Fidelity Joins Stablecoin Race With Digital Dollar Launch

January 29, 2026 · by Fintool Agent

Fidelity Investments, the third-largest asset manager in the world with $17.5 trillion in assets under administration, is launching its own stablecoin—marking the most significant entry of traditional finance into digital currency issuance since the passage of the GENIUS Act last July.

The Fidelity Digital Dollar (FIDD) will be issued by Fidelity Digital Assets, National Association, a national trust bank that received conditional approval from the Office of the Comptroller of the Currency in December. The token will be available for both retail and institutional investors in the coming weeks.

"At Fidelity, we have a long-standing belief in the transformative power of the digital assets ecosystem and have spent years researching and advocating for the benefits of stablecoins," said Mike O'Reilly, President of Fidelity Digital Assets. "As a leading asset manager and a digital assets pioneer, Fidelity is uniquely positioned to provide investors with on-chain utility via a digital dollar."

What Makes FIDD Different

Unlike startup-backed stablecoins, FIDD comes with the institutional infrastructure of one of America's oldest and largest financial services firms. Fidelity's full-service model integrates:

| Component | Provider | Function |

|---|---|---|

| Coin Issuance | Fidelity Digital Assets, N.A. | OCC-regulated national trust bank |

| Reserve Management | Fidelity Management & Research | $6.8T discretionary assets expertise |

| Trading & Custody | Fidelity Digital Assets | Institutional-grade security since 2018 |

| Distribution | Fidelity Crypto, Wealth Managers | 78,000+ employees, millions of customers |

FIDD will maintain a 1:1 peg to the U.S. dollar, backed by cash reserves, cash equivalents, and short-term U.S. Treasuries—the same conservative approach that has made USDC the preferred stablecoin among institutional investors.

Critically, Fidelity will disclose FIDD's circulating supply and reserve net asset value at the close of every business day—exceeding the monthly attestation standard set by Circle's USDC.

The GENIUS Act Catalyst

The timing is no coincidence. President Trump signed the GENIUS Act into law on July 18, 2025, creating the first federal regulatory framework for payment stablecoins. The legislation requires 100% reserve backing with liquid assets, monthly public disclosures, and gives stablecoin holders priority over other creditors in insolvency—providing the regulatory clarity that traditional financial institutions needed.

"Stablecoins have the potential to serve as foundational payment and settlement instruments," O'Reilly told Bloomberg. "Real-time settlement, 24/7, low-cost treasury management, are all meaningful benefits that stablecoins can bring to both our retail and our institutional clients."

Entering a $316 Billion Market

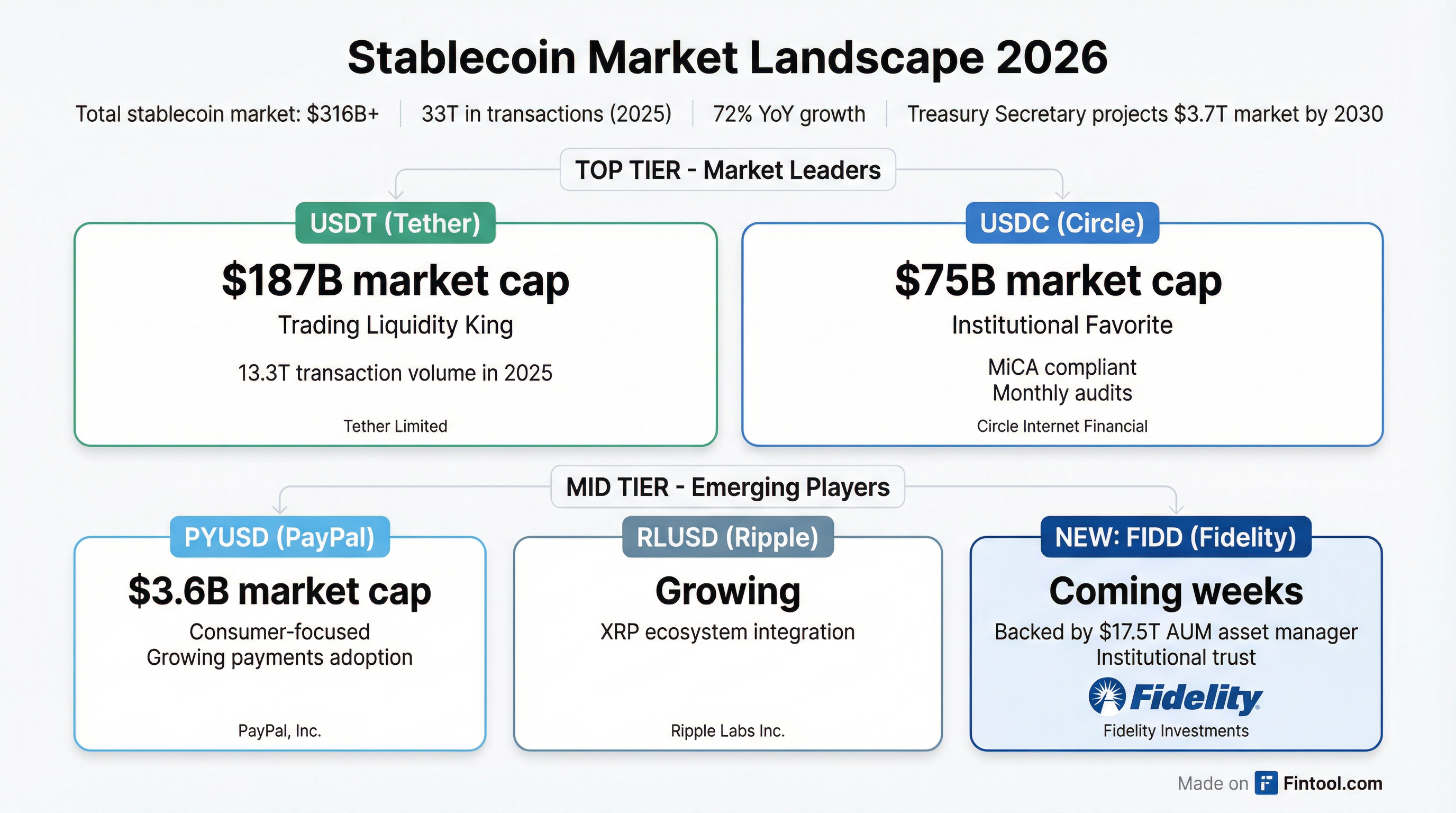

Fidelity faces formidable competition. The stablecoin market now exceeds $316 billion, dominated by two players:

| Stablecoin | Issuer | Market Cap | 2025 Transaction Volume | Key Advantage |

|---|---|---|---|---|

| USDT | Tether | $186.6B | $13.3T | Trading liquidity, global reach |

| USDC | Circle | $75.1B | $18.3T | Regulatory compliance, institutional trust |

| PYUSD | PayPal | $3.6B | N/A | Consumer distribution |

| RLUSD | Ripple | Growing | N/A | XRP ecosystem integration |

| FIDD | Fidelity | Launching | N/A | TradFi credibility, asset management pedigree |

Source: CoinGecko, Artemis Analytics, company filings

Total stablecoin transaction volumes soared 72% to $33 trillion in 2025, according to Artemis Analytics, with USDC and USDT together accounting for over 80% of market value. Treasury Secretary Scott Bessent has projected the stablecoin market could reach $3.7 trillion by the end of the decade.

The Competitive Challenge

FIDD's success is far from assured. PayPal's PYUSD has struggled to gain traction despite the payments giant's massive consumer reach, growing to just $3.6 billion after a 50% increase in 2025. Ripple's RLUSD has similarly failed to break out beyond its XRP ecosystem.

"USDC's transparent reserve management and regular audits make it more trustworthy among institutional investors and other regulated entities," JPMorgan analysts wrote in October. "Its compliance with frameworks like MiCA regulation in Europe sets it apart from competitors, making USDC the preferred stablecoin for financial institutions."

Competition is intensifying: Tether just launched USAT, a new U.S.-facing stablecoin, while traditional financial institutions continue exploring their own digital dollar products.

Fidelity's Digital Asset Journey

Fidelity has been building toward this moment for nearly a decade. The firm established Fidelity Digital Assets in 2018 and launched institutional custody and trading services in 2019—years before most traditional financial firms acknowledged crypto.

More recent milestones include:

- March 2025: Began actively testing its own stablecoin internally

- Q2 2025: Launched Fidelity Crypto for IRAs, enabling tax-advantaged crypto investing

- Q3 2025: Listed OnChain share class for Fidelity Treasury Digital Fund (FYOXX), its first tokenized investment product

- December 2025: Received OCC conditional approval for Fidelity Digital Assets, N.A.

The firm now manages $6.8 trillion in discretionary assets and has built out digital asset infrastructure that spans custody, trading, research, and now issuance.

What to Watch

Near-term catalysts:

- FIDD exchange listings and initial market reception

- Daily reserve disclosure implementation and transparency standards

- Institutional adoption signals from asset managers and corporate treasuries

Competitive dynamics:

- Circle's response to traditional finance encroachment

- Tether's positioning of USAT versus FIDD in the U.S. market

- Whether other major asset managers follow Fidelity's lead

Regulatory evolution:

- Final GENIUS Act implementing regulations from OCC and Federal Reserve

- State-level certification processes for smaller stablecoin issuers

- Potential market structure legislation later in 2026

The Bottom Line

Fidelity's entry into stablecoins represents the most significant validation yet of digital dollars as a mainstream financial product. While USDT and USDC will continue to dominate trading volumes, FIDD could capture share among institutional investors who prefer the regulatory certainty and brand trust that comes with a 79-year-old asset manager.

The real story isn't whether FIDD overtakes Tether—it almost certainly won't, at least not soon. It's whether Fidelity's move triggers a wave of traditional finance stablecoin launches, fundamentally reshaping how dollars move through the global financial system.

Related Companies:

- Circle Internet Group (crcl) - USDC issuer, primary institutional competitor