Buckle Closes Fiscal 2026 With $1.3B in Sales as Women's Apparel Drives Growth

February 5, 2026 · by Fintool Agent

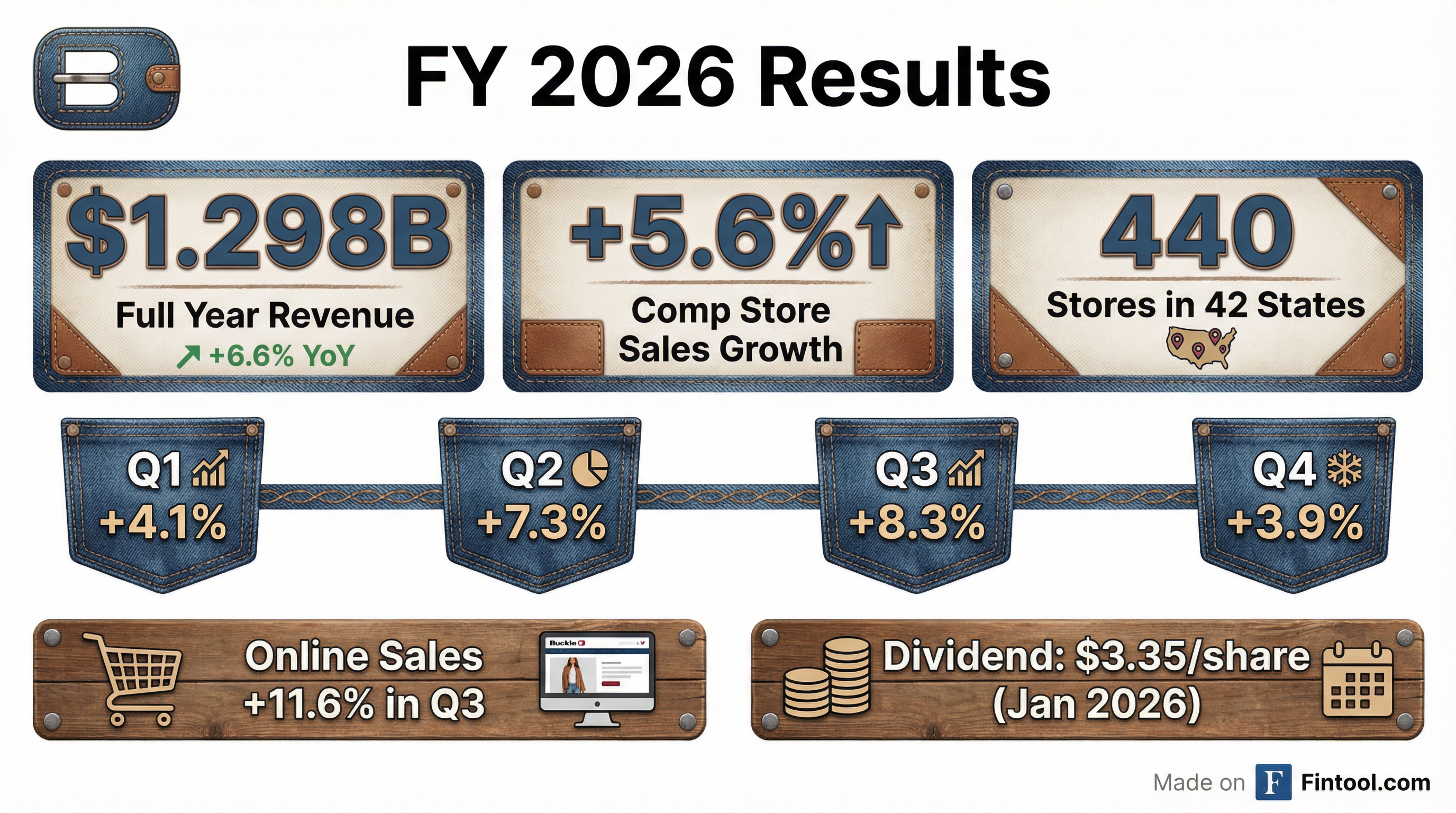

The Buckle closed fiscal 2026 with net sales of $1.298 billion, up 6.6% from $1.218 billion in the prior year, as women's apparel emerged as the clear growth driver while men's business contracted . Comparable store sales for the 52-week fiscal year rose 5.6%, capping a year of consistent positive momentum for the Kearney, Nebraska-based denim retailer.

Shares closed at $50.88, up 0.85% on the session, though the stock remains below its 52-week high of $61.69.

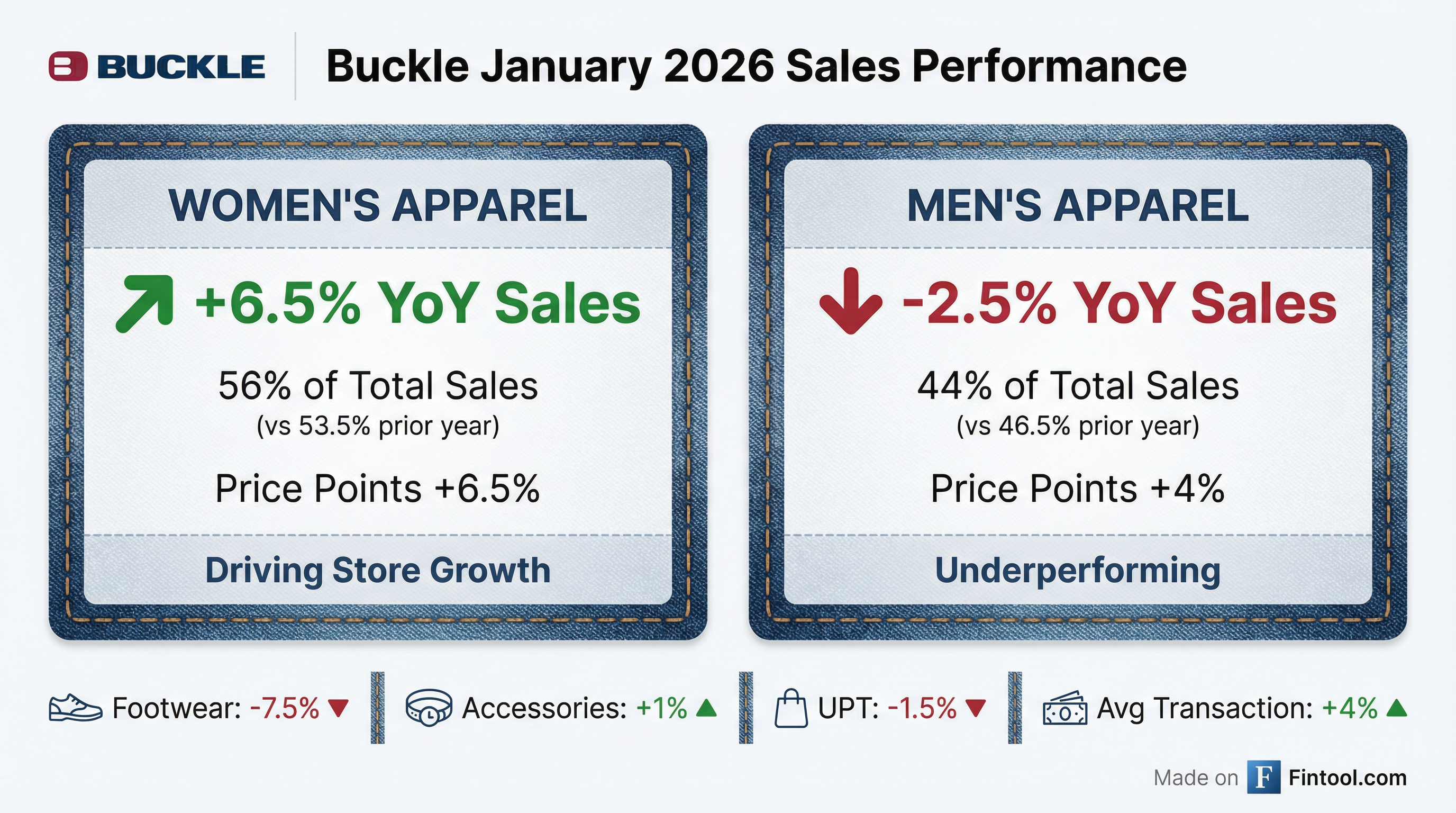

Women's Business Surges, Men's Stumbles

The January sales commentary revealed a notable shift in Buckle's business mix. Women's apparel sales increased 6.5% for the four-week fiscal month ending January 31, 2026, now representing 56% of total net sales versus 53.5% in the prior year . Men's apparel moved in the opposite direction, declining 2.5% and falling to 44% of the mix from 46.5% .

The divergence reflects what CFO Tom Heacock described in the recorded sales commentary as ongoing strength in women's fashion trends, particularly in denim fits and casual apparel . Price points continued to rise across both categories—up 6.5% for women's and 4% for men's—suggesting the retailer is maintaining pricing power despite the traffic headwinds .

January Deceleration Caps Strong Q4

While the full-year numbers were solid, January's results showed a notable deceleration. Comparable store sales for the four-week period rose just 1.7%, the slowest monthly gain in recent quarters . This compares to December's 5.5% comp gain and August's 12.2% surge .

The fourth quarter as a whole remained healthy, with comparable store sales up 3.9% and net sales increasing 5.3% to $399.1 million from $379.2 million . This builds on a strong Q3 that saw comps up 8.3% and net sales up 9.3% to $320.8 million .

| Period | Comp Sales Growth | Net Sales | YoY Change |

|---|---|---|---|

| Q4 FY26 (13 weeks) | +3.9% | $399.1M | +5.3% |

| Q3 FY26 (13 weeks) | +8.3% | $320.8M | +9.3% |

| Q2 FY26 (13 weeks) | +7.3% | $305.7M | +8.3% |

| FY26 Full Year | +5.6% | $1.298B | +6.6% |

Transaction Dynamics: Fewer Items, Higher Spend

Buckle's unit sales continued to face pressure, with units per transaction (UPT) declining approximately 1.5% for the month . However, average transaction value increased about 4%, driven by the higher price points across categories .

Footwear remained a weak spot, with sales declining 7.5% despite average price points rising 10.5% . Accessories managed a modest 1% gain with price points up 7.5% .

Financial Performance & Shareholder Returns

Buckle's financial profile remains robust. The company reported Q3 FY26 net income of $48.7 million, or $0.96 per diluted share, up from $44.2 million ($0.88 diluted) in the prior year period . Gross margins have held steady in the high-50% range, with Q3 coming in at 57.8%*.

| Metric | Q4 FY25 | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|---|

| Revenue | $379.2M | $272.1M | $305.7M | $320.8M |

| Net Income | $77.2M | $35.2M | $45.0M | $48.7M |

| Diluted EPS | $1.54 | $0.70 | $0.89 | $0.96 |

| Gross Margin | 61.6%* | 58.4%* | 57.5%* | 57.8%* |

*Values retrieved from S&P Global.

In December 2025, the Board authorized a combined cash distribution of $3.35 per share—a $3.00 special dividend plus the regular $0.35 quarterly dividend—paid to shareholders on January 29, 2026 .

Store Footprint Stable

Buckle operated 440 retail stores in 42 states as of the fiscal year end, unchanged from the prior year . The company closed four stores during fiscal January but maintained the same overall count, reflecting ongoing portfolio optimization rather than expansion .

What to Watch

Buckle will report Q4 FY26 earnings results in March, which will provide the first look at full-year profitability and any color on FY27 expectations. Key items for investors to monitor:

- Women's vs. Men's trajectory — Can women's momentum continue to offset men's weakness, or does management need to reinvigorate the men's assortment?

- Footwear turnaround — The 7.5% decline stands out; expect questions on product strategy

- Online penetration — Q3 saw online sales up 13.6%; watch for digital contribution in Q4 results

- Dividend sustainability — The $3.35 combined payout signals strong cash generation, but FY27 capital allocation will be in focus

Related: Bke Company Profile