Compass-Anywhere Merger Closes Tomorrow: 340,000 Agents Unite in $10 Billion Real Estate Mega-Deal

January 8, 2026 · by Fintool Agent

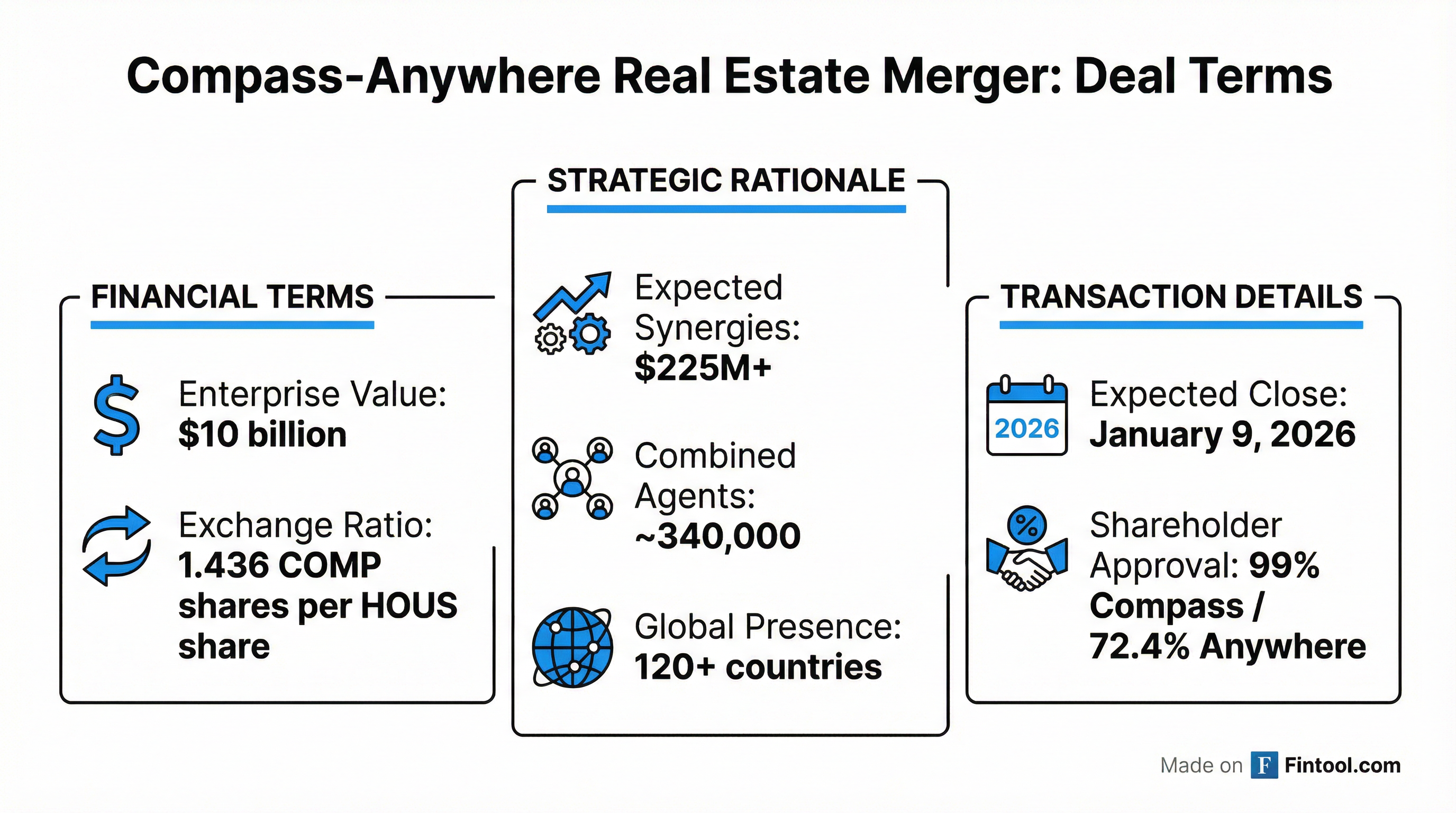

The largest residential real estate combination in U.S. history is set to close tomorrow. Compass and Anywhere Real Estate shareholders overwhelmingly approved the $10 billion merger on January 7, with the deal expected to close January 9, 2026 . The all-stock transaction creates a behemoth platform uniting Compass's technology with Anywhere's portfolio of iconic brands—Century 21, Coldwell Banker, Sotheby's International Realty, Better Homes and Gardens Real Estate, Corcoran, and ERA.

Approximately 99% of Compass votes and 72.4% of Anywhere's outstanding shares approved the deal, representing decisive shareholder support despite three lawsuits alleging insufficient merger disclosures filed in mid-December .

The Deal at a Glance

Under the merger terms, Anywhere shareholders receive 1.436 shares of Compass Class A common stock for each share of Anywhere common stock . Based on Compass's November 10, 2025 stock price of $8.79, this valued the equity consideration at approximately $1.4 billion, with total consideration of $1.87 billion including the repayment of Anywhere's $416.8 million revolving credit facility .

| Metric | Value |

|---|---|

| Enterprise Value | $10 billion |

| Exchange Ratio | 1.436 COMP per HOUS |

| Combined Agents | 340,000 globally |

| Expected Synergies | $225M+ annual OPEX savings |

| Combined Transactions | 1.2 million annually |

| Global Presence | 120 countries and territories |

Strategic Rationale: Technology Meets Brand Power

The combination pairs Compass's $1.8 billion technology investment over the past decade with Anywhere's household-name brands and diversified revenue streams .

"Today marks a monumental step towards our mission to empower real estate professionals with everything they need to grow their business and better serve their clients," said Compass CEO & Founder Robert Reffkin. "By bringing together two of the best companies in our industry, while preserving the unique independence of Anywhere's leading brands, we now have the resources to build a place where real estate professionals can thrive for decades to come."

The transaction diversifies Compass by adding over $1 billion in revenue from Anywhere's established franchise, title and escrow, and relocation operations . For Anywhere, the deal provides access to Compass's proprietary technology platform that includes cloud-based software for CRM, marketing, and client services—custom-built for the real estate industry .

What Each Side Brings

Compass:

- Largest U.S. residential brokerage by sales volume

- ~40,000 top-producing agents with industry-leading retention

- Proprietary end-to-end technology platform

- Christie's International Real Estate network in 50 countries

Anywhere:

- 300,000+ affiliated agents globally

- Seven iconic franchise brands

- Established title and escrow operations

- Relocation services and mortgage joint ventures

- Presence in approximately 120 countries

Market Reaction: Stocks Surge Then Settle

Both stocks have been on a tear since the September 22, 2025 merger announcement . Compass shares hit a 52-week high of $12.58 on the vote approval day, with trading volume of 103 million shares—more than 10x normal volume.

| Stock | Price (1/8) | YTD Change | 52-Week Range | Market Cap |

|---|---|---|---|---|

| COMP | $11.63 | +94% (1-yr) | $5.10 - $12.58 | $6.4B |

| HOUS | $16.67 | +515% (1-yr) | $2.71 - $18.03 | $1.9B |

Anywhere shareholders have seen remarkable gains from the deal, with shares trading around $2.71 a year ago before rallying to near $17 .

Financial Profile: Combining Two Distinct Business Models

The merger combines Compass's brokerage-focused model with Anywhere's diversified platform. Pro forma combined revenue approaches $10 billion annually .

Compass Recent Financials

| Metric | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|

| Revenue | $1.36B | $2.06B | $1.85B |

| Net Income | -$50.7M | $39.4M | -$4.6M |

| Cash | $127M | $177M | $170M |

| Total Debt | $556M | $547M | $481M |

Anywhere Recent Financials

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $1.33B | $1.17B | $1.65B | $1.59B |

| Net Income | -$64M | -$78M | $27M | -$13M |

| Cash | $118M | $110M | $266M | $139M |

| Total Debt | $3.07B | $3.16B | $3.34B | $3.12B |

The combined entity faces integration challenges but also significant synergy opportunities. Management expects $225+ million in annual operating expense synergies, net of dissynergies and friction costs .

Financing the Deal: $850M Convertible Notes

To finance the transaction, Compass announced an upsized $850 million convertible senior notes offering on January 8, 2026—up from an initial $750 million target {{ref:BBRV4KyAoFc}}. The proceeds will be used to repay Anywhere's revolving credit facility and fund integration costs.

This replaces the bridge loan facility originally contemplated in the merger agreement, providing more favorable long-term financing .

What to Watch: Integration Execution

With the deal expected to close tomorrow, investors should watch for:

-

Agent Retention: The combined platform serves 340,000 agents. Keeping top producers—especially in Compass's core luxury markets—will be critical.

-

Technology Integration: Bringing Anywhere's 300,000 agents onto Compass's platform represents a massive undertaking. Timeline and execution quality matter.

-

Synergy Realization: The $225M+ target requires eliminating duplicate corporate functions while maintaining service quality.

-

Brand Strategy: Management has committed to preserving the "unique independence" of Anywhere's brands. Balancing brand identity with operational efficiency will be delicate.

-

Housing Market Conditions: The combined entity's fortunes remain tied to transaction volumes and home prices. Mortgage rates and inventory levels will impact near-term results.

The merger closes as housing market conditions show signs of normalization. According to Compass's December 2025 outlook, 2026 is expected to bring "the most balanced housing market in years" {{ref:bC6QtN_85Zo}}.