Broadwood Partners Backs Up Deal Rejection With $8.8M STAAR Surgical Stock Purchase

January 9, 2026 · by Fintool Agent

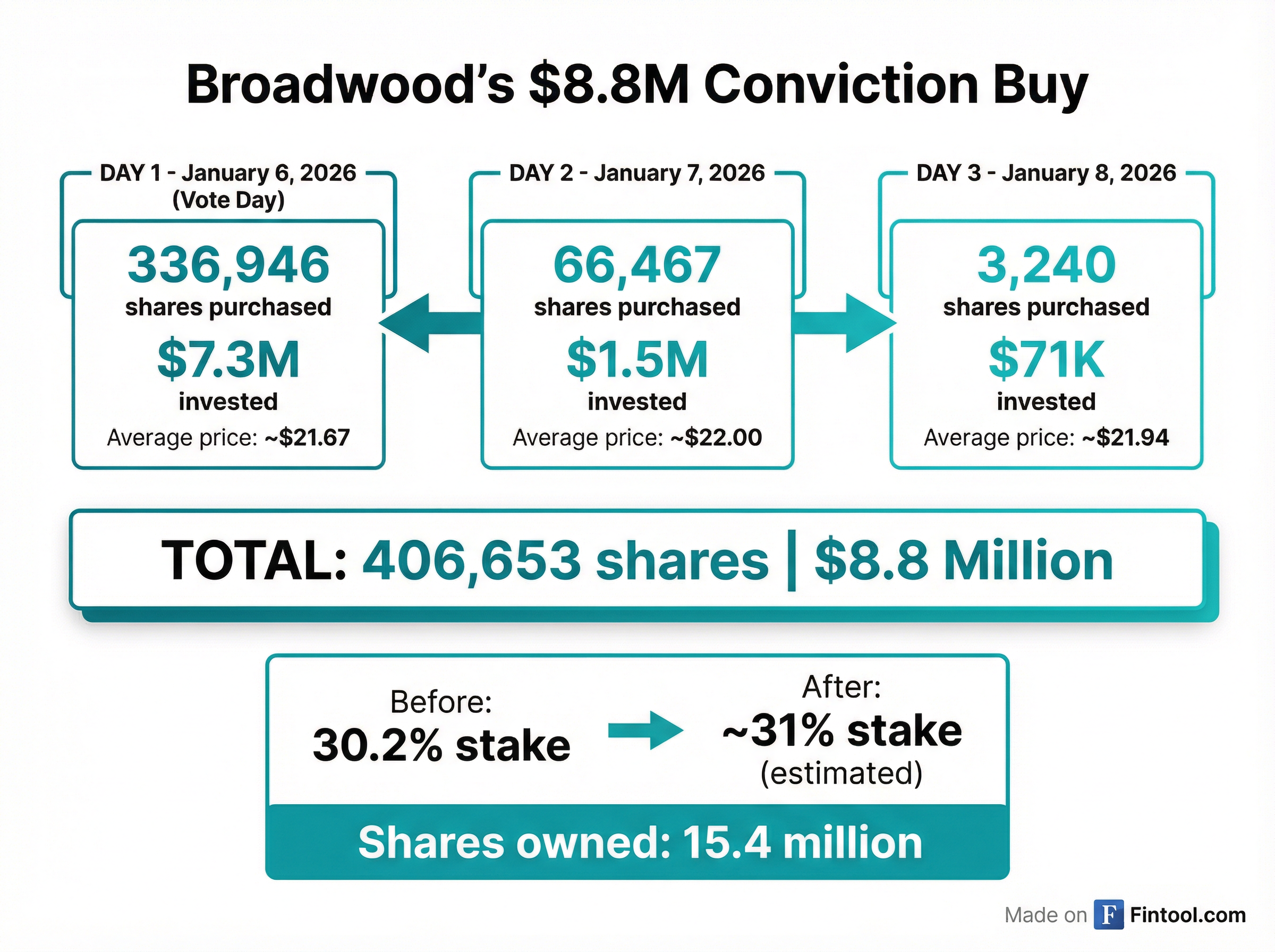

Three days after successfully blocking Alcon's $1.6 billion acquisition of Staar Surgical, activist investor Broadwood Partners is putting its money where its mouth is—purchasing $8.8 million worth of stock as shares cratered following the deal's collapse.

