'Genius or Totally Foolish': Ryan Cohen Eyes Major Acquisition to Transform GameStop Into $100B Giant

January 30, 2026 · by Fintool Agent

Gamestop CEO Ryan Cohen has revealed plans to pursue a transformative acquisition, telling The Wall Street Journal he aims to turn the $11 billion video game retailer into a "$100 billion-plus juggernaut."

The 40-year-old billionaire disclosed he is eyeing a "big" acquisition of a publicly traded company, likely in the consumer or retail sector. "It's ultimately either going to be genius or totally, totally foolish," Cohen said in a rare interview—his most extensive public comments since taking control of the company in 2021.

Shares rose 4.5% on the news, trading at $23.83, as investors digested the prospect of Cohen finally deploying GameStop's massive cash hoard.

The $35 Billion Bet

Cohen's acquisition ambitions are directly tied to a landmark compensation package approved by the board earlier this month. The structure is unprecedented: zero guaranteed pay—no salary, no cash bonuses, no time-based vesting.

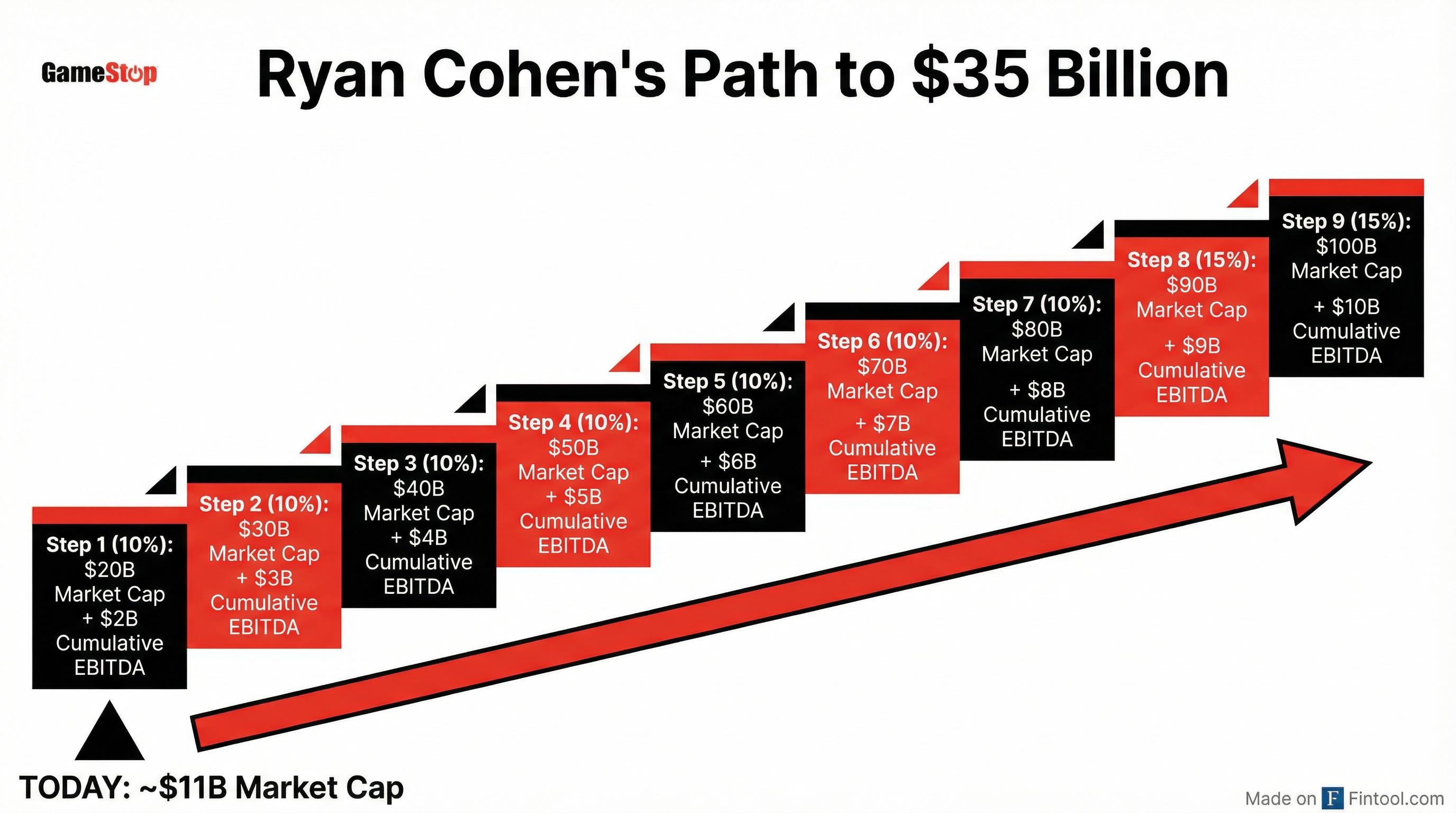

Instead, Cohen received options on 171.5 million shares at $20.66, structured across nine tranches that only vest if GameStop achieves both market cap and profitability milestones.

