Expeditors Educates DoD Contractors on Tariff Relief: DCMA Duty-Free Entry Emerges as Cost-Saving Lifeline

January 27, 2026 · by Fintool Agent

Expeditors International hosted a webinar today walking defense contractors through the DCMA Duty-Free Entry process—a regulatory mechanism gaining newfound urgency as the Trump administration's sweeping tariffs push import costs to levels that threaten contractor margins and defense program affordability.

The session, titled "Tariff Relief for DoD Contractors and Subs," drew a mix of prime contractors, subcontractors, and those exploring entry into defense contracting. It arrives months after the Pentagon issued a memorandum mandating that contracting officers include the duty-free entry clause in all defense contracts—a policy shift that effectively exempts most foreign-origin supplies acquired by the Department of Defense from tariffs.

"With the tariff increases over the past year, importers are looking for available opportunities to reduce those additional costs," said Lauren Holcomb, Program Manager for Government Services at Expeditors. "For DoD contractors, the DCMA Duty-Free Entry has an established process and a feasible path towards major cost savings."

The Pentagon's August 2025 Memorandum Changed the Game

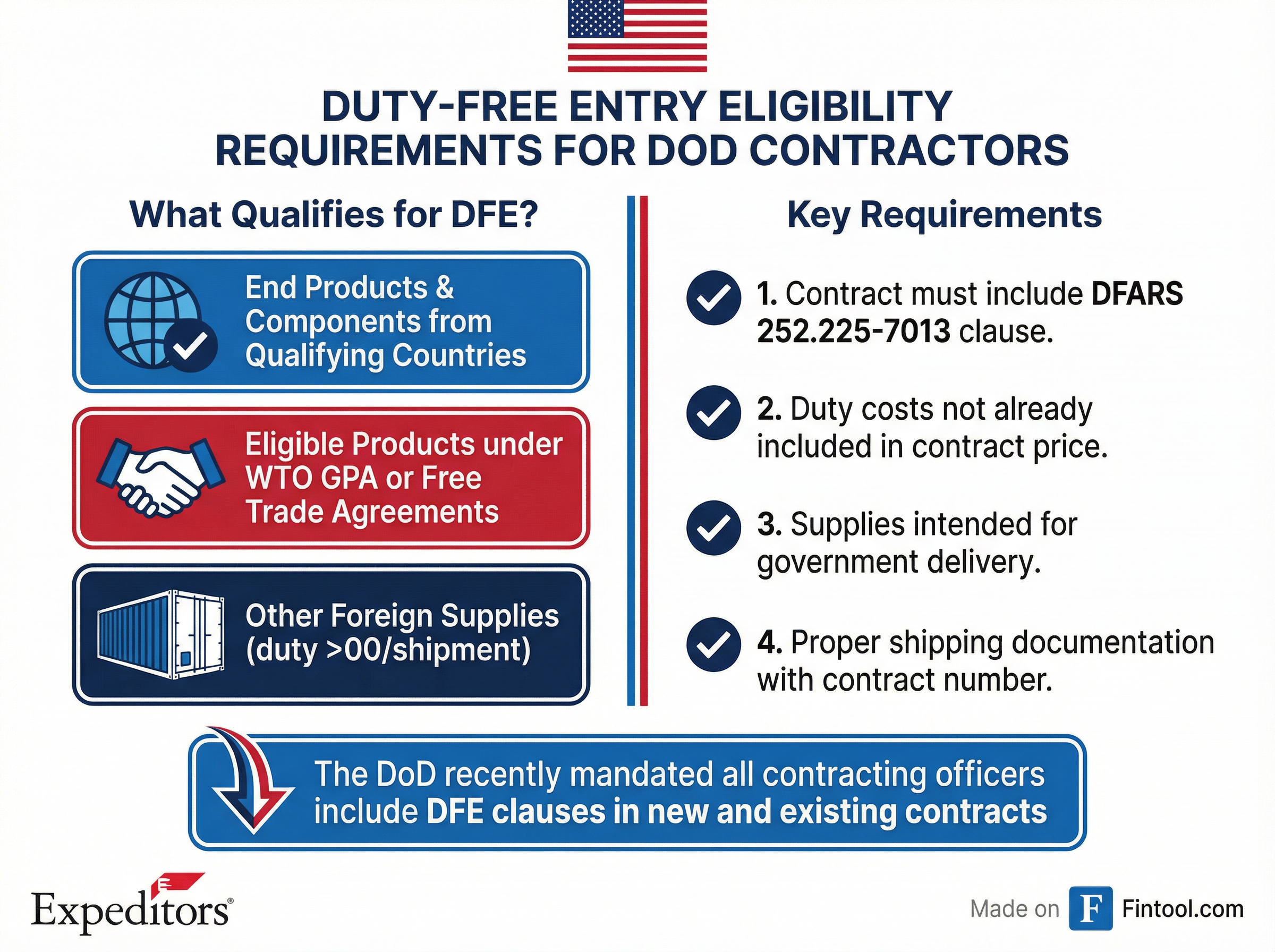

The Defense Department's August 25, 2025 memorandum, issued by Principal Director John Tenaglia, directed all contracting officers to include or modify contracts to incorporate DFARS 252.225-7013—the Duty-Free Entry clause—for any contract involving imported items. The guidance was explicit: duty-free exemptions apply to tariffs, not just traditional customs duties.

This clarification resolved confusion that had plagued contractors uncertain whether they would absorb tariff costs or could recover them through the established duty-free process.

"The DoD recently issued a memorandum that instructs contracting officers to include the Duty-Free Entry clause in all existing and future contracts, where Duty-Free Entry may be applicable," Holcomb noted during the webinar.

How the DCMA Duty-Free Process Works

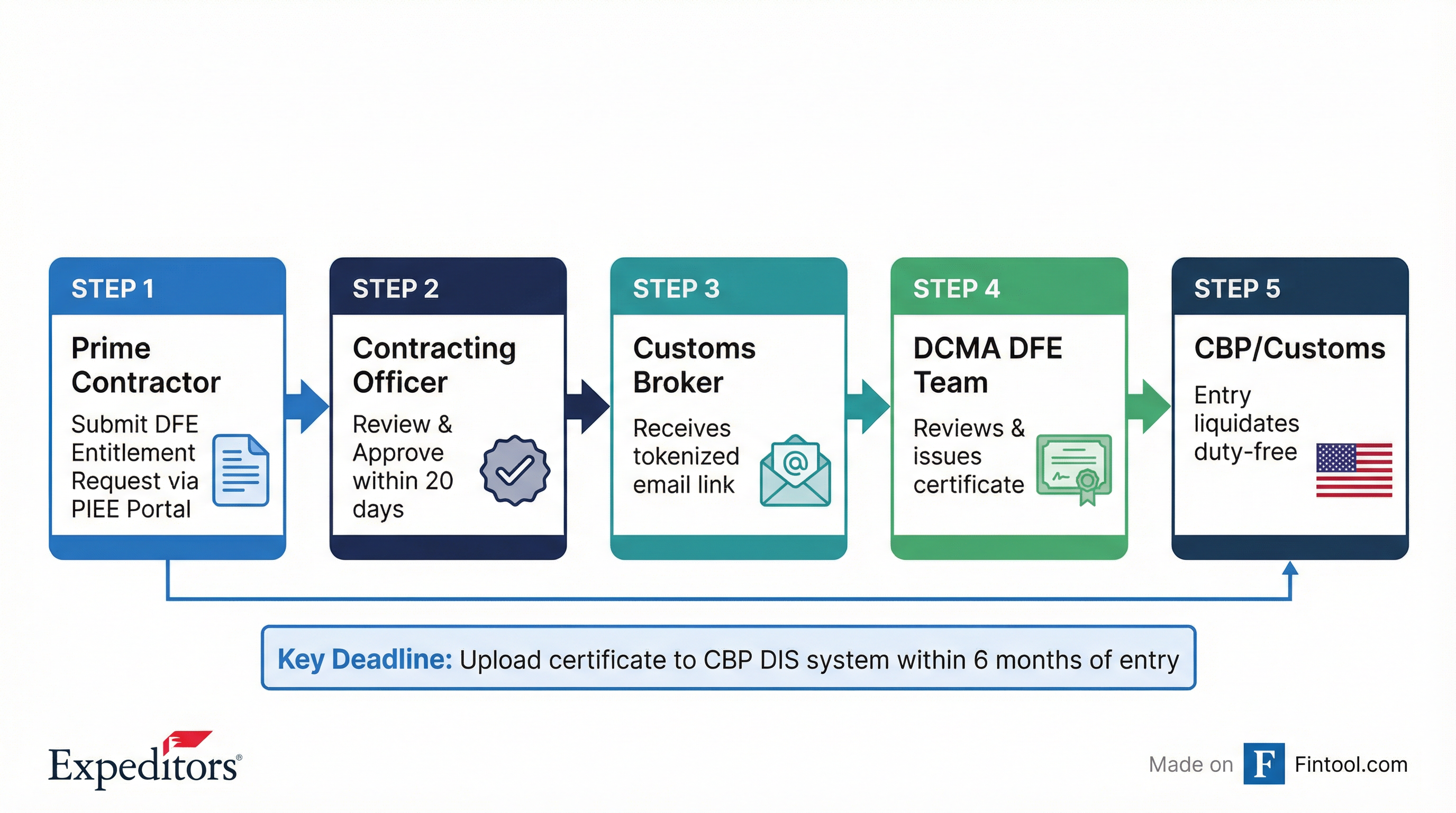

The webinar detailed the step-by-step mechanics of a process that—while established—remains unfamiliar to many contractors now scrambling to use it.

The process begins when a prime contractor submits a Duty-Free Entitlement request through the Procurement Integrated Enterprise Environment (PIEE) portal. The contracting officer has 20 days to review and approve the request. Upon approval, a tokenized email is automatically sent to the designated customs broker, who then creates the actual Duty-Free Entry certificate request after the goods have cleared customs.

The DCMA Duty-Free Entry Team—a unit of just five or six people—reviews approximately 30,000 certificates annually. Once approved, the broker must upload the certificate to U.S. Customs and Border Protection's Document Imaging System (DIS) within six months of the entry date.

"If by the 6-month mark, the certificate was not provided to Customs, they will liquidate the entry with duties and fees assessed against it at a regular duty rate," warned Natalia Bailey, Compliance Manager for Government Services at Expeditors.

Eligibility Requirements and Common Pitfalls

Not all imports qualify. The DFARS clause provides duty-free treatment for three categories:

- End products and components from qualifying countries—nations with reciprocal defense procurement agreements

- Eligible products under the WTO Government Procurement Agreement or free trade agreements

- Other foreign supplies where estimated duty exceeds $300 per shipment

Critically, the duty-free entry clause must be included in the contract, and duty costs cannot already be embedded in the contract price.

The most common reasons for returned entitlement requests include incorrect total contract dollar values, wrong contract expiration dates, incorrect contract types, and erroneous CAGE codes. Duplicate requests are automatically denied.

Supply Chain Complexity Multiplies Risk

For subcontractors, the process adds layers of complexity. Only prime contractors can submit entitlement requests in PIEE, meaning subcontractors who serve as importers of record must coordinate closely with their primes—while bearing the ultimate risk if certificates aren't processed in time.

"If something goes wrong during the DCMA Duty-Free Entry process and the certificate does not get approved timely, it is the subcontractor who will be on the hook for paying the duty," Bailey explained.

The webinar also addressed scenarios where shipments contain goods from multiple foreign suppliers or multiple contracts—situations that require multiple entitlements and certificates per customs entry, significantly complicating processing for both contractors and the understaffed DCMA team.

Why This Matters for Expeditors

Expeditors positions itself as experienced in navigating these complexities. The company's Government Services team has been fielding growing demand for DCMA Duty-Free Entry assistance as tariffs bite.

"We at Expeditors do not have a contract with the DoD for the procurement of goods or supplies, because that's not what we do. We provide services like transportation and customs brokerage," Holcomb clarified. "Our first-hand experience is only with acting as the customs broker in this process."

The logistics company has been on a strong run. Shares have climbed 44% over the past year, currently trading around $158, as the global supply chain dislocation and tariff complexity drive demand for sophisticated brokerage services.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $2,955 | $2,666 | $2,652 | $2,895 |

| Net Income ($M) | $236 | $204 | $184 | $222 |

| EBITDA Margin | 10.7%* | 10.5%* | 9.9%* | 10.4%* |

*Values retrieved from S&P Global

The Broader Policy Context

The DCMA duty-free mechanism exists within a broader policy environment where the Trump administration simultaneously pressures defense contractors on performance while tariffs strain their cost structures.

On January 7, 2026, President Trump signed an executive order titled "Prioritizing the Warfighter in Defense Contracting," which bars underperforming defense contractors from stock buybacks and dividends, caps executive compensation for laggards, and threatens to withdraw government advocacy for foreign military sales to companies failing to deliver on time and on budget.

The Pentagon's duty-free mandate serves the same underlying goal: maximizing defense budget effectiveness. As the memorandum stated, exemptions are necessary "to maximize the Department's budget to meet warfighter needs."

Meanwhile, the Senate Armed Services Committee has moved to codify and expand these exemptions. Section 874 of the Senate-passed FY 2026 NDAA would require the DoD to issue duty-free certificates for qualifying imports, removing the $300 threshold entirely.

What Contractors Should Do Now

The webinar concluded with actionable guidance for both prime contractors and subcontractors:

For Prime Contractors:

- Verify that DFARS 252.225-7013 is in your contract; if not, request a modification

- Flow down the clause to subcontractors

- Submit entitlement requests as early as possible—ideally when the purchase order is placed

- Use customs brokers with DCMA DFE experience

For Subcontractors:

- Confirm the clause was properly flowed down from the prime

- Share broker information with your prime to avoid token misdirection

- Monitor that entitlements are approved before goods arrive

- Maintain records of all DFE entitlements and certificates

The Bottom Line

The DCMA Duty-Free Entry process offers defense contractors a proven path to tariff relief, but only if they navigate the bureaucracy correctly. With processing times extending as demand surges and a six-month hard deadline for certificate submission, contractors who wait risk absorbing costs that should be the government's burden.

Expeditors' webinar underscores a broader market reality: in an era of aggressive trade policy and complex global supply chains, expertise in regulatory compliance has become a competitive differentiator—for logistics providers and their defense contractor clients alike.

Related