The buying spree, disclosed in SEC Form 4 filings, saw Broadwood acquire 406,653 shares between January 6-8 at prices ranging from $21.01 to $22.38—roughly 30% below Alcon's rejected $30.75 per share offer.

The Vote That Changed Everything

On January 6, STAAR announced that shareholders had voted decisively to reject the Alcon merger agreement at the Special Meeting of Stockholders, dealing a rare defeat to a deal that had been restructured and sweetened multiple times.

The market reaction was brutal. STAAR shares plunged from $23.94 on January 5 to open at $20.00 on January 6—immediately pricing in the failed deal premium. Trading volume exploded to 7.3 million shares, roughly 10x normal levels.

Broadwood, which owns 30.2% of STAAR's outstanding shares and had been the most vocal opponent of the transaction, wasted no time. As the stock traded between $19.82 and $22.59 on vote day, the activist firm began accumulating shares.

Buying the Dip They Created

The purchases followed a methodical pattern:

| Date | Shares Purchased | Amount Invested | Avg Price |

|---|---|---|---|

| January 6 | 336,946 | $7.3M | $21.67 |

| January 7 | 66,467 | $1.5M | $22.00 |

| January 8 | 3,240 | $71K | $21.94 |

| Total | 406,653 | ~$8.8M | $21.64 |

Following these transactions, Broadwood directly owns 15,426,144 shares. Neal Bradsher, founder and president of Broadwood Capital (the general partner of Broadwood Partners), also personally holds 25,900 shares.

The Battle That Got Here

The path to this moment was contentious. Alcon first approached STAAR in October 2024 with a proposal of $55 per share plus a contingent value right worth approximately $7—a total of $62 per share. However, Alcon withdrew that offer after due diligence revealed structural challenges in STAAR's business, particularly in China where the company generates over 50% of its revenue.

Alcon returned in July 2025 with a reduced $28 per share offer, later bumped to $30.75 after Broadwood mounted a fierce opposition campaign. The activist argued the board conducted a "deficient process," transacted at the "wrong time," and accepted an "inadequate price."

STAAR's board countered that Broadwood's claims were "flawed and misleading," noting that no other buyer had emerged in over a decade and that the company faced significant standalone risks including declining China sales, increasing local competition, and potential government volume-based procurement pressures.

STAAR's Standalone Challenge

As a standalone company, STAAR faces a complex operating environment. The company's financials show recent progress but significant volatility:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $48.9M | $42.6M | $44.3M | $94.7M |

| Net Income | $(34.2M) | $(54.2M) | $(16.8M) | $8.9M |

| Gross Margin | 64.7% | 65.8% | 74.0% | 82.2% |

| EBITDA Margin | (52.0%) | (75.9%) | (51.2%) | 28.0% |

Source: S&P Global

The Q3 2025 results showed a notable improvement, with STAAR turning EBITDA-positive for the first time in recent quarters. This may have emboldened Broadwood's conviction that the company's turnaround is underway.

Broadwood's Standalone Thesis

In its campaign against the deal, Broadwood argued that STAAR's challenges were "transitory" and that the company was "well on its way to returning to substantial profitability."

Following the vote, Broadwood struck a collaborative tone in a press release:

"We would like to thank our fellow shareholders for their courage in rejecting this transaction... We reiterate our enthusiasm for the Company's standalone prospects and look forward to engaging with the Board and fellow shareholders and working towards a bright future for STAAR."

CEO Stephen Farrell acknowledged the outcome: "We respect the outcome of the vote and look forward to working collaboratively with shareholders to ensure the best possible outcome for STAAR as a stand-alone company."

What to Watch

The $8.8 million purchase sends an unambiguous signal: Broadwood believes STAAR is worth materially more than the $22 it's trading at today—and certainly more than the $30.75 Alcon was offering.

Key catalysts ahead:

- Q4 2025 Earnings – Will the Q3 improvement continue? Management's ability to sustain profitability is critical

- China Recovery – Procedural volumes remain the swing factor; any rebound in consumer confidence could accelerate growth

- Board Engagement – Broadwood has pledged cooperation; any governance changes or strategic shifts will be closely watched

- New Competition – Local Chinese phakic lens manufacturers are progressing through regulatory approval

For now, Broadwood has demonstrated conviction that goes beyond words. At $21.64 per share, they're betting STAAR's standalone future is worth at least 42% more than today's price just to match the offer they helped kill.

Related: