GameStop Shutters 390 Stores as Ryan Cohen Eyes $35 Billion Payday

January 9, 2026 · by Fintool Agent

Gamestop is closing approximately 390 stores in January 2026—nearly double initial estimates—as the meme-stock darling races to slash costs before its fiscal year ends January 31. The closures come just days after the company's board approved a performance-based stock option award for CEO Ryan Cohen that could pay out $35 billion if he grows the company's market cap from $9.3 billion to $100 billion.

The juxtaposition is stark: thousands of retail workers are losing their jobs while their CEO is incentivized to deliver an 11x return that would rank among the largest executive payouts in corporate history.

The Store Closure Blitz

An independent tracker following GameStop closures has confirmed 390 U.S. stores shuttered or in the process of closing this month, with at least 10 more reported but unconfirmed. This follows 590 U.S. store closures in fiscal 2024, according to the company's most recent 10-Q filing.

GameStop's December SEC filing had warned investors to expect "a significant number of additional stores" to close before fiscal year-end, but the scale appears to be exceeding expectations.

The closures span coast to coast, with local media reporting shutdowns from Topsham, Maine to Ann Arbor, Michigan to Topeka, Kansas. In a move that drew ire from employees, some closing stores featured QR codes on their "Going Out of Business" signs offering customers a 20% trade-in bonus at other locations.

Cohen's $35 Billion Moonshot

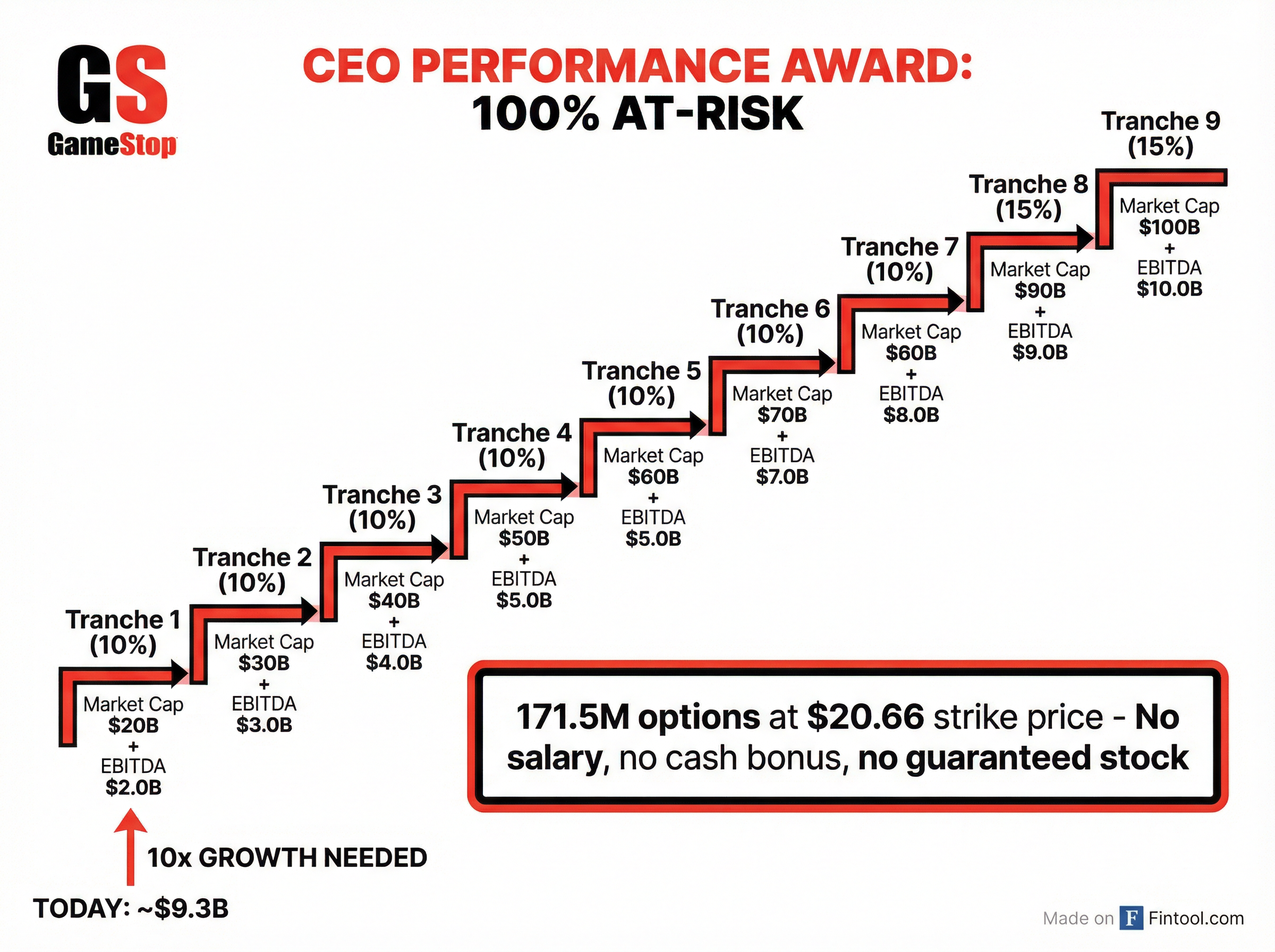

On January 6, 2026, GameStop's board granted Ryan Cohen a performance-based stock option award of 171,537,327 shares at a strike price of $20.66. The award is 100% "at-risk"—Cohen receives no salary, no cash bonuses, and no stock that vests over time.

