work," Levie told Cisco President and CPO Jeetu Patel in a fireside chat. "And it's not a subtle point."

The comments come as Box navigates the intersection of its legacy content management business and the AI agent wave—a positioning Levie has been pushing aggressively through the company's Enterprise Advanced tier and Box AI agents. Box shares closed down 8% Monday at $23.80 amid a broader technology selloff, trading 39% below their 52-week high of $38.80.

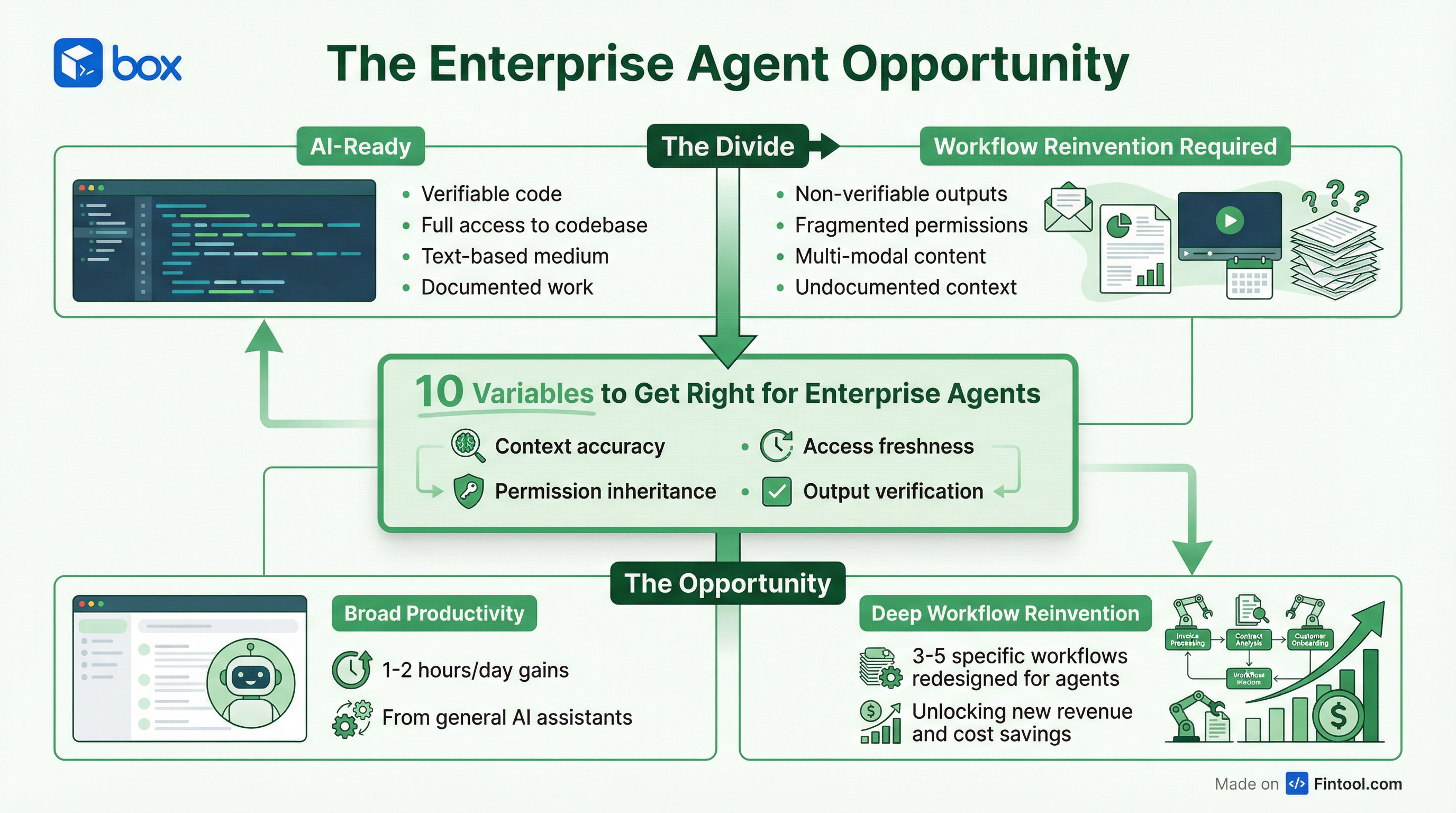

The "Tale of Two Cities" Problem

Levie described AI adoption as a "tale of two cities"—with engineering racing ahead while virtually every other enterprise function lags behind.

