ICL Inks $2.54B Deal With Israel, Ends 65-Year Dead Sea Monopoly

January 28, 2026 · by Fintool Agent

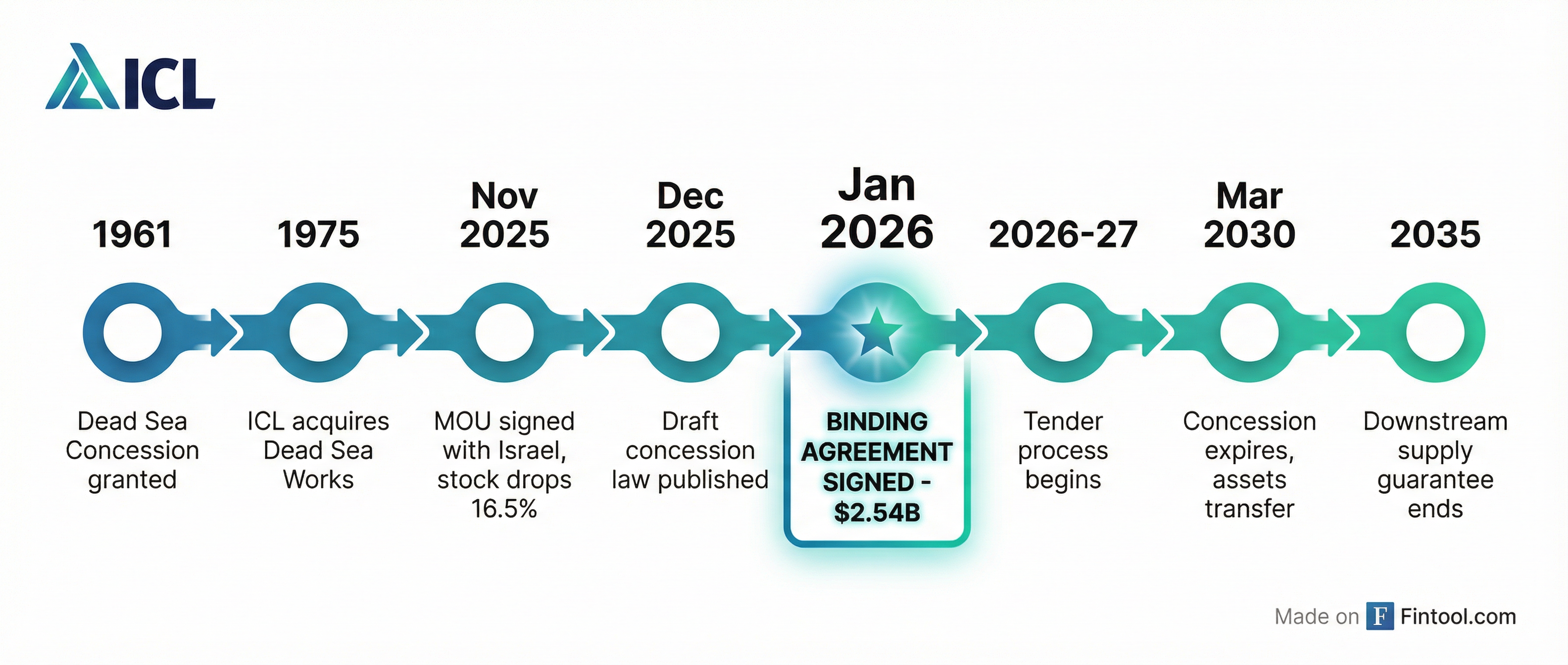

Icl Group has signed a binding agreement with the State of Israel that locks in a $2.54 billion valuation for its Dead Sea mineral extraction assets, ending months of uncertainty following a November memorandum of understanding that sent shares tumbling 16.5% in a single session.

The deal, finalized on January 27, 2026, marks the formal conclusion of ICL's 65-year exclusive grip on one of the world's most productive sources of potash and bromine. Israel's Finance Ministry is now preparing a competitive international tender for the concession that expires in March 2030—a process that could see a new operator take control of assets ICL had previously valued at $6 billion.

"This agreement removes the uncertainty that could have lasted for years, giving us the stability we need to manage the company effectively," ICL President Elad Aharonson told investors on a call this morning. "It allows us to prepare for any scenario and ensures that ICL will emerge stronger, no matter what path we take."

The Numbers: What ICL Locked In

The binding agreement codifies six critical elements that investors have been watching since negotiations began:

| Term | Details |

|---|---|

| Asset Valuation | $2.54 billion, plus hundreds of millions for the permanent Salt Harvesting Project |

| Payment Schedule | 95% on April 1, 2030; remaining 5% on September 1, 2030 |

| No Setoff Rights | State cannot deduct from total consideration under any circumstance |

| Downstream Supply | Raw materials guaranteed through 2035 for bromine compounds and periclase |

| Right of First Offer | Waived—ICL must cooperate with competitive tender |

| Asset Transfer | All tangible and intangible assets in "usable condition" at concession expiry |

The no-setoff provision was "a very important clause for us," Aharonson emphasized. This means Israel cannot reduce the $2.54 billion payout regardless of any disputes that may arise over the next four years.

