Compass Pathways Wins FDA Green Light for PTSD Trial as Psilocybin Pioneer Prepares for 2026 Launch

January 7, 2026 · by Fintool Agent

Compass Pathways is having its breakout moment. Shares surged 9.6% to $7.73 on Tuesday—hitting a fresh 52-week high—after the FDA accepted the company's IND application for COMP360 psilocybin therapy in post-traumatic stress disorder, unlocking a late-stage trial in a 13-million-patient U.S. market that hasn't seen a new drug approval in over 25 years.

But the bigger story isn't just PTSD. In a webinar that doubled as a commercial coming-out party, management revealed they're now targeting launch readiness by year-end 2026 for treatment-resistant depression—months ahead of prior expectations—with pivotal Phase 3 data due within weeks.

"We enter 2026 with excitement and strong momentum," CEO Kabir Nath told analysts. "Our focus is on ensuring seamless access to COMP360 for patients living with TRD, if approved."

The timing is strategic. With Johnson & Johnson's Spravato generating $1.6 billion in annual sales and growing 50%+ year-over-year, Compass has a validated market to target—and a differentiated product that could fundamentally change how physicians approach care.

The Data That Changes Everything

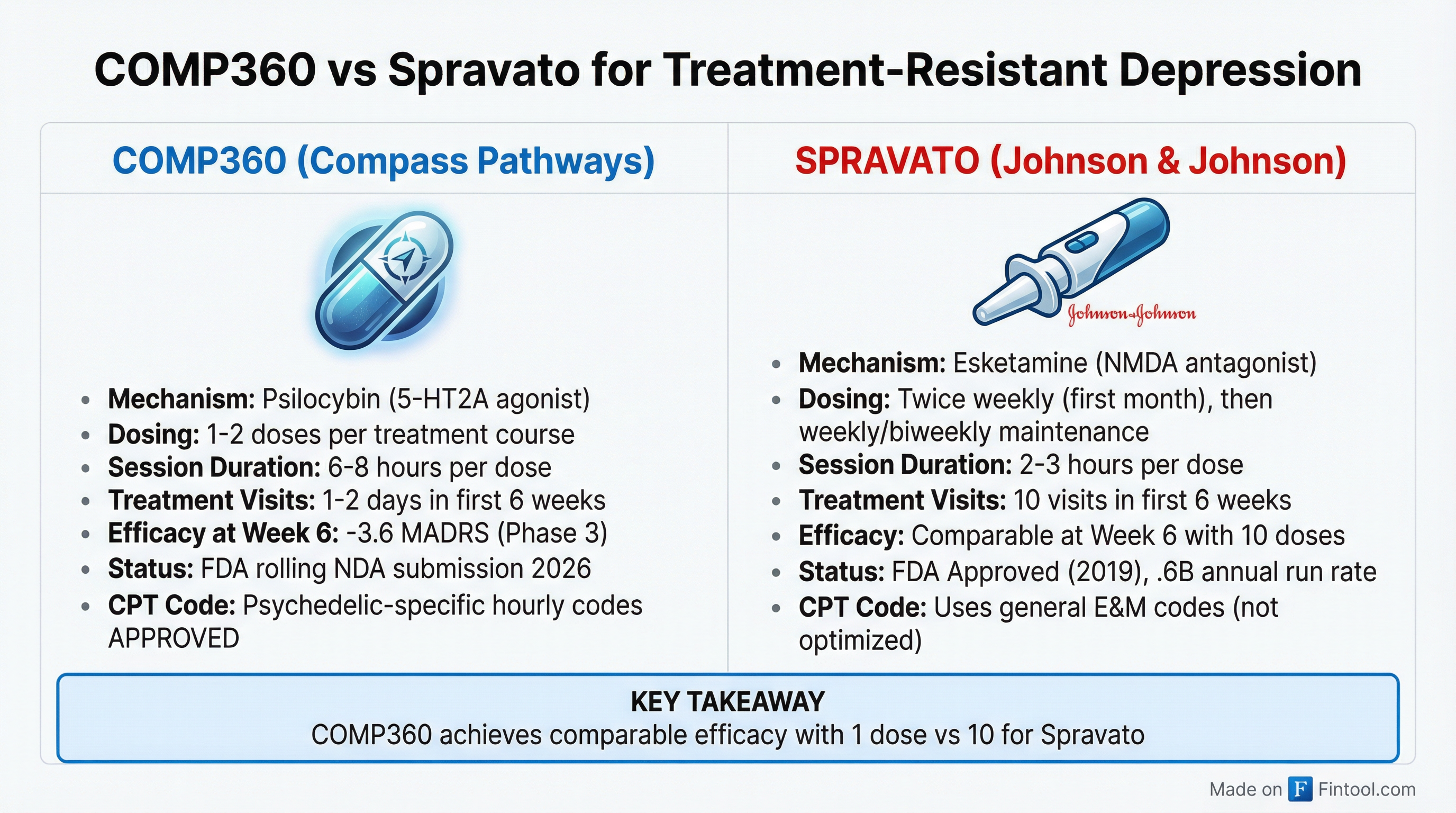

The core investment thesis comes down to a simple comparison: one dose versus ten.

In Compass's Phase 3 trial (COMP005), a single administration of COMP360 achieved a statistically significant improvement in depression scores at six weeks—matching what Spravato requires 10 treatment sessions to accomplish.

"Never in the history of medicine has a modality been offered that provides such quick relief and such good durability for our patients struggling with treatment-resistant depression," said Dr. Geoffrey Grammer, Chief Medical Officer of Greenbrook (a Neuronetics subsidiary with 95 treatment centers). "The comparable model in the medical world is the cardiac cath lab."

The patient experience differential is stark:

| Metric | COMP360 | Spravato |

|---|---|---|

| Doses to achieve 6-week efficacy | 1 | 10 |

| In-clinic time (first 6 weeks) | 6-8 hours total | 25-30 hours |

| Patient days off work | 1-2 | 10+ |

| Annual maintenance visits | TBD | 25-35 |

For caregivers, clinics, and payers, this isn't incremental—it's transformational.

PTSD: The Second Act Worth Billions

Tuesday's FDA acceptance opens what could become Compass's larger market opportunity.

PTSD affects an estimated 13 million Americans, with an economic burden exceeding $230 billion annually. The condition has been a graveyard for drug development—only two medications are FDA-approved (sertraline and paroxetine), both 25+ year-old SSRIs with limited efficacy and significant side effects.

Compass's open-label Phase 2 study showed promising signals: sustained symptom reduction through 12 weeks after a single 25mg dose, with no serious adverse events.

The new Phase IIB/III trial (COMP202) will test two 25mg doses against a 1mg active control, with the primary endpoint at week 8 on the CAPS-5 scale. Patient screening begins this quarter, with a design the FDA accepted without significant modifications.

"The unmet needs in PTSD—limited treatment options, insufficient efficacy with incomplete symptom relief, and the long absence of innovation—demand bold action," said Chief Medical Officer Guy Goodwin.

For context: the failure of Lykos Therapeutics' MDMA therapy last year left PTSD without a near-term breakthrough option. Compass now has a clear runway.

The Commercial Playbook

What separated this webinar from typical biotech updates was the depth of commercial preparation on display.

Compass paraded a roster of healthcare partners—Greenbrook, Journey Clinical, HealthPort—each detailing how they're already scaling infrastructure for a COMP360 launch:

Greenbrook (95 centers): "This is our CEO's priority for 2026. We will be ready on day one."

Journey Clinical (3,000 therapist network): "90% of our therapists surveyed said they would deliver COMP360 within our model."

HealthPort (Community Behavioral Health Clinic): "There's bipartisan support for this intervention... this revolution is going to be amazing."

The industry backdrop supports their confidence. There are now over 6,800 Spravato-certified treatment centers in the U.S.—infrastructure that translates directly to COMP360 readiness.

Critically, Compass has secured something Spravato lacks: dedicated CPT codes for psychedelic treatments. These allow providers to bill hourly for monitoring, eliminating the reimbursement gaps that have crimped Spravato economics.

"For COMP360, the full six to eight hours could be reimbursed, filling the gaps in reimbursement that practices currently have between patients for Spravato," noted Chief Patient Officer Steve Levine.

