Century Aluminum Cedes Majority Control to UAE's EGA in Historic 750,000-Tonne Oklahoma Smelter Deal

January 26, 2026 · by Fintool Agent

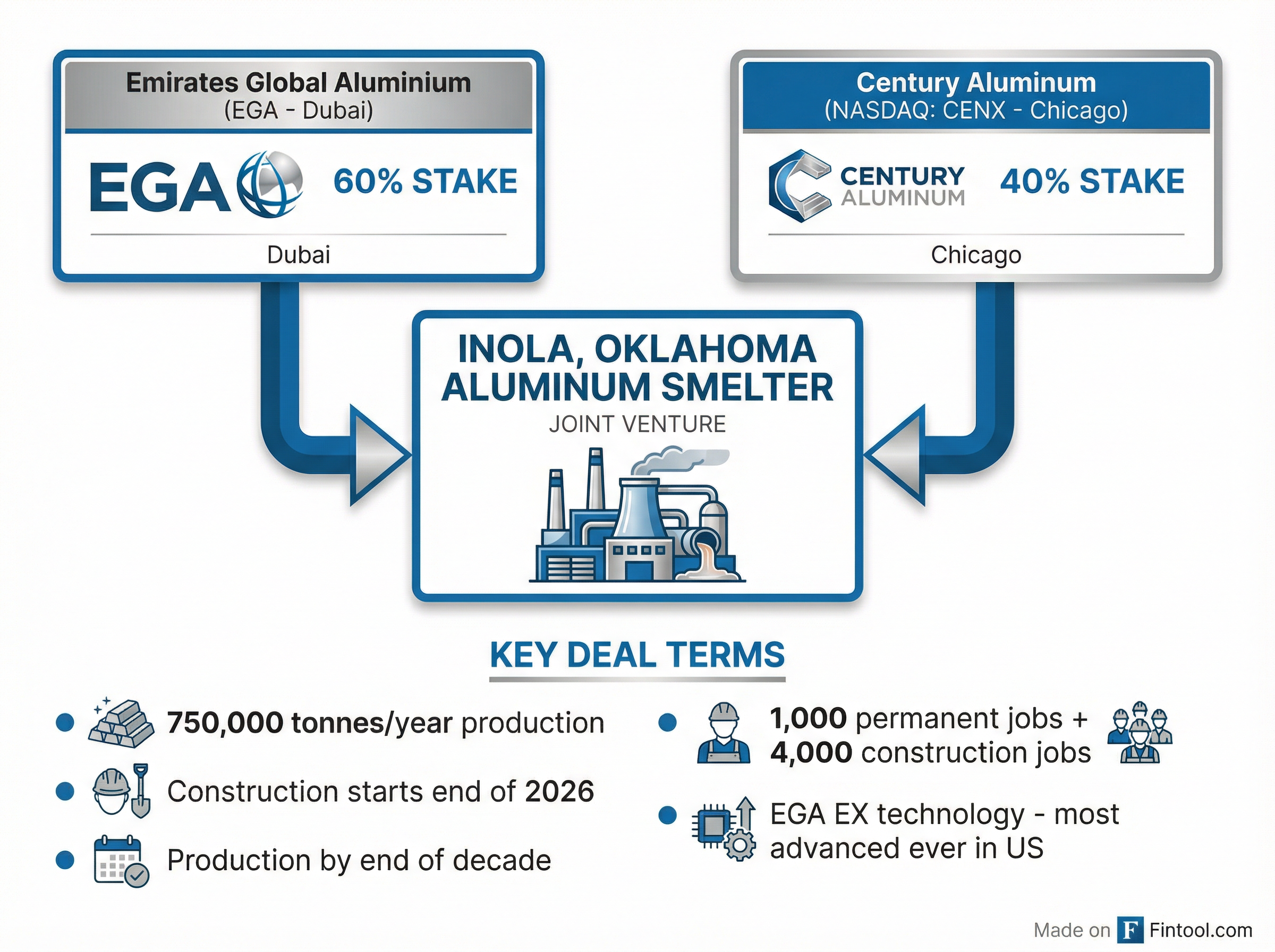

Century Aluminum gave up majority control of its greenfield smelter ambitions Monday, partnering with Dubai-based Emirates Global Aluminium to build the first U.S. primary aluminum plant in nearly 50 years—but investors weren't cheering. CENX shares dropped 7.4% to $45.11 as the market digested a deal structure that hands 60% ownership to the UAE company.