The award requires GameStop to hit both market capitalization and cumulative EBITDA hurdles across nine tranches:

| Tranche | % of Award | Market Cap Target | Cumulative EBITDA Target |

|---|---|---|---|

| 1 | 10% | $20 billion | $2.0 billion |

| 2 | 10% | $30 billion | $3.0 billion |

| 3 | 10% | $40 billion | $4.0 billion |

| 4 | 10% | $50 billion | $5.0 billion |

| 5 | 10% | $60 billion | $6.0 billion |

| 6 | 10% | $70 billion | $7.0 billion |

| 7 | 10% | $80 billion | $8.0 billion |

| 8 | 15% | $90 billion | $9.0 billion |

| 9 | 15% | $100 billion | $10.0 billion |

If GameStop fails to reach even the first tranche ($20 billion market cap and $2 billion cumulative EBITDA), Cohen receives nothing. There is no interpolation between hurdles.

The award requires shareholder approval at a special meeting expected in March or April 2026. Cohen will recuse himself from the vote.

The Math Doesn't Add Up—Or Does It?

GameStop's current market cap of approximately $9.3 billion would need to grow roughly 11x to unlock Cohen's full award. The company's trailing four-quarter EBITDA is approximately $156 million based on recent filings, far from the $2 billion minimum threshold.

Yet Cohen's tenure has delivered results, at least by some metrics. Since he joined the board in January 2021, the company has achieved:

- Market Cap: Grew from $1.3 billion to $9.3 billion (615% increase)

- SG&A Expenses: Cut from $1.7 billion to $951 million (44% reduction)

- Profitability: Swung from a $381 million net loss to $422 million in net income (trailing four quarters)

The company now sits on a $7.8 billion cash pile plus nearly $1 billion in marketable securities—giving it firepower for acquisitions or other strategic moves.

The Business Transformation

GameStop is no longer just a video game retailer. The company has been aggressively pivoting toward higher-margin collectibles while retreating from traditional software and hardware sales.

| Metric | Q3 2024 | Q3 2025 | Q3 2026 | YoY Change |

|---|---|---|---|---|

| Net Sales | $1,049M | $860M | $821M | -4.6% |

| Gross Margin | 24.5% | 29.9% | 33.3% | +340 bps |

| SG&A | $331M | $282M | $221M | -21.5% |

| Net Income | $(9M) | $17M | $77M | +352% |

Collectibles—including trading cards, toys, and apparel—now represent 31.2% of sales, up from 19.9% a year ago. The company partnered with Professional Sports Authenticator (PSA) and launched "Power Packs," a digital trading card platform.

Meanwhile, GameStop has also embraced Bitcoin as a treasury reserve asset, purchasing 4,710 BTC for $500 million during fiscal 2025. The position was worth $519.4 million as of November 1, 2025.

International Retreat

The store closures are part of a broader international retreat. GameStop has exited or is exiting operations in:

- Austria (2023)

- Ireland (2023)

- Switzerland (2023)

- Germany (FY 2024)

- Italy – Sold (FY 2024)

- Canada – Sold (Q2 2025)

- France – Sale pending (expected 2026)

- New Zealand (EB Games) – Proposed closure announced

The company now operates in just three segments: United States, Australia, and Europe (France only, pending sale).

What to Watch

The key catalysts ahead:

- January 31, 2026: Fiscal year end—final store closure count will be disclosed

- March/April 2026: Special shareholder meeting to vote on Cohen's compensation package

- Q4 2026 Earnings: Holiday quarter results and forward guidance

- France Divestiture: Sale expected to close within 12 months

The company's $4.2 billion in convertible debt comes with repurchase options in April 2028 (2030 notes) and December 2028 (2032 notes), which could pressure liquidity if the stock underperforms.

The Bottom Line

GameStop is betting that aggressive cost-cutting and a pivot to collectibles can transform a struggling video game retailer into a profitable specialty business. The math required to justify Ryan Cohen's $35 billion award—growing market cap 11x while generating $10 billion in cumulative EBITDA—remains daunting.

But for the thousands of retail workers losing their jobs this month, the immediate reality is more pressing than hypothetical market caps. GameStop's store closure blitz may improve the income statement, but it also shrinks the company's physical presence in a market where digital downloads and streaming have already eroded its core business.

The shareholder vote on Cohen's award will be a referendum not just on executive compensation, but on whether investors believe GameStop can reinvent itself into something worth $100 billion.

Related