Concentrix Takes $1.5B Goodwill Hit as Webhelp Bet Sours

January 13, 2026 · by Fintool Agent

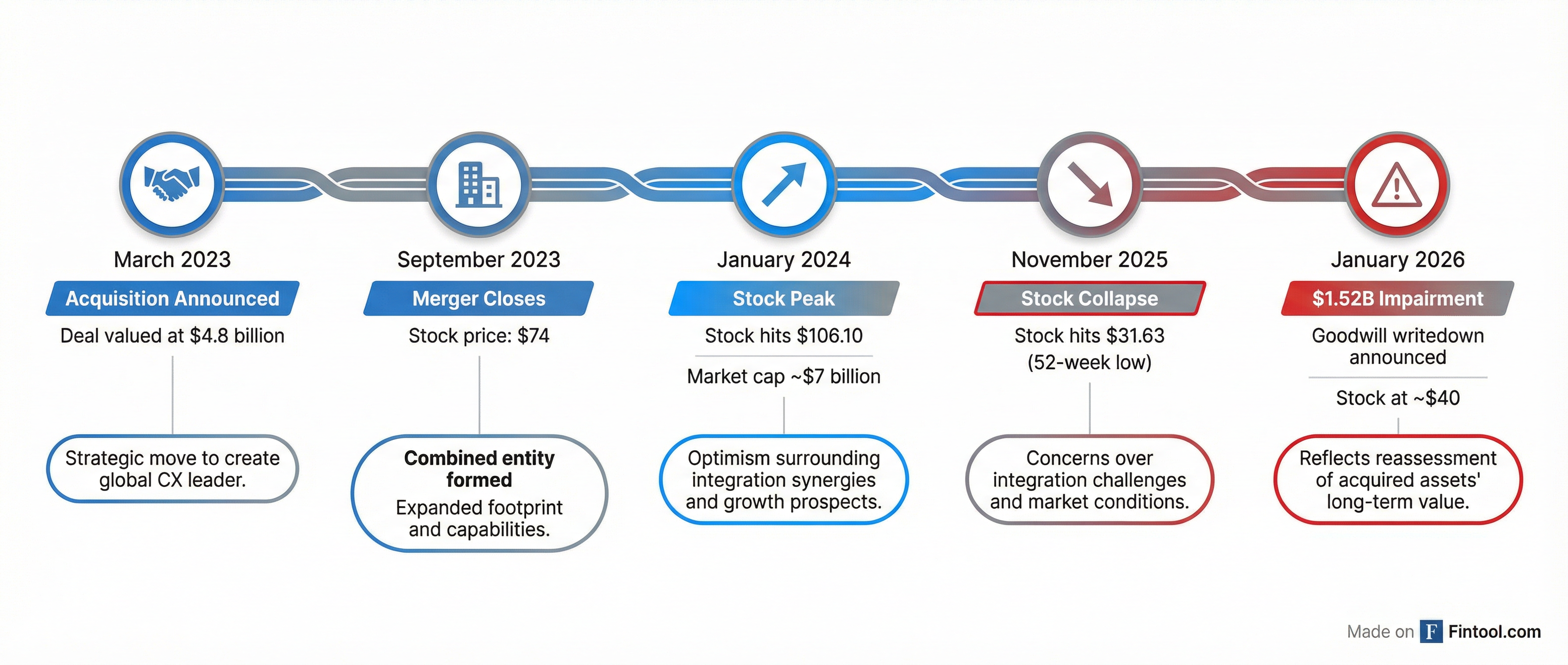

Concentrix announced a $1.52 billion goodwill impairment charge in its fiscal Q4 2025 results, acknowledging that its stock price collapse has forced a dramatic write-down of value from the $4.8 billion Webhelp acquisition just 27 months ago. The charge, equivalent to nearly 60% of the company's current $2.5 billion market cap, transforms what was supposed to be a transformative deal into a cautionary tale about M&A in an industry facing AI disruption.

"Our positive fourth quarter and fiscal year results reflect our steadfast commitment to advance our business to meet evolving client demand while delivering value to shareholders," said CEO Chris Caldwell, conspicuously avoiding any direct mention of the massive impairment in his prepared remarks.