The Inola, Oklahoma facility will produce 750,000 tonnes of aluminum annually—larger than previously envisioned and enough to more than double current U.S. production. But for Century shareholders who had been tracking the company's discussions about building its own smelter, the minority stake represents a significant pivot from earlier ambitions.

The Deal Structure

Under the joint development agreement, EGA will own 60% of the joint venture, with Century holding 40%. Both companies have agreed to focus their U.S. greenfield development efforts exclusively on the Inola site.

Key terms include:

| Metric | Details |

|---|---|

| Production Capacity | 750,000 tonnes/year |

| Ownership | EGA 60% / Century 40% |

| Construction Start | End of 2026 |

| Production Start | End of the decade |

| Permanent Jobs | 1,000 |

| Construction Jobs | 4,000 |

| Technology | EGA's EX smelting technology |

The facility will use EGA's latest state-of-the-art EX technology, which will be the most advanced aluminum smelting system ever installed in the United States.

Why Century Gave Up Control

Century had previously outlined plans for its own greenfield smelter that would "double the size of the existing U.S. industry, creating over 1,000 full-time direct jobs and over 5,500 construction jobs." In its Q3 2025 earnings call, CEO Jesse Gary noted the company had "lots of interest from potential joint venture partners" and saw "some form of partnership as the most likely path forward with the project."

The pivot to a minority position reflects the capital intensity of aluminum smelting. EGA brings:

- World-class smelting technology and construction expertise

- Deep pockets—EGA is the world's largest "premium aluminum" producer, manufacturing one in every 25 tonnes made globally

- Existing U.S. relationships through its Spectro Alloys recycling operation in Minnesota

Century CEO Jesse Gary explicitly credited the Trump administration: "Our partner EGA brings world-class smelting technology and construction expertise that are fast-tracking our collective efforts to realize President Trump's vision of rapidly increasing domestic primary aluminum production."

