Darden Ends Bahama Breeze After 30 Years: 14 Closures, 14 Conversions

February 3, 2026 · by Fintool Agent

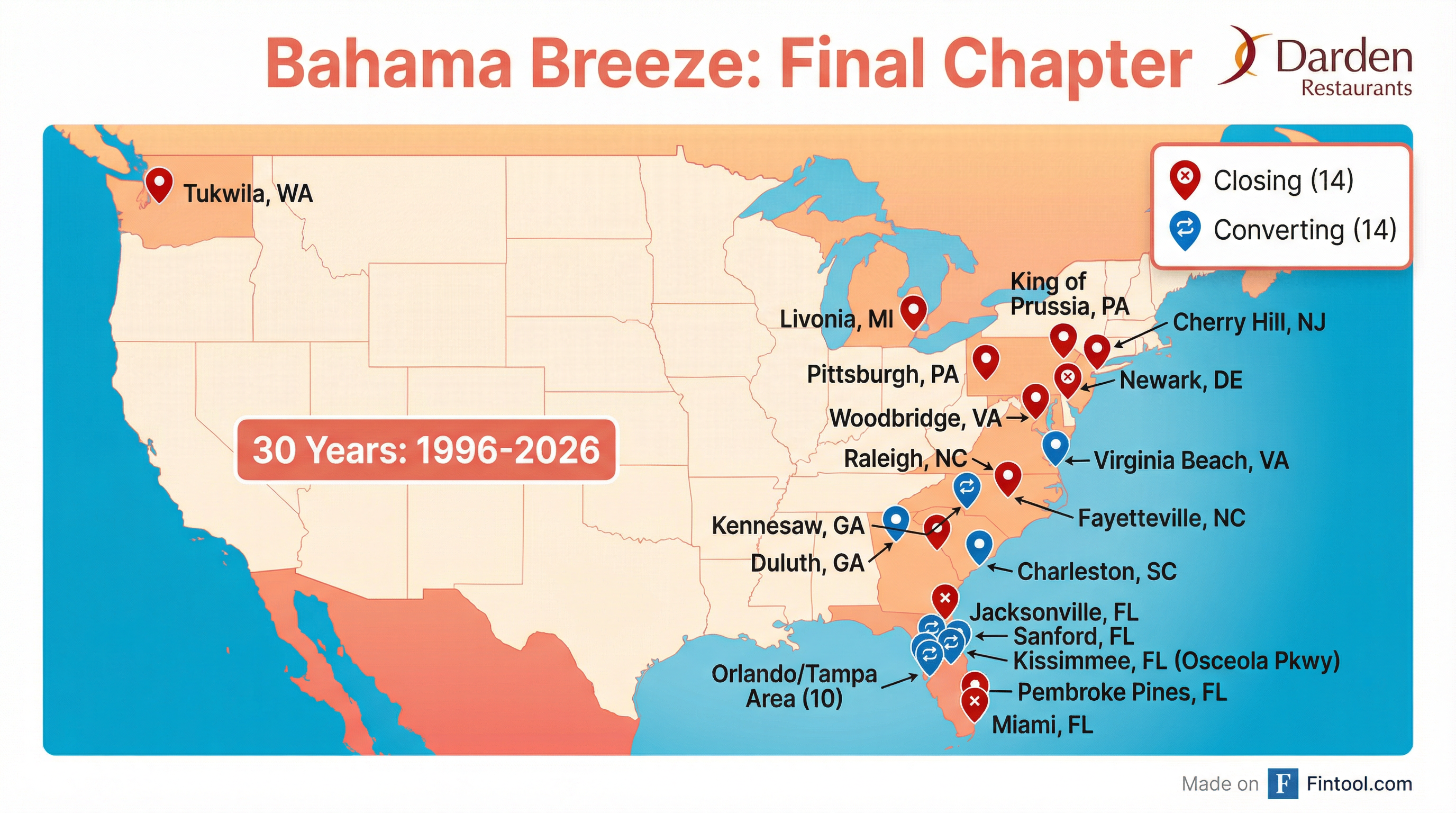

Darden Restaurants is shuttering its Bahama Breeze brand after 30 years, ending a Caribbean-themed concept that once numbered 43 locations but no longer fit the company's strategic criteria. The Orlando-based restaurant operator will permanently close 14 locations by April 5, 2026, and convert the remaining 14 to other Darden brands over the next 12-18 months.

The decision marks the final chapter for a brand that first opened on International Drive in Orlando in 1996. Darden shares rose 2.6% on the news, closing at $205.49, as investors welcomed the company's continued portfolio rationalization.

The Decision

Darden announced in June 2025 that Bahama Breeze was "not a strategic priority" and that it would explore alternatives including a potential sale. That exploration has concluded with no buyers stepping forward.

"We made the decision that Bahama Breeze doesn't meet the criteria anymore," CEO Rick Cardenas said on the company's Q4 2025 earnings call. "We think that they have a lot of growth potential with another owner. We were not going to be putting a lot of investment into Bahama Breeze."

The company does not expect the closures to have a material impact on financial results—a key reason the stock responded positively.

What's Closing vs. Converting

The geographic split tells the story. Florida locations—particularly those clustered around Orlando and Tampa—will convert to other Darden concepts. Locations in the Northeast, Midwest, and Pacific Northwest will close permanently.

Closing Permanently (14 locations by April 5, 2026):

| State | Locations |

|---|---|

| Florida | Miami, Jacksonville, Kissimmee (Osceola), Pembroke Pines, Sanford |

| Pennsylvania | King of Prussia, Pittsburgh |

| Others | Newark (DE), Duluth (GA), Livonia (MI), Cherry Hill (NJ), Raleigh (NC), Woodbridge (VA), Tukwila (WA) |

Converting to Other Brands (14 locations over 12-18 months):

| State | Locations |

|---|---|

| Florida | Altamonte Springs, Brandon, Ft. Myers, Kissimmee (Irlo Bronson), Lutz, Orlando (4), Tampa |

| Others | Kennesaw (GA), Fayetteville (NC), Charleston (SC), Virginia Beach (VA) |

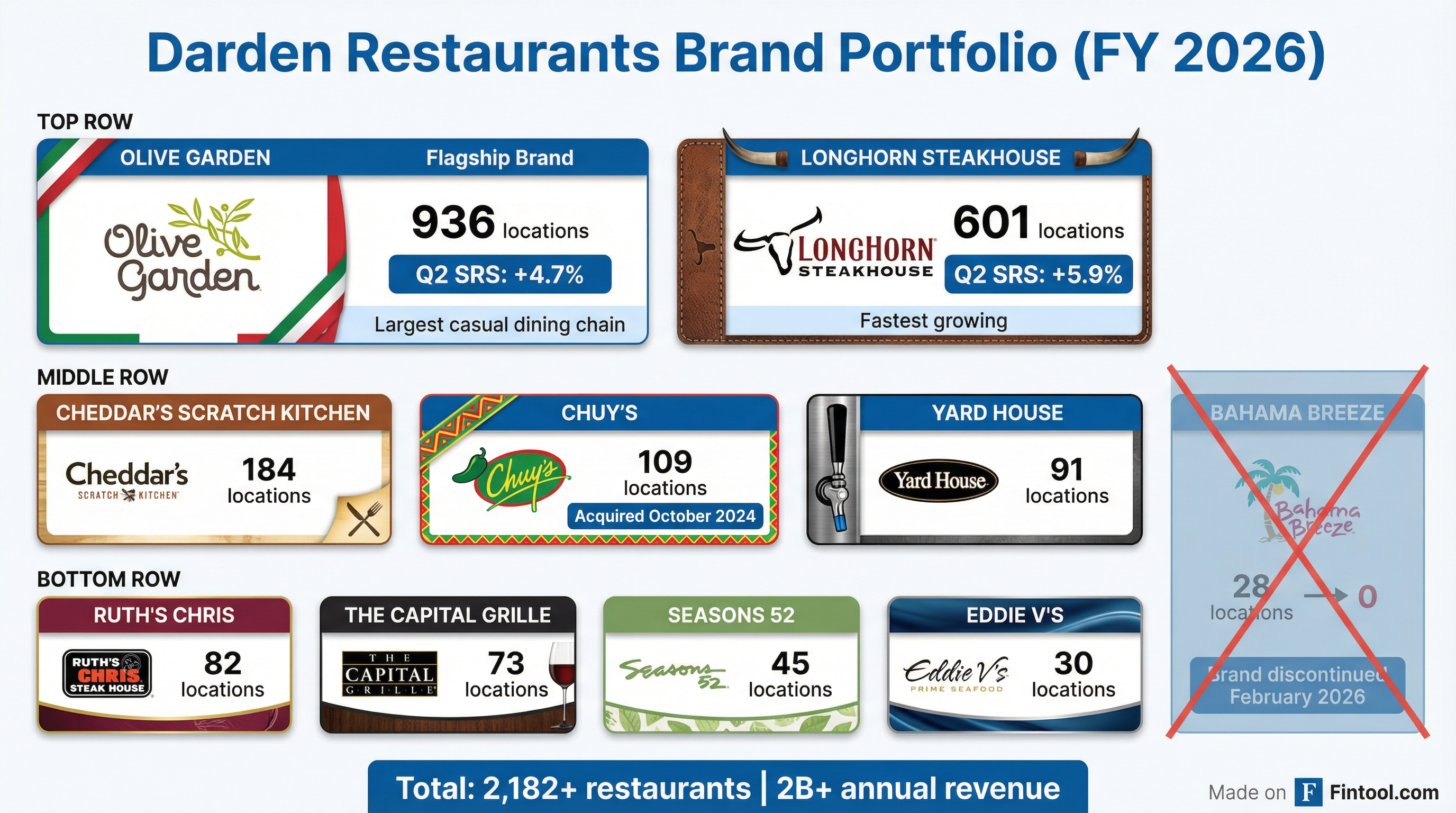

Darden has not disclosed which brands will take over the converted sites, but the company's portfolio includes Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Chuy's, Yard House, Ruth's Chris, The Capital Grille, Seasons 52, and Eddie V's.

A Brand in Decline

The writing was on the wall. In May 2025, Darden abruptly closed 15 Bahama Breeze locations, reducing the footprint from 43 to 28. At the time, management said the remaining restaurants were "the highest performing" and that focusing on them would "strengthen the brand's overall performance."

That strategy lasted less than a year.

Industry analyst John Gordon told the Orlando Sentinel that Bahama Breeze's fall stems from "the relatively limited popularity of Caribbean food in the U.S." combined with a challenging real estate cost profile—Bahama Breeze locations are among the largest in Darden's portfolio by square footage.

The timing aligns with broader casual dining headwinds. Consumer confidence has slumped, and lower-income diners—a segment that frequented Caribbean-themed casual chains—have pulled back on discretionary spending.

Darden's Streamlined Portfolio

Bahama Breeze's exit leaves Darden with nine active brands and over 2,180 restaurants. The company's strategic focus remains on its two flagship concepts—Olive Garden and LongHorn Steakhouse—which together drive the majority of revenue.

| Metric | Q3 2025 | Q4 2025 | Q1 2026 | Q2 2026 |

|---|---|---|---|---|

| Revenue ($B) | $3.16 | $3.27 | $3.04 | $3.10 |

| Net Income ($M) | $323 | $304 | $258 | $237 |

| Diluted EPS | $2.74 | $2.59 | $2.19 | $2.03 |

Darden's most recent quarter showed Olive Garden same-restaurant sales up 4.7% and LongHorn up 5.9%—both outperforming the broader casual dining industry.

The company acquired Chuy's in October 2024, adding 103 Tex-Mex locations and demonstrating its preference for brands with clearer growth trajectories. Meanwhile, it sold its Canadian Olive Garden locations and exited Bahama Breeze—a clear portfolio reshaping toward higher-performing, more scalable concepts.

What to Watch

Employee transitions: Darden says its "primary focus" is placing team members in other portfolio roles. With 2,180+ restaurants, the company has capacity to absorb workers, though geographic mismatches (closing Michigan but converting Florida) may limit options.

Conversion brand selection: Which concepts Darden chooses for the 14 converted sites will signal where management sees the best unit economics. Olive Garden and LongHorn are the obvious candidates given their traffic trends.

Casual dining consolidation: Bahama Breeze joins a growing list of struggling casual concepts. With consumer spending under pressure, the restaurant industry may see further brand rationalization from multi-concept operators.

Darden's fiscal 2026 guidance remains unchanged: total sales growth of 8.5-9.3%, same-restaurant sales growth of 3.5-4.3%, and adjusted diluted EPS of $10.50-$10.70. The Bahama Breeze exit, while marking the end of a 30-year brand, appears to be a footnote rather than a turning point for the nation's largest full-service restaurant company.