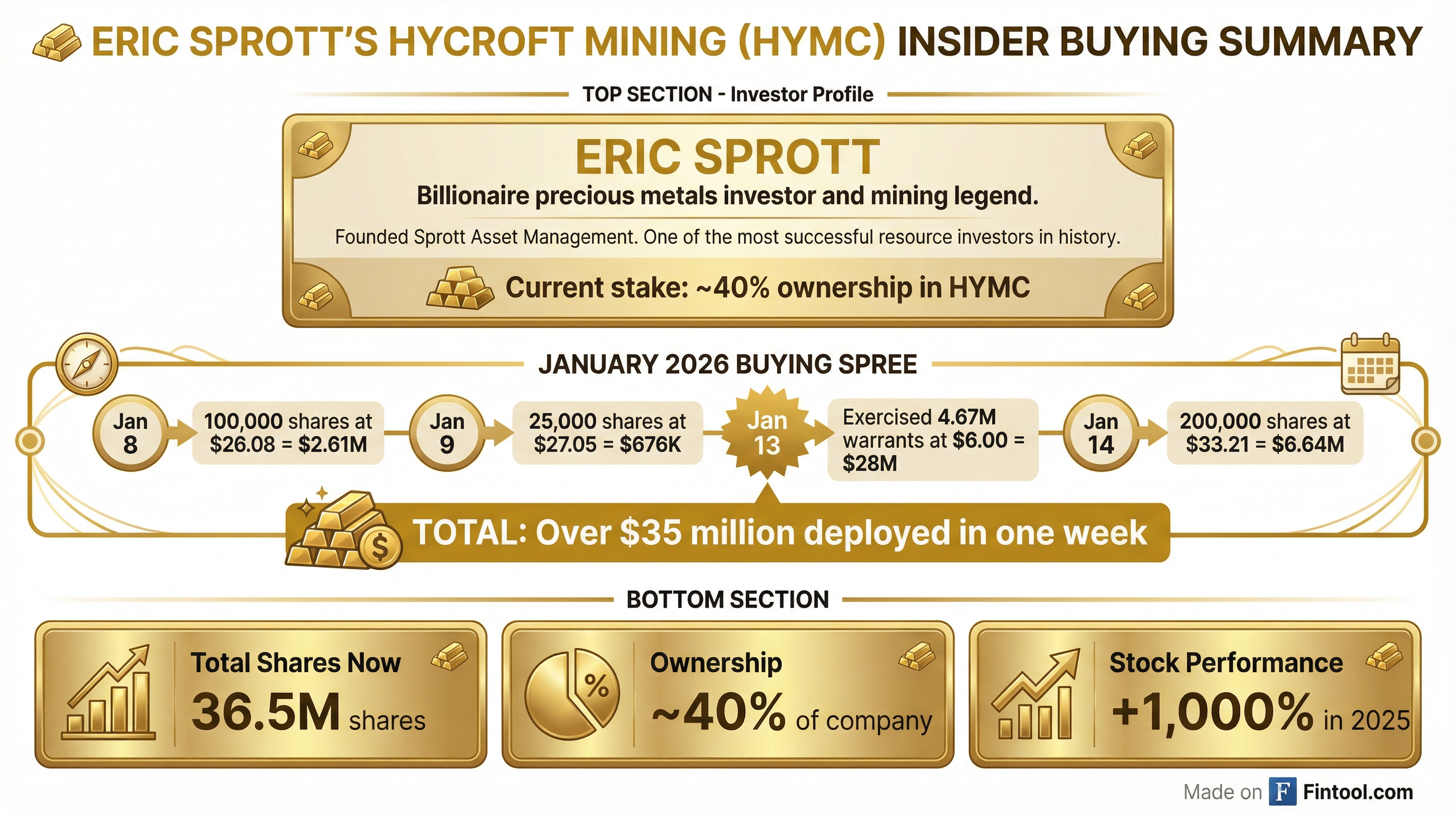

Billionaire Eric Sprott Deploys $35M+ Into Hycroft Mining in One Week

January 17, 2026 · by Fintool Agent

When Eric Sprott writes a check, the mining world pays attention. The legendary precious metals investor just deployed over $35 million into Hycroft Mining in a single week—including a $6.64 million open market purchase on January 14 at $33.21 per share.

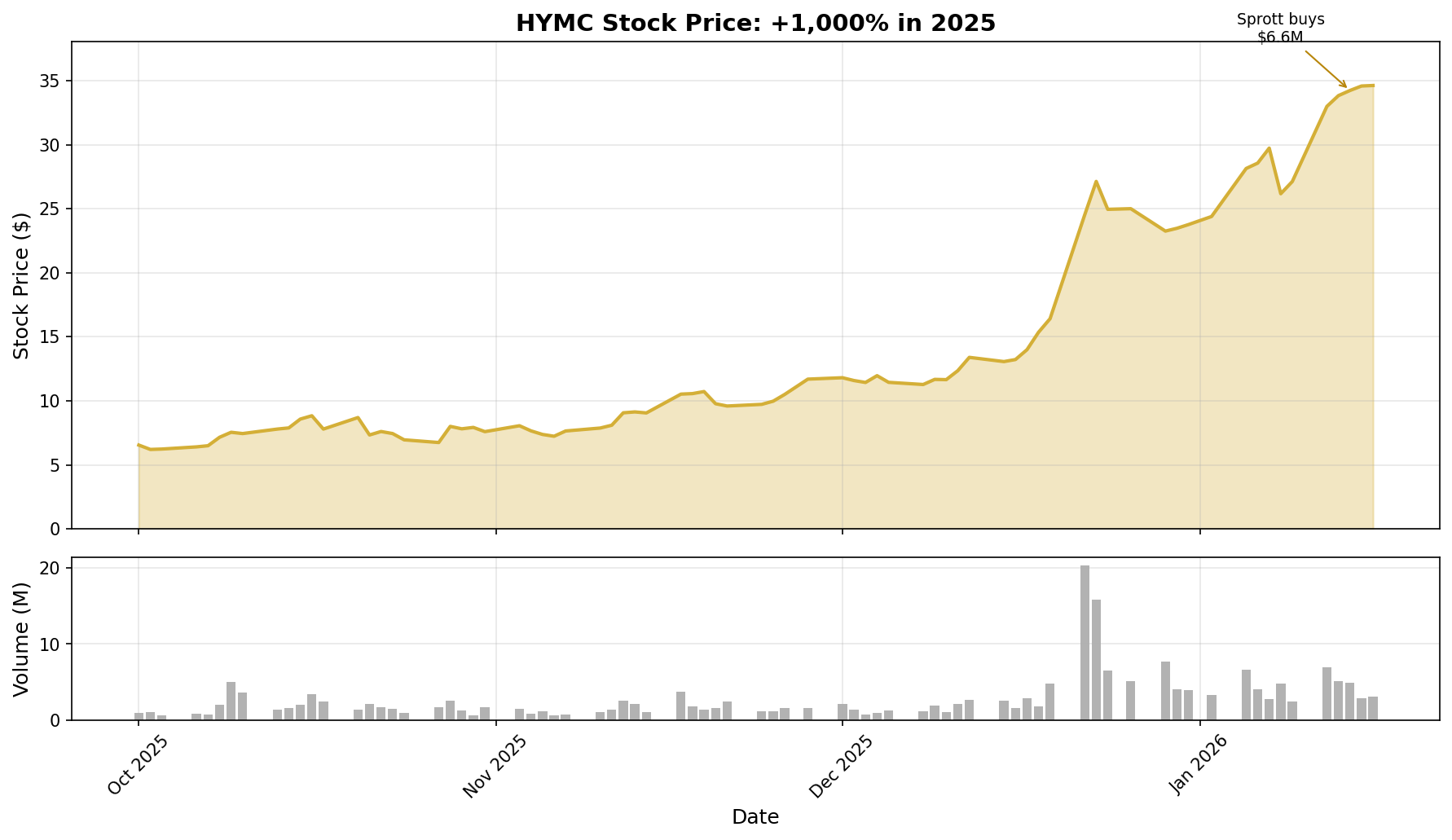

The timing is no accident. Gold is trading at record highs above $4,600 per ounce. Silver has cracked $90 for the first time in history. And Hycroft—a Nevada-based gold and silver explorer that went from near-bankruptcy to debt-free in 2025—is sitting on what Sprott clearly believes is an undervalued asset ahead of major catalysts.

The January Buying Spree

Sprott's January activity has been relentless. SEC Form 4 filings reveal a pattern of aggressive accumulation:

| Date | Transaction | Shares | Price | Value |

|---|---|---|---|---|

| Jan 8 | Open Market Purchase | 100,000 | $26.08 | $2.61M |

| Jan 9 | Open Market Purchase | 25,000 | $27.05 | $676K |

| Jan 13 | Warrant Exercise | 4,672,352 | $6.00 | $28.0M |

| Jan 14 | Open Market Purchase | 200,000 | $33.21 | $6.64M |

| Total | 4,997,352 | $37.9M |

The warrant exercise alone—nearly 4.7 million shares at $6—signals conviction. Sprott could have let those warrants expire worthless if he didn't believe in the story. Instead, he converted them into stock and kept buying in the open market at prices more than five times higher.

Sprott now owns approximately 36.5 million shares of Hycroft, representing roughly 40% of the company—up from 31.5 million shares at the start of January.

Who Is Eric Sprott?

For those unfamiliar with the name, Sprott is Canadian mining royalty. The billionaire founder of Sprott Asset Management built his fortune betting on gold and silver when others dismissed them as relics. His track record of identifying undervalued precious metals plays before they ran is legendary in the resource investing community.

When Sprott takes a position, it's rarely a casual bet. His involvement with Hycroft dates back several years, and his willingness to increase his stake at current prices—after the stock already surged roughly 1,000% in 2025—speaks volumes about his conviction in what comes next.

