Cruz Warned Trump of Market 'Bloodbath' From Tariffs—Got Cursed Out Instead

January 25, 2026 · by Fintool Agent

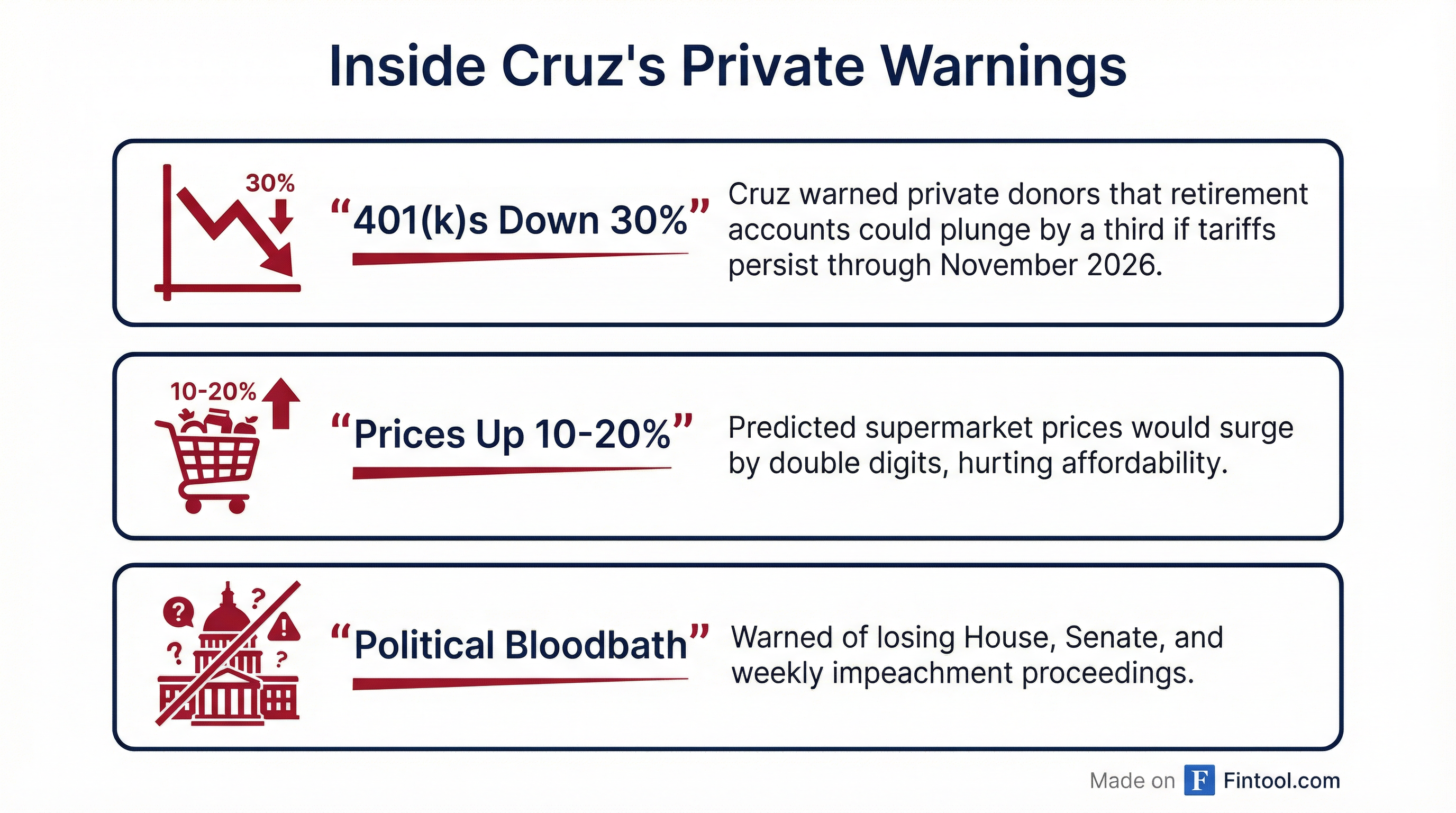

Leaked recordings of Senator Ted Cruz warning donors that President Trump's tariffs could crash retirement accounts by 30% expose the deepest rift yet within the Republican Party over trade policy—and raise questions about what happens when the market rally that has defined Trump's second term eventually ends.

The nearly 10 minutes of audio, obtained by Axios from a Republican source and published Sunday, capture the Texas senator in private donor meetings in mid-2025 delivering "some of the harshest criticisms of Trump and Vance by a fellow Republican since they took office."

Cruz, who publicly remains one of Trump's closest Senate allies, painted a dire economic picture behind closed doors—one that has not materialized.

The April Confrontation

The recordings reveal that shortly after Trump's "Liberation Day" tariff announcement in April 2025, Cruz and several Republican senators held a late-night phone call with the president, urging him to reverse course.

"Mr. President, if we get to November of [2026] and people's 401(k)s are down 30% and prices are up 10–20% at the supermarket, we're going to go into Election Day, face a bloodbath," Cruz recounted telling Trump.

"You're going to lose the House, you're going to lose the Senate, you're going to spend the next two years being impeached every single week."

Trump's response was blunt: "F*** you, Ted."

The call, which Cruz said stretched past midnight, "did not go well," with the president "yelling" and "cursing" at the lawmakers.

Markets Tell a Different Story

Cruz's apocalyptic warnings have not come to pass—at least not yet.

Since the Liberation Day tariffs were announced in April 2025, markets have delivered strong returns:

| Index | April 1, 2025 | January 23, 2026 | Performance |

|---|---|---|---|

| S&P 500 | 5,633 | 6,916 | +22.8% |

| Nasdaq-100 (QQQ) | $472.70 | $622.72 | +31.7% |

| Dow Jones | 41,990 | 49,099 | +16.9% |

Source: S&P Global

Rather than the 30% decline Cruz warned of, retirement accounts invested in broad market indices have gained roughly a quarter of their value. The divergence between Cruz's private fears and market reality underscores why policy predictions are notoriously difficult—and why investors should be cautious about political forecasting, even from senior lawmakers with insider access.

"Wall Street was rocked by the president's tariff plan initially, but has since shrugged off any concerns," noted Mediaite in its coverage of the recordings.

Internal GOP Divisions

The recordings offer a rare window into internal Republican tensions on trade policy. Cruz told donors he threatened to fire any staffer who used the phrase "Liberation Day" in his presence—distancing himself from Trump's signature trade initiative.

"I've told my team if anyone uses those words, they will be terminated on the spot. That is not language we use," Cruz said.

The senator also revealed ongoing battles to secure a trade agreement with India, alleging that Vice President JD Vance, advisor Peter Navarro, and "sometimes Trump" himself have blocked the deal.

This matters for investors tracking emerging market exposure and the broader trajectory of U.S. trade relations with the world's largest democracy.

The Vance Factor

Cruz's private comments also took aim at Vice President JD Vance, the overwhelming favorite for the 2028 Republican nomination according to prediction markets.

"Tucker created JD. JD is Tucker's protégé, and they are one and the same," Cruz allegedly said, referencing the ex-Fox News host Tucker Carlson with whom Cruz has publicly feuded.

Cruz, 55, is widely expected to make his own presidential run in 2028, setting up a potential collision with the 41-year-old Vance. The recordings suggest Cruz is positioning himself as a "traditional free trade, pro-interventionist Republican"—a contrast to Vance's more protectionist, non-interventionist approach.

Cruz's office did not deny the contents of the recordings. In a statement to Axios, his spokesperson said the senator "is the president's greatest ally in the Senate and battles every day in the trenches to advance his agenda."

What This Means for Investors

The Cruz recordings matter for three reasons:

1. Policy uncertainty persists. While markets have rallied, the recordings confirm that senior Republicans privately harbor deep concerns about tariff impacts. If economic conditions deteriorate, political support for current trade policy could evaporate quickly.

2. Trade deal delays. Cruz's claim that Vance and Navarro are blocking an India trade deal suggests the path to bilateral agreements remains contested. Companies with significant India exposure should factor in continued policy friction.

3. 2026 midterm risk. Cruz's warning about a "bloodbath" was about political consequences, not just economic ones. If Republicans lose Congress, the legislative landscape for corporate tax policy, regulation, and trade could shift dramatically.

What to Watch

Federal Reserve: Chair announcement expected this week could overshadow political noise—or amplify market volatility if combined with policy uncertainty.

Inflation data: Cruz specifically cited supermarket prices. January CPI readings will test whether his 10-20% warning has any basis.

Corporate guidance: Q4 earnings season commentary on tariff impacts will provide real-world evidence of policy effects beyond market indices.

India trade talks: With Republic Day celebrations underway, watch for any movement on bilateral negotiations.

Related: