Henkel Circles Olaplex in Potential Takeover, Shares Surge 22%

January 8, 2026 · by Fintool Agent

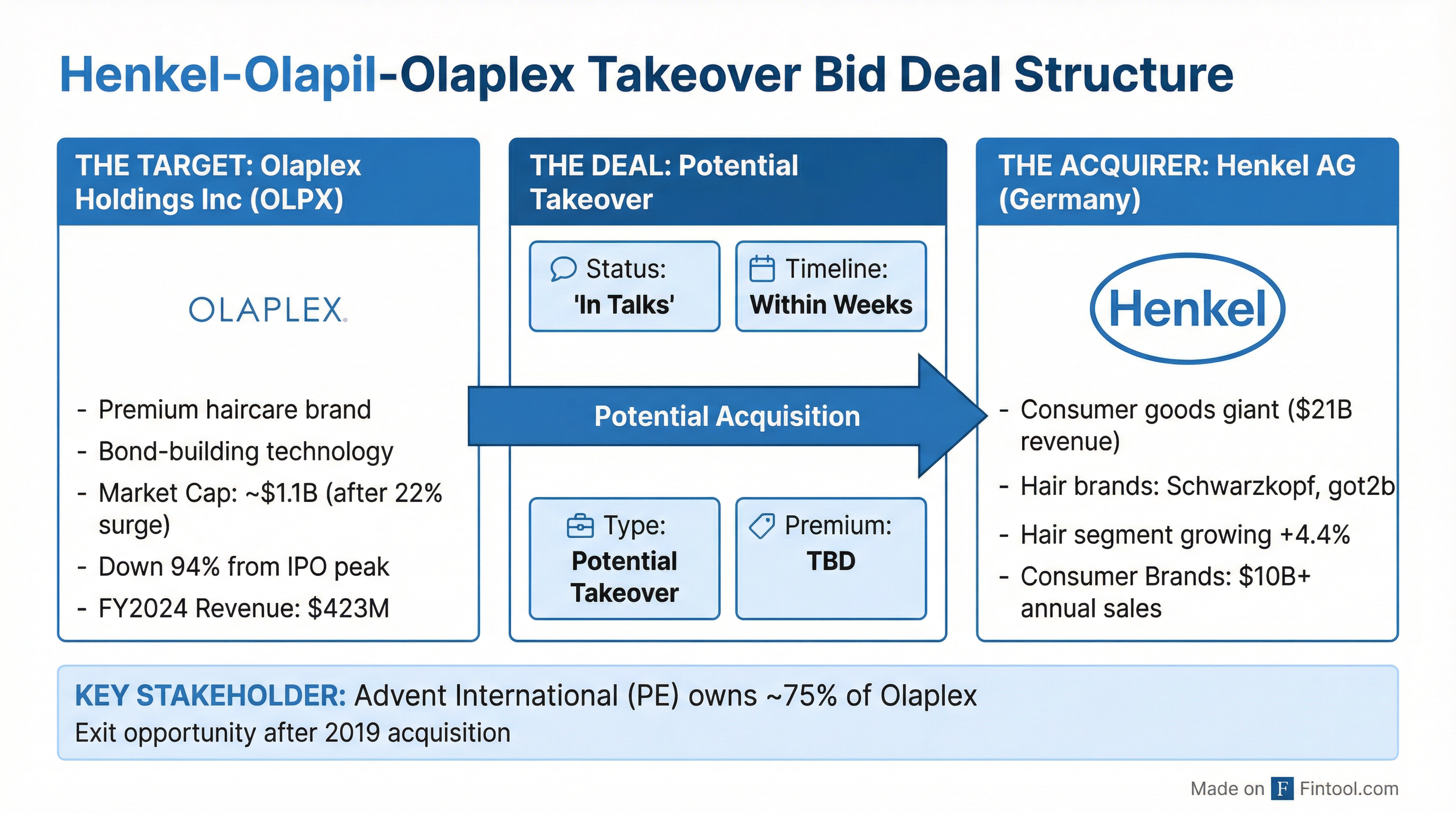

Olaplex shares surged 22% on Wednesday after Bloomberg reported that German consumer goods giant Henkel has submitted a takeover offer for the troubled haircare brand—a potential lifeline for a company that has lost 94% of its value since going public in 2021.

The stock closed at $1.65 on volume of 17.4 million shares—roughly 17 times normal levels—giving the once-highflying haircare disruptor a market capitalization of approximately $1.1 billion.

Discussions between Henkel and Olaplex could produce a deal "within weeks," according to people familiar with the matter, though no final decision has been made and talks could still collapse. Private equity firm Advent International, which acquired Olaplex in 2019 and controls approximately 75% of shares outstanding, would be the primary beneficiary of any transaction.

