Comstock Raises $50M to Dominate U.S. Solar Panel Recycling as Silver Prices Surge to $85

February 03, 2026 · by Fintool Agent

Comstock Inc.+17.30% just closed a $50 million equity raise that was 5x oversubscribed—and management is moving fast to spend it. In a business update webinar today, CEO Corrado De Gasperis outlined plans to file permits for a second solar panel recycling facility next week and order equipment in March, while revealing that surging silver prices have fundamentally transformed the company's unit economics.

The solar panel recycler, which holds the only zero-landfill certification in North America, is racing to capture what it sees as a multi-billion-dollar opportunity as 1.3+ billion panels deployed across the U.S. begin reaching end-of-life—a decade earlier than planned.

The Numbers Behind the Raise

Comstock priced 18,181,819 shares at $2.75, netting $46.5 million after fees—a 22% discount to where the stock was trading before the announcement. Combined with existing cash, the company now has over $60 million on hand with zero debt.

The offering was led by existing institutional shareholders (65-70% of prior investors participated again) and several new institutions, suggesting the smart money is betting on the acceleration thesis.

| Use of Proceeds | Amount |

|---|---|

| Facility #2 (permits, equipment, storage) | $13M |

| Sites 3-7 (selection, storage, permitting) | $5M |

| Domestic refining solution development | $10M |

| General corporate/working capital | Remainder |

Source: Company webinar

Silver at $85 Changes Everything

The real story isn't the capital raise—it's what happened to silver since August. When Comstock closed its first $30 million offering in August 2025, silver was trading in the mid-$30s. Today it's at $85 per ounce, up 158% from a year ago.

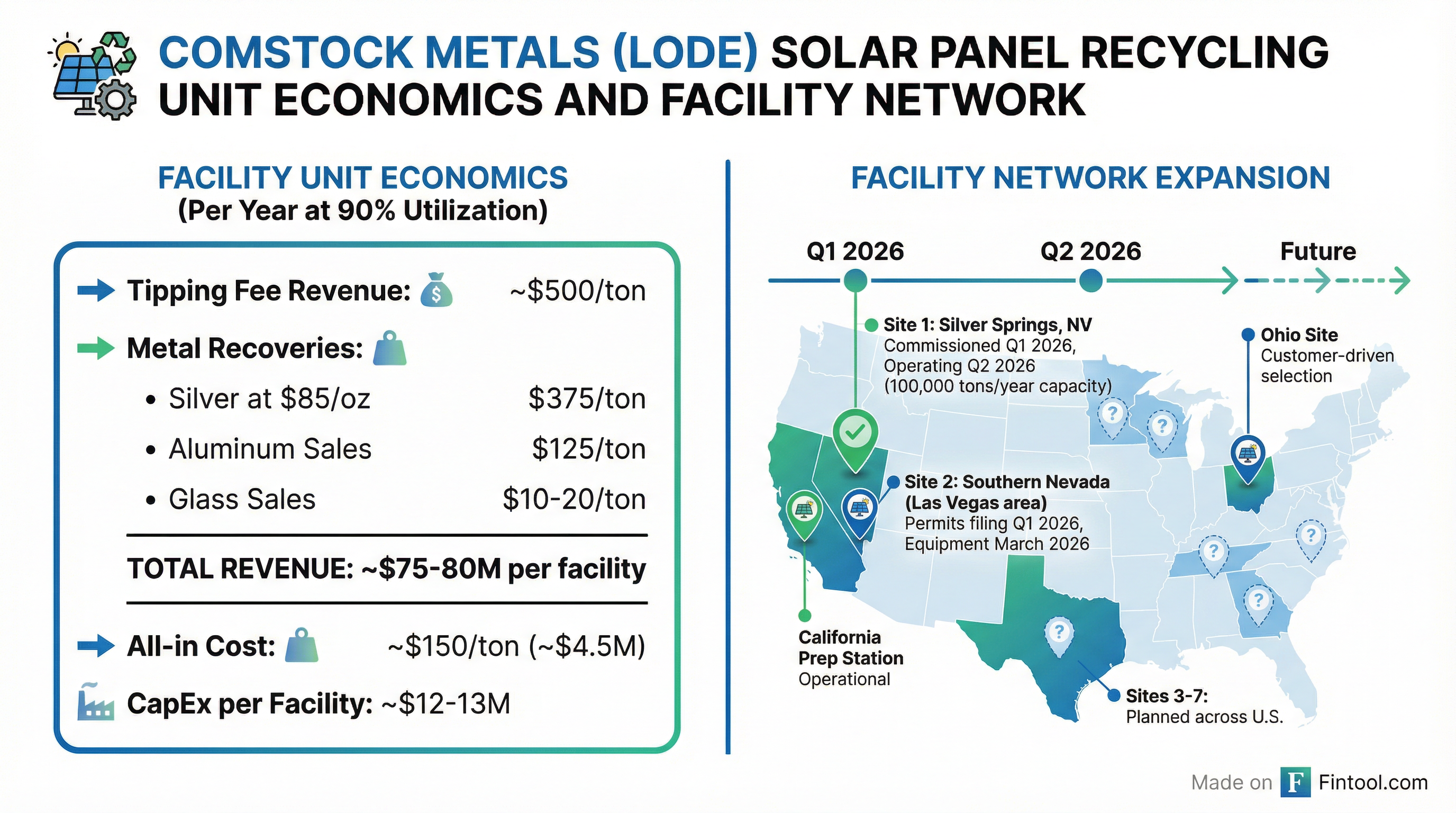

This transforms the economics of every panel Comstock processes. De Gasperis walked through the math:

- Tipping fees: ~$500/ton (paid by utilities to remove liability)

- Aluminum sales: ~$125/ton equivalent

- Glass sales: $10-20/ton

- Metal tailings: Originally $125/ton → now $375/ton at current silver prices

That's an additional $250/ton—or $20-25 million more per facility per year—purely from the commodity tailwind. At 90% utilization, a single facility could generate $75-80 million in revenue against an all-in cost of roughly $150/ton.

"We must corner this U.S. market. We must go faster," De Gasperis said. "I'd rather be criticized for going too fast than going too slow."

Facility #1 On Schedule, #2 Accelerated

Comstock's first industry-scale facility in Silver Springs, Nevada received all required permits on January 9, 2026—including the critical Written Determination Permit from Nevada's environmental agency. The timeline remains intact:

- Q1 2026: Commissioning

- Q2 2026: Continuous operations begin

- Capacity: 3+ million panels/year (100,000 tons)

For the second facility just outside Las Vegas, the company will file permits "as soon as next week" and order equipment in March. Management expects a faster permitting process this time—7-8 months versus 13-14 months for the first-of-its-kind approval.

Why the urgency? The Southwest region (California, Arizona, Nevada) represents over 50% of the U.S. solar panel market, and Comstock believes it has a 2+ year regulatory lead over any potential competitor in Nevada.

"The closest competitor we saw was in Texas. They shut their doors. They called us and asked if we could take some material from them," De Gasperis noted.

The Domestic Refining Play

Perhaps the most strategically significant development: Comstock is accelerating work on a U.S.-based refining solution to process metal tailings domestically rather than shipping them to Asia.

Currently, the company sells metal-rich tailings under offtake agreements where they receive less than 50% of the silver value after transportation and overseas refining costs. A domestic solution would capture:

- The other 50%+ of silver value currently left on the table

- Copper, gallium, tellurium, and silicon metal recoveries

- Strategic positioning as the U.S. government prioritizes domestic critical mineral processing

Dr. Fortunato Villamagna, President of Comstock Metals, described a multi-step refining process using proven extraction, separation, and recovery technologies—not speculative R&D—rejigged for this specific application. Target: full feasibility by end of 2026, demo refinery by 2027, industrial scale by 2028-2029.

At reasonable recoveries, De Gasperis claims two recycling facilities could generate 2.6 million ounces of silver annually—the same amount sitting in the company's Dayton mine, which would take 8 years to extract at 55-60% recovery.

Market Context: A $1B+ Industry by 2030

The solar panel recycling market is projected to grow from $460 million in 2025 to $1.12 billion by 2030—a 19.5% CAGR—driven by the wave of panels reaching end-of-life. By 2050, up to 78 million tonnes of solar waste could accumulate globally.

For context, Comstock estimates there are currently 1.3-1.4 billion solar panels deployed in the U.S., with 33 million panels expected to come off the market by 2030. At 3.3 million panels per facility per year, Comstock would need 10 facilities just to meet 2030 demand—and the wave only accelerates from there.

The company's 2025 billings came in at $3.51 million—8x the prior year and slightly ahead of guidance—operating from just a small demonstration facility.

Stock Reaction and Valuation

LODE shares have fallen 22% from pre-offering levels, trading at $2.94 after closing at $3.53 before the January 28 announcement. This mirrors the August 2025 pattern, when shares dropped 18% on the prior $30 million raise.

With 71.3 million shares outstanding (potentially 74 million if underwriters exercise their over-allotment), the current market cap is roughly $210 million—valuing the company at less than 3x annual revenue potential of a single facility at current commodity prices.

The bear case centers on execution risk: permitting delays, slower-than-expected customer ramp, and commodity price volatility. Management acknowledged they have limited visibility past 3-5 months on panel supply, though the macro setup—billions of aging panels with nowhere to go—appears compelling.

What to Watch

- Facility #1 ramp: Target 20,000-25,000 tons in 2026, breakeven utilization around 20%

- Facility #2 permitting: Filing next week, 7-8 month expected approval

- 10-K filing: Expected late February with detailed financials

- Mining asset monetization: "Serious, significant, very capable" inquiries ongoing

- Silver prices: Every $10/oz move materially impacts economics

Related Research: