Century Aluminum and Emirates Global Join Forces to Build First US Smelter in Nearly 50 Years

January 28, 2026 · by Fintool Agent

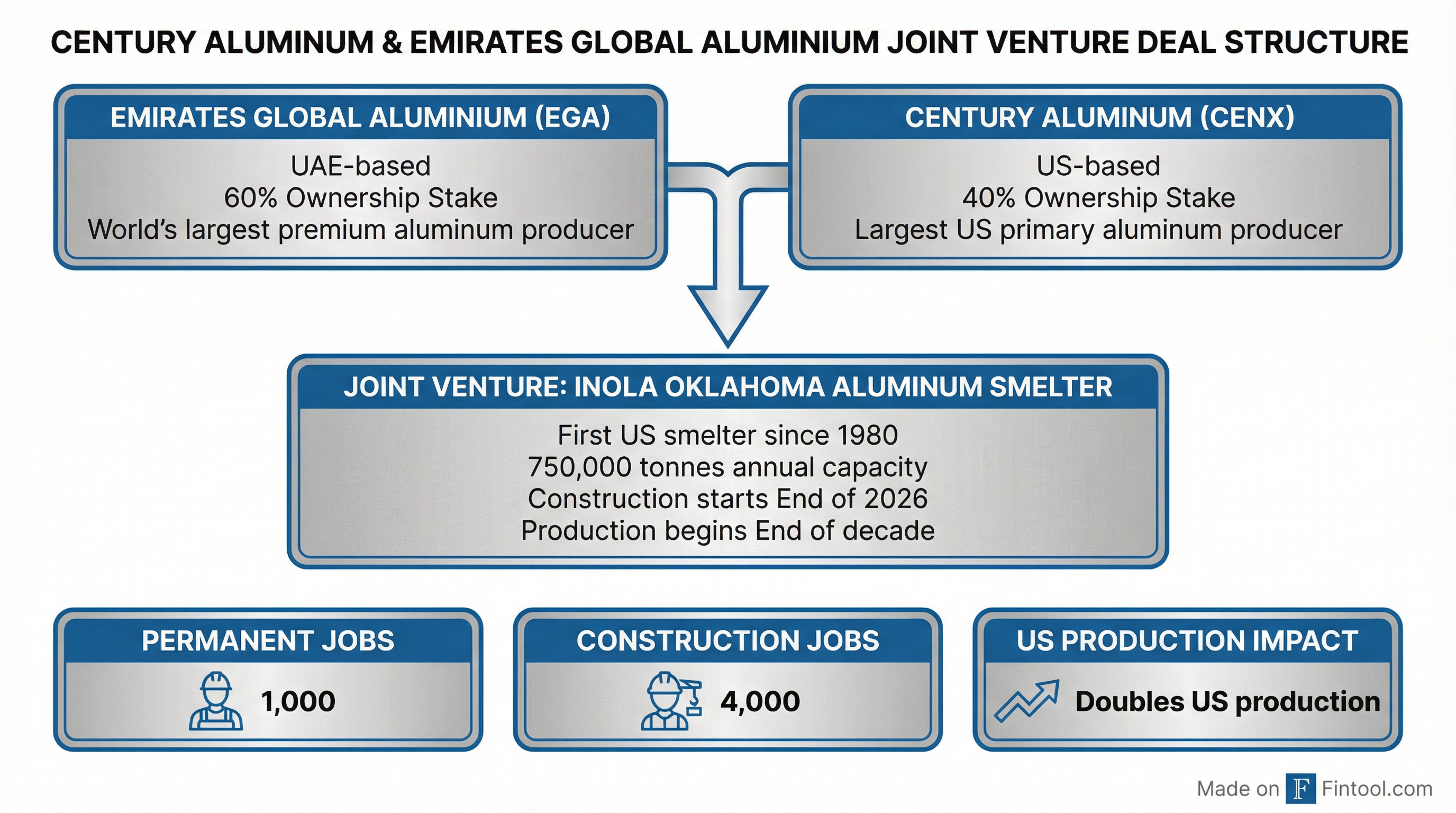

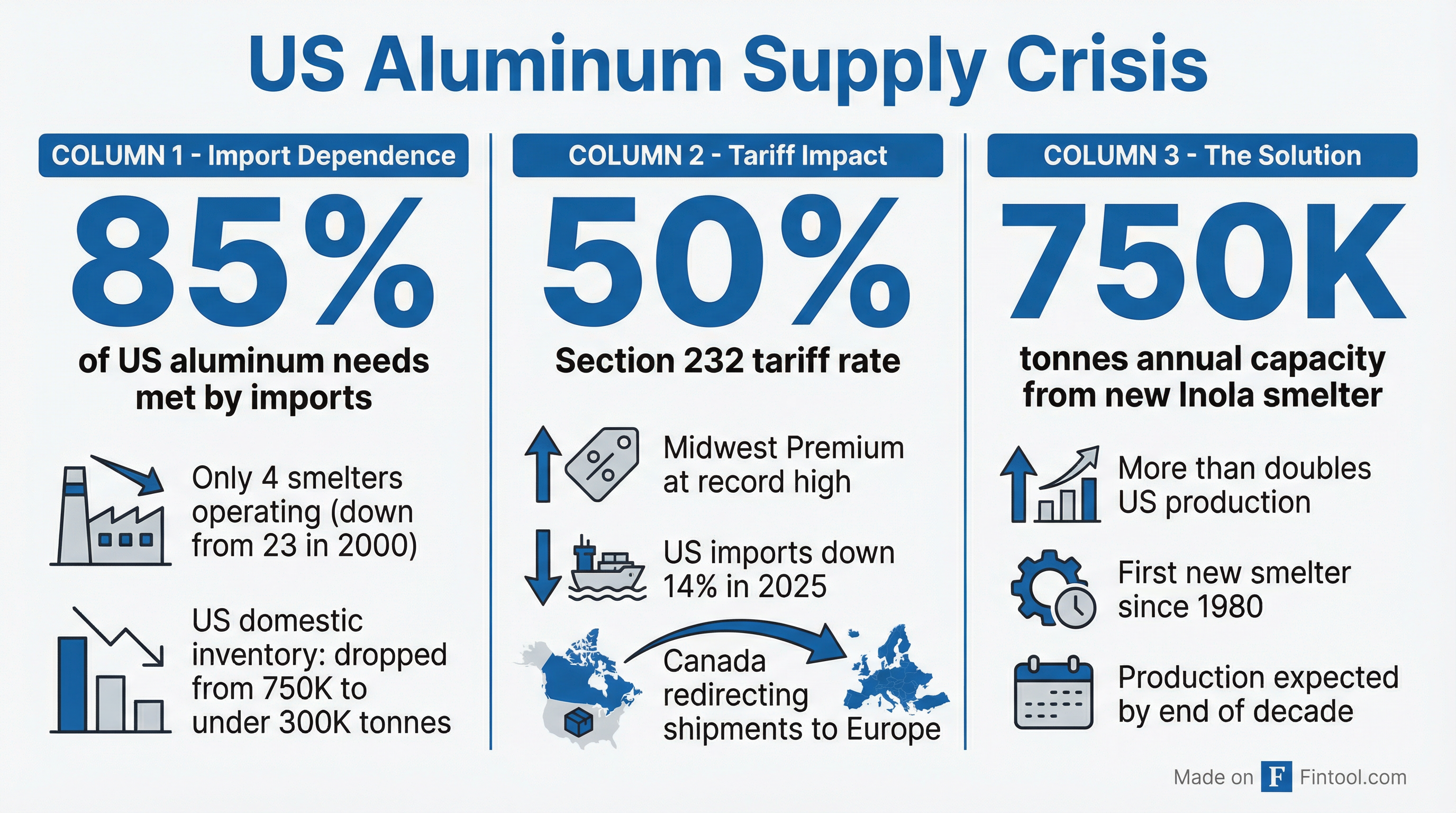

Century Aluminum and Emirates Global Aluminium (EGA) have announced a joint development agreement to build a 750,000-tonne aluminum smelter in Inola, Oklahoma—the first new primary aluminum production plant in the United States since 1980. The deal marks a potential turning point for an industry that has seen its domestic footprint shrink from 23 smelters in 2000 to just four today.

Under the agreement, EGA will own 60% of the joint venture while Century holds 40%. The facility's capacity has been increased from 600,000 tonnes originally envisioned by EGA to 750,000 tonnes, which would more than double current US aluminum production.

The Deal Structure

The partnership combines EGA's world-class smelting technology and construction expertise with Century's deep experience operating US facilities. EGA, owned by Abu Dhabi's Mubadala Investment Company and the Investment Corporation of Dubai, is the world's largest "premium aluminum" producer, manufacturing one in every 25 tonnes of aluminum made globally.

The project will use EGA's latest state-of-the-art EX technology—the most advanced ever installed in the United States. Both companies will now focus their greenfield development efforts exclusively on the Inola site, abandoning Century's previously contemplated Kentucky location where it had secured up to $500 million in Department of Energy funding.

Why Now: The Supply Crisis

The timing reflects an acute supply crisis in the US aluminum market. American industries rely on imports for approximately 85% of their aluminum needs, leaving the nation vulnerable to supply disruptions and geopolitical risk at a time when the metal is designated a critical mineral for defense applications.