The first tranche—representing 10% of the award—requires GameStop to hit $20 billion in market cap while generating $2 billion in cumulative EBITDA from Q1 2026 onward. For the full award to vest, the company must reach $100 billion in market cap with $10 billion in cumulative EBITDA.

| Tranche | % of Award | Market Cap Hurdle | Cumulative EBITDA Hurdle |

|---|---|---|---|

| 1 | 10% | $20B | $2B |

| 2 | 10% | $30B | $3B |

| 3 | 10% | $40B | $4B |

| 4 | 10% | $50B | $5B |

| 5 | 10% | $60B | $6B |

| 6 | 10% | $70B | $7B |

| 7 | 10% | $80B | $8B |

| 8 | 15% | $90B | $9B |

| 9 | 15% | $100B | $10B |

Source: GameStop 8-K Filing

For context: GameStop's trailing four-quarter EBITDA is approximately $238 million. Reaching $2 billion—let alone $10 billion—would require a fundamental transformation of the business.

The War Chest

Cohen has ammunition. GameStop closed Q3 with $8.8 billion in cash, cash equivalents, and marketable securities—a staggering sum for an $11 billion company. This includes approximately $519 million in Bitcoin purchased during 2025.

The cash pile represents roughly 80% of GameStop's current market capitalization—an extraordinary ratio for any public company. It was built largely through stock offerings during the meme stock rallies of 2021-2024, when Cohen capitalized on retail investor enthusiasm to raise billions.

| Metric | Q4 FY25 | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|---|

| Cash & Equivalents | $4.8B | $6.4B | $8.7B | $7.8B |

| Revenue | $1.28B | $732M | $972M | $821M |

| Net Income | $131M | $45M | $169M | $77M |

Note: GameStop fiscal year ends in February. FY26 corresponds to calendar 2025.

Michael Burry's Endorsement

The timing of Cohen's disclosure coincides with a notable vote of confidence. Michael Burry—the hedge fund manager who famously bet against subprime mortgages before the 2008 financial crisis—revealed on January 26 that he has been buying GameStop shares.

In a Substack post, Burry compared Cohen to Warren Buffett, arguing the CEO is "doing what Warren Buffett did" by turning a struggling operating business into a platform for capital allocation.

"Ryan is making lemonade out of lemons. He has a crappy business, and he is milking it best he can while taking advantage of the meme stock phenomenon to raise cash and wait for an opportunity to make a big buy of a real growing cash cow business." — Michael Burry

Burry said he expects to be buying near "1x tangible book value" and noted that Cohen's compensation structure—with its ambitious acquisition-enabling milestones—is "the deal I would want if I wanted more ownership, was sitting on a growing, giant pile of cash and planned a transformative acquisition."

The Transformation Track Record

Cohen pointed to GameStop's turnaround as evidence of his ability to execute. When he joined the board on January 11, 2021, GameStop's market cap was approximately $1.3 billion. Today it stands at roughly $10.7 billion—a 615% increase during his tenure.

The operational metrics are equally dramatic:

- SG&A Expenses: Reduced from $1.7 billion in FY2021 to $951 million in trailing four quarters—a 44% reduction

- Profitability: Transitioned from $381 million net loss in FY2021 to $422 million net income over trailing four quarters

- Cash Flow: Six consecutive quarters of positive operating cash flow

But the core retail business continues to struggle. Q3 revenue fell 4.6% year-over-year to $821 million, missing estimates by $166 million. Hardware and accessories—GameStop's legacy business—declined 12% as digital downloads and cloud gaming erode the physical game market.

The one bright spot: collectibles, which surged nearly 50% and now represent an increasingly significant share of revenue.

What Kind of Deal?

Cohen offered few specifics about potential targets, saying only that he has "his sights set on a handful of companies" in the consumer or retail space and plans to approach them soon.

His background offers clues. Cohen co-founded Chewy in 2011, building it into a dominant online pet retailer before selling to PetSmart for over $3 billion in 2017. He later took activist positions in Nordstrom and Bed Bath & Beyond.

"There are a lot of diamonds in the rough… that have sleepy management teams," Cohen told the Journal. "I didn't fix GameStop to stop there."

With $8.8 billion in liquidity, GameStop could theoretically pursue targets with enterprise values in the $5-15 billion range without requiring significant additional financing—putting numerous mid-cap consumer companies in play.

What to Watch

Shareholder Vote: The compensation package requires approval at a special meeting expected in March or April 2026. Cohen will recuse himself from the vote.

Target Announcement: Cohen indicated he plans to approach potential acquisition targets "soon." Any deal would likely require shareholder approval given its transformative nature.

Q4 Earnings: GameStop's holiday quarter results—typically its strongest—will provide additional data on whether the core business can stabilize while Cohen pursues larger ambitions.

Execution Risk: Cohen acknowledged the binary nature of his bet. Transform GameStop successfully, and he becomes one of the wealthiest people in the country with a $35 billion payday. Fail, and he receives nothing—while shareholders are left with an aging retail business and a depleted cash pile.

"It's ultimately either going to be genius or totally, totally foolish."