First Busey's Heir Apparent Exits: CrossFirst CEO Maddox Departs with $9M, 5 Months Before Planned Succession

January 27, 2026 · by Fintool Agent

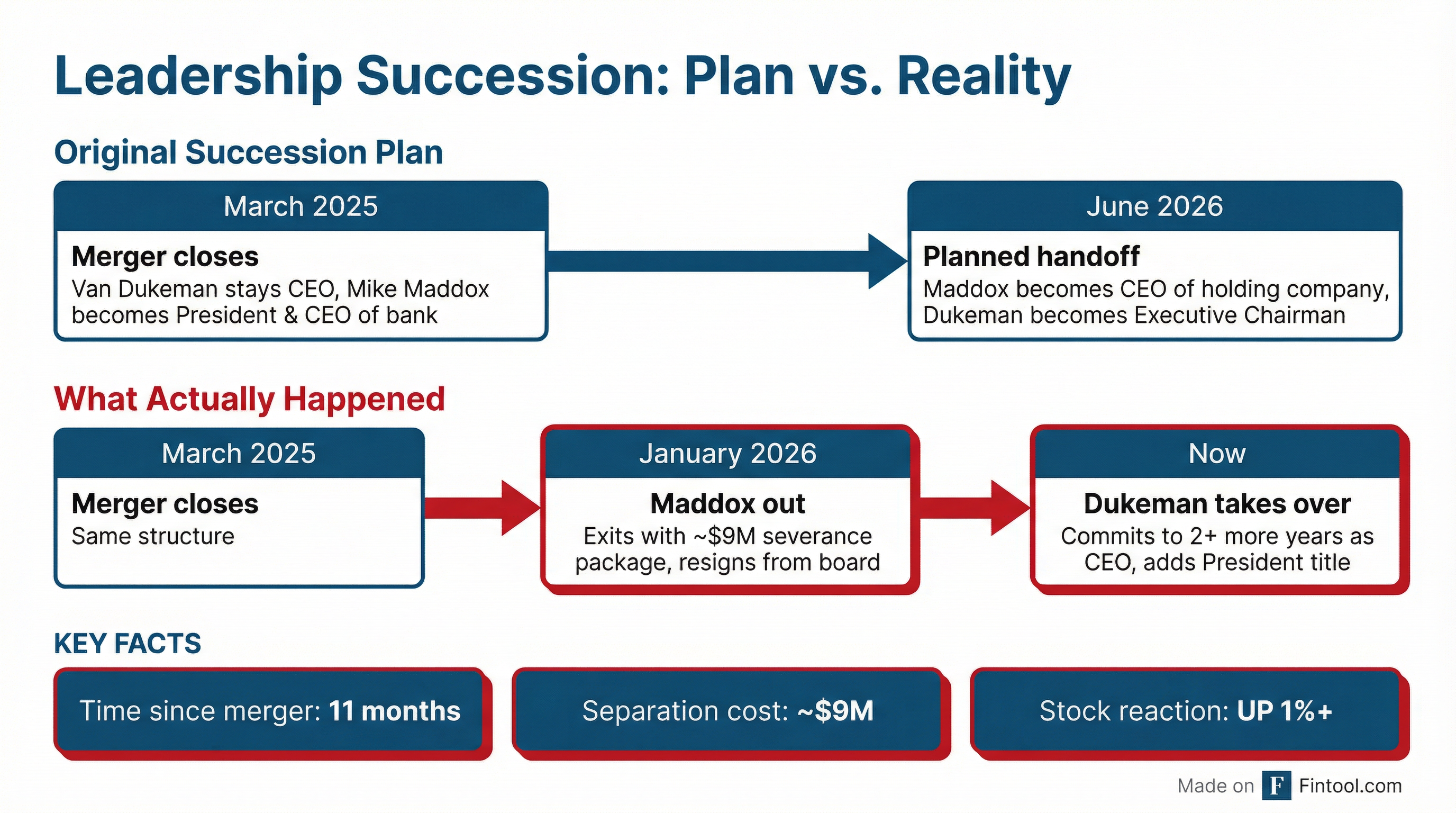

First Busey Corporation announced today that Michael J. Maddox, the former CrossFirst Bank CEO who was designated to succeed Van Dukeman as chief executive, has "separated" from the company effective immediately—just 11 months after the $3 billion merger closed and roughly five months before he was scheduled to take the helm.

The departure costs approximately $9 million in severance and benefits, a substantial price tag for abandoning a succession plan that was central to the CrossFirst deal thesis.

Investors appear unfazed. BUSE shares rose 1.3% to $25.05 in regular trading, with after-hours prints at $25.70—suggesting the market has more confidence in 67-year-old Dukeman remaining at the controls than it did in the planned handoff.

The Succession Plan That Wasn't

When First Busey announced its acquisition of CrossFirst Bankshares in August 2024, the dual-CEO structure was presented as a strength. Dukeman, who has led Busey since 2007, would remain as Chairman and CEO of the holding company. Maddox, who built CrossFirst from a Kansas City startup into a $7.5 billion regional player, would run the combined bank and eventually ascend to the top job.

The merger agreement was explicit: Maddox would become CEO of First Busey "on the earlier of the one-year anniversary of the bank merger or the 18-month anniversary of the holding company merger." With the bank merger closing in June 2025, that meant Maddox was scheduled to take over around June 2026.

Instead, the board has "reappointed" Dukeman as President of First Busey and CEO of Busey Bank—the roles Maddox held since March 2025—and elevated Tony Hammond, the President of Regional Banking, to lead the bank's day-to-day operations.

What Went Wrong?

The 8-K filing offers no explanation for the split, using only the neutral term "separated" to describe Maddox's exit. The separation letter requires a release of claims from Maddox in exchange for his benefits—standard for negotiated departures.

Several factors may have contributed:

Integration friction: Merging two distinct cultures—Busey's conservative Midwest deposit franchise with CrossFirst's growth-oriented commercial platform—required delicate navigation. The bank merger only closed in June 2025, meaning the organizations were still integrating systems and teams when tensions may have emerged.

Power sharing challenges: The dual-CEO structure created inherent complexities. Maddox ran Busey Bank day-to-day while Dukeman remained CEO of the holding company, creating potential for conflicting priorities on everything from capital allocation to expense management.

Board dynamics: The combined board included eight legacy Busey directors and five from CrossFirst. With Maddox gone, the CrossFirst contingent loses its most prominent voice. The bylaws required 75% board approval to remove either Dukeman or Maddox from their positions—suggesting the departure was negotiated rather than forced.

Dukeman's comfort: At 67, Dukeman committed to "at least two more years" running the combined company. His willingness to reassume the President title and bank CEO role suggests either concern about the succession or simply a preference for remaining in operational control.

The $9 Million Exit

The separation package is comprehensive:

| Component | Amount |

|---|---|

| Cash severance (base + bonus through 3rd anniversary) | $4,363,333 |

| 2025 performance bonus | TBD (actual performance) |

| Unvested retention award | $4,175,559 |

| Accelerated equity vesting | At target |

| Outplacement reimbursement | Up to $25,000 |

First Busey expects to record approximately $9 million in non-recurring pre-tax expense in Q1 2026 for the portion not previously accrued. Maddox remains bound by non-compete, non-solicitation, and non-disclosure covenants from his original employment agreement.

Strong Q4 Results Provide Cover

The departure was announced alongside Q4 2025 earnings that beat expectations and demonstrated the merger's financial logic is intact:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Net Income | $60.8M | $28.1M | +116% |

| Diluted EPS | $0.63 | $0.49 | +29% |

| Adj. EPS | $0.68 | $0.53 | +28% |

| Net Interest Margin | 3.71% | 2.95% | +76 bps |

| Adj. ROAA | 1.41% | 1.02% | +39 bps |

| Adj. ROATCE | 13.58% | 11.93% | +165 bps |

The company achieved 100% of its announced $25 million expense synergies by year-end 2025, with full realization expected in 2026. Tangible book value per share grew 13.1% year-over-year to $20.23.

What Happens Now

The new leadership structure:

- Van Dukeman (67): Chairman, President & CEO of First Busey; Chairman & CEO of Busey Bank

- Tony Hammond: President of Busey Bank, overseeing regional operations

- Chris Chan: CFO (joined September 2025 from FNB Corporation)

Dukeman's commitment to "at least two more years" pushes any succession discussion to 2028 or beyond. The board will need to identify a new eventual successor—whether Hammond, Chan, or an external candidate.

For investors, the calculus is relatively simple: the stock has risen 4% since the merger closed and 36% from its April 2025 lows. The integration is delivering promised synergies. The departure removes uncertainty about a leadership transition that the market may have viewed skeptically.

The biggest question may be cultural. CrossFirst executives—including COO Amy Fauss who joined as Chief Information and Technology Officer—remain at the combined company. But Maddox was the visible link between the organizations. His exit signals that this is now firmly Busey's show.

Key Dates to Watch

- Q1 2026: $9M non-recurring charge for Maddox separation

- January 30, 2026: Quarterly dividend payment ($0.26 per share, up 4%)

- April 2026: Next earnings report—first full quarter under revised leadership

- 2027: Two-year anniversary of bank merger; bylaw protections may begin expiring

- 2028+: Dukeman's stated minimum commitment period ends