CGI and OpenAI Forge Global Alliance to Deploy Enterprise AI at Scale

January 27, 2026 · by Fintool Agent

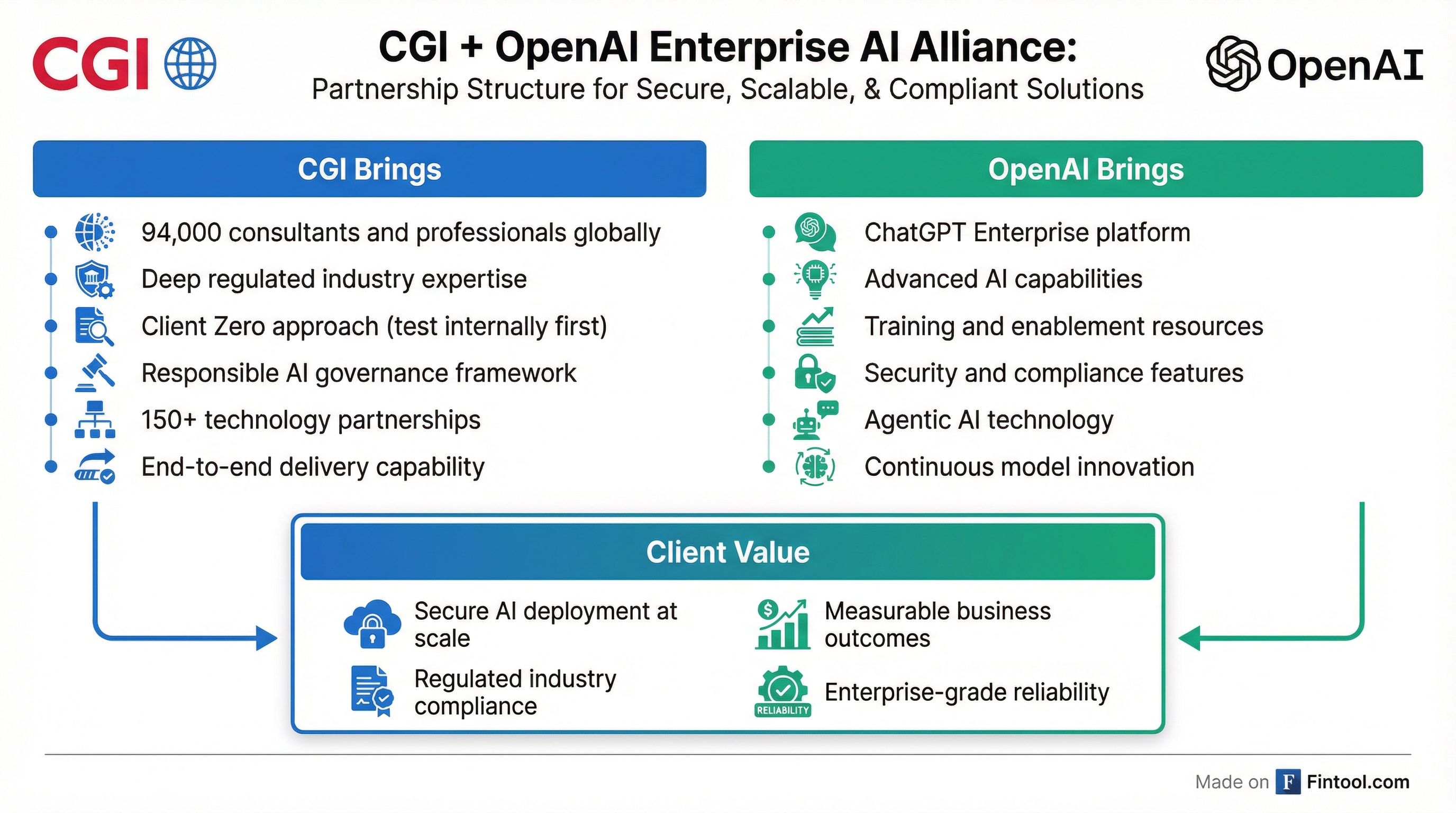

Cgi Inc., one of the world's largest independent IT and business consulting firms, announced a global go-to-market alliance with OpenAI on Monday, marking a significant milestone in the progression of enterprise AI adoption from pilot programs to production-scale deployment.

Under the agreement, CGI will expand its use of OpenAI's ChatGPT Enterprise platform to equip "tens of thousands" of its consultants and professionals—a substantial portion of the company's 94,000-person global workforce. The partnership builds on a successful multi-year pilot program in the UK and positions CGI to help heavily regulated organizations deploy generative AI securely and at scale.

"CGI's expanded collaboration with OpenAI is well-timed to the progression of AI adoption across industries and regions—from pilots and experimentation to larger-scale enterprise integration," said Dave Henderson, Chief Technology Officer at CGI.