The Tender Timeline

Israel's government has laid out an ambitious schedule for finding ICL's potential replacement:

| Phase | Expected Timing |

|---|---|

| Law legislation complete | Within 12-18 months |

| Pre-qualification (PQ) phase | 2026 |

| RFP issued | 2027 |

| Concession holder selected | End of 2027 |

| New concession allocated | Beginning of 2028 |

"I think it's a bit optimistic schedule," Aharonson acknowledged on the call.

The draft law published in December 2025 would raise the state's share of concession profits to an average of 50% from 35% currently, partly through royalties. Finance Minister Bezalel Smotrich has emphasized that the competitive process is "intended to ensure the rightful share for the public and the State from this unique natural resource."

National Security May Limit Competitors

One wildcard that could favor ICL: the Israeli government has signaled it may restrict foreign ownership of the concession on national security grounds.

"In the new law, the government left room for what they call national security arrangements," Aharonson explained. "In the future, they will elaborate what are the limitations for foreign competitors to join the process."

When pressed by analysts on whether this means the government may limit bidders to Israeli-friendly parties, Aharonson confirmed: "Yes."

This echoes historical restrictions on ICL ownership itself—there was previously a period when no single shareholder could own more than 14% of ICL, and a 30% threshold was later established.

The Downstream Protection

Perhaps the most strategically significant element for ICL's long-term business model: even if the company loses the Dead Sea concession entirely, its high-margin downstream operations are protected for nearly a decade.

The agreement secures continued supply of bromine and other raw materials required for ICL's downstream activities through 2035—five years beyond the concession's expiration. This period can be extended unless either party chooses to end it.

"Based on current prices and the agreed arrangements, we do not expect a material change in the profitability of our downstream or concession operations," Aharonson said. "The downstream operation will continue the same level of profitability at least until 2035, almost 10 years from now."

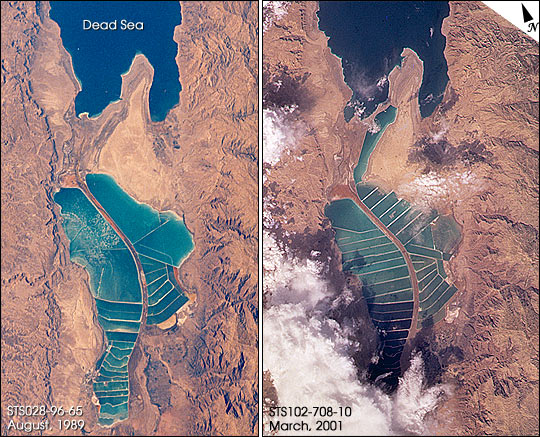

ICL's Industrial Products segment—which includes bromine compounds and flame retardants—benefits from the Dead Sea's highest bromine concentration in the world. The bromine is extracted from end brines that are a byproduct of potash production, giving ICL a significant cost advantage.

Even in a worst-case scenario where ICL is not selected as the new concession holder, Aharonson believes the economics will favor continued supply arrangements: "I believe the new concession owner will have to sell us bromine even after 2035."

ICL's Positioning: "The Natural Candidate"

Despite waiving its right of first offer, ICL management is confident the company remains best positioned to win the new tender.

"If the future concession terms make economic sense, we remain confident that we are the natural and leading candidate for it," Aharonson stated. "We have clear business strategy. If we decide to pursue the concession under the new terms, we remain confident that ICL is the natural and most experienced and leading candidate to win it, even without the right of first offer."

The company has operated the Dead Sea site since 1975 when it acquired Dead Sea Works, which had held the concession since 1961. ICL was originally founded as a state-owned firm called Israel Chemicals before being partially privatized.

If the new tender terms prove economically unviable, the $2.54 billion-plus in guaranteed compensation would give ICL significant optionality. Industry sources have suggested the company could use the proceeds to expand other areas including advanced agriculture, phosphate, and flame retardants.

Financial Snapshot

| Metric | FY 2023 | FY 2024 | FY 2026E | FY 2027E |

|---|---|---|---|---|

| Revenue | $7.54B | $6.84B* | $7.52B | $7.79B |

| EBITDA | $1.63B | $1.28B* | — | — |

| Net Income | $647M | $407M* | — | — |

| EBITDA Margin | 21.6% | 18.7%* | — | — |

*Values retrieved from S&P Global

Potash and magnesium—the primary products from the Dead Sea concession—account for approximately 30% of ICL's annual revenue.

Market Reaction

ICL shares closed at $5.49 on January 27, 2026, up 1.9% on the day of the announcement—a muted response compared to the 16.5% plunge when the MOU was announced in November 2025.

| Price Metric | Value |

|---|---|

| Current Price | $5.49 |

| 52-Week High | $7.35 |

| 52-Week Low | $4.85 |

| Market Cap | $7.1B |

| YTD Performance | +2.4% |

The stock remains well below its pre-MOU levels of approximately $6.45, suggesting investors are still pricing in some risk around the concession transition.

Morgan Stanley maintained its Equalweight rating on ICL in mid-January, raising its price target to $6.15 from $5.80.

What to Watch

February 18, 2026: ICL reports Q4 2025 and full-year results. Management is expected to provide additional color on concession economics and strategic alternatives.

2026: Pre-qualification phase of the tender begins. Watch for disclosure of bidder interest and any national security restrictions that may narrow the field.

End of 2027: If the government's timeline holds, a new concession holder will be announced—potentially the most significant event for ICL's valuation in decades.