Charles & Colvard Fires CEO Six Weeks After Activist Victory

January 8, 2026 · by Fintool Agent

The activist investors who seized control of Charles & Colvard+0.00%'s board in November moved swiftly to clean house, terminating President and CEO Don O'Connell without cause on January 5, 2026 — just six weeks after their election victory was certified.

Board Chair Michael Levin, a well-known activist investor and founder of The Activist Investor advisory firm, has assumed the role of Executive Chair for an initial three-month term at $18,000 per month while the new board searches for a permanent CEO.

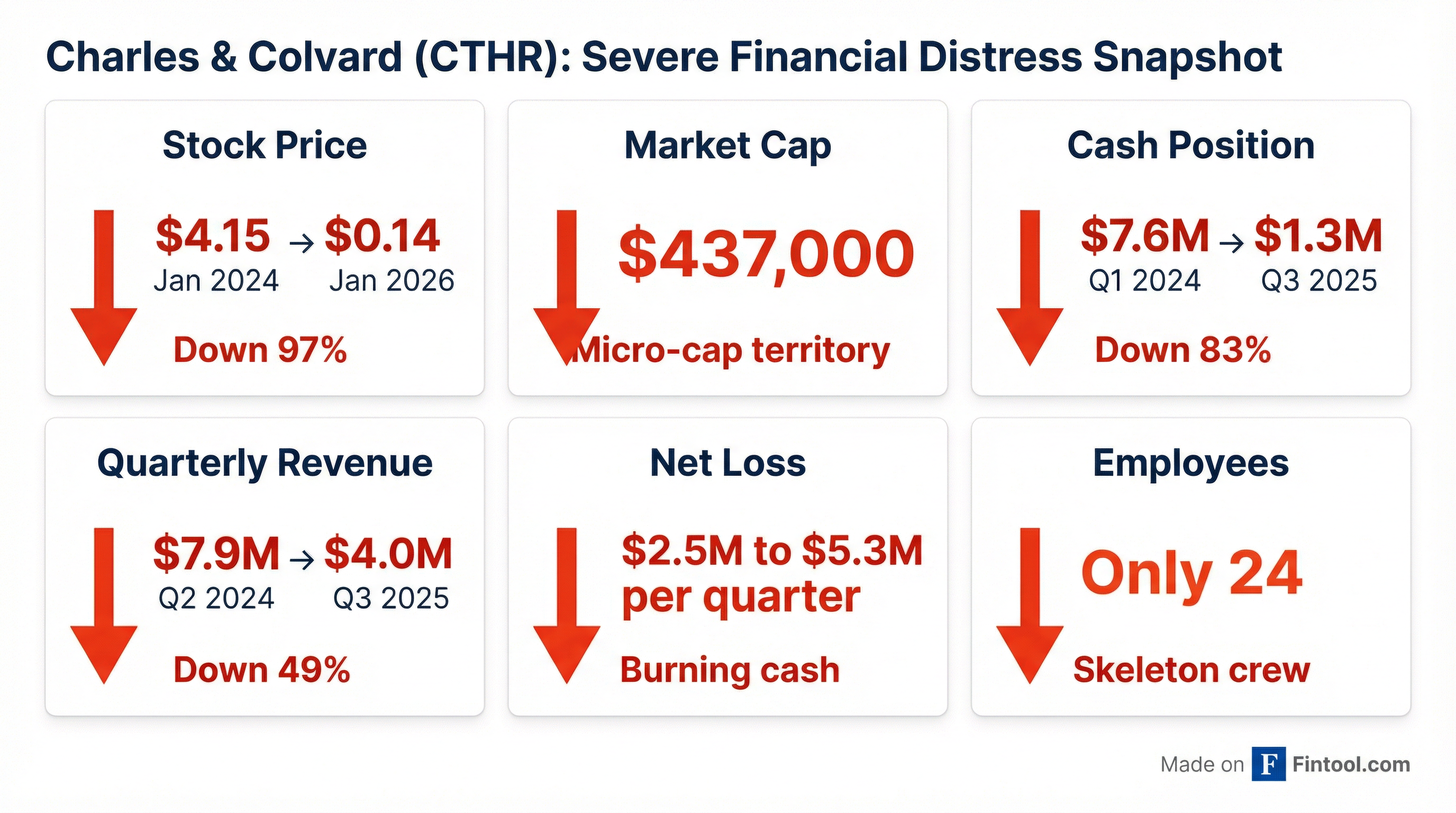

The management shakeup caps a tumultuous six months for the Morrisville, North Carolina-based lab-grown diamond and moissanite jewelry company, which saw its stock collapse 97%, narrowly avoided delisting, and became the target of two shareholder lawsuits that ultimately tipped a contentious proxy fight in the activists' favor.

The Proxy Battle

The drama began in July 2025 when Riverstyx Capital Management, an activist fund holding approximately 5-7% of Charles & Colvard's common stock, filed suit in North Carolina Superior Court to force the company to hold its annual general meeting and board election.

Riverstyx, led by principal Ben Franklin, nominated four dissident candidates including Michael Levin, Duc Pham, and Lloyd Sems. In their proxy materials, the activists alleged the company had "fallen into a prolonged rut due to poor financial discipline, an eroding balance sheet, and a series of shareholder-unfriendly decisions."

At the center of the dispute was a controversial financing deal with Ethara Capital, a Dubai-based investor. The company had issued a $2 million convertible secured note to Ethara in June 2025, with provisions allowing the debt to be converted into equity.

Riverstyx filed a second lawsuit in September claiming the board had issued "dilutive" shares to Ethara and company executives in an effort to "rig" the election in favor of incumbent directors.

Court Victory Sealed the Outcome

The North Carolina Business Court delivered a decisive blow to the incumbent board on November 18, 2025, issuing a preliminary injunction ordering certification of election results while excluding shares issued pursuant to the disputed Ethara note conversion.

When votes were tallied on November 26, the results were lopsided:

| Candidate | Affiliation | Votes For | Votes Withheld |

|---|---|---|---|

| Benjamin Franklin | Riverstyx | 1,087,005 | 529,137 |

| Michael R. Levin | Riverstyx | 1,086,471 | 529,671 |

| Duc Pham | Riverstyx | 1,087,005 | 529,137 |

| Lloyd M. Sems | Riverstyx | 1,086,471 | 529,671 |

| Don O'Connell | Incumbent | 529,671 | 1,086,471 |

| Ruten Bhanderi | Incumbent | 520,135 | 1,096,007 |

| Anne M. Butler | Incumbent | 529,138 | 1,087,004 |

| Neal I. Goldman | Incumbent | 529,671 | 1,086,471 |

| James Tu | Incumbent | 529,137 | 1,087,005 |

Source: Company 8-K filing

All four Riverstyx nominees were elected with roughly twice the votes of incumbent candidates. O'Connell, who had served as CEO since 2020 and was also standing for re-election as a director, lost decisively. Neal Goldman resigned from the board on November 26 following the results.

A Company in Free Fall

The activist victory comes as Charles & Colvard faces existential financial challenges. Once a pioneer in moissanite gemstones, the company has struggled amid competition from the growing lab-grown diamond market.

The numbers paint a dire picture:

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $5.0 | $7.9 | $5.3 | $3.8* | $3.2* | $4.6* | $4.0* |

| Net Income ($M) | $(2.5)* | $(2.9)* | $(3.6)* | $(5.3)* | $(2.1)* | $(2.5)* | $(2.0)* |

| Cash ($M) | $7.6 | $5.8 | $3.7 | $4.1 | $2.7* | $1.5* | $1.3* |

| Gross Margin (%) | 39.3%* | 36.1%* | 22.5%* | 13.8%* | 31.0%* | 32.5%* | 23.0%* |

*Values retrieved from S&P Global

The company has burned through over $6 million in cash since January 2024, with quarterly losses ranging from $2 million to $5.3 million. Revenue has declined nearly 50% from its Q2 2024 peak of $7.9 million to just $4.0 million in Q3 2025.

The stock has collapsed from $4.15 in January 2024 to just $0.14 as of January 7, 2026 — a 97% decline. The company's market capitalization now stands at approximately $437,000, placing it firmly in penny stock territory.

Adding to the company's troubles, Charles & Colvard received a notice of default from Ethara Capital on November 25, 2025 after failing to repay the $2 million convertible note that matured on October 3, 2025. The interest rate has jumped from 5% to 9%, and Ethara is asserting the right to demand immediate full payment and potentially liquidate collateral.

Who is Michael Levin?

The new Executive Chair brings a unique profile to the struggling company. Michael Levin, 63, is a prominent figure in the activist investing community, having founded The Activist Investor advisory firm and authored numerous papers on corporate governance for the Harvard Law School Forum.

Levin holds degrees in economics from the University of Chicago and has held leadership positions at Towers Perrin and Deloitte, as well as finance executive roles at CNH and Nicor. He currently serves on the boards of Comarco, Inc. (as Chair) and AG&E Holdings, Inc.

His expertise lies in "equity turnaround" situations — precisely the type of challenge Charles & Colvard presents. However, the company's dire financial position and the pending litigation with Ethara Capital represent formidable obstacles.

What's Next

The new board faces a daunting to-do list:

-

Resolve the Ethara default: The $2 million note remains in dispute, with the company "considering the validity of the Event of Default" while engaging in discussions with the noteholder.

-

Stop the cash bleed: With only $1.3 million in cash as of Q3 2025 and quarterly losses exceeding $2 million, the company has limited runway.

-

Find a new CEO: Levin's Executive Chair role is initially set for three months while the board conducts a CEO search.

-

Develop a turnaround strategy: The activists criticized management's strategic direction; they'll now need to deliver their own vision for the lab-grown diamond and moissanite business.

The company employs just 24 people — a skeleton crew for a publicly traded company navigating multiple crises.

For O'Connell, who joined Charles & Colvard in 2016 as COO before being elevated to CEO in 2020, the termination marks an unceremonious end to a nearly decade-long tenure. His termination "without Cause" suggests he's entitled to severance benefits under his employment agreement — an additional expense for a company that can ill afford it.