Greenland Technologies Shareholders Approve 25-to-1 Dual-Class Structure, Handing Chairman 90% Voting Control

January 30, 2026 · by Fintool Agent

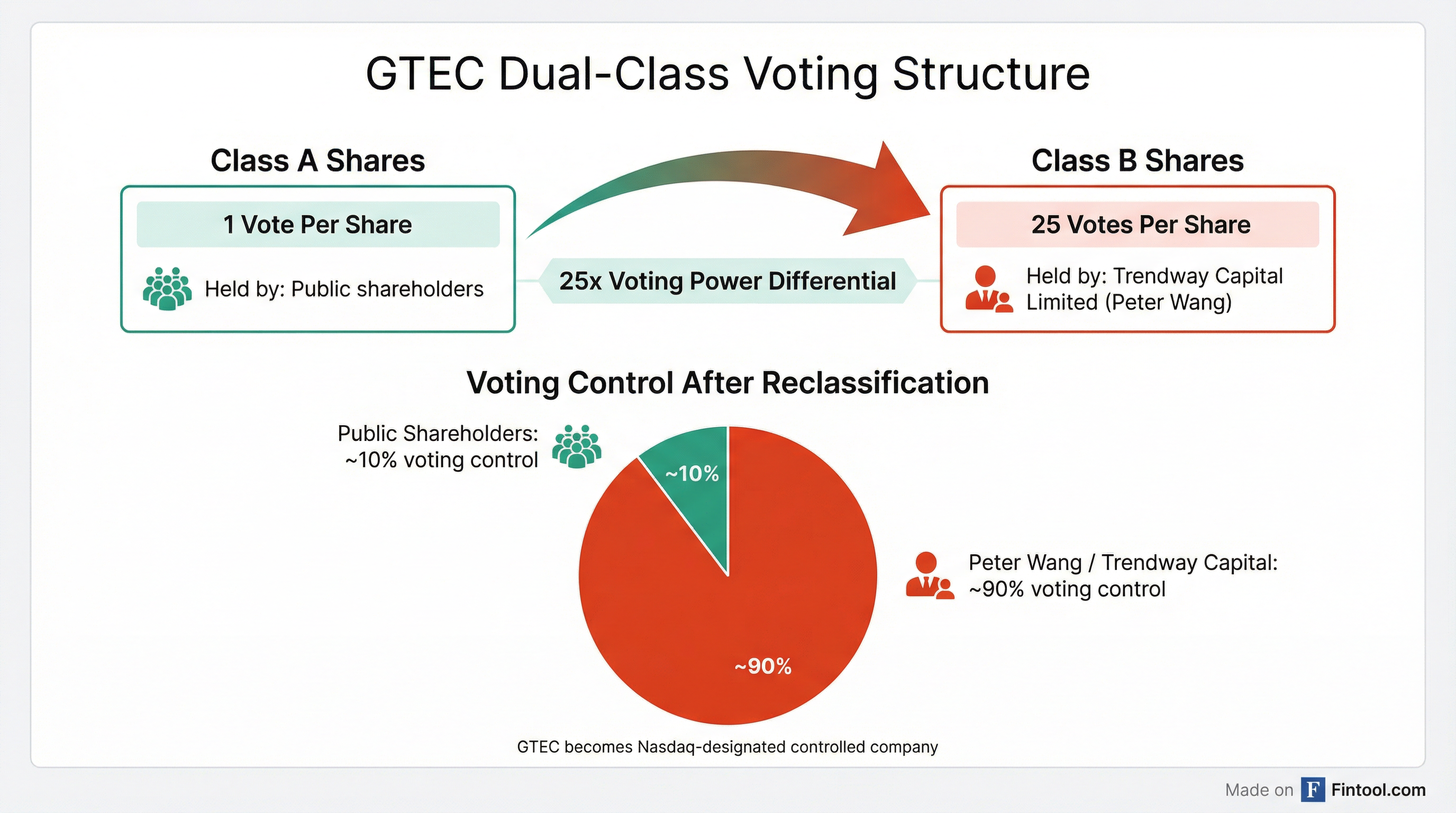

Greenland Technologies Holding Corporation shareholders approved a controversial dual-class share structure at the company's 2026 Annual General Meeting today, concentrating approximately 90% of voting power with Chairman Peter Zuguang Wang through his holding company Trendway Capital Limited.

The electric industrial vehicle manufacturer's stock fell 7.4% to $0.92 following the vote, extending a sharp decline from $1.24 earlier this week when the company closed a dilutive $6.1 million public offering.

AGM Results: All Proposals Pass After Quorum Drama

The meeting, held virtually at 9:00 a.m. EST, came after a rocky start. The original December 29, 2025 AGM was adjourned after only 6.56% of outstanding shares showed up—far short of the quorum needed to conduct business.