The Client Zero Approach

What distinguishes CGI's strategy is its "Client Zero" methodology—the firm deploys and tests AI tools internally before recommending them to clients. This approach creates a proven, action-ready model that enterprise customers can adopt with confidence.

"Being Client Zero means we learn the hard lessons first, so our clients don't have to," said Tara McGeehan, President of CGI's UK & Australia Operations. "We have tested, iterated, and embedded generative AI across our own business. That experience allows us to help clients deploy AI with confidence—faster, more securely and with measurable commercial outcomes."

This includes early adoption of agentic AI capabilities—where AI systems can execute tasks, coordinate workflows, and support human decision-making across core enterprise operations.

Financial Context: AI Already Driving CGI's Business

CGI has been steadily integrating AI across its business, and the metrics reflect growing momentum. According to the company's most recent earnings call, 40% of CGI's intellectual property (IP) revenue now has AI capabilities embedded—spanning ERP systems, wealth management platforms, and government solutions.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($M) | $2,631 | $2,799 | $2,999 | $2,882 |

| EBITDA Margin % | 19.8% | 20.1% | 20.1% | 18.1% |

| Net Income Margin % | 11.6% | 10.7% | 10.0% | 9.5% |

*Values retrieved from S&P Global

The firm's pipeline tells an even stronger story. CEO François Boulanger noted that bookings from go-to-market partnerships totaled more than $2.6 billion in the first nine months of fiscal 2025—up over 120% compared to the prior year. The managed services pipeline is up more than 20% year-over-year, with AI-related wins demonstrating "the depth of our expertise globally."

"Across industries and geographies, AI remains a powerful enabler for monetization, optimization and transformation," Boulanger said.

OpenAI Gets Enterprise Distribution at Scale

For OpenAI, the partnership provides something equally valuable: access to heavily regulated enterprise clients through a trusted intermediary with deep domain expertise.

Nicolai Skabo, Head of OpenAI's EMEA Enterprise Sales, noted: "Working with CGI helps further enterprise AI from promise to practice. By scaling ChatGPT Enterprise across CGI's team and developing a deeper collaboration, we're combining platform capability with delivery expertise to help organizations transform how work gets done securely, responsibly, and with real business impact."

CGI applies ChatGPT Enterprise through its Responsible Use of AI Framework, governed by a global AI Executive Steering Committee. This governance structure is critical for clients in regulated industries—government agencies, financial services firms, and healthcare organizations—that require strict security, privacy, and ethical standards.

Market Reaction and Analyst Perspective

CGI shares (NYSE: GIB) traded at $88.67 on Monday, down 0.6% in a session where broader markets advanced. The stock has underperformed over the past year, trading 28% below its 52-week high of $122.79.

| CGI Stock Data | Value |

|---|---|

| Current Price | $88.67 |

| Market Cap | $19.7B |

| 52-Week High | $122.79 |

| 52-Week Low | $84.00 |

| YTD Performance | -3.2% |

Analysts have historically questioned whether AI partnerships translate to meaningful revenue growth for IT services firms. Prior CGI announcements involving AI—including deals with Google Cloud's Gemini Enterprise and AWS—have produced "modest and often negative next-day price moves, suggesting investors treat AI partnership news cautiously," according to StockTitan analysis.

The key question: Can CGI convert this partnership into concrete adoption metrics, revenue contributions, and operational efficiency gains?

The Broader Enterprise AI Landscape

CGI's OpenAI partnership joins an expanding list of 150+ technology alliances, including Microsoft, Apple, Google, and AWS. The company also announced last week a partnership with Google's Gemini Enterprise for agentic AI capabilities.

The timing aligns with broader enterprise AI momentum. CGI's CEO has emphasized that clients are increasingly seeking "practical use cases grounded in business reality" rather than experimental pilots.

On the Q3 2025 earnings call, Boulanger explained the economics: "Now with AI, they can do more with less. Some of these savings that we can produce by delivering faster, they're turning around and saying, 'Finally, I can do more,' and let's accelerate some transformation that we were not able to do in the past."

What to Watch

Near-term catalysts:

- CGI's fiscal Q1 2026 results (expected early February) will provide the first glimpse of OpenAI partnership impact

- Details on how many consultants are using ChatGPT Enterprise and productivity metrics

- Client wins specifically attributed to the OpenAI collaboration

Longer-term questions:

- Will CGI's "Client Zero" approach differentiate it versus competitors making similar partnerships?

- Can regulated industries overcome compliance concerns to deploy generative AI at scale?

- How will agentic AI capabilities—where AI executes tasks autonomously—change the consulting delivery model?

The alliance represents another step in the enterprise AI journey from pilot to production. Whether it moves CGI's stock depends on execution—and concrete evidence that the partnership drives measurable business outcomes.

Related Companies: Cgi Inc. (gib)