"If you go talk to an engineer, AI has become basically an unstoppable force in the future of engineering," he said. "Probably this year, it would be impossible for the average engineer to build software without AI. Like, they will not be capable of doing so."

The divide stems from fundamental structural differences in how work gets done:

| Factor | Coding | Enterprise Knowledge Work |

|---|---|---|

| Verification | Code runs or doesn't | Outputs require human review |

| Access | Engineers get full codebase | Fragmented permissions matrix |

| Medium | Pure text | Multi-modal, meetings, calls |

| Documentation | Work is documented | Context often undocumented |

"Think about how much more hostile every other form of work is compared to coding," Levie said. Marketing, legal, sales, and finance all involve "person-to-person context that gets generated" in meetings and calls that "doesn't get digitized."

The Context Problem: 10 Variables to Get Right

The core challenge for enterprise AI agents, Levie argued, is context—and getting it wrong in any dimension undermines the entire system.

"If you try and just do the least amount of context possible, then the agent doesn't have enough to work with. If you give it the most amount of context, then we have something called context rot, where the agent starts to do worse and worse the more information it gets."

Security compounds the complexity: agents must inherit user permission sets, but those permissions must be "up-to-date and authoritative"—a state many enterprises haven't achieved even for human users.

What "Good" Looks Like: Bimodal Adoption

When asked what successful enterprise AI adoption should look like in one-to-three years, Levie outlined a barbell strategy.

Broad productivity layer: "Check the box" on general AI tools that give employees "1-2 hours of productivity gains a day"—better content generation, intelligent search, basic automation.

Deep workflow reinvention: Target 3-10 specific processes for complete redesign. "Being targeted, largely probably top-down in terms of where you deploy the energy, on that second end of the barbell, I think having 3-5 wins over the next year or two would be pretty key."

Box has been pitching exactly this playbook to customers. Recent examples from earnings calls include:

- A Fortune 500 hospitality chain automating global design and planning workflows with AI-powered metadata extraction

- A global industrial automation company centralizing contract management with AI extraction of renewal dates and legal obligations

- A U.S. law firm replacing both a cloud platform vendor and e-signature company with Box Enterprise Advanced

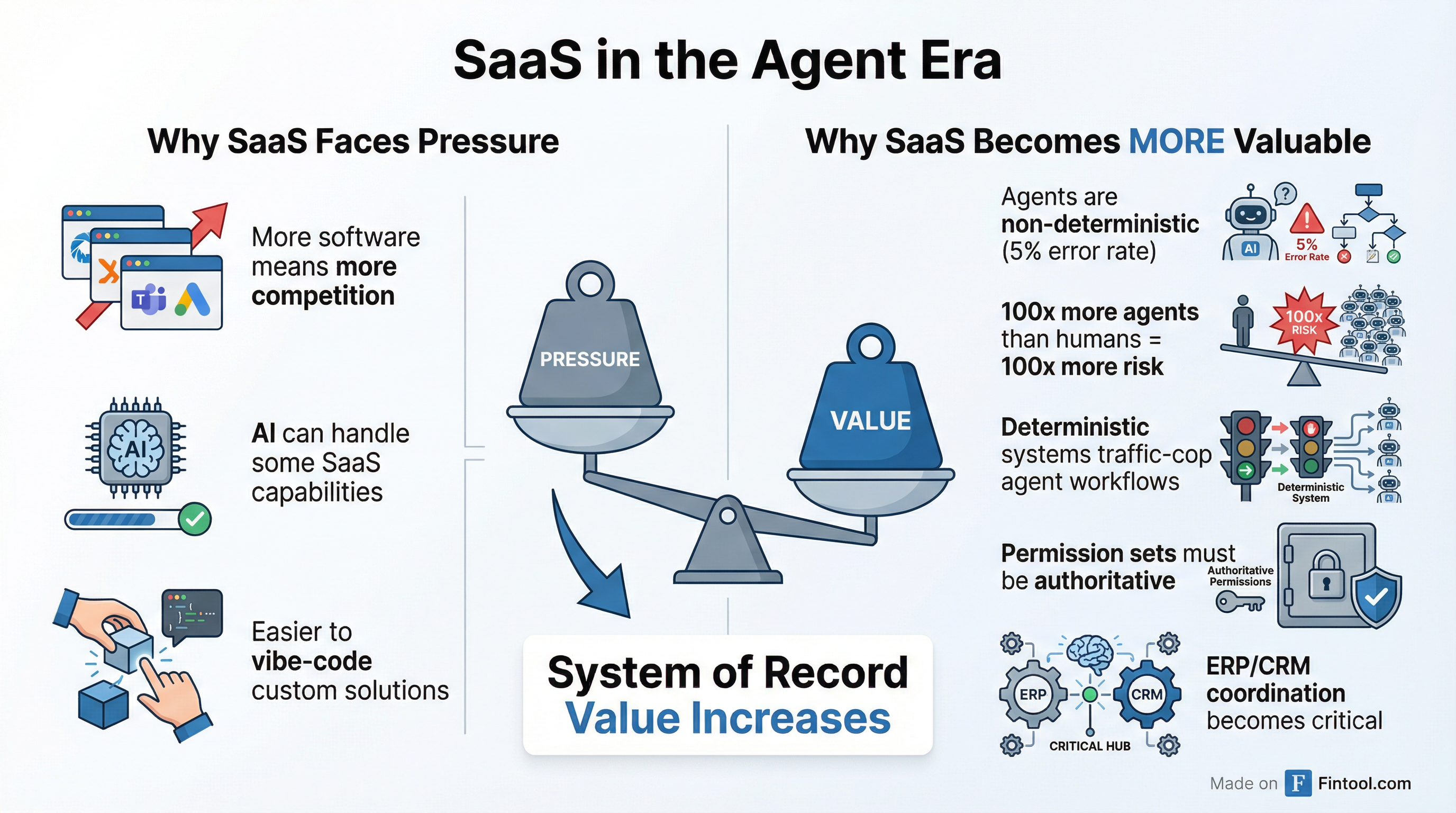

Why SaaS Isn't Dead

Levie pushed back directly on the "SaaS is dead" narrative circulating in venture and tech circles.

"You might imagine I'm gonna say SaaS is not dead. So that's my message," he said, before acknowledging legitimate pressures: software will be cheaper to build, creating more competition and likely pricing pressure.

But Levie made a counter-argument that flips the conventional wisdom: in an agent-dominated enterprise, deterministic systems become more valuable, not less.

"If you imagine a world of 100 times or 1,000 times more agents in an enterprise than people, and those agents are all gonna be non-deterministic, they're all gonna be probabilistic, they'll all make the wrong decision 5% of the time, then the value of the system that traffic cops what those agents can work on... I would argue, goes up in value."

The logic: agents need authoritative permission sets, reliable data sources, and consistent workflow routing. Those are precisely what enterprise SaaS systems provide. "The deterministic side is the workflow that says it's gonna happen exactly the same way every single time. We will never accidentally have [an agent] look at data that he shouldn't have access to. That's the power of software."

Pricing Models: Consumption Meets Subscription

On the commercial evolution, Levie predicted a hybrid model would emerge—driven by customer preferences rather than vendor ideology.

"In the early stage, when you're experimenting with AI, you're gonna say, 'I don't wanna commit a lot upfront, so I actually want consumption-based.' And then you're at a certain scale, and you're like, 'Actually, I'd rather lock in a rate, because I don't want my EPS to go up or down 3% every single quarter.'"

Box has already moved in this direction with AI Units—consumption-based pricing for Box AI capabilities layered on top of traditional per-seat subscriptions. Enterprise Advanced carries a 20-40% price premium over Enterprise Plus.

Market Reaction and Financials

Box shares fell alongside the broader technology sector Monday, closing at $23.80—down 8% on the session and 18% below its 50-day moving average of $29.05.

The selloff reflects macro concerns rather than company-specific news. Box's fundamentals have shown steady improvement:

| Metric | Q4 FY25 | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|---|

| Revenue ($M) | $280 | $276 | $294 | $301 |

| EBITDA Margin | 8.6%* | 7.2%* | 10.0%* | 11.3%* |

| Gross Margin | 79.0% | 78.3% | 79.1% | 79.6% |

*Values retrieved from S&P Global

Analysts expect Box to generate $306M in Q4 FY26 revenue, with consensus EPS of $0.34.

The Big Picture

Levie closed with an exhortation to use AI for ambition rather than cost-cutting.

"Ironically, we think about that list as, okay, those are then lower priority things. Totally the opposite. What will start to happen is people will say, 'Because agents have lowered the cost of doing something by 10X, I can actually now do the more ambitious things.'"

For Box, that ambition translates to expanding from secure content collaboration into "intelligent content management"—positioning the company's $1.1B in annual revenue as the foundation for enterprise agent workflows. Whether enterprises buy that vision will determine if Box can close the gap between its current $3.4B market cap and its 52-week high valuation.

Related Companies: Box · Cisco

Event: Cisco AI Summit 2026 (February 3, 2026)