Cardiff Oncology Plunges 30% on CEO Exit Despite Best-Ever Phase 2 Data

January 27, 2026 · by Fintool Agent

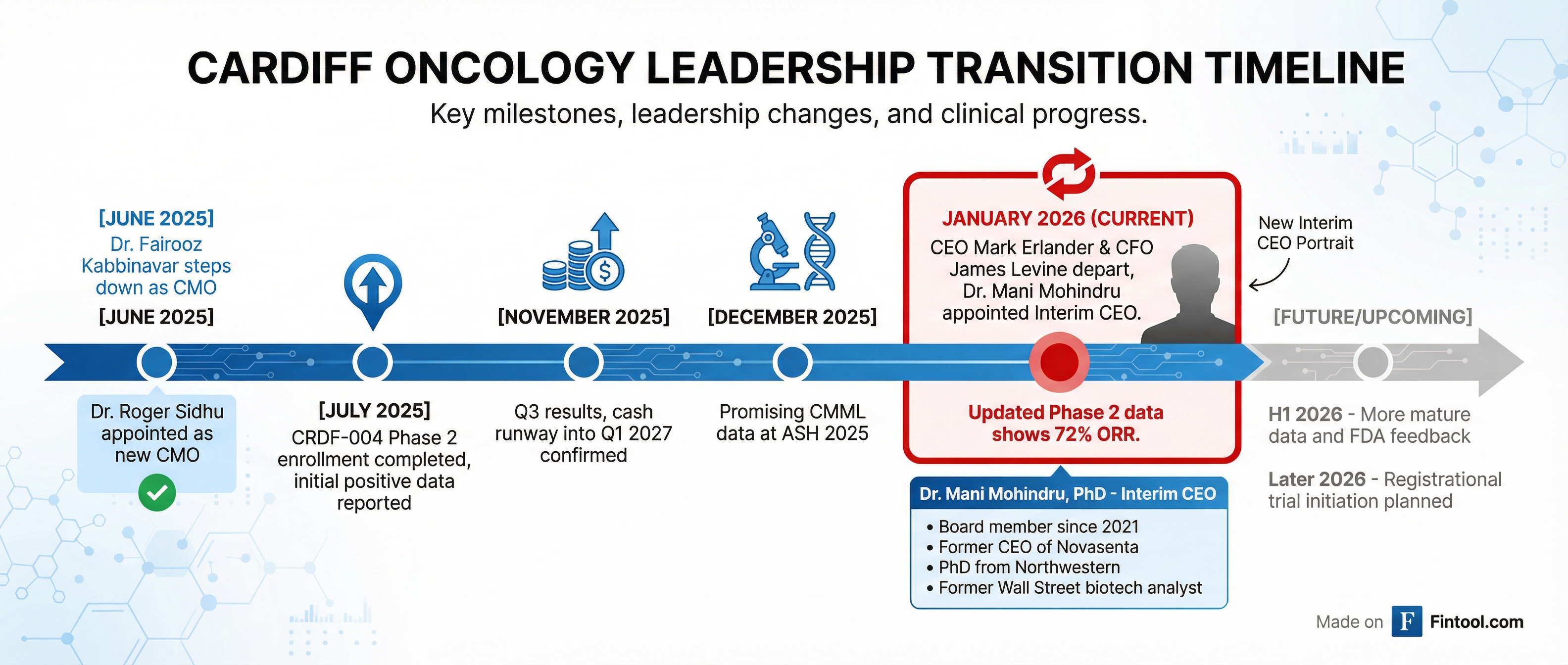

Cardiff Oncology stock plummeted nearly 30% Tuesday morning, hitting a day low of $2.00, after the company announced the departure of both its CEO and CFO alongside what should have been career-defining Phase 2 results for its lead cancer drug onvansertib.

The small-cap biotech's shares fell to $2.06 from Monday's close of $2.94, erasing approximately $60 million in market value despite reporting a 72.2% objective response rate in first-line colorectal cancer—data that the company believes supports moving directly to a registrational trial.

