Gallo Acquires Four Roses Bourbon for $775M, Becoming a Major Force in American Whiskey

February 6, 2026 · by Fintool Agent

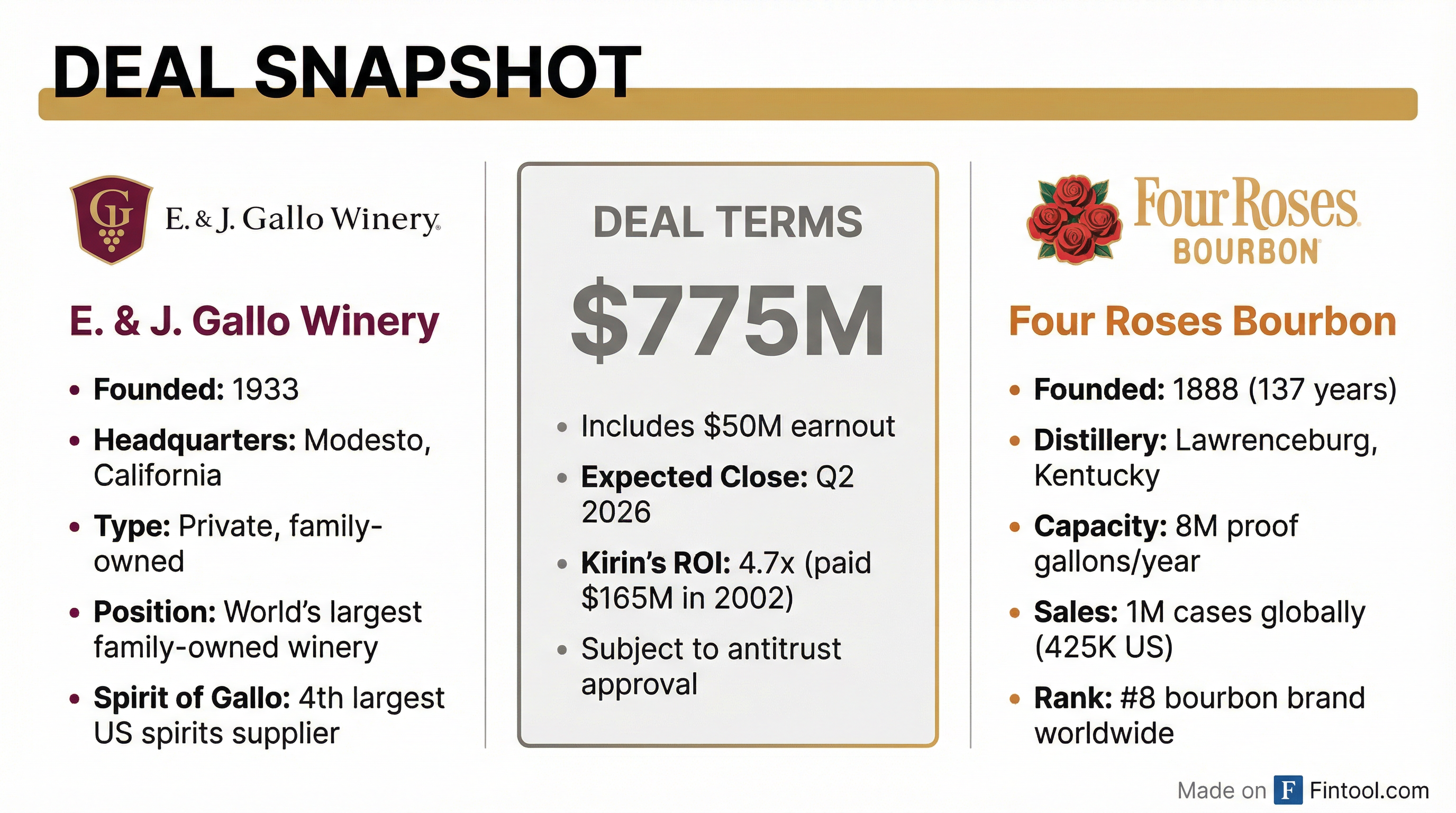

E. & J. Gallo Winery has agreed to acquire Four Roses Bourbon from Japan's Kirin Holdings for up to $775 million—the wine giant's largest deal ever in American whiskey and a strategic pivot that transforms Spirit of Gallo into a serious player in the premium bourbon market.

The transaction, which delivers Kirin a 4.7x return on its original $165 million investment in 2002, marks the end of an era for one of bourbon's most storied brands—and signals Gallo's ambition to build a spirits empire to rival its wine dominance.

The Deal

Gallo will pay up to $775 million for Four Roses, including:

- Base price: $725 million at closing

- Earnout: Additional $50 million contingent on Four Roses meeting undisclosed revenue targets post-acquisition

The deal is expected to close in Q2 2026, subject to U.S. antitrust approval. Gallo confirmed no changes are planned to Four Roses' operations, production, or distribution.

| Deal Metric | Value |

|---|---|

| Purchase Price | Up to $775M |

| Base Payment | $725M |

| Contingent Earnout | $50M |

| Expected Close | Q2 2026 |

| Kirin's 2002 Purchase Price | $165M |

| Implied Return Multiple | 4.7x |

| Holding Period | 24 years |

The sale price came in below initial expectations. The Financial Times reported in October 2025 that Kirin was seeking up to $1 billion, with UBS running the sale process.

A 137-Year-Old Brand with a Complicated History

Four Roses traces its origins to 1888, when Paul Jones Jr. trademarked the name—allegedly inspired by a romantic gesture involving a corsage of four red roses. The brand's Spanish Mission-style distillery in Lawrenceburg, Kentucky, built in 1910, is listed on the National Register of Historic Places.

But Four Roses' path to its current status was anything but smooth.

The Seagram Era (1943-2002): Canadian distiller Seagram acquired Four Roses in 1943 and made a fateful decision in the late 1950s—discontinuing the bourbon in the U.S. market and converting the brand to a low-end blended whiskey domestically while shipping the quality bourbon to Europe and Japan. For decades, American consumers knew Four Roses only as a bottom-shelf blend.

The Kirin Renaissance (2002-2026): When Kirin purchased Four Roses in 2002—following Seagram's breakup and brief ownership by Vivendi, Pernod Ricard, and Diageo—the Japanese brewer immediately discontinued the blended whiskey and returned Four Roses Kentucky Straight Bourbon to American shelves.

Under Kirin's stewardship, Four Roses became a craft bourbon darling, known for using ten different bourbon recipes derived from two mash bills and five proprietary yeast strains—a complexity no other major Kentucky distillery matches. In 2015, Kirin invested $55 million to double production capacity from 4 million to 8 million proof gallons annually.

Today, Four Roses ranks as the 8th largest bourbon brand globally with approximately 1 million cases in annual sales (425,000 in the U.S.).

Why Kirin Is Selling

Kirin's decision to exit bourbon reflects a broader strategic pivot away from beverages toward healthcare and health sciences.

The Japanese conglomerate has been aggressively repositioning its portfolio:

| Kirin Healthcare M&A | Value | Year |

|---|---|---|

| Blackmores (Australian vitamins) | $1.2B | 2023 |

| Fancl (Japanese supplements) | $1.5B | 2024 |

| Four Roses (Divestiture) | $775M | 2026 |

Kirin aims to grow its health science unit to ¥500 billion ($3.3 billion) in annual revenue—roughly five times its current level.

"This transaction will allow Kirin to reallocate its resources toward businesses that could further grow by leveraging Kirin's own organizational capabilities," the company said in its announcement.

The timing also reflects challenging conditions in the spirits industry. Domestic American whiskey sales fell 0.9% to $5.1 billion in 2025, with volume declining 1% to 30 million nine-liter cases, according to the Distilled Spirits Council.

Gallo's Spirits Ambition

For Gallo, the acquisition represents a transformational move in American whiskey.

Founded in 1933 by brothers Ernest and Julio Gallo, the Modesto, California company is the world's largest family-owned winery. But through its Spirit of Gallo division—now the 4th largest spirits supplier in the U.S. by volume—the company has been steadily building a spirits portfolio.

Spirit of Gallo Portfolio Highlights:

| Brand | Category | Notable Status |

|---|---|---|

| High Noon | Hard Seltzer | Top-selling spirit-based RTD |

| New Amsterdam | Vodka | Mass-market leader |

| E&J Brandy | Brandy | America's top-selling brandy |

| Horse Soldier | Bourbon | Ultra-premium (acquired 2022) |

| The Dalmore | Scotch Whisky | Imported luxury single malt |

| Camarena | Tequila | Value segment |

| Don Fulano | Tequila | Super-premium |

| RumChata | Cream Liqueur | Acquired 2021 |

Gallo made its first move into American whiskey in 2022 with a strategic investment in Horse Soldier Bourbon, an ultra-premium brand founded by Green Berets.

But Four Roses is a different proposition entirely—an established, scalable brand with decades of heritage, a devoted following among bourbon enthusiasts, and production capacity to support significant growth.

"Gallo has entered into a purchase agreement with Kirin to acquire Four Roses Bourbon," a Gallo spokesperson confirmed. "As we move through the regulatory process and await a closing date, we're incredibly excited about this acquisition and the opportunity to welcome Four Roses into our portfolio."

What's at Stake for Bourbon Purists

The acquisition raises an essential question for bourbon aficionados: Will Gallo maintain Four Roses' craft-focused positioning, or push the brand toward mass-market distribution?

"Bourbon fans have always recognized the quality and uniqueness of Four Roses—what with their ten different recipes, something no other Kentucky brand can approach," said VinePair spirits editor Aaron Goldfarb. "The distillery has never done anything gimmicky like deal in weird finishes, fanciful brand names, luxury packaging, or celebrity partnerships. They simply put out great, mature, complexly-blended bourbon year after year."

Gallo's statement that "no changes are planned to operations, production, or distribution" offers some reassurance. But the economics of a $775 million acquisition will inevitably create pressure to grow the brand beyond its current 425,000 cases in the U.S.

The good news: Four Roses has the production capacity to scale. The 2015 expansion doubled output to 8 million proof gallons annually—enough to fill over 130,000 barrels per year. That capacity has been underutilized, suggesting growth potential without compromising quality.

Market Context

Despite the deal's significance, it arrives during a challenging period for American whiskey. The category's flat-to-declining volumes contrast sharply with tequila's continued surge and the resilience of premium spirits.

However, there's nuance in the data. While overall volumes are soft, demand for high-end premium whiskeys remains robust.

"There is still a great deal of consumer interest and passion for America's native spirit," said Chris Swonger, CEO of the Distilled Spirits Council. He noted that premium whiskeys—which age longer and command higher prices—continue to perform well.

Kentucky's bourbon industry remains at historic scale:

- 125 licensed distilleries operating in the state (all-time high)

- 16.1 billion barrels aging in Kentucky warehouses (all-time high)

- $10.6 billion annual economic contribution to Kentucky

What to Watch

Antitrust review: The deal requires U.S. approval. Given Gallo's relatively small share of the bourbon market, clearance is expected without significant delay.

Integration approach: Will Gallo keep Four Roses as an independent operation (like Kirin did), or integrate it more closely with Spirit of Gallo's distribution network?

Pricing and positioning: Any moves to lower prices or pursue mass-market distribution could alienate Four Roses' loyal following—but would likely accelerate volume growth.

Investment in aged inventory: Premium bourbon requires years of aging. Whether Gallo continues to invest in building aged inventory will signal its long-term commitment to the brand's quality positioning.