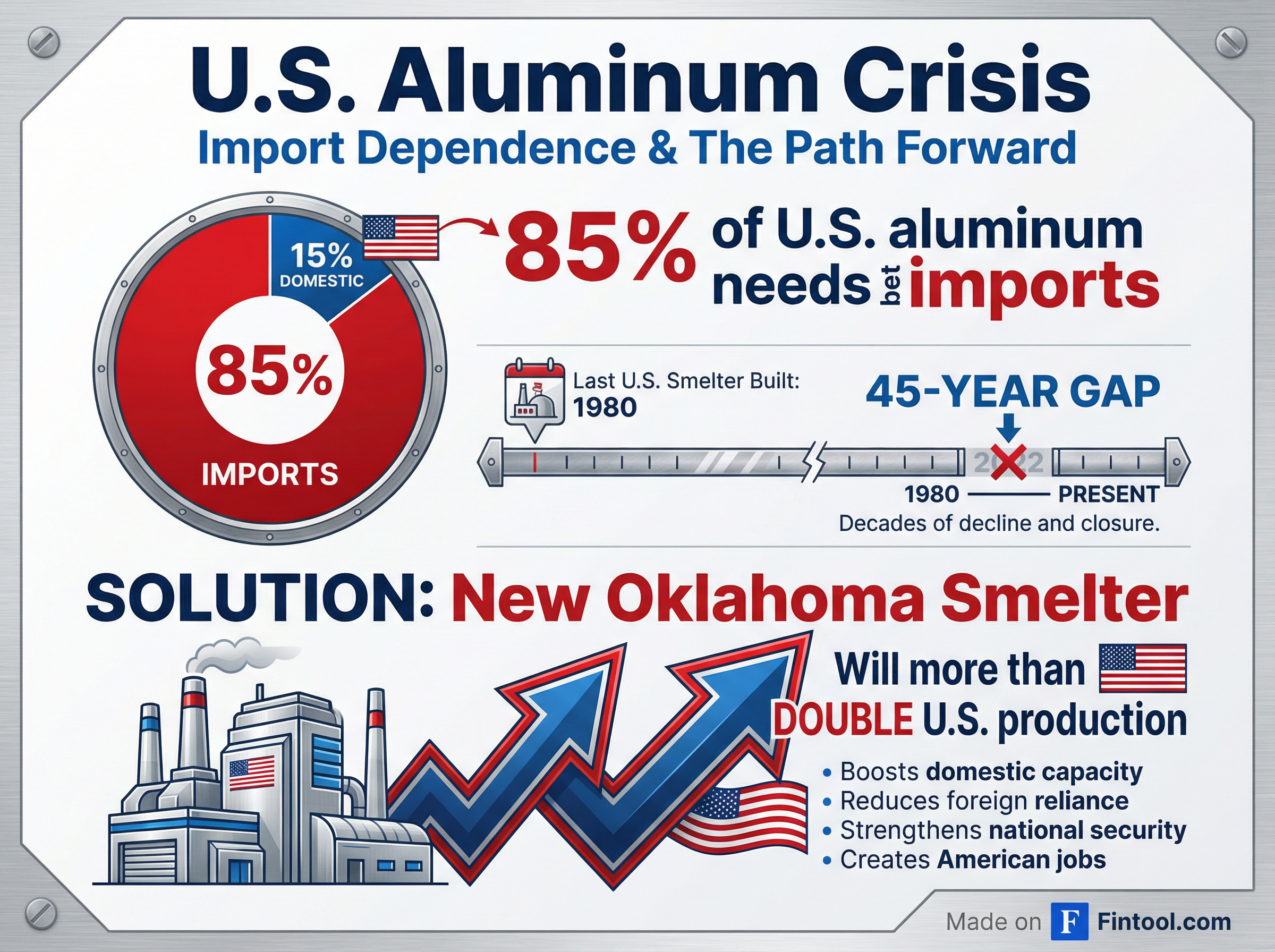

The 85% Import Problem

The strategic rationale is clear: approximately 85% of U.S. aluminum needs are currently met by imports. The last primary aluminum smelter built in America was completed in 1980—a 45-year gap that has left critical industries dependent on foreign supply.

The new smelter will be the largest primary aluminum production plant ever built in the United States. Once operational, it will supply industries including automotive, aerospace, construction, packaging, and defense.

Market Reaction

CENX shares had been on a strong run heading into the announcement, more than tripling from a 52-week low of $13.05 to trade near all-time highs. The stock opened at $48.79 Monday before the deal announcement sent it tumbling 7.4%.

| Metric | Value |

|---|---|

| Current Price | $45.11 |

| Daily Change | -7.4% |

| 52-Week High | $50.16 |

| 52-Week Low | $13.05 |

| Market Cap | $4.2B |

| Volume | 3.56M shares (elevated) |

Values retrieved from S&P Global

The selloff likely reflects:

- Diluted ownership — Century had explored building its own smelter, potentially with DOE grant funding

- Control premium — EGA, not Century, will control the JV's strategic direction

- Execution risk — Construction and regulatory approvals still required

Century's Financial Position

Century has been generating strong cash flows amid elevated aluminum prices and tariff protection:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $631M | $634M | $628M | $632M |

| Net Income | $43M | $30M | -$5M | $15M |

| EBITDA | $66M | $67M | $41M | $79M |

| Cash | $33M | $45M | $41M | $151M |

The company had been targeting $300 million in net debt and discussed returning capital to shareholders through buybacks once that target was reached.

Location: Tulsa Port of Inola

The plant will be built at the industrial park at Tulsa Port of Inola, strategically located on the McClellan-Kerr Arkansas River Navigation System (M-KARNS). This waterway connects to the Mississippi River system, enabling efficient bulk freight movement for raw materials and finished aluminum.

The facility is expected to catalyze development of a regional aluminum-focused industrial hub in Oklahoma, creating additional jobs in the upstream supply chain and downstream aluminum manufacturing.

What to Watch

Near-term catalysts:

- Finalization of power supply negotiations with Public Service Company of Oklahoma

- Detailed engineering completion and construction commencement (targeted end of 2026)

- Any regulatory or permitting updates

Long-term questions:

- Will Century's 40% stake prove accretive to shareholders, or will EGA capture most of the value?

- How will this facility impact U.S. aluminum self-sufficiency and national security?

- Can the project deliver on its end-of-decade production timeline?

Related Companies: Century Aluminum (cenx) · Alcoa (aa) · Nucor (nue)