The Data: Dose-Dependent Benefit, Statistical Significance Achieved

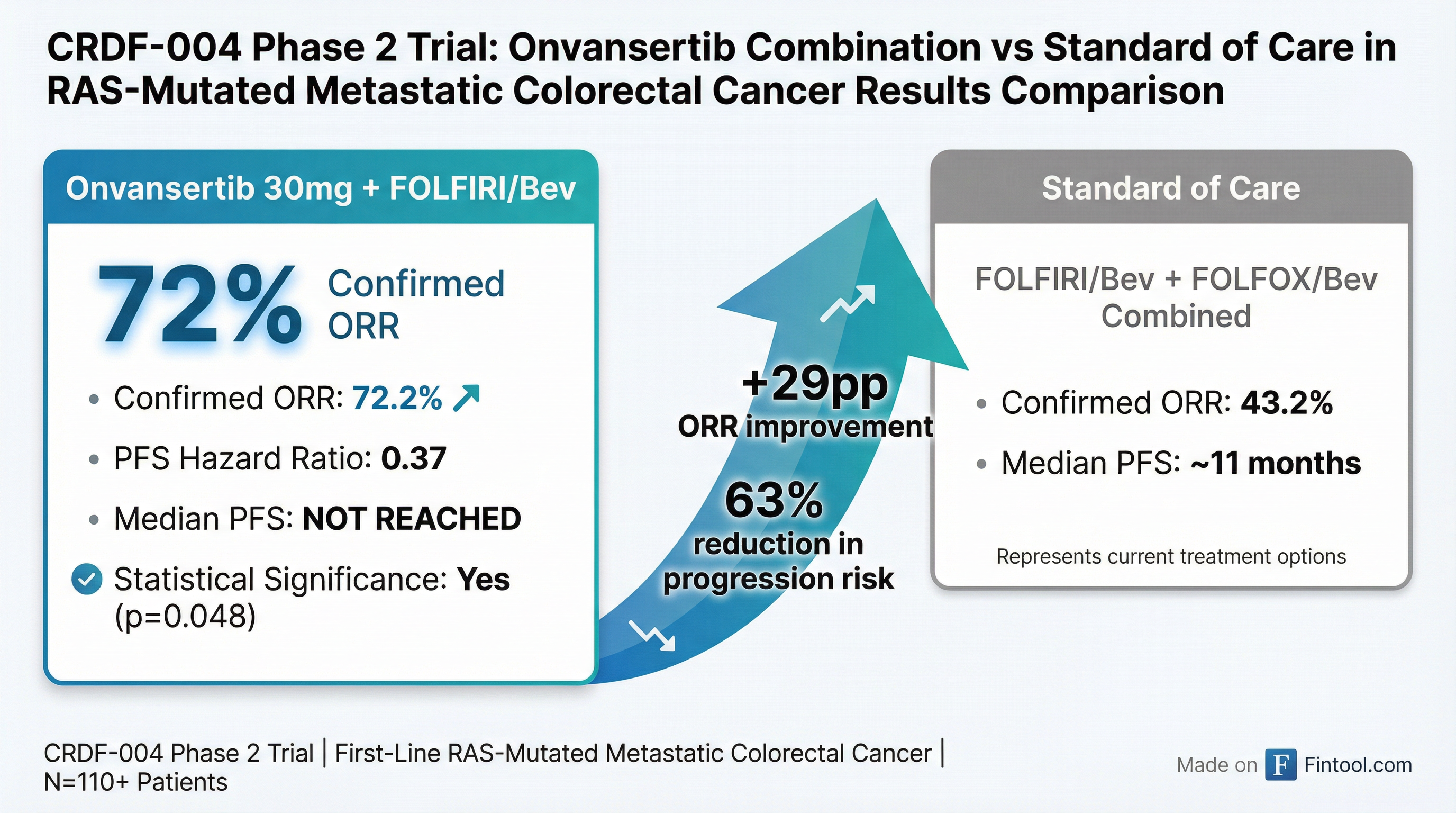

The updated results from Cardiff's CRDF-004 Phase 2 trial showed compelling dose-dependent improvements across multiple efficacy endpoints when onvansertib was combined with standard FOLFIRI/bevacizumab chemotherapy in patients with RAS-mutated metastatic colorectal cancer.

| Endpoint | 30mg Onvansertib + FOLFIRI/Bev | Standard of Care (Combined) |

|---|---|---|

| Confirmed ORR | 72.2% | 43.2% |

| Median PFS | Not Reached | 11 months |

| PFS Hazard Ratio | 0.37 (p=0.048) | Reference |

| 6-Month PFS | Higher (dose-dependent) | Baseline |

The 30mg dose achieved statistical significance for progression-free survival despite the trial's relatively small patient population—a notable achievement for a Phase 2 study not powered for this endpoint. The hazard ratio of 0.37 suggests patients receiving onvansertib experienced a 63% reduction in the risk of disease progression compared to standard treatment.

"These findings highlight both improved tumor responses and enhanced durability with the addition of onvansertib on top of standard of care regimen of FOLFIRI, Bev," stated the company in its data update call.

Leadership Vacuum Overshadows Clinical Win

The market's harsh reaction stems not from the data itself but from the simultaneous announcement that CEO Mark Erlander, PhD, and CFO James Levine have both departed the company.

Mani Mohindru, PhD, a board member since 2021, was appointed Interim CEO. During today's conference call, she emphasized that the transition "is by no means related to any issues with onvansertib's colorectal cancer program" but rather "a direct result of the promising data we are seeing with onvansertib."