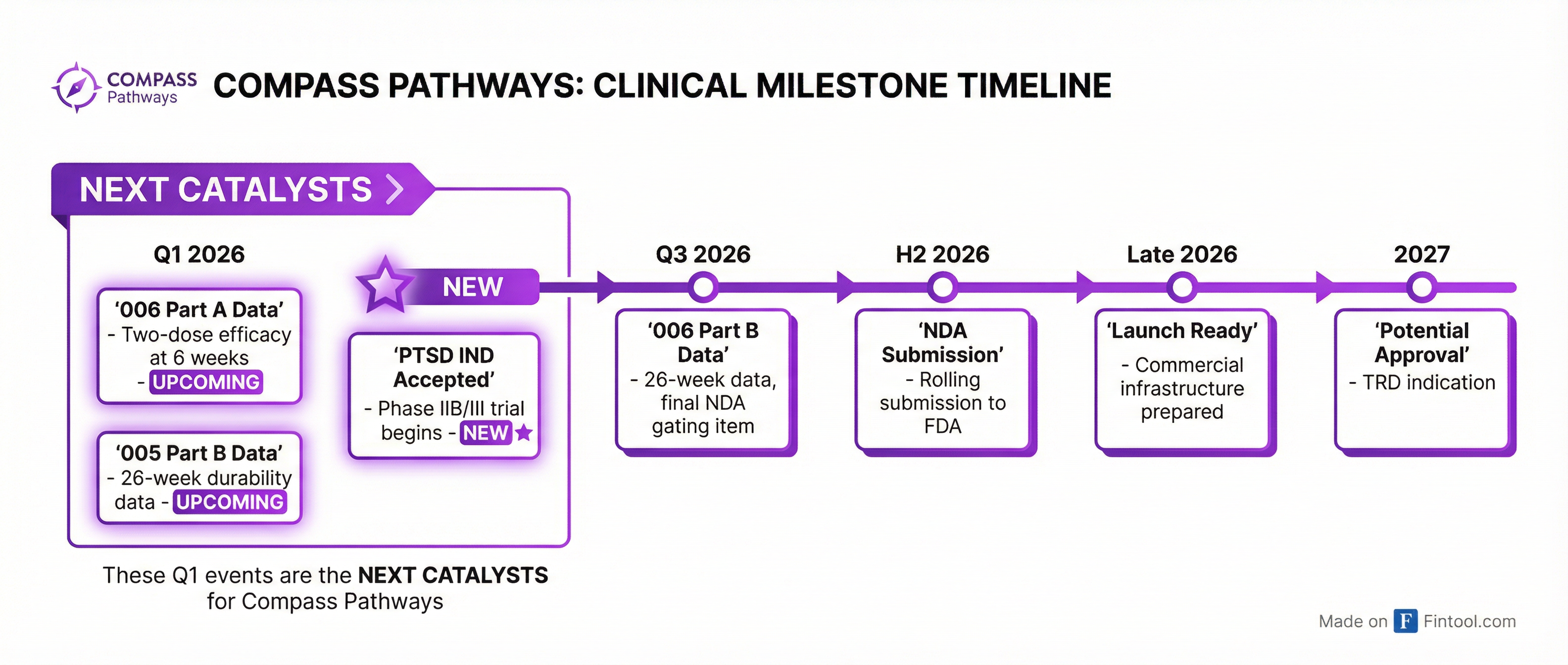

The Catalyst Calendar

The next 90 days are loaded:

Q1 2026 (imminent):

- COMP006 Part A data: Two-dose efficacy at 6 weeks (primary endpoint)

- COMP005 Part A details: Full dataset from the single-dose trial that hit its primary endpoint

- COMP005 Part B: 26-week durability data across remitters, responders, and non-responders

Q3 2026:

- COMP006 Part B: 26-week data—the final gating item for NDA submission

Late 2026:

- NDA submission via rolling review

- Commercial launch readiness

CEO Nath was explicit about the de-risking math: "Seeing a statistically significant result from the six-week primary endpoint of 006 will more fully de-risk regulatory and confirm the compelling clinical and commercial profile of COMP360."

The Financial Reality

Compass remains a pre-revenue biotech burning through cash. The company reported a net loss of $137.7 million in Q3 2025 and ended the quarter with $186 million in cash.* At the current burn rate of ~$35-40 million per quarter, runway extends into 2027—but a commercial launch could accelerate spending.

| Period | Net Loss | Cash Position |

|---|---|---|

| Q4 2024 | -$43.3M | $165.1M |

| Q1 2025 | -$17.9M | $260.1M |

| Q2 2025 | -$38.4M | $221.9M |

| Q3 2025 | -$137.7M | $185.9M |

Analysts remain constructive. The stock carries a consensus "Moderate Buy" rating with an average price target around $15-17—implying ~100%+ upside from current levels. The high target of $40 (from H.C. Wainwright's Patrick Trucchio) reflects a bullish approval scenario.

At $742 million market cap, Compass trades at a fraction of Spravato's $1.6 billion run rate—before any consideration of PTSD upside.

What Could Go Wrong

The path to approval isn't guaranteed:

-

Phase 3 data risk: COMP006 needs to hit its primary endpoint. The Phase IIb showed a -6.6 MADRS improvement; COMP005 delivered -3.6. A weaker 006 result could raise questions.

-

Functional unblinding: Psychedelic trials face the challenge that patients may know whether they received active drug, potentially biasing results.

-

REMS complexity: The FDA will likely impose a Risk Evaluation and Mitigation Strategy. The details—monitoring requirements, practitioner training, distribution controls—could affect commercial viability.

-

Pricing negotiations: Compass hasn't disclosed pricing strategy. Chief Commercial Officer Lori Englebert noted it's "premature" until the full clinical profile (including 26-week durability) is characterized.

-

Competitive encroachment: Atai Life Sciences and partner Beckley Psytech have a shorter-acting psychedelic (BPL-003) in development that could compress treatment time further.

The Investment Case

Compass Pathways is no longer just a science experiment. The company has:

- A Phase 3 program that hit its primary endpoint

- FDA openness to rolling NDA submission

- A second massive indication (PTSD) now in late-stage development

- 7 commercial partnerships with operators managing thousands of treatment centers

- Purpose-built reimbursement infrastructure (CPT codes)

- A validated market via Spravato's commercial traction

The next 90 days will determine whether COMP360 becomes the first classical psychedelic approved for a psychiatric indication—and whether Compass can capture a share of the multi-billion-dollar opportunity in treatment-resistant mental health.

As Dr. Grammer put it: "We are seeing an evolution in the field of behavioral health, and I think COMP360 is what finally pushes this over the line to broad acceptance within the community and within the medical establishment."

For investors, the question isn't whether psychedelics will reshape psychiatry. It's whether Compass gets there first.

*Values retrieved from S&P Global

Related: Compass Pathways · Johnson & Johnson · Atai Life Sciences · Neuronetics