The Numbers Tell the Story

The impairment produced staggering GAAP results: a Q4 net loss of $1.48 billion versus a $116 million profit a year earlier, translating to a loss of $23.85 per share compared to earnings of $1.72.

| Metric | Q4 FY2025 | Q4 FY2024 | Change |

|---|---|---|---|

| Revenue | $2.55B | $2.45B | +4.3% |

| GAAP Operating Income (Loss) | $(1.38B) | $145M | NM |

| Non-GAAP Operating Income | $323M | $347M | -6.8% |

| GAAP EPS | $(23.85) | $1.72 | NM |

| Non-GAAP EPS | $2.95 | $3.26 | -9.5% |

| Goodwill Impairment | $1,523M | $0 | - |

The company was unambiguous about the cause: the impairment resulted "primarily from the recent trading range for the Company's stock price and market capitalization."

From Deal Euphoria to Value Destruction

The Webhelp acquisition was supposed to be transformative. When announced in March 2023, the deal was billed as creating a "global CX titan" with combined revenues approaching $10 billion and operations spanning 70+ countries.

The merger closed on September 25, 2023 at a stock price of approximately $74. The stock then surged to $106.10 by January 2024 as investors bet on synergies and market dominance.

What followed was a relentless decline:

The stock bottomed at $31.63 in November 2025—a 70% collapse from peak—before recovering slightly to around $40 where it trades today. From merger close to impairment announcement, shareholders have lost 46% of their investment.

The AI Elephant in the Room

While management attributes the impairment to stock price mechanics, the underlying question is why investors have abandoned the stock so aggressively. The answer increasingly points to artificial intelligence.

The BPO industry—which employs millions globally to handle customer service calls, back-office processing, and support functions—faces an existential reckoning. Companies like Teleperformance have responded by investing heavily in AI partnerships, launching initiatives with Sanas (real-time accent modification), Parloa (AI agent platforms), and Ema (agentic AI).

TTEC, another major player, frames the 2026 outlook around "agentic AI becoming standard" and AI systems that can "autonomously decide steps, use tools, and iterate based on results"—capabilities that directly threaten the traditional call center model.

Concentrix itself has touted its "intelligent transformation solutions" and claims investments in AI are "paying off." But the market's verdict suggests skepticism about whether a company built on human-delivered customer service can successfully navigate a world where AI agents handle an increasing share of interactions.

Underlying Business: Stable but Pressured

Strip out the impairment and Concentrix's business remains functional, if unspectacular:

| Full Year FY2025 | Amount | YoY Change |

|---|---|---|

| Revenue | $9.83B | +2.2% |

| Non-GAAP Operating Income | $1.25B | -4.9% |

| Non-GAAP Operating Margin | 12.8% | -90 bps |

| Adjusted EBITDA | $1.47B | -5.5% |

| Adjusted EBITDA Margin | 15.0% | -120 bps |

| Operating Cash Flow | $807M | Record |

Revenue by vertical shows banking and financial services (+6%) and communications & media (+4%) growing, while technology & consumer electronics flatlined.

The company generated record operating cash flow of $807 million and returned $258 million to shareholders through dividends and buybacks while reducing debt. It maintains a $0.36 quarterly dividend and repurchased 1.3 million shares in Q4 at an average price of $42.48.

What Investors Should Watch

Near-term: Management introduced FY2026 guidance calling for "ongoing revenue growth and adjusted free cash flow expansion." The earnings call (likely later today) will be crucial for understanding how aggressively they'll invest in AI and whether the Webhelp integration is delivering promised synergies.

Medium-term: Margin pressure is the key metric. Non-GAAP operating margins contracted from 13.7% to 12.8% year-over-year, and adjusted EBITDA margins fell from 16.2% to 15.0%. If AI enables competitors to deliver equivalent service at lower cost, these margins could compress further.

Long-term: The strategic question is whether Concentrix can successfully transform from a labor arbitrage business to a technology-enabled services platform before AI disruption fundamentally reshapes the industry economics.

The Verdict

The $1.52 billion goodwill impairment is an accounting acknowledgment of value destruction that investors had already priced in. At roughly 4x adjusted EBITDA, Concentrix trades like a declining business rather than a growth company—a stark contrast to the optimism surrounding the Webhelp deal just two years ago.

The impairment doesn't impair the company's ability to generate cash, pay dividends, or serve clients. But it does represent a public admission that one of the BPO industry's largest-ever deals has failed to deliver for shareholders. In an industry facing structural AI disruption, that's a sobering development—and potentially a template for write-downs to come across the customer experience outsourcing sector.

Related: