GameStop's Ryan Cohen Targets 'Very Big' Consumer Megadeal as Bitcoin Exit Looms

February 2, 2026 · by Fintool Agent

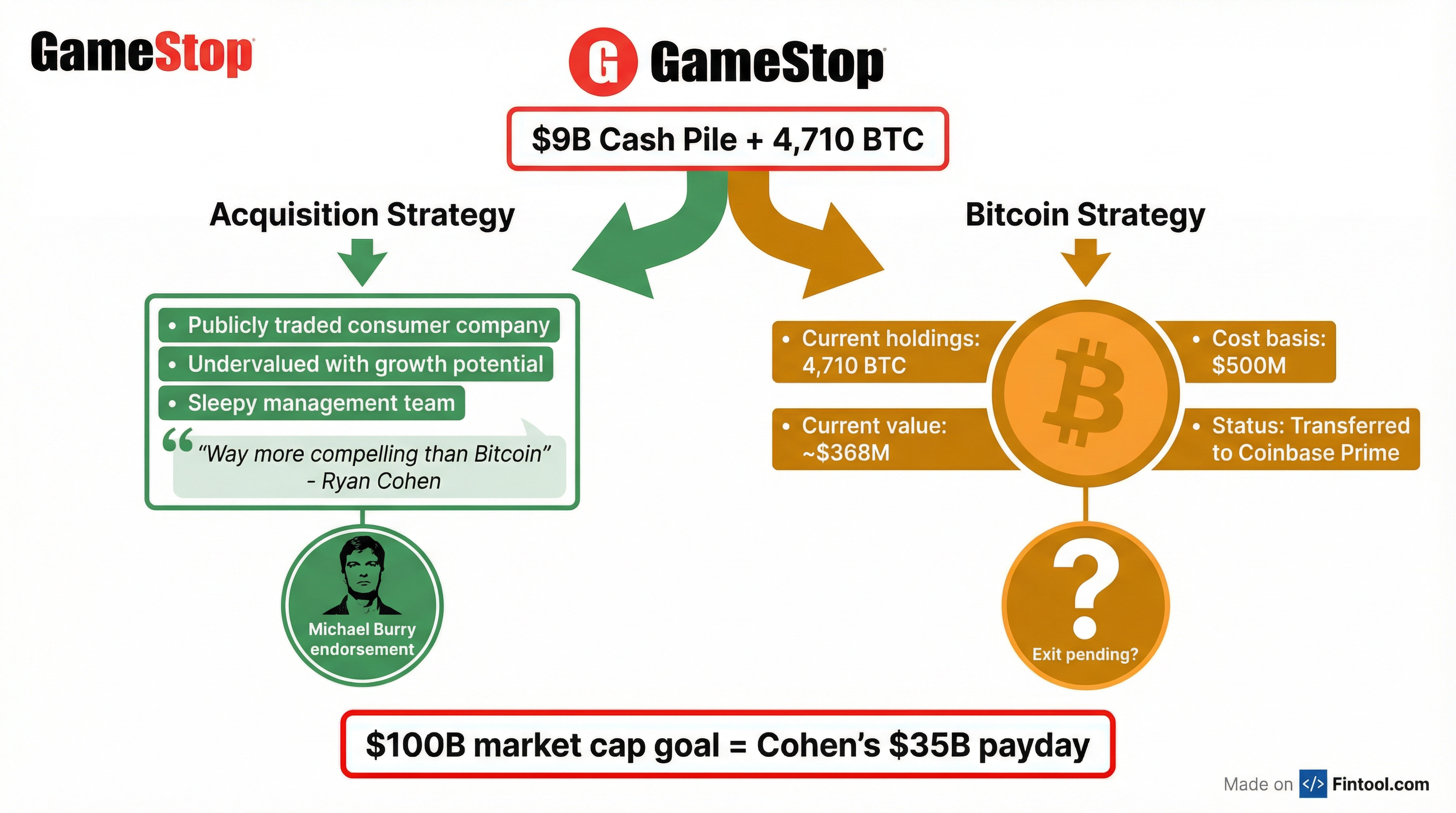

Gamestop shares surged 8% Monday after CEO Ryan Cohen doubled down on plans to acquire a "very, very, very big" publicly traded consumer company—a bet he says is "way more compelling than Bitcoin" and could transform the meme-stock darling into a $100 billion juggernaut.

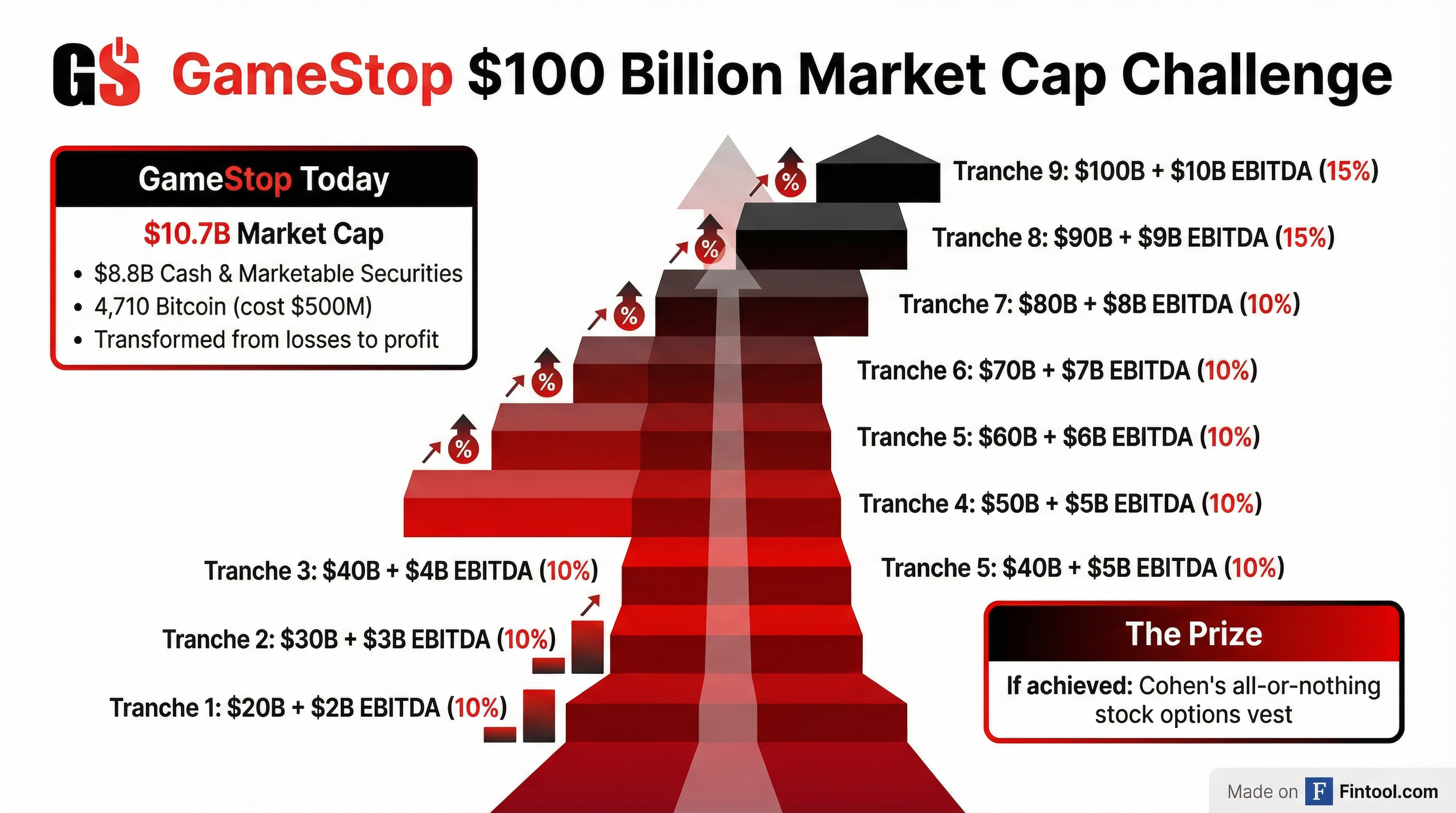

The stakes couldn't be higher: Cohen's entire compensation is tied to hitting that $100 billion market cap. If he succeeds, his stock options vest and he pockets up to $35 billion. If he fails, he gets nothing.

The Audacious Plan

"It's gonna be really big. Really big. Very, very, very big," Cohen told CNBC on Friday. "It's transformational. Not just for GameStop, but ultimately, within the capital markets… this is something that really has never been done before within the history of the capital markets."

Cohen, the co-founder and former CEO of Chewy, declined to name specific targets but outlined his criteria: a publicly traded consumer company that is "undervalued, high quality, durable, scalable with growth prospects" with a "sleepy management team" that he can optimize.

"If it works, it's genius. If it doesn't work, then, you know, it will be totally, totally foolish," Cohen acknowledged. "But I believe we have the components to make it work."

The Cash Pile

GameStop has ammunition. As of November 1, 2025, the company held $7.8 billion in cash and cash equivalents, plus marketable securities bringing the total war chest to approximately $8.8 billion.

| Metric | Q4 2024 | Q2 2025 | Q3 2026 (Latest) |

|---|---|---|---|

| Cash & Cash Equivalents | $922M | $4.2B | $7.8B |

| Total Equity | $1.3B | $4.4B | $5.3B |

| Net Income | $63M | $15M | $77M |

The cash pile has ballooned thanks to multiple stock offerings that tapped into retail investor enthusiasm. From under $1 billion in early 2025, GameStop now sits on nearly $9 billion in liquid assets—enough to fund a significant acquisition without debt financing.

Bitcoin: Exit Stage Left?

The crypto elephant in the room is GameStop's 4,710 Bitcoin, purchased for $500 million during Q2 2025. As of November 2025, those holdings were valued at $519.4 million—but Bitcoin's subsequent decline has erased those gains.

On-chain data from CryptoQuant shows GameStop transferred its entire Bitcoin stash to Coinbase Prime in late January, sparking immediate speculation of an impending sale.

When asked directly whether GameStop would liquidate its Bitcoin to fund acquisitions, Cohen declined to confirm—but his words were telling: "I'm not prepared to say," he told CNBC, adding that the new acquisition strategy is "way more compelling than Bitcoin."

The timing is notable. Bitcoin has pulled back significantly from its highs, and GameStop's holdings—purchased at an average price around $106,000 per coin—are now underwater at current prices near $78,000. A sale now would crystallize a meaningful loss, but it would also free up capital for Cohen's "transformational" deal.

The All-or-Nothing Payday

Cohen's compensation structure is unprecedented in its risk. On January 6, 2026, GameStop's board granted him stock options to purchase 171,537,327 shares at $20.66 per share—but with extraordinary strings attached.

The award is divided into nine tranches, each requiring both a market capitalization milestone and a cumulative EBITDA threshold:

| Tranche | Market Cap Hurdle | Cumulative EBITDA | % of Award |

|---|---|---|---|

| 1 | $20 Billion | $2.0 Billion | 10% |

| 2 | $30 Billion | $3.0 Billion | 10% |

| 3 | $40 Billion | $4.0 Billion | 10% |

| 4 | $50 Billion | $5.0 Billion | 10% |

| 5 | $60 Billion | $6.0 Billion | 10% |

| 6 | $70 Billion | $7.0 Billion | 10% |

| 7 | $80 Billion | $8.0 Billion | 10% |

| 8 | $90 Billion | $9.0 Billion | 15% |

| 9 | $100 Billion | $10.0 Billion | 15% |

Source: GameStop 8-K filing

"Under the award, Mr. Cohen receives no guaranteed pay—no salary, no cash bonuses, and no stock that vests simply over time," the company stated. "Instead, his compensation is entirely 'at-risk.'"