Today's reconvened meeting achieved 45.73% participation (7.96 million of 17.39 million shares), allowing all six proposals to pass:

| Proposal | For | Against | Abstain |

|---|---|---|---|

| New M&A Adoption | 7.66M | 2.79M | 210K |

| Share Capital Reorganization | 7.61M | 325K | 21K |

| Share Reclassification | 7.62M | 315K | 208K |

| Director Election (Peter Wang) | 7.81M | 126K | 23K |

| Director Election (Frank Shen) | 7.75M | 184K | 24K |

| Auditor Ratification | 79.0M | 35K | 15K |

The 25-to-1 Voting Power Grab

Under the approved structure, existing ordinary shares held by public shareholders will be redesignated as Class A shares carrying one vote each. Meanwhile, the 6.21 million shares held by Trendway Capital Limited—wholly owned by Chairman Peter Wang—will be reclassified as Class B shares carrying 25 votes per share.

The math is stark: Wang's economic stake of roughly 35% translates into approximately 90% voting control.

GTEC acknowledged in its proxy statement that this structure "may adversely affect the value and liquidity of the Class A Ordinary Shares" and could "discourage others from pursuing any change of control transactions that holders of our Class A Ordinary Shares may view as beneficial."

Why This Matters: "Controlled Company" Status

With the dual-class structure in effect, GTEC qualifies as a "controlled company" under Nasdaq Listing Rules. This designation allows the company to exempt itself from several governance requirements, including:

- Independent director requirement for nominating committee

- Independent director requirement for compensation committee

- Majority independent board composition

The company's board unanimously recommended shareholders approve all proposals, despite the obvious entrenchment benefits for insiders.

Timing Raises Eyebrows: Stock Offering Closed Just Yesterday

The governance overhaul comes just one day after GTEC closed a $6.1 million public offering at $1.20 per unit, issuing 5.08 million new shares and warrants.

The company had disclosed in its S-1 registration that new investors would face diluted voting rights: "If the dual class structure is implemented after this offering is completed, any Ordinary Shares sold in this offering will be re-designated as Class A Ordinary Shares, and their voting rights would adversely affected."

Shares have dropped 24% from $1.24 to $0.92 since the offering priced on January 28.

The Business Behind the Drama

GTEC operates two business lines: a profitable transmission manufacturing operation in China and a nascent electric industrial vehicle business in the U.S. under the HEVI brand.

Financial Snapshot (9M 2025 vs. 9M 2024):

| Metric | 9M 2025 | 9M 2024 | Change |

|---|---|---|---|

| Revenue | $66.8M | $64.6M | +3.4% |

| Gross Profit | $20.0M | $17.4M | +15.0% |

| Net Income (Attributable) | $6.5M | $6.5M | 0% |

| EPS | $0.41 | $0.48 | -15% |

The China transmission business remains the profit engine, selling 123,856 sets of transmission products in the first nine months of 2025 to over 100 forklift manufacturers.

HEVI, the company's U.S. electric vehicle subsidiary, sells all-electric wheel loaders and excavators from a 54,000 square foot facility in Baltimore. In August 2024, HEVI launched the H55L and H65L electric loaders, capable of lifting up to six tons with zero emissions.

The company had total assets of $123.4 million and shareholders' equity of $69.9 million as of September 30, 2025, with minimal debt.

The Dual-Class Debate

GTEC's move runs counter to the governance preferences of most institutional investors. The Council of Institutional Investors calls "one share, one vote" a "bedrock principle of good corporate governance" and expects newly public companies "to commit to their adoption over a reasonably limited period through sunset mechanisms."

Major index providers have also pushed back. S&P Dow Jones excludes firms with new dual-class offerings from the S&P Composite 1500 and its various indices, though it reversed a blanket ban in 2023.

The 25-to-1 voting ratio at GTEC is on the extreme end. Most dual-class structures use a 10-to-1 ratio, as seen at companies like Meta Platforms and Alphabet. A Congressional Research Service report noted that while the most common form of dual-class stock involves "10 times the voting power," some firms have issued shares with "20 times the voting power."

At 25-to-1, GTEC pushes even beyond that threshold.

What's Next

GTEC is now formally a controlled company with Chairman Peter Wang holding near-absolute voting power. Public shareholders retain their economic interest but have been effectively disenfranchised on governance matters.

The company intends to use proceeds from its recent offering for "working capital and general corporate purposes," as it continues developing its HEVI electric vehicle business for the North American market.

With a market cap now under $16 million and trading below $1, GTEC faces potential delisting risk if shares remain depressed. Investors betting on the company's electric industrial vehicle pivot must now do so knowing they have virtually no voice in how the company is run.