From $16 Billion Darling to Dollar Stock

Olaplex's fall from grace has been dramatic. The company went public in September 2021 at $21 per share, quickly reaching a peak of $29.41 in January 2022—a valuation of approximately $16 billion that made it one of the most valuable pure-play prestige haircare companies globally.

The subsequent collapse was swift and unrelenting. By November 2025, shares had fallen to an all-time low of $1.01 as revenue cratered from $704 million in FY2022 to $423 million in FY2024—a 40% decline over just two years.

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|

| Revenue ($M) | $598 | $704 | $458 | $423 |

| Net Income ($M) | $221 | $244 | $62 | $20 |

| EBITDA Margin (%) | 66.4% | 58.6% | 34.4% | 27.8% |

| Gross Margin (%) | 80.5% | 74.8% | 71.3% | 71.4% |

The company's struggles stemmed from a combination of factors: over-distribution that diluted its professional salon positioning, increased competition in the bond-building category it pioneered, and pandemic-era demand normalization. Lawsuits alleging hair loss from its products, while ultimately settled, damaged brand perception.

A Turnaround in Progress

CEO Amanda Baldwin, who joined in early 2024 to lead a brand revitalization, has been executing what she calls a "bonds and beyond" strategy—rebuilding the company's relationship with professional stylists, investing in marketing, and launching new products.

"We're pleased to share third quarter results that exceeded our expectations," Baldwin said on the company's most recent earnings call in November. "Our team executed well across a range of key initiatives, resulting in improvement in our sell-through trends at the end of the third quarter."

The company's recent Q3 2025 results showed signs of stabilization:

| Metric | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|

| Revenue ($M) | $119 | $101 | $97 | $106 | $115 |

| Net Income ($M) | $15 | ($9) | $0.5 | ($8) | $11 |

| Gross Margin (%) | 70.8% | 68.6% | 71.9% | 73.2% | 71.5% |

The professional channel, which is core to Olaplex's differentiation, grew 5.3% year-over-year in Q3 2025 as the company's "Blitz" education program and realigned partnerships began showing results. The August launch of two new hair masks—Rich Hydration Mask and Weightless Nourishing Mask—represented the company's "most integrated product launch in our history" with strong initial sell-through.

"According to the latest brand health tracker, which we fielded at the end of the quarter versus a baseline taken before we relaunched the brand, Olaplex is now perceived as more approachable and alluring while retaining its core identity as a scientific and iconic brand," Baldwin noted.

Why Henkel?

For Henkel, an Olaplex acquisition would represent a significant expansion in prestige haircare. The Düsseldorf-based conglomerate already owns Schwarzkopf, one of Europe's leading hair brands, and has reported strong momentum in its Hair business area—achieving 4.4% organic sales growth in Q3 2025, outpacing its broader Consumer Brands division.

Henkel's Consumer Brands segment generated €7.3 billion in revenue through the first nine months of 2025, with Hair as the clear growth driver while Laundry & Home Care declined. Adding Olaplex would give Henkel:

- Premium positioning: Entry into the prestige/clinical haircare tier, complementing Schwarzkopf's mass-market strength

- Professional salon channel: Olaplex's salon network and stylist relationships

- Patented technology: The company's bond-building chemistry and bisamino intellectual property

- U.S. market expansion: Olaplex's strong DTC and specialty retail presence in North America

The deal logic mirrors the broader wave of consumer goods consolidation in beauty, where large strategics have been acquiring innovative challenger brands to offset mature category growth.

Advent's Exit Path

For Advent International, a Henkel deal would mark the end of a turbulent ownership period. The private equity firm acquired Olaplex in 2019 in a deal reportedly valuing the company at around $1.4 billion. While the 2021 IPO delivered a significant markup on paper, Advent retained approximately 75% of shares and has watched that stake evaporate in value.

At the current ~$1.1 billion market capitalization, a modest takeover premium would still represent a loss versus Advent's initial investment—but would provide liquidity and certainty after years of public market volatility. The deal highlights a recurring challenge for PE-backed consumer brands that IPO at peak multiples only to see valuations compress as growth normalizes.

What to Watch

The deal remains preliminary, and several factors could influence the outcome:

-

Valuation: Olaplex's current enterprise value of roughly $1.0 billion represents approximately 2.4x trailing revenue—far below the 20x+ multiple implied at IPO but potentially attractive for Henkel if turnaround momentum continues

-

Due diligence: Any acquirer will scrutinize Olaplex's sell-through trends, competitive positioning, and remaining brand equity

-

Regulatory pathway: A straight acquisition by a German strategic should face minimal antitrust hurdles in the fragmented beauty industry

-

Advent's willingness: At current prices, Advent faces a loss on its 2019 acquisition. Whether a modest premium is enough to secure the PE firm's 75% stake remains unclear

Olaplex management has not commented on the reports. The company's next scheduled communication is its Q4 2025 earnings call, expected in late February.

Related: Olaplex