The Trump administration's aggressive tariff actions have dramatically shifted the economics. Section 232 tariffs on aluminum imports were increased from 10% to 25% in February 2025 and then to 50% in June 2025. The result: the Midwest Premium—the premium US buyers pay over the London Metal Exchange price—has surged to approximately $1,600 per tonne (about $0.72/lb), a record level.

Meanwhile, domestic inventory has plummeted from 750,000 tonnes at the start of 2025 to under 300,000 tonnes, according to Harbor Aluminum and Wittsend Commodity Advisors. Canada, historically the largest supplier to the US market, has been redirecting shipments to Europe.

Century's Market Position

Century Aluminum is the largest US primary aluminum producer, operating smelters in Kentucky (Hawesville and Sebree), South Carolina (Mt. Holly), and Iceland (Grundartangi). The company has been aggressively capitalizing on the favorable tariff environment:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $631* | $634 | $628 | $632 |

| Net Income ($M) | $43* | $30 | $(5) | $15 |

| EBITDA Margin (%) | 10.5%* | 10.5%* | 6.6%* | 12.4%* |

| Cash ($M) | $33 | $45 | $41 | $151 |

*Values retrieved from S&P Global

In August 2025, Century announced it would invest approximately $50 million to restart 50,000 tonnes of idled capacity at its Mt. Holly plant in South Carolina, returning the facility to full production by Q2 2026. This restart alone increases total US primary aluminum production by nearly 10%.

Stock Performance

Century's shares have been on a remarkable run, trading at $49.00 as of January 28—up approximately 275% from their 52-week low of $13.05. The stock is near its 52-week high of $50.16.

The company's market capitalization now stands at approximately $4.6 billion, reflecting investor enthusiasm for the reshoring narrative and tariff tailwinds.

The Power Challenge

Perhaps the biggest hurdle remains securing competitive long-term power. Aluminum smelting is extraordinarily energy-intensive—the Inola facility will require over 11 terawatt-hours of power annually, equivalent to the electricity needs of a city the size of Boston or Nashville.

Negotiations with Public Service Company of Oklahoma and the state of Oklahoma on power supply are ongoing. Oklahoma's electricity generation is split roughly between wind power (over 40%) and natural gas plants (about half), positioning it relatively well for energy-intensive industrial projects.

The location at the Tulsa Port of Inola, on the McClellan-Kerr Arkansas River Navigation System connected to the Mississippi River, provides efficient bulk freight access—critical for shipping raw materials in and finished aluminum out.

Economic Impact and Timeline

The project is expected to:

- Create 1,000 permanent direct jobs at the facility

- Support 4,000 construction jobs during the build phase

- Drive regional development of an aluminum-focused industrial hub in Oklahoma

- Generate upstream and downstream economic activity in the supply chain and aluminum manufacturing sectors

| Milestone | Target |

|---|---|

| Detailed Engineering | Underway |

| Construction Start | End of 2026 |

| First Hot Metal | By End of Decade |

| Full Production Rate | 2030 |

Investment Implications

The Century-EGA partnership validates the thesis that US aluminum production is experiencing a structural revival driven by:

- Tariff protection: 50% Section 232 tariffs make domestic production economically competitive

- Supply security concerns: Defense and critical infrastructure applications demand reliable domestic supply

- Record premiums: Midwest Premium at ~$1,600/tonne provides strong margins for domestic producers

- China capacity cap: Global supply growth is constrained as China operates near its government-mandated production ceiling

For Century specifically, the JV structure means the company can participate in the massive capacity expansion without bearing the full capital burden. EGA brings approximately $4 billion in previously announced investment commitment, along with construction expertise and proven technology.

What to Watch

- Power negotiations: The economics of the project hinge on securing competitive long-term electricity rates

- DOE funding status: Century's previously awarded $500 million in IRA funding for a Kentucky smelter was paused under executive orders; unclear how this affects the company's overall capital position

- Tariff durability: The business case depends on tariffs remaining in place through the construction and ramp-up period

- Grundartangi recovery: Century's Iceland smelter cut production by two-thirds in late October 2025 due to equipment failure, with full recovery expected to take 11-12 months

- Q4 2025 earnings: Expected in February, will provide updated guidance on the JV and Mt. Holly restart progress

The Inola smelter represents more than just a capacity addition—it's a test case for whether US manufacturing policy can reverse decades of industrial decline. If successful, Century's CEO Jesse Gary predicts US aluminum production could triple by the end of the decade.

Related Companies: Century Aluminum · Alcoa