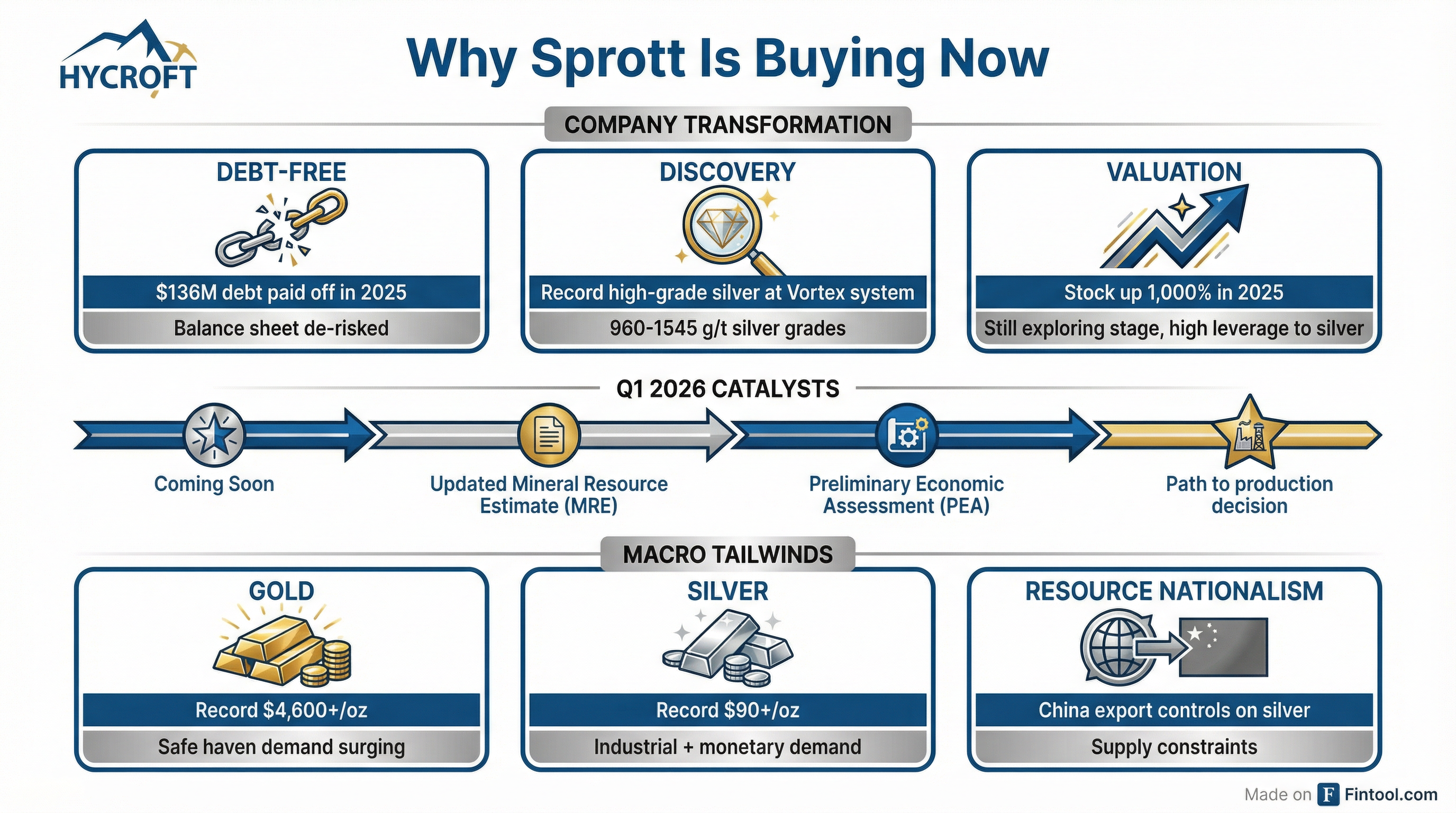

Why Now? The Hycroft Transformation

Hycroft's story has changed dramatically over the past year:

Debt Eliminated: The company paid off approximately $136 million in debt in 2025, emerging completely debt-free. This balance sheet transformation removes what had been the primary existential risk.

High-Grade Discovery: Recent drill results at the Vortex system revealed the highest silver grades in the company's history—between 960 and 1,545 grams per tonne. This extends the high-grade zone by 75 meters westward and suggests the deposit may be larger than previously estimated.

Q1 2026 Catalysts: Two major milestones are expected in the coming weeks:

- Updated Mineral Resource Estimate (MRE): Will quantify the expanded silver discovery

- Preliminary Economic Assessment (PEA): The first economic study that could outline a path to production

These catalysts matter because Hycroft has historically been viewed as a massive but low-grade deposit. If the MRE shows meaningful high-grade ounces and the PEA demonstrates economic viability, the stock could re-rate significantly.

The Macro Tailwind: Gold and Silver at Record Highs

Sprott's bet on Hycroft is inseparable from his broader view on precious metals—and that view appears to be extremely bullish.

Gold touched $4,641 per ounce on January 14, while silver broke above $92 for the first time ever. Both metals have been on a tear driven by:

- Geopolitical Uncertainty: Ongoing tensions and questions about Fed independence have pushed investors toward hard assets

- Resource Nationalism: China placed export controls on silver in December, tightening already constrained supply

- Industrial Demand: Silver's dual role as a monetary and industrial metal (critical for solar panels, electronics) creates persistent demand

Analysts are calling for $5,000 gold and $100 silver in the near term. For a silver-heavy asset like Hycroft, that macro backdrop creates enormous leverage.

| Metal | Current Price | 2025 Low | % Gain |

|---|---|---|---|

| Gold | $4,600/oz | $2,700/oz | +70% |

| Silver | $90/oz | $30/oz | +200% |

The Risk: Still Pre-Revenue

Let's be clear about what Hycroft is and isn't. This is not a producing mine. The company generated zero revenue in 2025 and remains in the exploration stage. The stock was up nearly 1,000% last year—but from a very low base—and remains down significantly from all-time highs.

The investment thesis rests entirely on future catalysts: the MRE, the PEA, and ultimately a production decision. If those disappoint, or if precious metals prices reverse, the stock could give back gains quickly.

That said, Sprott is not a momentum trader. His $35 million+ commitment suggests he has visibility into something—whether it's the drill results, the economics, or simply a deep conviction that silver above $90 makes previously uneconomic deposits suddenly very interesting.

What to Watch

Q1 Catalysts: The updated MRE and PEA will determine whether Hycroft can graduate from explorer to developer. Watch for specific numbers on high-grade ounces and projected economics.

Precious Metals Prices: Hycroft is a leveraged bet on gold and silver. If metals pull back sharply, the stock will likely follow regardless of company-specific news.

Sprott's Next Moves: With 40% ownership, any additional buying would be notable. Conversely, if he stops buying or starts selling, that would be a significant signal.

Related Companies: Hycroft Mining