Goldman Sachs CEO David Solomon Admits He Owns Bitcoin at Trump's World Liberty Forum

February 18, 2026 · by Fintool Agent

Goldman Sachs CEO David Solomon disclosed Wednesday that he personally owns bitcoin — a striking admission from the leader of one of Wall Street's most influential institutions and a longtime crypto skeptic.

Speaking at the World Liberty Forum at Mar-a-Lago in Florida, an event hosted by Eric Trump and Donald Trump Jr., Solomon characterized his holdings as "very, very limited" and described himself as "an observer" of bitcoin rather than a forecaster.

"I'm an observer of bitcoin," Solomon said, noting he is still trying to understand how the asset moves.

The confession comes as Goldman itself has built meaningful institutional exposure to digital assets — revealing a gap between the bank's public posture and its actual portfolio positioning.

From Skeptic to Holder

Solomon's admission marks a stark evolution from his prior public statements. In 2024, he told CNBC that bitcoin was "a speculative investment" and that he didn't "see a real use case." Just last month, he reiterated that he didn't view bitcoin as a threat to the U.S. dollar.

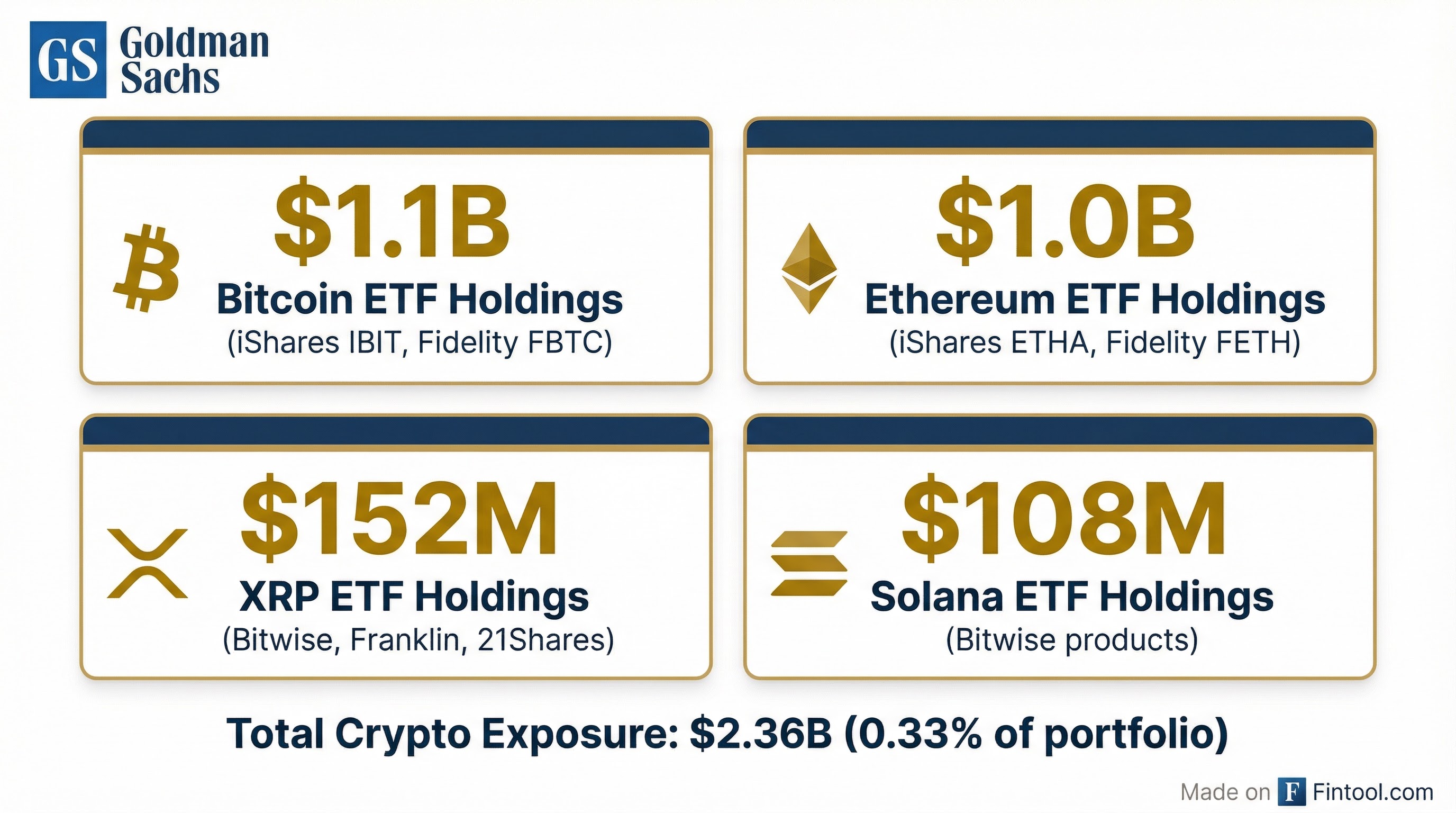

Yet Goldman's Q4 2025 13F filing, disclosed last week, revealed the bank holds approximately $2.36 billion in crypto exposure — entirely through spot ETFs rather than direct token ownership:

| Asset | Holding | Primary Vehicles |

|---|---|---|

| Bitcoin ETFs | $1.1 billion | Blackrock iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC) |

| Ethereum ETFs | $1.0 billion | iShares Ethereum Trust (ETHA), Fidelity Ethereum Fund (FETH) |

| XRP ETFs | $152 million | Bitwise, Franklin Templeton, 21Shares products |

| Solana ETFs | $108 million | Bitwise products |

The crypto allocation represents just 0.33% of Goldman's reported portfolio, but the dollar amounts are substantial — and the bank has been actively managing the position. Goldman reduced its Bitcoin ETF holdings by 39% quarter-over-quarter in Q4, trimming exposure as bitcoin's price fell 47% from its October 2025 highs.

A Calculated Pivot

Goldman's journey to crypto exposure has been deliberate. The bank restarted its crypto trading desk after 2020, expanded derivatives access for clients, and began accumulating spot ETF positions after the SEC approved them in early 2024. By Q3 2025, Goldman had tripled its Bitcoin ETF stake to roughly $1.5 billion.

But the firm still refuses to hold bitcoin directly on its balance sheet. Solomon acknowledged Wednesday that regulatory limitations prevent Goldman from trading or custodying the token itself — a constraint that doesn't apply to asset managers like Blackrock or exchanges like Coinbase.

"When you burden this system with excessive regulation, you start to extract capital," Solomon said at the forum, criticizing what he characterized as overreach in recent years. "That absolutely happened in the last five years."

Tokenization Over Bitcoin

Even as he disclosed his personal bitcoin holdings, Solomon steered the conversation toward what he views as the more transformative trend: tokenization.

"It's one system, it's our system," he said of traditional finance and crypto infrastructure. "We have to do it the right way … and there's going to be disagreements and that's OK."

Goldman has been exploring stablecoin integration and tokenized products, though it lags peers like JPMorgan, which has deployed its own JPM Coin and launched tokenized money market fund offerings.

Goldman's Financial Position

Goldman Sachs enters 2026 from a position of strength. The bank reported strong Q4 2025 results with net income of $4.6 billion and diluted EPS of $14.01.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $12.2 | $11.5 | $11.3 | $9.7 |

| Net Income ($B) | $4.7 | $3.7 | $4.1 | $4.6 |

| Diluted EPS | $14.12 | $10.91 | $12.25 | $14.01 |

| ROE (%) | 15.3% | 12.0% | 13.2% | 14.8%* |

*Value retrieved from S&P Global

Goldman shares closed at $933.73 Wednesday, up 1.9% on the session and trading near all-time highs. The stock is up more than 110% from its 52-week low of $439.38.

Bitcoin's Rough Patch

Solomon's disclosure arrives during a brutal stretch for bitcoin. The token has fallen roughly 47% from its October 2025 peak near $126,000, trading around $66,700 Wednesday — erasing more than $750 million in unrealized gains from Goldman's Q4 holdings.

The decline has triggered over $6 billion in outflows from spot Bitcoin ETFs since November, according to DefiLlama data.

Still, Goldman's continued exposure — even at reduced levels — suggests the firm sees value in maintaining optionality. The bank's Q4 trim may reflect risk management rather than a change in thesis.

What to Watch

Solomon's appearance at the Trump-affiliated World Liberty Forum signals Goldman's willingness to engage with the administration's crypto-friendly agenda. The SEC has signaled it will work with the CFTC on cryptocurrency classification, and legislative efforts like the Clarity Act could reshape which digital assets banks can hold directly.

For investors, the key question is whether Solomon's personal confession — however limited — presages a broader institutional embrace. When the CEO of a $283 billion market cap bank admits he owns bitcoin, the Overton window shifts.

Related: Goldman Sachs Company Profile | Blackrock Company Profile