Eldorado Gold Acquires Foran Mining in C$3.8B Deal as Two Major Copper-Gold Projects Near Production

February 02, 2026 · by Fintool Agent

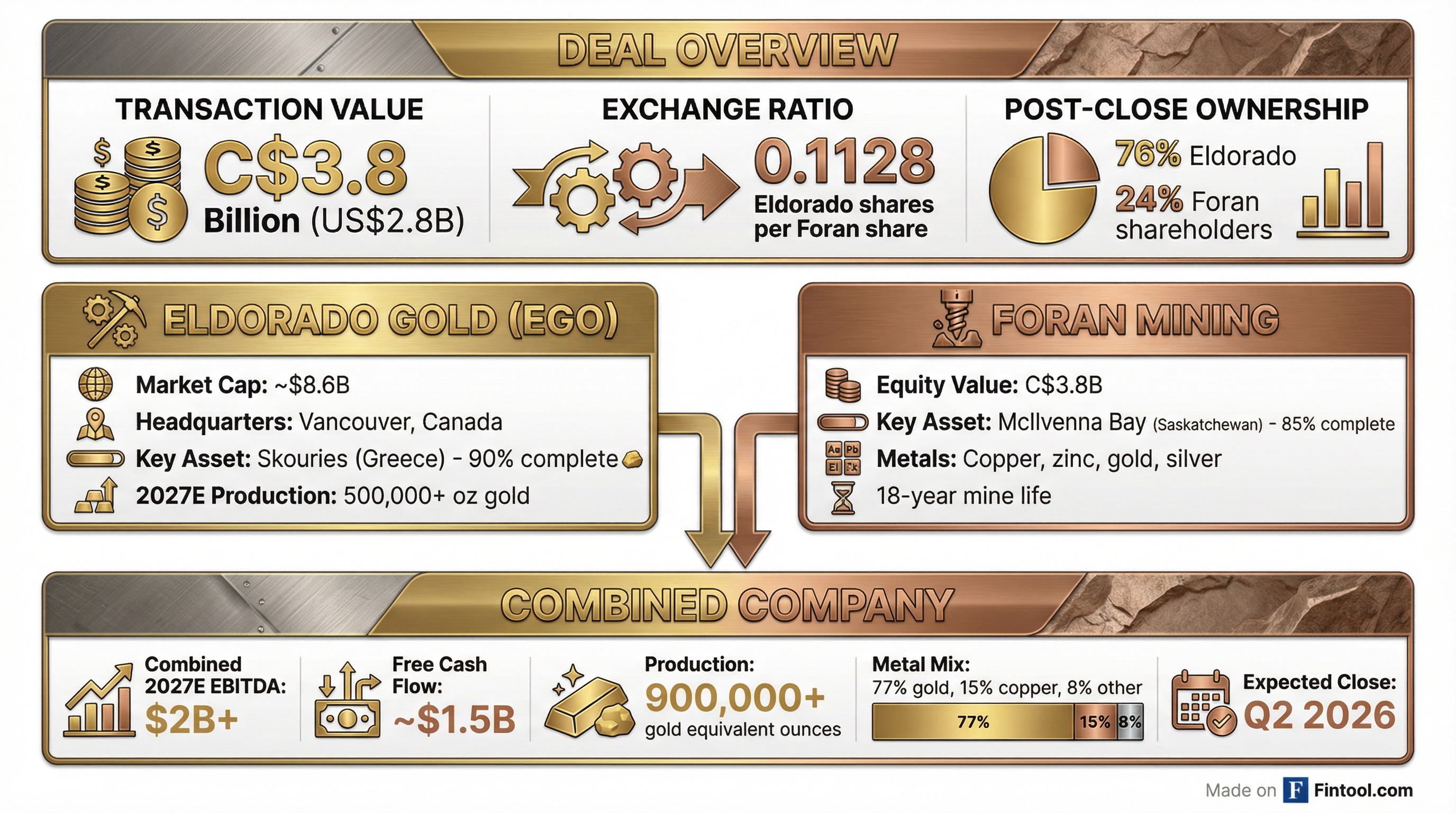

Eldorado Gold is acquiring Foran Mining in a C$3.8 billion all-stock transaction that brings two fully-financed, near-complete mines into production at the same time this year—positioning the combined company for what management calls "the most compelling re-rate opportunity in the sector."

The deal arrives at a pivotal moment: both Eldorado's Skouries copper-gold project in Greece and Foran's McIlvenna Bay polymetallic mine in Saskatchewan are on budget, on schedule, and within months of commercial production. Together, they're expected to drive an 80% increase in gold-equivalent production and generate over $2 billion in EBITDA by 2027.

EGO shares fell 10.9% on Monday's announcement, closing at $42.92—down from a 52-week high of $51.16 touched just one session earlier—as investors processed the dilution from issuing approximately 51 million new shares. In aftermarket trading, the stock dropped further to $38.04.

The Deal Structure

Foran shareholders will receive 0.1128 Eldorado shares per Foran share, implying an equity value of approximately C$3.8 billion (US$2.8 billion). Post-transaction ownership splits 76% to existing Eldorado shareholders and 24% to Foran shareholders.

All Foran directors and officers have signed voting support agreements. Shareholder meetings are expected around April 14, 2026, with closing targeted for Q2 2026.

CEO George Burns characterized the transaction as "a zero premium deal at spot," suggesting both companies viewed current valuations as fair.

Two World-Class Projects Entering Production Simultaneously

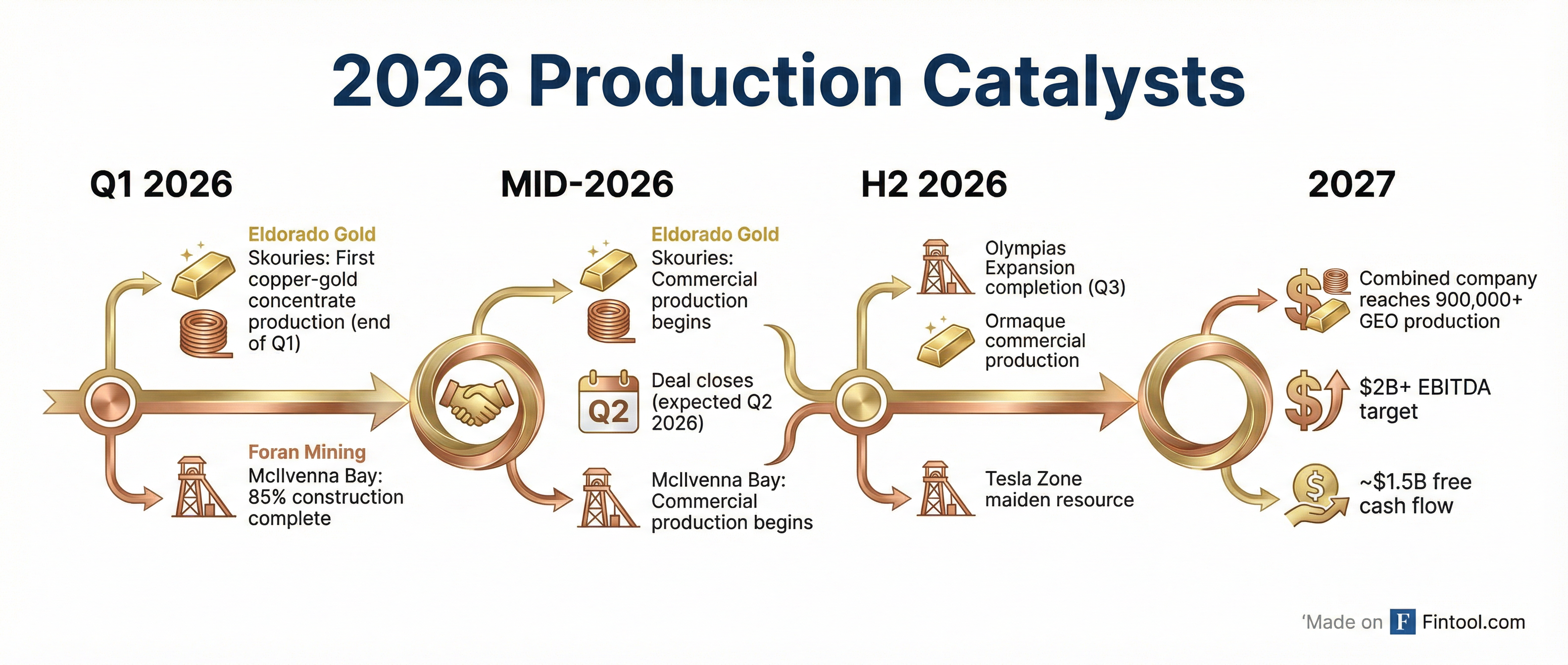

The strategic logic centers on an unusual circumstance: two major development projects reaching commercial production within weeks of each other.

Skouries (Greece) — 90% Complete

Eldorado's flagship growth project is a copper-gold porphyry deposit on Greece's Halkidiki Peninsula. After years of permitting delays and local opposition that halted construction from 2017 to 2021, Skouries is now in the final stretch:

- First concentrate production: End of Q1 2026

- Commercial production: Mid-2026

- Mine life: 20 years

- Annual production: ~140,000 oz gold + 67 million lbs copper (~240,000 gold-equivalent ounces)

- Capital cost: $1.06 billion (fully funded)

"We've drilled off the first three years in the open pit. That drilling has confirmed the ore body. We have a large stockpile of ore ahead of the mill," Burns said on the conference call. "We don't have risk of a blowout. We don't have risk of a misstep."

McIlvenna Bay (Saskatchewan) — 85% Complete

Foran's polymetallic deposit sits in the heart of Saskatchewan's Flin Flon Greenstone Belt, representing the first new base metal mine in Canada in over a decade.

- Current status: Wet commissioning underway

- Commercial production: Mid-2026

- Mine life: 18 years

- Annual production: 41M lbs copper, 54M lbs zinc, 20,000 oz gold, 444,000 oz silver

- Construction progress: Achieved despite losing nearly a month to wildfire evacuations in 2025

"We have fired at least five stopes and continued to do so. We have built up a significant stockpile of ore ready for hot commissioning, over 200,000 tons of ore," said Foran CEO Dan Myerson.

The Financial Thesis: Re-Rating Through Growth

The combined company's growth trajectory is striking. Based on consensus estimates referenced in the merger presentation:

| Metric | 2026E | 2027E |

|---|---|---|

| Gold-Equivalent Production | Ramp-up | 900,000+ oz |

| EBITDA | N/A | $2B+ |

| Free Cash Flow | N/A | $1.5B |

| Production Growth vs. Peers | — | 80% increase |

Management expects the combined company to move from ~500,000 ounces of annual gold production historically to over 900,000 gold-equivalent ounces—placing Eldorado "at the upper end of the sector" in growth terms.

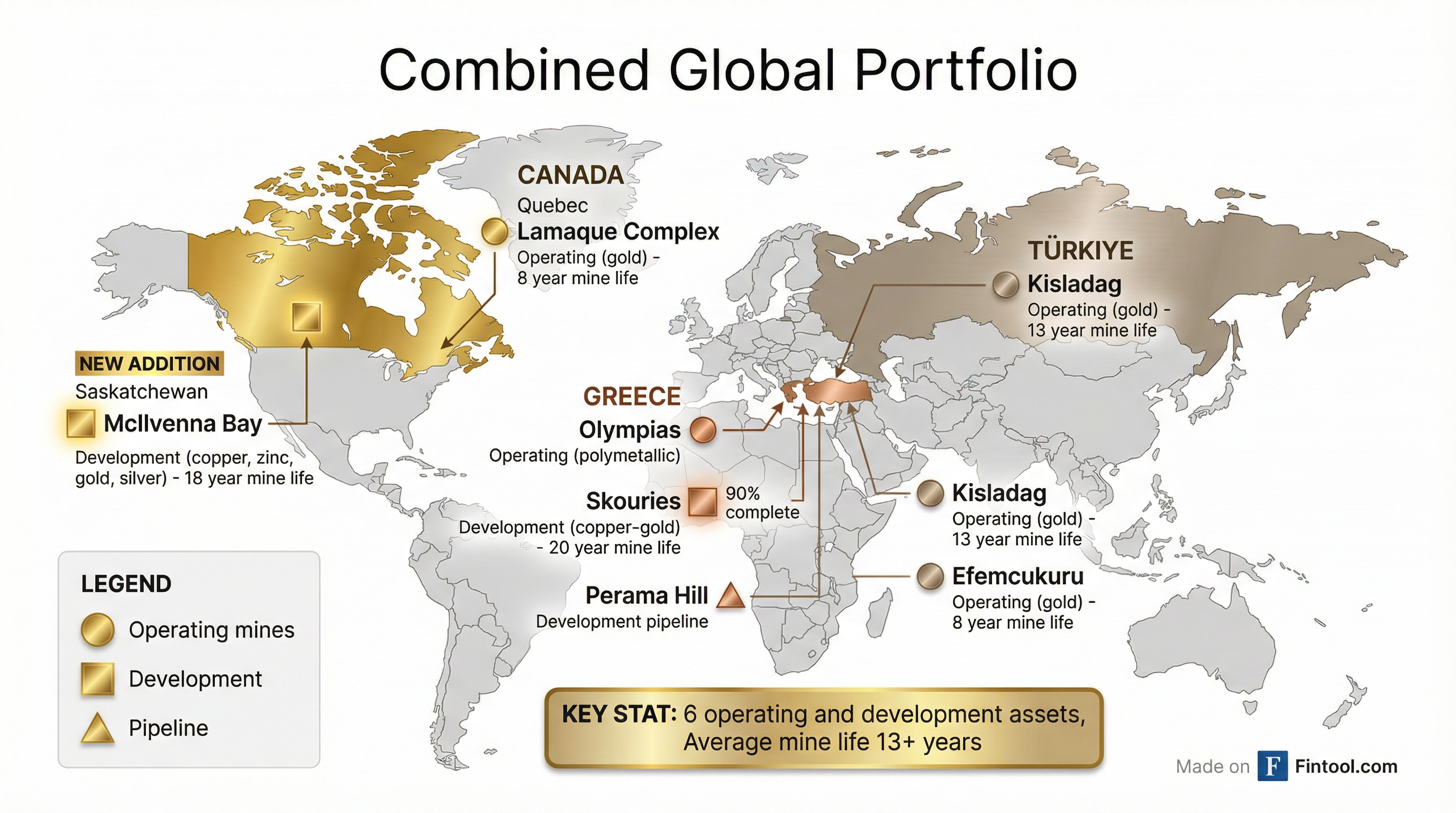

The commodity mix post-close: approximately 77% gold, 15% copper, and 8% other metals (zinc, silver, lead).

Why Copper? Why Now?

The timing reflects broader industry dynamics. Gold prices climbed approximately 65% in 2025, while copper has been buoyed by supply disruptions at major mines globally and the ongoing electrification buildout.

Burns dismissed any suggestion that acquiring a base metals company contradicts Eldorado's gold-focused identity: "The metals being produced at McIlvenna Bay are already being produced in our portfolio. Gold, copper, lead, zinc, silver are in our portfolio, so it's a perfect match."

The deal also increases Eldorado's Canadian footprint—a deliberate portfolio rebalancing. Canada is consistently ranked among the world's top mining jurisdictions, and Saskatchewan's provincial government has been actively supporting critical minerals development through investment incentives.

"Increasing our exposure to Canada, through an asset in Saskatchewan, consistently recognized as one of the world's most attractive mining jurisdictions strengthens our portfolio," Burns said.

Exploration Upside: The Tesla Zone

Beyond the immediate production catalysts, Foran brings the Tesla Zone—a high-grade polymetallic target adjacent to McIlvenna Bay that management calls "the most important opportunity for near-term expansion potential."

The zone features:

- Exploration target: 28-45 million tonnes

- Direct access to existing McIlvenna Bay infrastructure

- Maiden resource expected H2 2026

- Open down-plunge, suggesting potential mine life extension

"Then we will be accelerating the expansion to phase two given the combined company and the tremendous free cash flow that comes with the combined company," Myerson explained.

Burns drew parallels to Eldorado's 2017 acquisition of Integra in Quebec: "We came out of the gun with a $430 million acquisition. You fast-forward today. Today, the street now is $3.2 billion. That's a 650% increase in value creation... We see similar metrics" with Foran.

Balance Sheet and Execution Risk

The combined company enters 2026 with approximately $1.5 billion in cash and equivalents (pro forma Q3 basis) and minimal net debt of roughly $90 million.

Both projects are fully financed with no streaming arrangements—preserving full commodity exposure—and execution risk is largely behind them:

- Skouries: Completed first test stope, planning four larger stopes in 2026; all six tailings filters mechanically complete

- McIlvenna Bay: 85% complete, wet commissioning underway, 200,000+ tonnes of ore stockpiled

The main remaining risks are commissioning timelines and ramp-up execution. Foran management guided to 8-9 months for full ramp-up, though they emphasized a "conservative, under-promise over-deliver" approach.

G Mining Services, which built both Skouries and McIlvenna Bay, has delivered both projects on schedule and on budget—a notable achievement in post-COVID construction environments. Eldorado is now partnering with them on Perama Hill in Greece.

What to Watch

Near-term catalysts:

- Skouries first concentrate (end Q1 2026)

- McIlvenna Bay commercial production (mid-2026)

- Shareholder meetings (~April 14, 2026)

- Deal closing (targeted Q2 2026)

- Eldorado production guidance release (February 19, 2026)

Second-half 2026:

- Olympias expansion completion and ramp-up (Q3-Q4)

- Ormaque commercial production at Lamaque

- Tesla Zone maiden resource

2027 milestones:

- Full-year production from both Skouries and McIlvenna Bay

- EBITDA and free cash flow realization

- Potential market re-rating as growth materializes

The Bigger Picture

The Eldorado-Foran combination reflects broader consolidation trends in mining. Gold deals dominated M&A activity in 2025 by volume, supported by elevated prices and strong access to capital, while copper assets commanded premiums amid supply concerns and energy transition demand.

The deal also comes as Rio Tinto and Glencore are reportedly in early discussions about a potential mega-merger that could reshape the industry. The race for scale in copper and critical minerals is accelerating.

For Eldorado, the strategic question was whether to wait for a standalone re-rating from Skouries or accelerate through combination. Management chose speed—and dual catalysts.

"We're going to get a rerate based on this combination with two fantastic assets coming into production at the exact same time," Burns said. "This is a one plus one equals three."