There is no interpolation between hurdles. If GameStop never reaches $20 billion in market cap and $2 billion in cumulative EBITDA, Cohen receives nothing. The award is subject to shareholder approval at a special meeting expected in March or April 2026.

Burry Bets on Cohen

Perhaps the most notable endorsement came from Michael Burry—the legendary investor who famously shorted the housing market before the 2008 financial crisis and whose story was immortalized in "The Big Short."

On January 26, Burry disclosed via Substack that he has been buying GameStop shares, saying the stock may be approaching "1x tangible book value / 1x net asset value." He praised Cohen's capital allocation skills, writing that getting Cohen "to invest and deploy the company's capital could matter perhaps for the next 50 years."

Trading volumes went parabolic on the news—roughly 11.9 million shares traded by noon, more than six times the typical volume. Short-term call activity more than doubled its 20-day average.

Board member Lawrence Cheng also added conviction, purchasing 5,000 shares on January 26 for approximately $114,000.

The Transformation Track Record

Cohen's bullishness isn't unfounded. Since joining GameStop's board in January 2021, he has overseen a dramatic financial turnaround:

| Metric | January 2021 | Latest |

|---|---|---|

| Market Capitalization | $1.3 billion | $10.7 billion |

| SG&A Expenses (TTM) | $1.7 billion | $951 million |

| Net Income (TTM) | -$381 million | +$422 million |

Source: GameStop 8-K filing

The company has transitioned from a money-losing legacy retailer hemorrhaging cash to a profitable entity sitting on a mountain of liquidity. But revenue continues to decline—down 4.5% year-over-year in Q3 2026—as the core video game retail business shrinks.

Recent quarterly financials show the transformation:

| Metric | Q3 2025 | Q2 2026 | Q3 2026 |

|---|---|---|---|

| Revenue | $860M | $972M | $821M |

| Gross Margin | 29.9% | 29.1% | 33.3% |

| Net Income | $17M | $169M | $77M |

GameStop continues to shrink its physical footprint. At least 470 U.S. store closures have been confirmed so far in 2026, following 590 closures during fiscal 2024. The company has exited Ireland, Switzerland, Austria, and Germany; sold its Italian business; and is seeking buyers for its French and Canadian subsidiaries.

The Short Interest Wild Card

GameStop remains heavily shorted. As of mid-January 2026, short interest stood at 65.8 million shares with 12.6 days to cover—fuel that could ignite another squeeze if Cohen's acquisition plans materialize.*

| Date | Short Interest | Days to Cover |

|---|---|---|

| November 14, 2025 | 69.1M | 13.1 |

| December 15, 2025 | 68.0M | 8.9 |

| January 15, 2026 | 65.8M | 12.6 |

*Values retrieved from S&P Global

The combination of high short interest, a dedicated retail investor base, and potential acquisition catalysts creates conditions for significant volatility.

What to Watch

Shareholder vote (March/April 2026): Cohen's compensation package requires approval. Given his track record and the meme-stock investor base's loyalty, passage seems likely—but it's not guaranteed.

Bitcoin disposition: Any sale of the 4,710 BTC would signal Cohen is serious about redeploying capital into acquisitions. Watch for 8-K filings or blockchain transfers.

Acquisition announcement: Cohen has already identified "several potential targets." Any deal announcement would need to be substantial—likely in the $10-30 billion range—to move the needle on a $100 billion market cap goal.

Q4 earnings: The company's next quarterly report will provide updated cash positions and any commentary on strategic direction.

The Bottom Line

Ryan Cohen is making the ultimate bet: his entire compensation hinges on achieving what most analysts consider a nearly impossible goal—growing GameStop from $10.7 billion to $100 billion in market cap. To get there, he's willing to jettison the company's Bitcoin and pursue a "transformational" acquisition that he claims will be unlike anything capital markets have seen.

With Michael Burry in his corner, $9 billion in cash, and an army of retail investors ready to charge, Cohen has the ammunition. Whether he can hit the target—or even get close—will determine if his gamble was genius or folly.

As Cohen himself put it: "There are a lot of diamonds in the rough… that have sleepy management teams. I didn't fix GameStop to stop there."