ElevenLabs Raises $500 Million at $11 Billion Valuation, Becoming UK's Most Valuable AI Startup

February 4, 2026 · by Fintool Agent

ElevenLabs has closed a $500 million Series D round led by Sequoia Capital, valuing the voice AI startup at $11 billion and cementing its position as the United Kingdom's most valuable artificial intelligence company.

The round marks a stunning 233% increase from its $3.3 billion Series C valuation just 13 months ago—and a nearly 1,200x return from its $9 million pre-seed valuation in January 2023.

From Polish High School Friends to AI Unicorn

ElevenLabs was founded in 2022 by Mati Staniszewski, a former Palantir deployment strategist, and Piotr Dabkowski, an ex-Google machine learning engineer. The two met as high school students at Copernicus International Baccalaureate in Warsaw, Poland, and bonded over a shared frustration: the terrible quality of dubbed films in their home country.

In Poland, foreign films are traditionally voiced over by a single lektor—a lone male actor who delivers all dialogue in a monotone voice while the original audio plays faintly underneath. "Ask any Polish person and they will tell you it's terrible," Staniszewski told Forbes. "I guess it was a communist thing that stuck as a cheap way to produce content."

That childhood annoyance became a $11 billion business. After moving to the UK to attend Imperial College London (Staniszewski) and Oxford/Cambridge (Dabkowski), the pair quit their jobs at Palantir and Google to build AI that could make any voice speak any language naturally.

Revenue Trajectory: $0 to $330 Million ARR in Under 3 Years

ElevenLabs' growth has been exponential. The company crossed $330 million in annual recurring revenue (ARR) by late 2025, according to CEO Staniszewski.

The velocity is striking:

- 20 months to reach $100 million ARR

- 10 months to reach $200 million ARR

- 5 months to reach $330 million ARR

Enterprise revenue has grown more than 200% year-over-year, with the company approaching a 50/50 split between enterprise and self-serve customers. Fortune 500 companies including Cisco-2.12%, Epic Games, Adobe, and Nvidia-3.91% use ElevenLabs' technology.

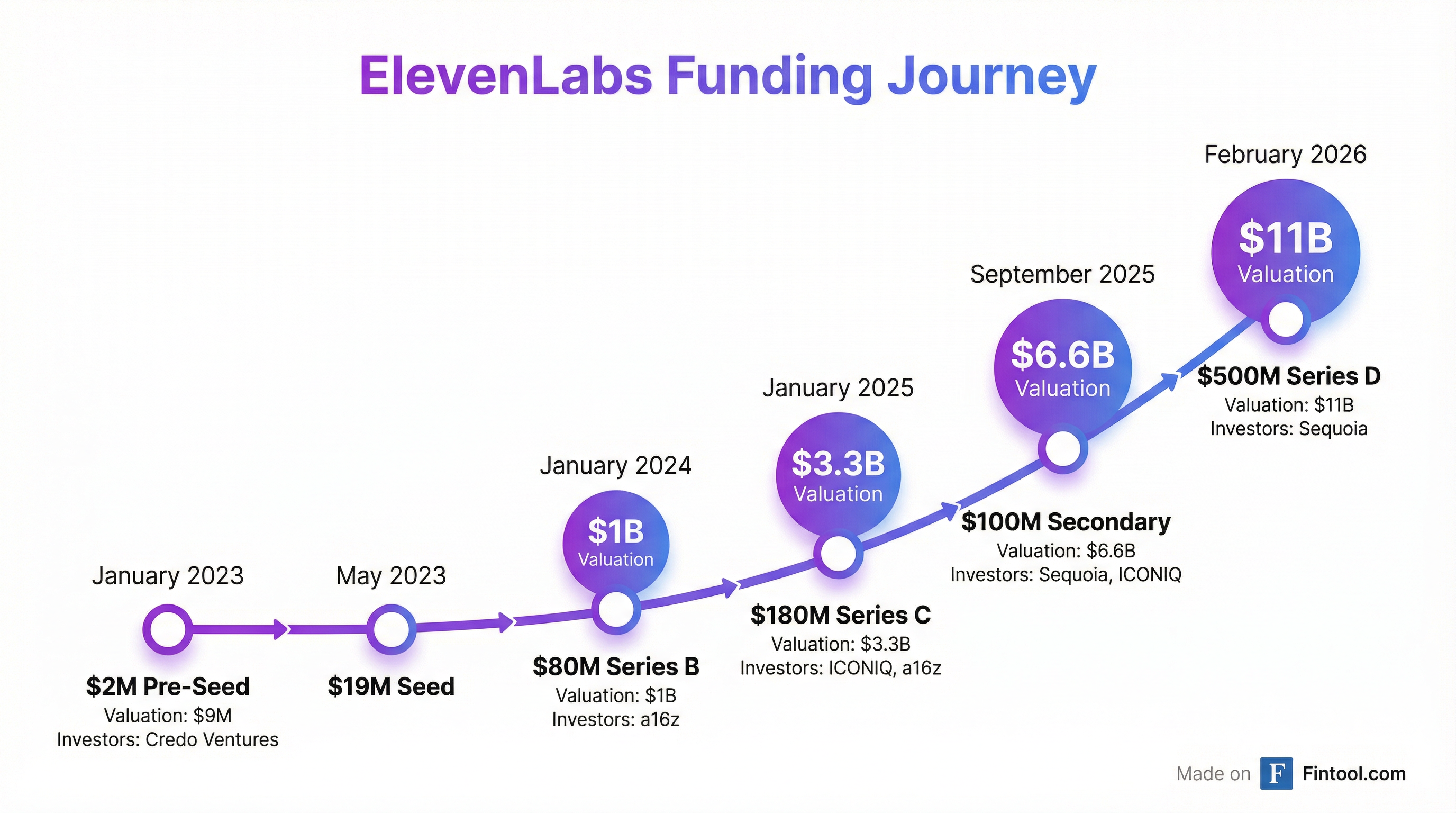

The Funding Journey

ElevenLabs' funding history reflects the AI investment frenzy of 2023-2026:

| Round | Date | Amount Raised | Valuation | Lead Investors |

|---|---|---|---|---|

| Pre-Seed | Jan 2023 | $2M | $9M | Credo Ventures, Concept Ventures |

| Seed | May 2023 | $19M | $100M | Andreessen Horowitz, Nat Friedman |

| Series B | Jan 2024 | $80M | $1B | Andreessen Horowitz |

| Series C | Jan 2025 | $180M | $3.3B | ICONIQ, Andreessen Horowitz |

| Secondary | Sep 2025 | $100M | $6.6B | Sequoia, ICONIQ |

| Series D | Feb 2026 | $500M | $11B | Sequoia Capital |

The cap table reads like a who's who of tech investors: Andreessen Horowitz, Sequoia Capital, ICONIQ, Nvidia, Salesforce Ventures, NEA, Smash Capital, and SV Angel. Angel investors include Mike Krieger (Instagram co-founder), Brendan Iribe (Oculus co-founder), and Mustafa Suleyman (DeepMind co-founder).

What ElevenLabs Actually Does

ElevenLabs started as a text-to-speech company but has expanded into a comprehensive voice AI platform:

Text-to-Speech (Eleven v3): The flagship product converts text into natural, emotionally expressive speech across 70+ languages with 3,000+ voices. Independent benchmarks show ElevenLabs achieves 81.97% pronunciation accuracy versus OpenAI's 77.30%, with lower hallucination rates (5% vs 10%).

Voice Cloning: Users can clone any voice from just 10 seconds of audio (instant cloning) or create studio-quality replicas from 60 minutes of audio (professional voice cloning).

Conversational AI Agents: Enterprises have deployed over 2 million AI voice agents built on ElevenLabs' platform, handling customer support, scheduling, and other interactions. Some enterprises run 50,000+ calls per month.

AI Music (Eleven Music): Launched in 2025, this generates studio-grade music from text prompts for commercial use.

Competitive Landscape: Taking on Big Tech

ElevenLabs operates in an increasingly crowded market, competing against deep-pocketed tech giants:

| Provider | Voice Quality (ELO) | Languages | Voices | Price per 1M chars |

|---|---|---|---|---|

| ElevenLabs | 1,108 | 70+ | 3,000+ | $206 (Pro tier) |

| OpenAI TTS | 1,105 | 50+ | 11 | $15 |

| Microsoft Azure | 1,051 | 100+ | 500+ | $16 |

| Amazon Polly | 1,060 | 40+ | 100+ | $16 |

| Google Cloud TTS | 1,050 | 50+ | 300+ | $16 |

Source: Artificial Analysis TTS Arena benchmarks

ElevenLabs' premium pricing—roughly 13x more expensive than hyperscaler alternatives—reflects its positioning as the quality leader. The company's Flash v2.5 model achieves 75ms latency, significantly faster than OpenAI's 200ms, making it preferred for real-time applications.

The biggest competitive threat may come from OpenAI. The company's Realtime API takes audio directly as input and output, bypassing the transcription step that ElevenLabs' architecture requires. This gives OpenAI potential latency advantages and preserves emotional context in conversations. However, OpenAI offers only 11 preset voices with no voice cloning capability—a significant limitation for brands seeking unique voice identities.

IPO on the Horizon

At $11 billion, ElevenLabs now rivals France's Mistral AI (~$12 billion) as one of Europe's most valuable AI startups. The company has established a global footprint with headquarters in both London and New York, plus offices in Warsaw, Bengaluru, and Tokyo.

CEO Staniszewski has signaled IPO intentions, telling CNBC that ElevenLabs plans to go public within five years "if the market is right." The company is focused on expanding its global hub network first.

The valuation implies roughly 33x forward revenue on its current ARR trajectory—aggressive but not unprecedented for high-growth AI companies. For comparison, Anthropic is reportedly seeking a $350 billion valuation at ~17.5x annualized revenue.

What to Watch

Enterprise adoption: The 50/50 split between enterprise and consumer revenue suggests ElevenLabs is successfully moving upmarket. Continued enterprise wins will validate the premium pricing strategy.

Competition from OpenAI: As OpenAI expands its Realtime API and potentially adds voice cloning, ElevenLabs' quality moat could narrow. The company's diversification into music generation and agentic workflows aims to stay ahead.

Path to profitability: With $330 million+ ARR and presumably strong gross margins on a software product, ElevenLabs may already be profitable or close to it—a rarity among AI unicorns.

IPO timing: The AI IPO market has been slow, with most major players (OpenAI, Anthropic, Databricks) remaining private. ElevenLabs' simpler, more profitable business model could make it an attractive public market candidate.

Related

- Nvidia-3.91% — Investor in ElevenLabs and key AI infrastructure provider