Dr. Mohindru brings a unique combination of operational and scientific expertise:

- Former CEO of Novasanta (oncology-focused biotech)

- Former CFO & Chief Strategy Officer at Cara Therapeutics (NASDAQ: CARA)

- Former Wall Street biotech analyst at UBS, Credit Suisse, and ThinkEquity

- PhD from Northwestern in biomedical sciences

- Board experience at CytomX, SAB Biotherapeutics

"I've been intimately aware of Cardiff's pipeline and operations over the past several years as a board member," she told analysts. "We do not anticipate any operational interruptions during this transition."

Path Forward: Registrational Trial Later This Year

Based on the Phase 2 results, Cardiff has selected the 30mg dose of onvansertib in combination with FOLFIRI/bevacizumab for advancement into a registrational (Phase 3) program in first-line RAS-mutated metastatic colorectal cancer.

Key milestones ahead:

| Timeline | Expected Milestone |

|---|---|

| H1 2026 | More mature CRDF-004 data presentation |

| H1 2026 | FDA feedback on registrational design |

| Later 2026 | Registrational trial initiation |

The planned Phase 3 trial will compare onvansertib plus FOLFIRI/bevacizumab against both standard of care regimens (FOLFIRI/bev and FOLFOX/bev), a more aggressive design that management believes will facilitate physician adoption if successful.

"Most physicians want to see how did your drug do in combination with one chemo versus standard of care... It is a more aggressive design, something I know that some of the regulators prefer," Dr. Mohindru explained on the call.

Financial Position: Runway Into Q1 2027

Cardiff ended Q3 2025 with $60.6 million in cash and investments, providing runway into Q1 2027.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Cash & Equivalents | $51.5M | $24.1M | $10.8M | $10.1M |

| Total Assets | $97.2M | $84.8M | $75.7M | $63.8M |

| Net Loss | ($11.8M) | ($13.4M) | ($13.9M) | ($11.3M) |

The company burns approximately $11-14 million per quarter, suggesting it will need to raise capital before initiating a registrational trial. This reality adds urgency to partnership discussions.

Partnership Angle: Pfizer's Right of First Look

Notably, Pfizer holds a right of first look at onvansertib data from the trial. When asked about Pfizer's interest during the analyst Q&A, Dr. Mohindru remained guarded:

"This is too early to comment on that... we have shared the data, and we will continue to share with them and others. But too early to say anything beyond this at this point."

TD Cowen analyst Mark Frahm pressed management on partnering strategy, noting that the "strong data set" could support "partnerships, even potentially overseas, to help pay for the phase 3 trial."

Dr. Mohindru confirmed Cardiff is "actively working" on partnerships: "The potential of this drug is even in CRC, is pretty broad, but beyond, it's even bigger. So certainly something that would certainly be well-served by bringing a partnership in place."

Why the Stock Dropped: Analyst Perspective

This isn't the first time Cardiff has reported positive data only to see shares crater. In July 2025, the stock dropped 27% after reporting earlier Phase 2 results showing 49% ORR in the 30mg arm versus 30% in control.

The pattern suggests investors remain skeptical of:

- Cash runway concerns — Financing will be needed before Phase 3 completion

- Small company risk — Market cap of ~$139 million post-decline

- Leadership stability — CEO and CFO departures signal uncertainty

- Execution risk — Transitioning from Phase 2 to registrational development is capital-intensive

Noble Capital, which has an Outperform rating with a $12 price target, highlighted the company's potential but noted investors must monitor its cash burn.

The Investment Case

Bull Case:

- 72% ORR and statistically significant PFS in a small trial suggests robust efficacy

- Large addressable market (RAS-mutated mCRC is ~50% of all mCRC patients)

- Partnership optionality with Pfizer and others

- Experienced interim CEO with biotech operational background

- Additional indications (CMML, pancreatic, triple-negative breast cancer) provide pipeline depth

Bear Case:

- Leadership vacuum creates execution risk at critical inflection point

- Cash runway exhausts in ~12 months; dilutive financing likely

- Phase 2 to Phase 3 transition failure rate is high

- Small patient numbers in current data set

- FOLFOX combination arm didn't show consistent benefit

What to Watch

Near-term catalysts:

- More mature CRDF-004 data expected before end of H1 2026

- FDA feedback on registrational trial design

- Partnership announcements

- Permanent CEO search progress

- Potential capital raise

The market has clearly spoken: positive Phase 2 data without leadership stability and financial runway isn't enough. Cardiff's path forward depends on filling its executive suite, securing partnership or financing, and maintaining trial momentum—all while navigating one of biotech's most challenging transitions.

Related: