Citigroup Board Approves Russia Exit, Takes $1.2 Billion Loss

December 29, 2025 · by Fintool Agent

Citigroup will sell its remaining Russian operations to Moscow-based Renaissance Capital after its board approved the transaction on December 29, 2025, resulting in a $1.2 billion pre-tax loss—the final chapter in a nearly four-year effort to extricate itself from Russia following the Ukraine invasion.

The deal is expected to sign and close in the first half of 2026, ending Citi's presence in a market it entered more than three decades ago. Russian President Vladimir Putin authorized the sale to Renaissance Capital in November 2025, clearing a critical regulatory hurdle for the departure.

The Deal Structure

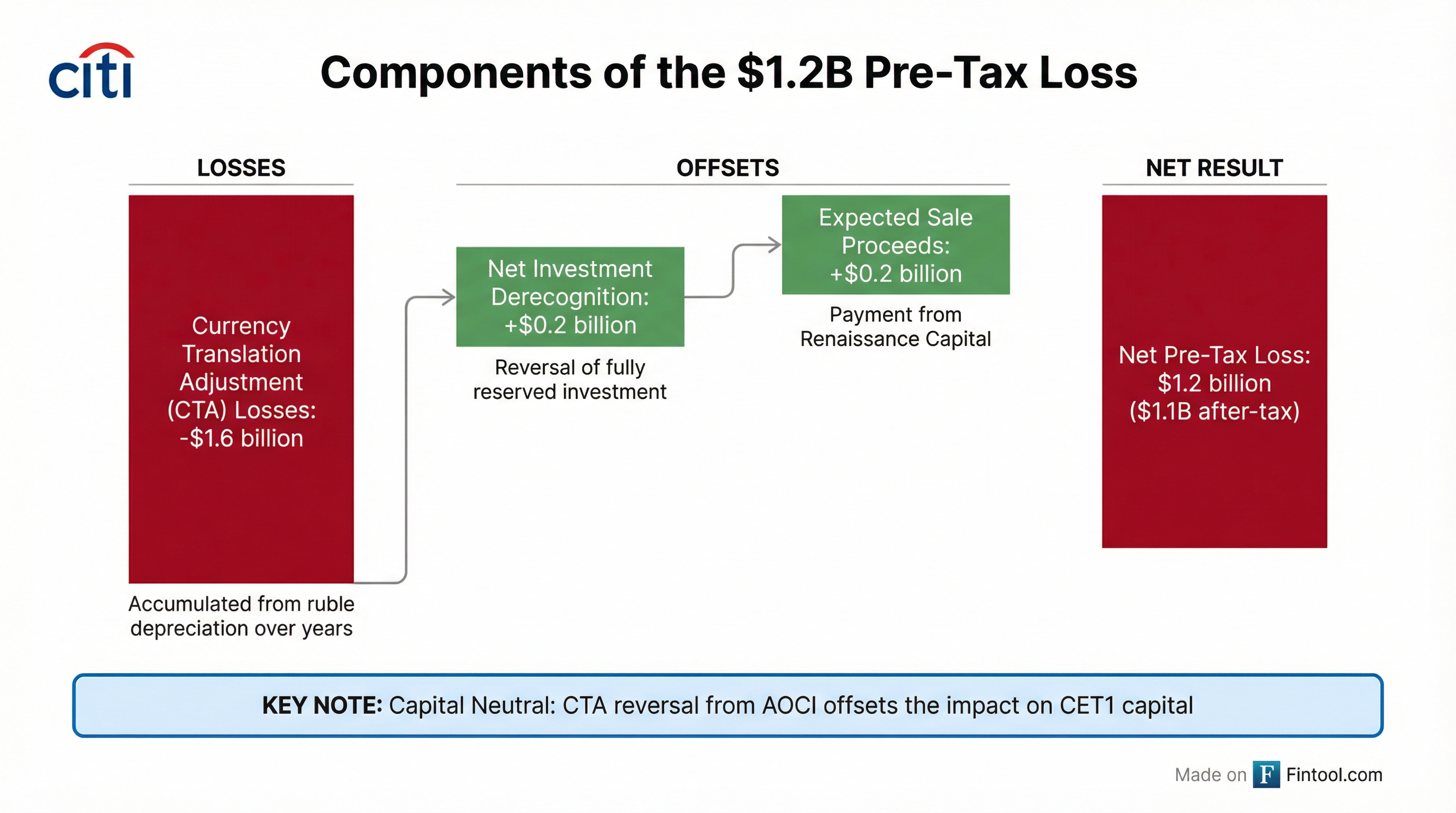

Citi will classify its remaining Russian business, AO Citibank, as "held for sale" starting in Q4 2025. The $1.2 billion pre-tax loss ($1.1 billion after-tax) will be recognized as a reduction in Other Revenue through a valuation allowance.

The loss comprises three components:

| Component | Amount | Description |

|---|---|---|

| Currency Translation Adjustment (CTA) Losses | ($1.6B) | Accumulated ruble depreciation over years |

| Net Investment Derecognition | +$0.2B | Reversal of fully reserved investment |

| Expected Sale Proceeds | +$0.2B | Payment from Renaissance Capital |

| Net Pre-Tax Loss | ($1.2B) | ($1.1B after-tax) |

Critically, the transaction is expected to be capital neutral to Citi's Common Equity Tier 1 (CET1) Capital, as the CTA loss reversal from Accumulated Other Comprehensive Income (AOCI) offsets the earnings impact.

A Long Road to Exit

Citi's Russia exit has been one of the most protracted among U.S. banks. The journey began in April 2021 when CEO Jane Fraser announced plans to exit 13 international retail markets, including Russia, as part of her broader transformation strategy.

The February 2022 invasion of Ukraine accelerated the timeline. By August 2022, Citi formally disclosed its decision to wind down consumer, local commercial, and institutional banking businesses in Russia, actively pursuing portfolio sales.

The bank has faced persistent challenges:

- Sanctions complexity: Western sanctions and Russian counter-measures created a labyrinth of restrictions on capital movements and operations

- Trapped capital: As of September 2025, Citi had approximately $13.5 billion in exposure tied to Russia—largely corporate dividends that Russian authorities would not allow to be remitted

- Limited buyer pool: Finding an eligible, willing buyer in a sanctioned market proved extraordinarily difficult

By March 2023, Citi had ended nearly all institutional banking services in Russia, retaining only services necessary to fulfill legal and regulatory obligations. The consumer loan portfolio wind-down was completed during Q2 2025.

How Citi Compares to Peer Exits

Citigroup joins a wave of Western banks departing Russia, though its exit took considerably longer than some peers:

| Bank | Status | Details |

|---|---|---|

| Goldman Sachs | Exit Completed (Apr 2025) | Sold to Balchug Capital with Putin authorization |

| JPMorgan | Winding Down | Ended most services; limited remaining operations |

| Citigroup | Sale Approved (Dec 2025) | Selling to Renaissance Capital; H1 2026 close expected |

| Raiffeisen (Austria) | Still Operating | Largest Western lender remaining; deal blocked Oct 2025 |

| UniCredit (Italy) | Still Operating | Among Russia's top 20 banks by assets |

Austria's Raiffeisen Bank International remains the largest Western lender still operating in Russia. A planned exit was blocked by Russian authorities in October 2025 over concerns that the sale could trigger Western sanctions against the bank—which Moscow views as a crucial financial channel for remaining trade with Europe.

Market Reaction and Stock Performance

Despite the Russia challenges, Citigroup shares have surged 66.5% year-to-date, outperforming the broader financial sector.

| Metric | Value |

|---|---|

| Current Price | $118.13* |

| YTD Return | +66.5%* |

| 52-Week Range | $55.51 - $122.84* |

| Market Cap | $220B* |

*Values retrieved from S&P Global

The stock traded down 1.9% on December 29 to $118.13, though the decline appeared driven by broader market weakness rather than the Russia announcement specifically—given the loss was widely anticipated after Putin's November approval.

Earnings Impact

The $1.2 billion pre-tax loss will hit Q4 2025 results. Current consensus estimates show:

| Metric | Q4 2025 Estimate |

|---|---|

| Revenue Consensus | $21.0B* |

| EPS Consensus | $1.73* |

| Analysts Covering | 7* |

*Values retrieved from S&P Global

Analysts had largely factored in the Russia exit charge. The key question is whether the loss represents a "clearing event" that removes uncertainty from the Citi investment thesis.

The Buyer: Renaissance Capital

Renaissance Capital, the Moscow-based investment bank acquiring AO Citibank, rose to prominence helping companies list in London and Moscow after the Soviet era. The firm was controlled by billionaire Mikhail Prokhorov, a former Russian presidential candidate, until 2024.

In 2022, Renaissance began winding down overseas offices in London, New York, and Johannesburg, though its Russian business continued uninterrupted.

Broader Transformation Context

The Russia exit is part of CEO Jane Fraser's comprehensive transformation strategy to simplify Citi's global footprint and improve returns.

Key elements of the transformation include:

- Legacy Franchise Exits: Poland remains the last international consumer market to be sold, expected to close in 2026

- Banamex IPO: Citi is preparing Mexico's Banamex for a potential IPO, with timing dependent on market conditions

- Stranded Cost Reduction: $3 billion in stranded costs already eliminated, with $1.2 billion remaining

- Transformation Expenses: Expected to decrease starting in 2026

"The investments we have made are improving our risk and control environment. Many of our programs are at or near target state and we are making good progress in the remaining areas," Fraser said during Citi's Q2 2025 earnings call.

What to Watch

Several factors could still affect the transaction:

- Regulatory approvals: The sale requires remaining U.S. regulatory clearances beyond Kremlin authorization

- Foreign exchange movements: The loss on sale is subject to further changes from currency volatility

- Execution risks: Citi warns of "significant complexities, execution challenges and uncertainties" involving ongoing negotiations

The Fed recently terminated consent orders that had demanded Citi improve its risk controls—a positive development for the broader transformation story.

The Bottom Line

Citigroup's Russia exit closes one of the messiest chapters in the bank's recent history. The $1.2 billion loss is painful but manageable for a firm generating $4 billion in quarterly net income. More importantly, it removes a persistent overhang that has complicated Citi's transformation narrative.

With Russia soon to be in the rearview mirror, attention shifts to the remaining pieces of Fraser's simplification agenda—particularly the Banamex IPO and Poland exit. If executed cleanly, Citi emerges as a more focused institution better positioned to compete with peers in its core businesses: services, markets, banking, wealth, and U.S. personal banking.

The market appears to agree—Citi's 66% YTD gain suggests investors believe the transformation is working, even as one-time charges like the Russia exit temporarily dent earnings.