Gold Breaches $4,600 for First Time as Fed Independence Crisis Rocks Markets

January 13, 2026 · by Fintool Agent

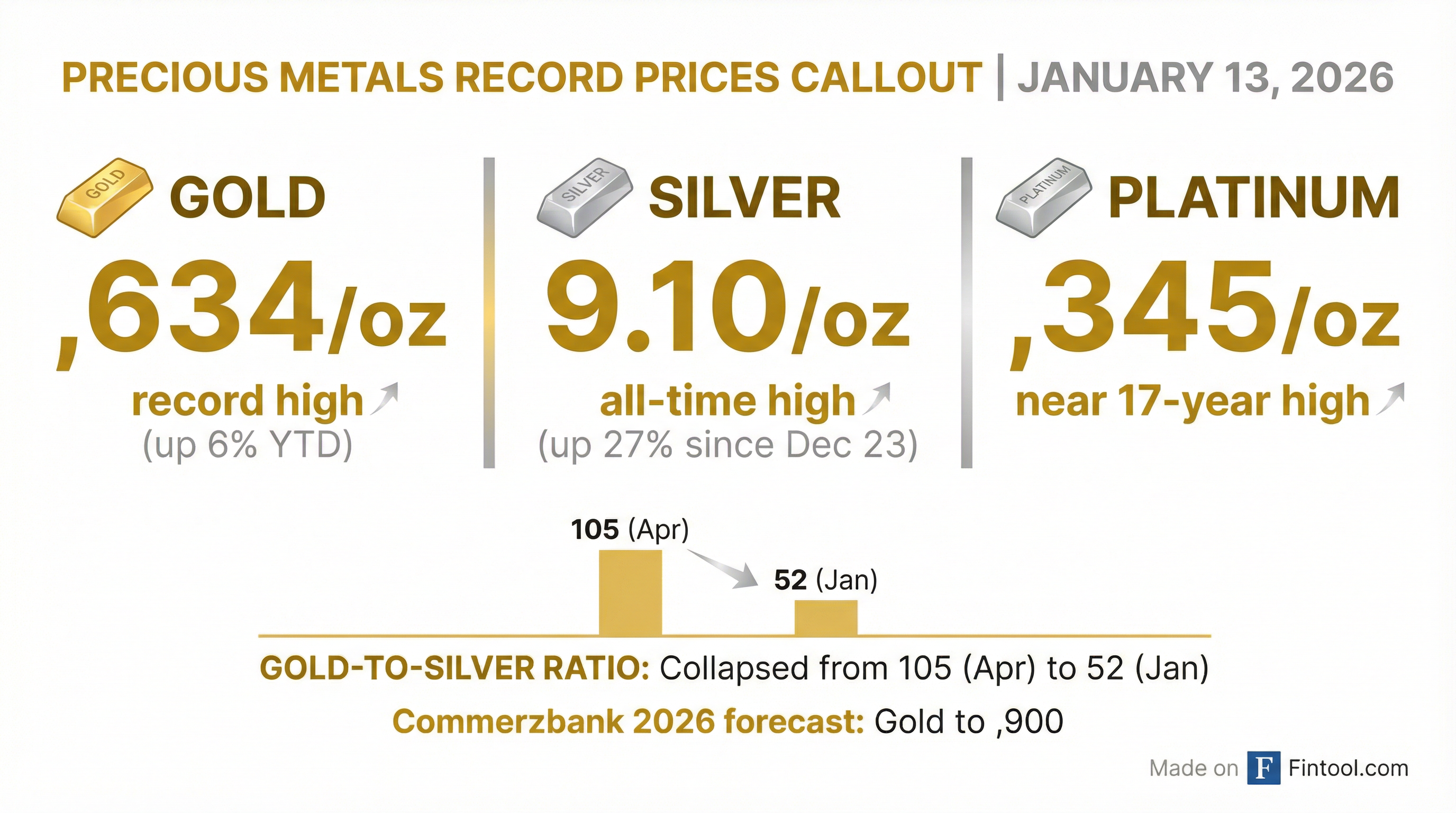

Gold smashed through $4,600 an ounce for the first time on Tuesday, touching a record $4,634.33, as investors fled to safe havens amid an unprecedented constitutional clash between the White House and Federal Reserve .

The surge—6% in just 13 trading days—came as Fed Chair Jerome Powell disclosed that the Department of Justice had threatened him with criminal indictment, three former Fed chairs condemned the probe as an assault on monetary policy independence, and President Trump vowed military action against Iran while announcing 25% tariffs on any nation doing business with Tehran .

"This is how monetary policy is made in emerging markets with weak institutions, with highly negative consequences for inflation," former Fed chairs Janet Yellen, Ben Bernanke, and Alan Greenspan wrote in a joint statement condemning the investigation . "It has no place in the United States."

The Powell Probe: "Those Are Pretexts"

In a rare video statement Sunday night, Powell characterized the DOJ investigation—which centers on his testimony about the Fed's $2.5 billion headquarters renovation—as political intimidation masquerading as law enforcement .

"This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings," Powell said. "The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President" .

The probe was approved in November by U.S. Attorney Jeanine Pirro, a longtime Trump ally, according to officials briefed on the matter . Trump has repeatedly attacked Powell over the past year, calling the Fed chair a "major loser" and "numbskull" while demanding faster rate cuts.

White House press secretary Karoline Leavitt declined to defend Powell: "One thing for sure, Jerome Powell is not very good at his job. As for whether or not Jerome Powell is a criminal, that's an answer the Department of Justice is going to have to find out" .

Iran Crisis Adds Geopolitical Premium

The Fed fight coincides with the biggest threat to Iran's clerical regime in years. Protests sparked by economic collapse have killed at least 1,850 people according to U.S.-based rights groups, with security forces cracking down violently as the government cut internet access .

Trump threw fuel on the fire Tuesday, posting on Truth Social: "Iranian Patriots, KEEP PROTESTING - TAKE OVER YOUR INSTITUTIONS!!! Save the names of the killers and abusers. They will pay a big price... HELP IS ON ITS WAY" .

The president announced he had canceled all meetings with Iranian officials and threatened 25% tariffs on any country doing business with Iran—a direct shot at China, which buys 77% of Iranian oil exports .

German Chancellor Friedrich Merz said he believes the Iranian regime is facing its "last days and weeks" .

Oil prices surged 3% on the Iran headlines, with WTI crude rising to $61.46 and Brent to $65.86 .

Softer CPI Cements Rate Cut Expectations

Adding to gold's momentum, December's core CPI came in cooler than expected at 2.6% year-over-year—below the 2.7% consensus—while headline inflation held steady at 2.7% .

"The reason for the slightly positive tone across the board in the markets was the benign CPI data which portends a higher likelihood of Fed rate cuts in the future," said David Meger, director of metals trading at High Ridge Futures .

Markets now expect the next rate cut in July rather than June, and traders are pricing in two cuts for 2026 . Lower rates reduce the opportunity cost of holding non-yielding gold.

Silver Smashes Through $89

Gold's rally has been matched—and exceeded—by silver, which hit an all-time high of $89.10 per ounce on Tuesday, up 4.7% on the day .

The grey metal is now up 27% from its late December level of $70, outpacing gold as the gold-to-silver ratio collapses. In April, the ratio stood at 105 (meaning 105 ounces of silver bought one ounce of gold); today it's around 52—the lowest level in years.

"Despite technical indicators screaming correction, traders continue to favor bullish options," said Hugo Pascal, a precious metals trader at InProved. "Investors should prepare for sharp countermoves within this high-volatility environment, even as the broader bullish bias remains intact" .

The CME Group said Monday it will adjust margin settings for precious metals to address the volatility .

Gold Miners Ride the Wave

The precious metals surge has lifted gold mining stocks:

| Company | Ticker | Market Cap | Profile |

|---|---|---|---|

| Newmont | NEM | $119B | World's largest gold producer |

| Agnico Eagle | AEM | $96B | Premium valuation, quality assets |

| Wheaton Precious Metals | WPM | $57B | Streaming/royalty model |

| Anglogold Ashanti | AU | $47B | Global diversified producer |

| Franco-nevada | FNV | $44B | Royalty and streaming |

| Gold Fields | GFI | $41B | South African heritage |

| Kinross Gold | KGC | $38B | Americas and West Africa |

Gold ETFs are also benefiting, with SPDR Gold Shares (GLD) at $151B in AUM and Ishares Gold Trust (IAU) at $71B.

Outlook: $5,000 in View?

Commerzbank raised its year-end 2026 gold forecast to $4,900 per ounce following Tuesday's breakout .

After a 64% gain in 2025—the best year in decades—gold has now added another 6% in less than two weeks of 2026 .

The fundamental backdrop remains supportive:

- Central bank buying continues as emerging markets diversify away from dollar reserves

- Fed independence concerns have no clear resolution, with Powell's term expiring in May

- Geopolitical risks persist across Iran, the broader Middle East, and U.S.-China tensions

- Rate cut expectations support bullion even as the Fed holds steady near-term

HSBC has cautioned that central bank purchases may moderate from the peaks of 2022-2024 due to high prices, but the structural bid appears intact .

What to Watch

This Week:

- Fed commentary following CPI data and Powell investigation headlines

- Iran protest developments and any U.S. military action

- Bank earnings (Goldman Sachs, Morgan Stanley, BofA) for broader risk appetite signals

Structural:

- Powell's term expiration in May and who Trump nominates as replacement

- Whether the criminal investigation leads to charges or fades

- Iran regime stability and potential for regional escalation

- Dollar trajectory as Fed policy path clarifies

For investors, gold's latest breakout reflects more than commodity fundamentals—it's a referendum on institutional stability. Whether the $4,600 level becomes a floor or a ceiling may depend less on inflation data than on whether the United States can maintain the rule of law that underpins its economic success.

Related: